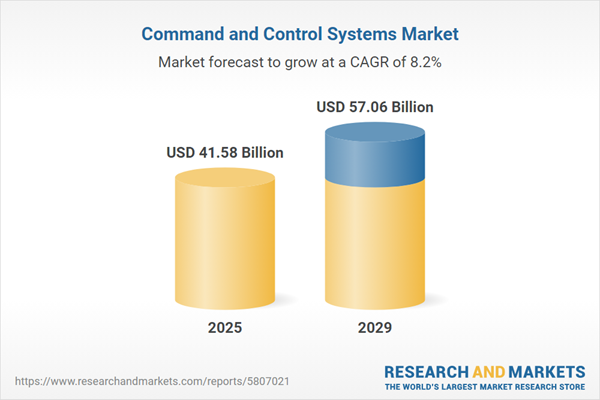

The command and control systems market size is expected to see strong growth in the next few years. It will grow to $57.06 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to integration of artificial intelligence (AI), network-centric warfare, space-based systems integration, multi-domain operations, strategic shifts in global alliances. Major trends in the forecast period include technological advancements in communication, integration of artificial intelligence (AI) and machine learning (ML), cybersecurity enhancement, interoperability and integration, cloud-based solutions.

The rise in military budgets around the world is anticipated to drive the growth of the command-and-control systems market in the coming years. A military budget refers to the funds allocated by a government for military-related expenses, which encompass salaries, training, equipment, research, development, and operational costs, all aimed at ensuring the readiness and effectiveness of the armed forces in defending the nation. The defense budget takes into account the size of the entity's economy, financial pressures, and the government's or public's willingness to finance military activities, thereby influencing the entity's capacity to support military operations, which in turn supports the command-and-control systems market. For example, in March 2023, the United States Department of Defense reported that the Fiscal Year (FY) 2024 budget request for the Department of Defense (DoD) is $842 billion, marking a $26 billion increase from FY 2023 and a $100 billion rise compared to FY 2022. Hence, the increasing military budgets globally are propelling the growth of the command-and-control systems market.

The anticipated growth in the command and control systems market is closely tied to the rise in geopolitical threats and concerns. Geopolitical dangers and issues encompass risks stemming from interactions and disputes between states or geopolitical entities on a global scale. Command and control systems play a pivotal role in addressing these threats by orchestrating military responses, facilitating intelligence gathering, and aiding strategic decision-making to mitigate concerns and uphold national security. For instance, as reported by ReliefWeb, a US-based humanitarian information portal, non-state conflicts surged to 82 in 2022, compared to 76 in 2021. Additionally, Africa witnessed the highest number of non-state conflicts, followed by the Americas. Consequently, the escalating geopolitical threats and concerns serve as a significant driving force behind the growth witnessed in the command and control systems market.

Technological advancement stands out as a prominent trend gaining traction within the command and control systems market. Major industry players in this sector are directing their focus towards the creation of innovative technologies, consistently developing and integrating them into these systems to augment their capabilities. An illustrative case is Milrem Robotics, an Estonia-based manufacturer of robotic vehicles, which introduced command and control (C2) technology for intelligent unmanned systems at Eurosatory 2022, a notable international exhibition focused on land and airland Defense and Security. Their solution for unmanned aerial and ground vehicles (UxV) amalgamates data from diverse payloads into a comprehensive command and control system. This integrated approach enables the continuous monitoring and management of critical parameters within UxV systems, encompassing aspects such as energy status, fault conditions, operational parameters, built-in diagnostic tests, initialization, and configurations. This emphasis on technological innovation is pivotal in advancing the capabilities of command and control systems, driving progress within the industry.

Prominent players in the command and control systems market are prioritizing cutting-edge solutions such as the Command, Control, Communications, and Computing (C4) platforms to better serve their current clientele. These integrated systems combine various technologies to provide comprehensive capabilities for military or organizational command and control activities. As an example, in September 2022, Anduril Industries, Inc., a US-based autonomous systems manufacturer, unveiled Menace. Menace represents a pioneering, secure, and all-encompassing C4 platform designed for rapid operational planning and execution in challenging, dispersed environments. It's engineered to be expeditionary, adaptable, and tailored to fulfill the specific needs outlined by the US Air Force's Agile Combat Employment (ACE) strategy and the US Marine Corps' Expeditionary Advanced Base Operations (EABO) doctrine. Menace delivers a versatile, multi-mission capacity, empowering warfighters to conduct diverse tasks such as local force control, base security, defense operations, counter Unmanned Aircraft Systems (cUAS), and logistical support from forward-deployed positions.

In September 2024, KBR, a US-based engineering technology firm, acquired LinQuest for an undisclosed sum. This acquisition aims to enhance KBR's capabilities in the national security, space, and intelligence sectors. It is expected to significantly strengthen KBR's offerings in advanced engineering, data analytics, and digital integration, particularly for U.S. government clients like the U.S. Space Force and the U.S. Air Force. LinQuest Corporation is a US-based company that specializes in delivering advanced technical solutions mainly for the national security and defense sectors.

Major companies operating in the command and control systems market include Siemens, General Electric Company, Raytheon Technologies Corporation, Boeing Company, Lockheed Martin Corporation, International Business Machines Corporation, Cisco Systems Inc., General Dynamics Corporation, Schneider Electric SE, Northrop Grumman, Honeywell International Inc., BAE Systems, NEC Corporation, Thales Group, ASELSAN Elektronik Sanayi ve Ticaret A.Ş., L3Harris Technologies Inc., Leonardo SpA, Motorola Solutions Inc., CACI International Inc., Sopra Steria Group, Rheinmetall AG, Collins Aerospace, Saab AB, Indra Sistemas S.A., Kongsberg Gruppen, LIG Nex1 Co. Ltd., Elbit Systems Ltd., Systematic A/S, Hitachi Ltd., Huawei Technologies Co. Ltd., Advantech Co. Ltd., Johnson Controls International plc.

North America was the largest region in the command and control systems market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global command-and-control systems market report during the forecast period. The regions covered in the command and control systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the command and control systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A command-and-control system is a collection of hardware and software tools, along with processes, utilized by an equipment operator or commander to oversee, plan, direct, and manage operations aimed at achieving a specific task. These systems are employed for planning, directing, coordinating, and controlling the operational activities of military forces.

Command and control systems feature two primary installation types such as fixed command centers and deployable command centers. Fixed command centers are established facilities by entities such as emergency response agencies, military units, or corporations, aiming to centrally coordinate and oversee operations. These centers integrate software and service solutions across platforms including land, maritime, airborne, and space, catering to applications in government and defense, homeland security, cyber protection, as well as commercial sectors.

The command and control systems market research report is one of a series of new reports that provides command and control systems optical components market statistics, including command and control systems optical components industry global market size, regional shares, competitors with a command and control systems optical components market share, detailed command and control systems optical components market segments, market trends, and opportunities, and any further data you may need to thrive in the command and control systems optical components industry. This command and control systems optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The command-and-control systems market consists of revenues earned by entities by providing air traffic control systems, emergency response and disaster management systems, industrial control systems, and military command, and control systems. The market value includes the value of related goods sold by the service provider or included within the service offering. The command-and-control systems market also includes sales of identification devices such as ID badges, card readers, keypads, and biometric readers which are used for providing command-and-control systems services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Command and Control Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on command and control systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for command and control systems? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The command and control systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Installation Type: Fixed Command Centers; Deployable Command Centers2) By Solution: Software; Services

3) By Platform: Land; Maritime; Airborne; Space

4) By Application: Government and Defense; Homeland Security and Cyber Protection; Commercial

Subsegments:

1) By Fixed Command Centers: Military Command Centers; Civil Command Centers; Emergency Operations Centers2) By Deployable Command Centers: Mobile Command Centers; Tactical Command Centers; Rapid Response Command Centers

Key Companies Mentioned: Siemens; General Electric Company; Raytheon Technologies Corporation; Boeing Company; Lockheed Martin Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens

- General Electric Company

- Raytheon Technologies Corporation

- Boeing Company

- Lockheed Martin Corporation

- International Business Machines Corporation

- Cisco Systems Inc.

- General Dynamics Corporation

- Schneider Electric SE

- Northrop Grumman

- Honeywell International Inc.

- BAE Systems

- NEC Corporation

- Thales Group

- ASELSAN Elektronik Sanayi ve Ticaret A.Ş.

- L3Harris Technologies Inc.

- Leonardo SpA

- Motorola Solutions Inc.

- CACI International Inc.

- Sopra Steria Group

- Rheinmetall AG

- Collins Aerospace

- Saab AB

- Indra Sistemas S.A.

- Kongsberg Gruppen

- LIG Nex1 Co. Ltd.

- Elbit Systems Ltd.

- Systematic A/S

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- Advantech Co. Ltd.

- Johnson Controls International plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 41.58 Billion |

| Forecasted Market Value ( USD | $ 57.06 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |