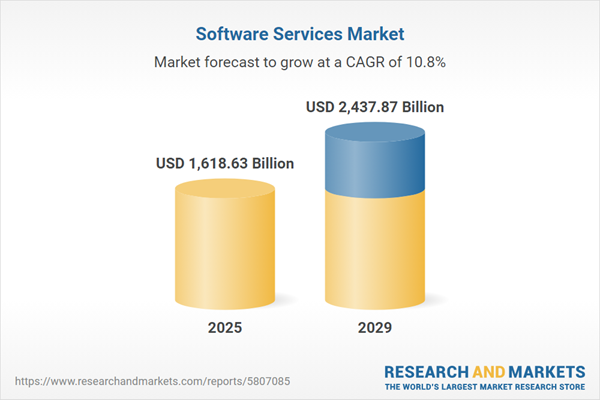

The software services market size is expected to see rapid growth in the next few years. It will grow to $2.43 trillion in 2029 at a compound annual growth rate (CAGR) of 10.8%. The growth in the forecast period can be attributed to internet of things (iot) integration, artificial intelligence (ai) and machine learning, remote work solutions, augmented reality (ar) and virtual reality, edge computing solutions. Major trends in the forecast period include sustainable and green technologies, 5g technology implementation, digital transformation, cloud-native development, focus on user experience (ux) design, subscription-based and saas models.

The rising automation of business processes is projected to drive the growth of the software services market in the coming years. Automation involves using technology to perform tasks with minimal human intervention. This approach not only helps in containing and reducing costs but also offers significant opportunities to enhance customer service while steadily lowering expenses. Consequently, the demand for automation in business processes is expected to elevate the software services market. For example, in April 2024, the International Federation of Robotics, a Germany-based professional non-profit organization, reported that manufacturing firms in the United States significantly increased their investment in automation, with industrial robot installations rising by 12% to reach 44,303 units in 2023. Therefore, the growing automation of business processes is fueling the expansion of the software services market.

The increase in remote work is anticipated to be a significant driver of growth in the software services market. Remote work, which is defined as a work arrangement allowing employees to carry out their job duties outside of a traditional office environment, has gained immense popularity. This trend highlights the demand for software services that enable seamless collaboration experiences, encompassing communication, project management, and virtual meetings. For example, in February 2023, the Office for National Statistics, a UK-based government agency, reported that between September 2022 and January 2023, 16% of working adults indicated that they worked exclusively from home, while a higher 28% stated they worked both from home and in the office. The increasing prevalence of remote work is a crucial factor propelling the growth of the software services market.

Technological advancement is a prominent trend gaining traction in the software services market, with major companies actively focusing on developing new technologies to strengthen their market positions. An example is Valvoline Inc., a US-based provider of automotive and industrial solutions, which, in January 2023, launched Vision Service Lane Technology. This unique feature provides a tailored, VIN-specific menu of services, empowering service departments to increase income. Vision stands out as one of the most detailed fixed-ops software products available, addressing pain points and unrealized potential in current software through collaborations with partners. Advisors use Vision to establish relationships, trust, and responsibility with clients in the service drive or at the service desk, reflecting a commitment to technological innovation in the software services market.

Leading companies in the software services market are actively engaged in the development of innovative products, such as cloud infrastructure platforms, to expand their customer bases, drive sales, and increase revenue. A cloud infrastructure platform, also known as a cloud platform or cloud computing platform, encompasses a comprehensive set of services and resources provided by a cloud service provider (CSP) for building, deploying, and managing applications in the cloud. An exemplary illustration is Oracle Corporation, a prominent US-based computer software company, which in October 2022, introduced Oracle Alloy. This unique offering is designed to empower service providers, integrators, independent software vendors (ISVs), and various organizations, including financial institutions and telecommunications providers, to transition into cloud providers. Oracle Alloy enables these entities to seamlessly introduce new cloud services to their clientele. It offers customization, branding, and tailoring capabilities to deliver a unique user experience. Organizations can also bundle additional value-added services and applications to meet the specific demands of their markets and industry verticals.

In October 2022, Aptean, a leading US-based provider of purpose-built, industry-specific software, acquired Merlin Business Software Ltd. for an undisclosed amount. This acquisition is expected to enhance Aptean's ability to support UK distributors and wholesalers, with Merlin's software being deployable on-premises or in the cloud as a subscription-as-a-service (SaaS). Merlin Business Software Ltd., a UK-based provider, specializes in offering bespoke enterprise business software solutions. The acquisition aligns with Aptean's strategy to strengthen its presence in specific industries and geographic regions, showcasing the ongoing evolution and expansion within the software services market.

Major companies operating in the software services market include Microsoft Corporation, Oracle Corporation, Epicor Software Corporation, International Business Machines Corporation, Infor Inc., Deltek Inc., Acumatica Inc., Unit4, Syspro Technologies, TOTVS S.A, SAP SE, Cloud Software Group Inc., Qliktech International AB, Tableau Software Inc., SAS Institute Inc., NetSuite Inc., Salesforce Inc., Adobe Inc., Workday Inc., Plex Systems Inc., Aras Corporation, PTC Inc., Autodesk Inc., Dassault Systemes, Parasoft, ComplianceQuest, Siemens AG, Atlassian Corporation, Hewlett Packard Enterprise, Veeva Systems, Intellect Software Solutions Pvt. Ltd., Kovair Software Inc.

North America was the largest region in the software services market in 2024. The regions covered in the software services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the software services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Software as a Service (SaaS) refers to a service delivery model where a cloud provider hosts software applications and offers access to end-users over the internet. This approach enables businesses to enhance client engagement and deliver efficient customer care.

The primary software categories within software services encompass finance, sales and marketing, human resources, supply chain management, and others. Financial software streamlines the automation, management, and storage of financial data, catering to both personal and professional needs. Services related to software services include consulting, managed services, and support and maintenance, serving a wide spectrum of enterprises, from large corporations to small and medium-sized businesses. These solutions are designed for cloud-based and on-premise deployment and find applications across diverse sectors such as aerospace and defense, banking and financial services, government, healthcare, IT and telecommunications, manufacturing, retail, transportation, and various other industries.

The software services market research report is one of a series of new reports that provides software services market statistics, including software services industry global market size, regional shares, competitors with software services market share, detailed software services market segments, market trends, and opportunities, and any further data you may need to thrive in the software services industry. This software services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The software services market includes revenues earned by entities by providing software training services, software insurance services, legal software services, software security services, and other related services. The market value includes the value of related goods sold by the service provider or included within the service offering. The software services market also includes sales of accounts software, database software, asset management software, billing software, and other related products. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Software Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on software services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for software services ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The software services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Software: Finance; Sales and Marketing; Human Resource; Supply Chain; Other Software Types2) by Service: Consulting; Managed Services; Support and Maintenance

3) by Deployment: Cloud; on-Premise

4) by Enterprise Size: Large Enterprises; Small and Medium Enterprises

5) by End-Use: Aerospace and Defense; Banking and Financial Institutions (BFSI); Government; Healthcare; IT and Telecom; Manufacturing; Retail; Transportation; Other End-Uses

Subsegments:

1) by Finance: Accounting Software; Financial Planning and Analysis Tools; Tax Management Software2) by Sales and Marketing: Customer Relationship Management (CRM); Marketing Automation Tools; Sales Enablement Software

3) by Human Resource: Human Resource Management Systems (HRMS); Payroll Software; Talent Acquisition and Management Tools

4) by Supply Chain: Inventory Management Systems; Order Management Software; Logistics and Transportation Management Tools

5) by Other Software Types: Project Management Software; Collaboration and Communication Tools; Business Intelligence and Analytics Software

Key Companies Mentioned: Microsoft Corporation; Oracle Corporation; Epicor Software Corporation; International Business Machines Corporation; Infor Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Software Services market report include:- Microsoft Corporation

- Oracle Corporation

- Epicor Software Corporation

- International Business Machines Corporation

- Infor Inc.

- Deltek Inc.

- Acumatica Inc.

- Unit4

- Syspro Technologies

- TOTVS S.A

- SAP SE

- Cloud Software Group Inc.

- Qliktech International AB

- Tableau Software Inc.

- SAS Institute Inc.

- NetSuite Inc.

- Salesforce Inc.

- Adobe Inc.

- Workday Inc.

- Plex Systems Inc.

- Aras Corporation

- PTC Inc.

- Autodesk Inc.

- Dassault Systemes

- Parasoft

- ComplianceQuest

- Siemens AG

- Atlassian Corporation

- Hewlett Packard Enterprise

- Veeva Systems

- Intellect Software Solutions Pvt. Ltd.

- Kovair Software Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1618.63 Billion |

| Forecasted Market Value ( USD | $ 2437.87 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |