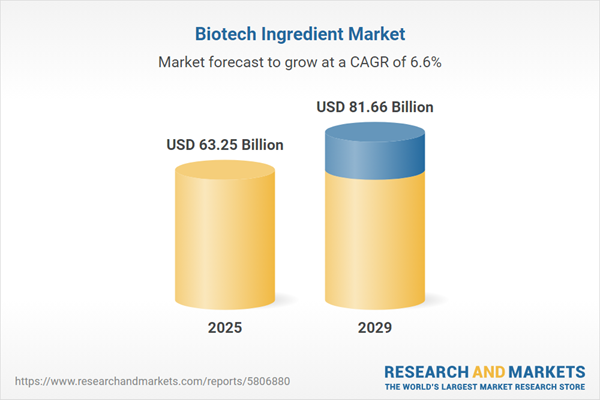

The biotech ingredient market size is expected to see strong growth in the next few years. It will grow to $81.66 billion in 2029 at a compound annual growth rate (CAGR) of 6.6%. The growth in the forecast period can be attributed to focus on personalized nutrition, expansion of cell-based meat production, development of therapeutic biotech ingredients, bio ingredients for waste reduction, shift towards bioplastics. Major trends in the forecast period include biotech-based functional foods, biotech solutions for circular economy practices, therapeutic biotech ingredients, biotech ingredients for clean energy production, global emphasis on biodiversity conservation.

The forecast of 6.6% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. drug manufacturers by increasing the cost of high-purity biotech ingredients sourced from Belgium and the Netherlands, thereby delaying production timelines and elevating biopharmaceutical development costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing demand for generic medicines is expected to drive the growth of the biotech ingredient market in the future. A generic medicine is a drug designed to possess the same properties as a previously approved medication. Biotech ingredients play a crucial role in generic medicine, serving as a cost-effective and efficient source for producing a variety of active ingredients that closely resemble the original products and are subject to stringent regulatory standards. For example, according to the Personalized Medicine Coalition, a US-based professional membership organization, the approval of 12 new personalized medicines in 2022 represented approximately 34% of all newly approved therapies, reflecting a notable increase compared to prior years. Thus, the rising demand for generic medicines is fueling the growth of the biotech ingredient market.

A significant factor contributing to the growth of the biotech ingredient market is the increasing demand for personal care products. Personal care products, encompassing items for personal hygiene and appearance enhancement, utilize biotech ingredients that offer benefits such as a reduced environmental footprint, sustainability, consistent quality, reduced allergenic potential, biocompatibility, enhanced efficacy, and reduced dependence on petrochemicals. In 2022, the average consumer expenditure on personal care products increased by 12.3%, reaching $866, as reported by the Bureau of Labor Statistics. This growth in consumer spending reflects the increasing demand for personal care products, driving the demand for biotech ingredients in this market.

A key trend in the biotech ingredient market is technological advancement, with major companies introducing new technologies to develop innovative products and strengthen their market position. For example, in March 2023, International Flavors & Fragrances Inc., a U.S.-based manufacturer, launched Aurist AGC, a novel biopolymer for hair care. Leveraging the Designed Enzymatic Biopolymers (DEB) technology, this biotechnology platform produces unique biobased polysaccharides with distinct structures and product features. The introduction of such innovative technologies highlights the commitment of major companies to staying at the forefront of the biotech ingredient market.

Prominent companies in the biotech ingredient market are strategically focusing on innovative products to drive revenue growth. One such example is the emphasis on biosyn-bisabolol, a sesquiterpene component found in nature known for its skin protection properties, anti-inflammatory effects, skin-soothing attributes, and barrier restoration capabilities. Aneco Chemicals Co. Ltd., a China-based specialty ingredient maker, showcased its commitment to innovation by launching biosyn-bisabolol in June 2023. This sustainable product is derived through a green production approach that preserves biodiversity and benefits the ecosystem. With a minimum assay of 95%, biosyn-bisabolol is entirely composed of bio-based carbon, making it suitable for use in skin care and sun care products. It can be seamlessly combined with various cosmetic ingredients. The creation of biosyn-bisabolol involved a unique technology ensuring excellent purity, quality, and heightened physiological activity.

In February 2022, Kerry Group plc, an Ireland-based taste and nutrition company, made a significant acquisition by acquiring c-LEcta for $226 million. This acquisition aligns with Kerry's goal to strengthen its innovation activities in enzymatic engineering, fermentation, and biotechnological development. Additionally, Kerry plans to invest in cutting-edge sustainable technologies to drive the development of sustainable food and health systems in the future. c-LEcta, based in Germany, is a biotechnology innovation firm specializing in highly precise fermentation, optimized bio-processing, and bio-transformation to produce high-value targeted biomolecules and ingredients. This strategic acquisition demonstrates the commitment of major companies to advancing their capabilities in the dynamic and innovative field of biotech ingredients.

Major companies operating in the biotech ingredient market include Merck & Co. Inc., Sanofi S.A., AbbVie Inc., International Flavors & Fragrance (IFF) Inc., Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan Inc., Boehringer Ingelheim International GmbH., AstraZeneca plc., Givaudan, Firmenich SA, Amyris Inc., Advanced BioTech, Sollice Biotech, Novocap S.A., Eli Lilly, Bristol-Myers Squibb Company, GlaxoSmithKline plc., F. Hoffmann-La Roche AG, Biogen Inc., Amgen Inc., Johnson & Johnson, Genentech Inc., Regeneron Pharmaceuticals Inc., Vertex Pharmaceuticals Incorporated, Alexion Pharmaceuticals Inc., Celgene Corporation, Gilead Sciences Inc., BioMarin Pharmaceutical Inc., Incyte Corporation, Seattle Genetics Inc., Alnylam Pharmaceuticals Inc., Ionis Pharmaceuticals Inc., Moderna Inc., Editas Medicine Inc., Intellia Therapeutics Inc., Sangamo Therapeutics Inc., Bluebird Bio Inc., Spark Therapeutics Inc.

Europe was the largest region in the biotech ingredient market in 2024. Asia-Pacific is expected to be the fastest-growing region in the biotech ingredients market report during the forecast period. The regions covered in the biotech ingredient market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biotech ingredient market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The biotech ingredient market research report is one of a series of new reports that provides biotech ingredient market statistics, including biotech ingredient industry global market size, regional shares, competitors with a biotech ingredient market share, detailed biotech ingredient market segments, market trends and opportunities, and any further data you may need to thrive in the biotech ingredient industry. This biotech ingredient market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Biotech ingredients encompass chemical components produced by microbes, notably yeast, yeast-such as organisms, or algae, whose DNA has been modified to generate commercially viable compounds through their metabolic processes. These ingredients offer enhanced safety and often present a more cost-effective option for consumers.

The primary categories of biotech ingredients include active pharmaceutical ingredients (APIs) and biosimilars. APIs constitute components within over-the-counter or prescription medications that induce the intended health effects. These ingredients utilize diverse expression systems such as mammalian, microbial, yeast, plant, and insect systems, applied across various sectors such as food and beverages, personal care and cosmetics, cleaning products, and other industries.

The biotech ingredient market consists of sales of shea butter, coconut oil, mango butter, frankincense essential oil, patchouli essential oil, and licorice extract. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Biotech Ingredient Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biotech ingredient market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biotech ingredient? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The biotech ingredient market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Active Pharmaceutical Ingredients; Biosimilars2) By Expression Systems: Mammalian Expression Systems; Microbial Expression Systems; Yeast Expression Systems; Plant Expression Systems; Insect Expression Systems

3) By Application: Food and Beverages; Personal Care and Cosmetics; Cleaning Products; Other Applications

Subsegments:

1) By Active Pharmaceutical Ingredients (APIs): Biologic APIs; Synthetic APIs2) By Biosimilars: Monoclonal Antibodies; Recombinant Proteins; Insulin Biosimilars

Companies Mentioned: Merck & Co. Inc.; Sanofi S.A.; AbbVie Inc.; International Flavors & Fragrance (IFF) Inc.; Novartis AG; Pfizer Inc.; Teva Pharmaceutical Industries Ltd.; Mylan Inc.; Boehringer Ingelheim International GmbH.; AstraZeneca plc.; Givaudan; Firmenich SA; Amyris Inc.; Advanced BioTech; Sollice Biotech; Novocap S.A.; Eli Lilly; Bristol-Myers Squibb Company; GlaxoSmithKline plc.; F. Hoffmann-La Roche AG; Biogen Inc.; Amgen Inc.; Johnson & Johnson; Genentech Inc.; Regeneron Pharmaceuticals Inc.; Vertex Pharmaceuticals Incorporated; Alexion Pharmaceuticals Inc.; Celgene Corporation; Gilead Sciences Inc.; BioMarin Pharmaceutical Inc.; Incyte Corporation; Seattle Genetics Inc.; Alnylam Pharmaceuticals Inc.; Ionis Pharmaceuticals Inc.; Moderna Inc.; Editas Medicine Inc.; Intellia Therapeutics Inc.; Sangamo Therapeutics Inc.; Bluebird Bio Inc.; Spark Therapeutics Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Biotech Ingredient market report include:- Merck & Co. Inc.

- Sanofi S.A.

- AbbVie Inc.

- International Flavors & Fragrance (IFF) Inc.

- Novartis AG

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan Inc.

- Boehringer Ingelheim International GmbH.

- AstraZeneca plc.

- Givaudan

- Firmenich SA

- Amyris Inc.

- Advanced BioTech

- Sollice Biotech

- Novocap S.A.

- Eli Lilly

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc.

- F. Hoffmann-La Roche AG

- Biogen Inc.

- Amgen Inc.

- Johnson & Johnson

- Genentech Inc.

- Regeneron Pharmaceuticals Inc.

- Vertex Pharmaceuticals Incorporated

- Alexion Pharmaceuticals Inc.

- Celgene Corporation

- Gilead Sciences Inc.

- BioMarin Pharmaceutical Inc.

- Incyte Corporation

- Seattle Genetics Inc.

- Alnylam Pharmaceuticals Inc.

- Ionis Pharmaceuticals Inc.

- Moderna Inc.

- Editas Medicine Inc.

- Intellia Therapeutics Inc.

- Sangamo Therapeutics Inc.

- Bluebird Bio Inc.

- Spark Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 63.25 Billion |

| Forecasted Market Value ( USD | $ 81.66 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |