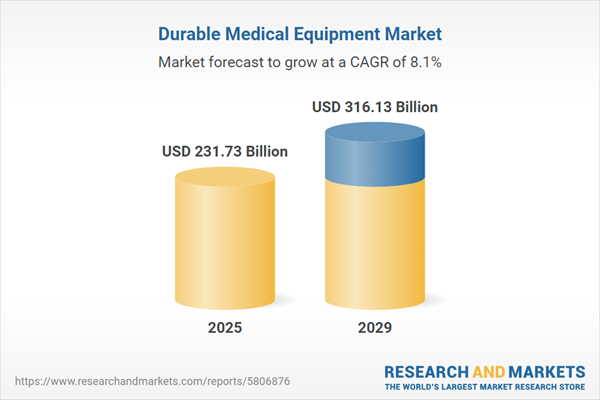

The durable medical equipment market size is expected to see strong growth in the next few years. It will grow to $316.13 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to telehealth expansion, value-based healthcare, rising healthcare costs, global health challenges, data security concerns, focus on preventive healthcare, regulatory changes. Major trends in the forecast period include rapid technological advancements, lightweight and portable solutions, emphasis on preventive healthcare, personalization of healthcare solutions, home healthcare trends.

The growth of the durable medical equipment market is anticipated to be driven by the increasing aging population. An aging population signifies a demographic shift characterized by a rise in the proportion of older individuals within a population. With aging, there's a higher prevalence of age-related ailments, necessitating the use of durable medical equipment such as blood glucose analyzers, vital sign monitors, infusion pumps, nebulizers, and more for prolonged periods. Consequently, the surge in the aging population becomes a key driver for the durable medical equipment market. For example, as per the United Nations' projections in January 2023, the global population aged 65 years or older is expected to escalate from 761 million in 2021 to 1.6 billion by 2050, emphasizing the considerable impact of this demographic shift on the durable medical equipment market's growth.

The rising number of surgical procedures is projected to drive the growth of the durable medical equipment (DME) market in the future. Surgical procedures encompass medical interventions that involve making incisions or employing minimally invasive techniques to treat, repair, remove, or diagnose conditions within the body. Durable medical equipment plays a vital role in various surgical procedures by providing support and comfort for patients, mobility assistance, safety and stability, infection control, enhanced surgical outcomes, and shorter hospitalization durations. For example, in June 2024, a report from the International Society of Aesthetic Plastic Surgery, a US-based organization for board-certified aesthetic plastic surgeons, indicated that the total number of surgical and non-surgical procedures increased by 3.4% in 2023, reaching 34.9 million. Procedures related to the face and head experienced notable growth, totaling over 6.5 million, which is a 19.6% rise from the previous year. Noteworthy procedures included eyelid surgeries, with more than 1.7 million performed and a 24% increase, rhinoplasties with 1.1 million procedures reflecting a 21.6% rise, and lip enhancement/perioral procedures, which grew by 29% to reach 0.9 million. Thus, the increasing number of surgical procedures is propelling the growth of the durable medical equipment market.

Technological advancements emerge as a prominent trend shaping the durable medical equipment market. Major industry players are actively integrating new technologies to fortify their market standing. For instance, in March 2023, Dexcom, a US-based developer and distributor of continuous glucose monitoring systems, introduced the Dexcom G6 CGM System for eligible patients with type 1 and type 2 diabetes in Canada. This system utilizes a small wearable sensor and transmitter to continuously measure glucose levels and wirelessly transmit this data to a smart device, exemplifying the advancements in continuous glucose monitoring technology aimed at enhancing patient care and management.

Leading companies within the durable medical equipment market are prioritizing strategic partnerships to enhance their operational capabilities. These partnerships involve leveraging each other's strengths and resources to achieve mutual benefits and success. An example of this occurred in November 2023 when Humana Inc., a for-profit American health insurance company based in Kentucky, collaborated with two national durable medical equipment (DME) organizations such as AdaptHealth Corp. and Rotech Healthcare Inc. This partnership aimed to offer improved DME services to its Medicare Advantage HMO members. The objective was to enhance access to durable medical equipment, provide enhanced value, and streamline the experience for individuals managing their health at home. AdaptHealth Corp. is a home healthcare equipment company based in Pennsylvania, while Rotech Healthcare Inc., located in Florida, specializes in providing ventilators, oxygen, sleep apnea treatment, wound care solutions, and home medical equipment.

In December 2022, Atlas Copco, a Sweden-based company renowned for manufacturing industrial tools and equipment, acquired Shandong Meditech Medical Technology for an undisclosed sum. This strategic acquisition by Atlas Copco aims to bolster its portfolio and expertise, intending to expand its footprint in the healthcare sector, specifically in the global oxygen market. Meditech Equipment Co. Ltd., based in China, specializes in the manufacture of medical equipment and oxygen generators. Through this acquisition, Atlas Copco aims to solidify its presence and offerings in the medical equipment domain, particularly focusing on the growing demand for oxygen-related solutions worldwide.

Major companies operating in the durable medical equipment market include Invacare Corporation, GF Health Products Inc., Stryker Corporation, Hill-Rom Holdings Inc., Siemens Healthcare GmbH, Koninklijke Philips NV, Sunrise Medical Inc., Drive Medical, Masimo Corporation, Becton Dickinson and Company, Getinge AB, Medtronic PLC, Nihon Kohden Corporation, Mindray Medical International Limited, ArjoHuntleigh, Permobil AB, ResMed Inc., OMRON Corporation, Medline Industries Inc., Abbott, Compass Health Brands, GE Electric Company, Pride Mobility, Baxter International Inc., Roche Diagnostic Equipment, SAMAPLAST.

North America was the largest region in the durable medical equipment market in 2024. The regions covered in the durable medical equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the durable medical equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Durable medical equipment (DME) comprises medical devices or supplies necessary for maintaining a person’s health on a long-term basis. These items are prescribed by a doctor, qualified nurse practitioner, physician assistant, or clinical nurse specialist for a patient's routine and extended use.

The primary types of durable medical equipment include personal mobility devices, bathroom safety devices and medical furniture, monitoring and therapeutic devices, and others. Personal mobility devices are designed to assist with walking and enhance the mobility of individuals with physical and mobility impairments. Payment for durable medical equipment can be facilitated through public, private, or out-of-pocket payer modes. These devices find application in various settings, including hospitals, nursing homes, home healthcare, and others.

The durable medical equipment market research report is one of a series of new reports that provides durable medical equipment market statistics, including durable medical equipment industry global market size, regional shares, competitors with a durable medical equipment market share, detailed durable medical equipment market segments, market trends and opportunities, and any further data you may need to thrive in the durable medical equipment industry. This durable medical equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The durable medical equipment market consists of sales of wheelchairs, scooters, walkers, and rollators. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Durable Medical Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on durable medical equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for durable medical equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The durable medical equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Personal Mobility Devices; Bathroom Safety Devices and Medical Furniture; Monitoring and Therapeutic Devices; Other Products2) by Payer: Public; Private; Out-of-Pocket

3) by End-Use: Hospitals; Nursing Homes; Home Healthcare; Other End-Uses

Subsegments:

1) by Personal Mobility Devices: Wheelchairs; Scooters; Walkers and Canes; Crutches2) by Bathroom Safety Devices and Medical Furniture: Grab Bars; Shower Chairs; Commodes; Hospital Beds; Bedside Tables

3) by Monitoring and Therapeutic Devices: Blood Pressure Monitors; Glucose Monitors; Nebulizers; CPAP Machines

4) by Other Products: Orthotic Devices; Respiratory Equipment; Mobility Aids

Key Companies Mentioned: Invacare Corporation; GF Health Products Inc.; Stryker Corporation; Hill-Rom Holdings Inc.; Siemens Healthcare GmbH

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Durable Medical Equipment market report include:- Invacare Corporation

- GF Health Products Inc.

- Stryker Corporation

- Hill-Rom Holdings Inc.

- Siemens Healthcare GmbH

- Koninklijke Philips NV

- Sunrise Medical Inc.

- Drive Medical

- Masimo Corporation

- Becton Dickinson and Company

- Getinge AB

- Medtronic PLC

- Nihon Kohden Corporation

- Mindray Medical International Limited

- ArjoHuntleigh

- Permobil AB

- ResMed Inc.

- OMRON Corporation

- Medline Industries Inc.

- Abbott

- Compass Health Brands

- GE Electric Company

- Pride Mobility

- Baxter International Inc.

- Roche Diagnostic Equipment

- SAMAPLAST

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 231.73 Billion |

| Forecasted Market Value ( USD | $ 316.13 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |