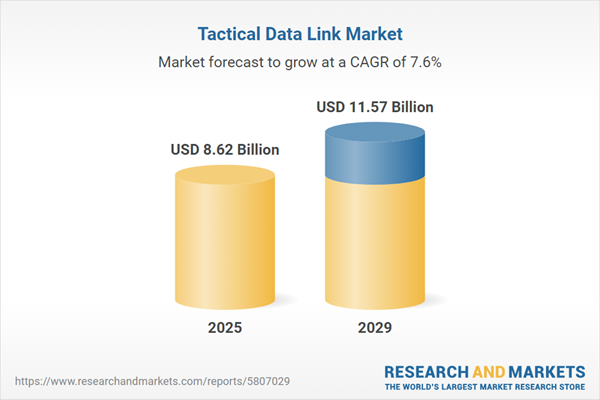

The tactical data link market size is expected to see strong growth in the next few years. It will grow to $11.57 billion in 2029 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to evolution of multi-domain operations, cybersecurity and electronic warfare concerns, integration with unmanned systems and platforms, global military alliances and cooperation, increasing threats and contingency preparedness. Major trends in the forecast period include multi-domain operations, advanced encryption and security protocols, reduced size, weight, and power (swap), real-time data analytics, satellite communication integration.

The rising military expenditure is anticipated to drive the growth of the tactical data link market in the future. Military expenditure refers to the funds allocated by the government to equip its military with personnel, weapons, and equipment. Tactical data links are secure military communication protocols that enable various platforms and missions to share tactical information. For example, in April 2024, the Stockholm International Peace Research Institute, a Sweden-based independent non-profit organization, reported that global military expenditure reached $2.44 trillion in 2023, representing a 6.8% increase in real terms compared to 2022. Consequently, the growth in military expenditure is fueling the expansion of the tactical data link market.

The escalating threat of terrorism is projected to contribute to the growth of the tactical data link market. Terrorism, characterized by the unlawful use of force or violence for coercion, intimidation, or ransom, poses a persistent challenge to global security. Tactical data links play a pivotal role in supporting military and security operations aimed at countering terrorism by facilitating the swift dissemination of intelligence, surveillance, and reconnaissance (ISR) data. Notably, in March 2023, ReliefWeb reported an increase in the average fatalities per terrorist attack from 1.3 in 2021 to 1.7 in 2022, marking the first rise in lethality rates in five years. This underscores the crucial role of tactical data links in enhancing the effectiveness of military and security forces in monitoring and responding to terrorist activities.

Technological advancements represent a prominent trend gaining momentum within the tactical data link market. Leading companies in this sector are actively incorporating innovative technologies to maintain and enhance their market positions. A noteworthy example is Curtiss-Wright Defense Solutions, a US-based defense and space manufacturing company. In November 2022, the company introduced Link 22 support to its existing suite of tactical data link (TDL) solutions. This strategic move aims to improve interoperability and capabilities for the US military and coalition partners. The integration of Link 22 into Curtiss-Wright's TCG product line streamlines TDL certification programs, eliminating the need for separate systems and minimizing the learning curve associated with multiple user interfaces.

Major players in the tactical data link market are intensifying efforts to launch support for tactical datalink communication systems, including Link 16, from space, as a means to gain a competitive advantage. Link 16, a secure and jam-resistant tactical data link system, is utilized by military satellites for the real-time exchange of critical battlefield information. An illustrative case is the May 2023 launch of Link 16 support from space by Eglin Air Force Base. This initiative, part of Tranche 0 of the Proliferated Warfighter Space Architecture, demonstrates the capability to transfer Link 16 data from space to ground stations and terrestrial radios. The integration of Link 16 satellites into low-Earth orbit enhances real-time situational awareness for the US, NATO, and coalition forces.

In January 2023, L3 Harris Technologies Inc., a prominent US-based aerospace and defense company, completed the acquisition of the tactical data links product line from Viasat Inc. for approximately $1.96 billion. This acquisition includes Viasat's Link 16 space assets, strengthening L3Harris's resilient communication and networking capabilities. The move allows L3Harris to expand its user base, providing broader end-to-end, sensor-to-shooter connectivity. Viasat Inc., a US-based satellite communications company specializing in tactical data links and networking systems, catered to both military and commercial markets. This acquisition positions L3 Harris Technologies Inc. as a key player in advancing and enhancing tactical data link solutions.

Major companies operating in the tactical data link market include General Dynamics Corporation, Northrop Grumman Corporation, BAE Systems plc, Thales Group, Leonardo SpA, RTX Corporation, L3Harris Technologies Inc., Saab AB, Tactical Communications Corporation, Science Applications International Corporation, Aselsan AS, Elbit Systems Deutschland GmbH & Co. KG, ViaSat Inc., Lockheed Martin Corporation, Curtiss-Wright Corporation, Calian Group Ltd., Comtech Telecommunications Corp., Datron World Communications Inc., DRS Technologies Inc., Echodyne Corporation, Inmarsat plc, Kratos Defense & Security Solutions Inc., Speedcast International Limited, Singapore Technologies Engineering Ltd.

North America was the largest region in the tactical data link market in 2024 and is expected to be the fastest-growing region in the tactical data link market report during the forecast period. The regions covered in the tactical data link market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the tactical data link market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Tactical data links are robust military communication protocols designed to facilitate the secure exchange of tactical data among platforms and commanders. They function as secure wireless communication networks, ensuring the safe transfer of critical military data across various platforms and command structures.

The primary solutions used for tactical data links comprise hardware and software components. Hardware encompasses the devices and technologies, both internal and external, necessary for specific functionalities. In the context of tactical data links, hardware includes radios, networks, sensors, cables, connectors, and computer systems utilized for transmitting and receiving data securely. Various types of data links such as link 11, link 16, link 22, and others operate across air, ground, and sea platforms, serving multiple applications including command and control operations, intelligence gathering, surveillance, reconnaissance (ISR), electronic warfare, radio communication, and enhancing situational awareness in military operations.

The tactical data link market research report is one of a series of new reports that provides tactical data link market statistics, including tactical data link industry global market size, regional shares, competitors with a tactical data link market share, detailed tactical data link market segments, market trends and opportunities, and any further data you may need to thrive in the tactical data links industry. This tactical data link market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The tactical data link market consists of revenues earned by entities by providing a multi-function information distribution system (MIDS), joint tactical information distribution system (JTIDS) and tactical targeting network technology (TTNT). The market value includes the value of related goods sold by the service provider or included within the service offering. The tactical data link market also includes sales of sensors, antennas, weapon data link controllers, and processors that are used in providing tactical data link services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Tactical data link Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on tactical data link market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for tactical data link ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The tactical data link market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Solution: Hardware; Software2) by Data Link Type: Link 11; Link 16; Link 22; Other Data Link Types

3) by Platform: Air; Ground; Sea

4) by Application: Command and Control; Intelligence, Surveillance and Reconnaissance (ISR); Electronic Warfare; Radio Communication; Situational Awareness

Subsegments:

1) by Hardware: Data Link Terminals; Communication Processors; Antennas; Modems2) by Software: Data Link Management Software; Simulation and Testing Software; Network Management Systems; Security and Encryption Software

Key Companies Mentioned: General Dynamics Corporation; Northrop Grumman Corporation; BAE Systems plc; Thales Group; Leonardo SpA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Tactical Data Link market report include:- General Dynamics Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- Thales Group

- Leonardo SpA

- RTX Corporation

- L3Harris Technologies Inc.

- Saab AB

- Tactical Communications Corporation

- Science Applications International Corporation

- Aselsan AS

- Elbit Systems Deutschland GmbH & Co. KG

- ViaSat Inc.

- Lockheed Martin Corporation

- Curtiss-Wright Corporation

- Calian Group Ltd.

- Comtech Telecommunications Corp.

- Datron World Communications Inc.

- DRS Technologies Inc.

- Echodyne Corporation

- Inmarsat plc

- Kratos Defense & Security Solutions Inc.

- Speedcast International Limited

- Singapore Technologies Engineering Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.62 Billion |

| Forecasted Market Value ( USD | $ 11.57 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |