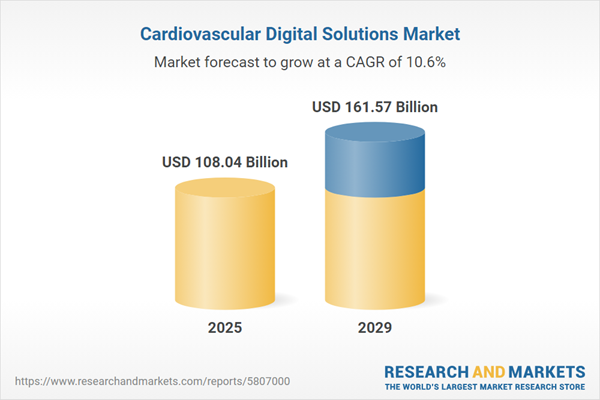

The cardiovascular digital solutions market size is expected to see rapid growth in the next few years. It will grow to $161.57 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to artificial intelligence and machine learning integration, expanding role of digital biomarkers, remote cardiac rehabilitation programs, interoperability of healthcare systems, focus on real-time monitoring and alerts. Major trends in the forecast period include blockchain for secure health data management, integration of EHRS and cardiovascular digital solutions, mobile health apps for cardiovascular management, focus on cardiovascular rehabilitation solutions, collaborations between tech companies and healthcare providers.

The increasing prevalence of cardiovascular diseases (CVDs) worldwide is anticipated to drive the growth of the cardiovascular digital solutions market in the future. CVDs encompass a range of conditions affecting the heart and blood vessels, representing a widespread health concern. Cardiovascular digital solutions empower patients by enabling them to self-monitor health activities that can reduce risk factors and encourage adherence to lifestyle changes. The implementation of these solutions has been shown to lower morbidity and mortality rates associated with cardiovascular diseases. For example, in March 2024, data from the Office for Health Improvement and Disparities, a UK government department, revealed that in 2023, there were over 1,862,500 individuals (3%) diagnosed with coronary heart disease in England. As such, the rise in cardiovascular disease prevalence globally is fueling the growth of the cardiovascular digital solutions market.

The anticipated rise in telehealth visits is expected to drive the growth of the cardiovascular digital solutions market in the future. Telehealth involves utilizing digital communication technologies to deliver remote healthcare services and support. Cardiovascular digital solutions enhance the effectiveness of telehealth visits by facilitating real-time monitoring and analysis of cardiac health metrics, which promotes comprehensive remote patient care. For instance, data from Telehealth.HHS.gov, a US government information provider, indicated that in the fourth quarter of 2023, telehealth usage reached approximately 21,883,731 users, marking an increase of 2,783,159 users, or a 13% rise compared to the previous quarter. Therefore, the growth in telehealth visits is significantly contributing to the expansion of the cardiovascular digital solutions market.

Product innovation stands out as a key trend within the cardiovascular digital solutions market, with major companies actively focusing on developing innovative products to strengthen their market positions. In February 2023, Eko Health, a US-based manufacturer of digital health solutions for heart and lung diseases, introduced the SENSORA Cardiac Disease Detection Platform. SENSORA is a cutting-edge cardiovascular disease detection platform that integrates advanced machine learning with the widely used medical device, the stethoscope. By harnessing AI to reliably recognize structural murmurs indicating heart valve disease, SENSORA offers a comprehensive solution for cardiac disorder detection. This innovation showcases the industry's commitment to leveraging digital technologies for enhanced diagnosis and patient care in the cardiovascular digital solutions market.

Prominent companies in the cardiovascular digital solutions market are strategically focusing on the development of innovative therapeutic solutions, with a particular emphasis on digital therapeutics solutions, to advance cardiac care. Digital therapeutics solutions refer to technology-based interventions or software designed to prevent, manage, or treat specific medical conditions. In January 2023, Lupin Digital Health, an India-based software company, launched LYFE, a digital therapeutics solution specifically tailored for cardiac care and developed in collaboration with Indian cardiologists. LYFE utilizes FDA and CE-approved wearables for real-time vital monitoring, emergency notifications, and medication reminders. The platform incorporates expert intervention through care managers, health coaches, and nutritionists, with the overarching goal of enhancing patient outcomes, improving therapy adherence, and reducing caregiver stress.

In May 2024, DHC Group Co. LLC, a UAE-based company specializing in integrated engineering, procurement, and construction solutions for the energy sector, acquired ECG On-Demand for an undisclosed sum. This acquisition is intended to strengthen DHC Group Co. LLC's position as a leading provider of specialized outpatient pathways and diagnostic services by incorporating ECG On-Demand into its operations. The collaboration aims to enhance access to high-quality 12-lead ECG interpretation and Holter monitoring services within both the NHS and private sectors. ECG On-Demand is a UK-based provider of innovative healthcare services, concentrating on cardiovascular digital solutions to improve patient care and management.

Major companies operating in the cardiovascular digital solutions market include iRythm Technologies Inc., Apple Inc., General Electric Company, Uber Diagnostics Private Limited, AlivCor Inc., Verily Life Sciences, HeartFlow Inc., Bardy Diagnostics Inc., BioTelemetry Inc., eviCore healthcare, Nanowear Inc, Cardiac Insight Inc., Bay Labs Solutions, Change Healthcare, Medtronic PLC, BenevolentAI Limited, Cardiologs Technologies, Cardiopulmonary Corp., Congenica Ltd., Cyient Limited, Data4Cure Inc., Deep Genomics Incorporated, DNAnexus Inc., Emedgene Technologies Ltd., Fabric Genomics Inc., FDNA Inc., Freenome Holdings Inc., GNS Healthcare, IBM Watson Health, Illumina Inc., Microsoft Corporation, Niramai Health Analytix, NVIDIA Corporation, Omron Healthcare Co. Ltd.

North America was the largest region in the cardiovascular digital solutions market in 2024. Asia-Pacific is expected to be the fastest-growing region in the cardiovascular digital solutions market report during the forecast period. The regions covered in the cardiovascular digital solutions market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cardiovascular digital solutions market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cardiovascular digital solutions encompass personalized diagnostic and treatment methods employing technology such as wearables, smartphones, sensors, and AI. These tools aim to encourage adherence to lifestyle changes and empower patients in self-monitoring health interventions.

These solutions offer services such as unobtrusive testing, cardiovascular health informatics, cardiac rehabilitation programs, and more. Unobtrusive testing involves data collection without direct consent or involvement from the data creators. The components typically include devices and software, deployable either through cloud-based systems or on-premise installations. End-users of these solutions span hospitals, clinics, ambulatory care centers, and other healthcare facilities.

The cardiovascular digital solutions market research report is one of a series of new reports that provides cardiovascular digital solutions market statistics, including cardiovascular digital solutions industry global market size, regional shares, competitors with a cardiovascular digital solutions market share, detailed cardiovascular digital solutions market segments, market trends and opportunities, and any further data you may need to thrive in the cardiovascular digital solutions industry. This cardiovascular digital solutions market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cardiovascular digital solutions market includes revenues earned by entities by providing services such as sensors and digital technologies, such as decision-making aids, motivating and instructive smartphone platforms, tele monitoring, and tele rehabilitation, remote patient monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. The cardiovascular digital solutions market also includes sale of cardiac monitoring patches, heart pumps, artificial valves, artificial implants. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cardiovascular Digital Solutions Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cardiovascular digital solutions market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cardiovascular digital solutions ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cardiovascular digital solutions market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Components: Devices; Software2) by Services: Unobtrusive Testing; CVD Health Informatics; Cardiac Rehab Programs; Other Services

3) by Deployment: Cloud-Based; on-Premise

4) by End-Use: Hospitals and Clinics; Ambulatory Care Centers; Other End-Users

Subsegments:

1) by Devices: Wearable Devices; Implantable Devices; Remote Monitoring Devices2) by Software: Cardiac Monitoring Software; Data Analytics Platforms; Telehealth Solutions; Patient Management Software

Key Companies Mentioned: iRythm Technologies Inc.; Apple Inc.; General Electric Company; Uber Diagnostics Private Limited; AlivCor Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Cardiovascular Digital Solutions market report include:- iRythm Technologies Inc.

- Apple Inc.

- General Electric Company

- Uber Diagnostics Private Limited

- AlivCor Inc.

- Verily Life Sciences

- HeartFlow Inc.

- Bardy Diagnostics Inc.

- BioTelemetry Inc.

- eviCore healthcare

- Nanowear Inc

- Cardiac Insight Inc.

- Bay Labs Solutions

- Change Healthcare

- Medtronic PLC

- BenevolentAI Limited

- Cardiologs Technologies

- Cardiopulmonary Corp.

- Congenica Ltd.

- Cyient Limited

- Data4Cure Inc.

- Deep Genomics Incorporated

- DNAnexus Inc.

- Emedgene Technologies Ltd.

- Fabric Genomics Inc.

- FDNA Inc.

- Freenome Holdings Inc.

- GNS Healthcare

- IBM Watson Health

- Illumina Inc.

- Microsoft Corporation

- Niramai Health Analytix

- NVIDIA Corporation

- Omron Healthcare Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 108.04 Billion |

| Forecasted Market Value ( USD | $ 161.57 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |