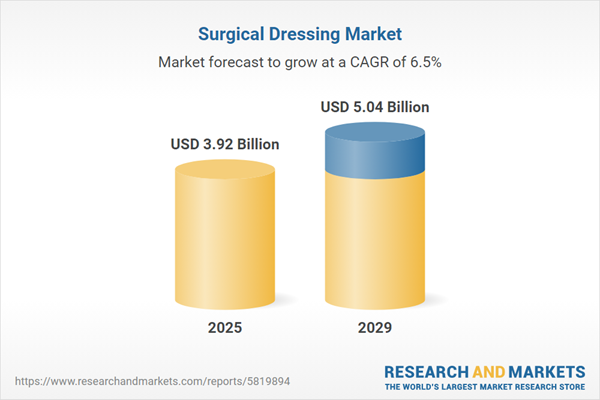

The surgical dressing market size is expected to see strong growth in the next few years. It will grow to $5.04 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%. The growth in the forecast period can be attributed to aging population, preventive healthcare practices, advancements in wound care, global health challenges, patient-centric care. Major trends in the forecast period include customized dressing solutions for specific wounds, rise in adoption of negative pressure wound therapy, telemedicine integration in wound care management, growing demand for advanced hemostatic dressings, expansion of dressing options for chronic wounds.

The increasing number of surgeries is anticipated to drive the growth of the surgical dressing market in the future. Surgeries refer to the medical field focused on treating diseases and injuries through manual or operative procedures. With the aging population and the rising incidence of chronic diseases, the frequency of surgical procedures is also on the rise. Surgical dressings are vital for post-operative wound care, playing a crucial role in infection prevention and healing promotion. They are utilized to cover and protect surgical incisions, absorb excess fluid, and create a barrier against bacteria and other contaminants. Consequently, the growing number of surgeries boosts the demand for the surgical dressing market. For example, in September 2023, the International Society of Aesthetic Plastic Surgery, a Lebanon-based organization for board-certified plastic surgeons, reported an 11.2% overall increase in procedures performed by plastic surgeons in 2022, with over 14.9 million surgical and 18.8 million non-surgical procedures conducted globally. Furthermore, both surgical and non-surgical procedures saw increases since the previous survey (16.7% and 7.2%, respectively). Thus, the rising number of surgeries is fueling the growth of the surgical dressing market.

The growth trajectory of the surgical dressing market is also anticipated to be fueled by the increasing prevalence of chronic diseases. Chronic diseases, lasting a year or longer and requiring ongoing medical care, create a demand for advanced surgical dressings due to the need for frequent wound care and the elevated risk of infections. According to the National Center for Biotechnology Information (NCBI), the number of individuals aged 50 years and above with at least one chronic illness is projected to increase by 99.5% by the year 2050, emphasizing the growing need for surgical dressings in managing persistent medical conditions. The increasing prevalence of chronic diseases is a key driver behind the growth of the surgical dressing market.

Major companies in the surgical dressing market are concentrating on developing innovative all-in-one, extended-wear wound dressings to enhance wound healing rates and improve patient care in healthcare settings. An all-in-one, extended-wear wound dressing is a single, comprehensive product that combines multiple functions usually provided by separate components, designed for long-term use. For instance, in September 2024, Solventum Corporation, a US-based healthcare company, introduced the V.A.C. Peel and Place Dressing, an integrated dressing that can be applied in under two minutes and worn by patients for up to seven days. This dressing represents the next evolution in V.A.C. Therapy, featuring an all-in-one dressing and drape design that simplifies application while reducing the time and training needed for dressing application and changes.

Key players in the surgical dressing market are focused on developing innovative products such as wound dressings to meet diverse medical needs, enhance healing processes, and expand their market presence. Theruptor Novo is an anti-microbial and non-toxic wound dressing. For example, in October 2022, Healthium Medtech, an India-based medical devices company specializing in surgical dressings, launched Theruptor Novo, a new line of wound dressings specifically designed to manage chronic wounds like diabetic foot ulcers and leg ulcers. This launch strengthens Healthium's portfolio of patented products within the advanced wound dressing sector, reinforcing its existing offerings.

In December 2022, Argentum Medical, a US-based medical company, acquired Anacapa Technologies, Inc. for an undisclosed amount. This acquisition aims to enhance Argentum Medical's wound care portfolio and improve patient outcomes by integrating antimicrobial wound cleansers and gels into its existing product line, thereby expanding its solutions for managing wounds, surgical sites, and burns. Anacapa Technologies, Inc. is a US-based company that specializes in the development and production of antimicrobial wound care and skin products.

Major companies operating in the surgical dressing market include 3M Company, Smith & Nephew plc, Mölnlycke Health Care AB, Convatec Group Plc., Johnson & Johnson, Coloplast Corp, Medtronic plc, Cardinal Health Inc., Medline Industries LP, Advancis Medical, B. Braun SE, Baxter International Inc., Derma Sciences Inc., Organogenesis Holdings Inc., Essity Aktiebolag, BSN Medical GmbH, DeRoyal Industries Inc., Lohmann & Rauscher GmbH & Co. KG, Paul Hartmann AG, Winner Medical Co. Ltd., Hartmann USA Inc., McKesson Medical-Surgical Inc., M Health Care Ltd., Hollister Incorporated, Integra LifeSciences Corporation, DermaRite Industries LLC.

North America was the largest region in the surgical dressing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the surgical dressing market report during the forecast period. The regions covered in the surgical dressing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the surgical dressing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A surgical dressing refers to a sterile material used to cover and safeguard a wound, providing protection and absorbing a wide array of fluids such as blood and exudate from damaged tissue. It serves the purpose of covering incisions to prevent stitches or staples from adhering to clothing.

The principal products within the surgical dressing market include primary dressing, secondary dressing, and other related products. Primary dressings are directly applied onto the wound surface. Surgical dressings find application in various medical procedures such as diabetes-based surgeries, cardiovascular treatments, ulcer care, burn management, transplant sites, and other medical interventions. They are utilized across multiple healthcare settings including hospitals, specialty clinics, home healthcare setups, ambulatory surgery centers, and cater to diverse end-users in need of wound care solutions.

The surgical dressing market research report is one of a series of new reports that provides surgical dressing market statistics, including the surgical dressing industry global market size, regional shares, competitors with a surgical dressing market share, detailed surgical dressing market segments, market trends, and opportunities, and any further data you may need to thrive in the surgical dressing industry. This surgical dressing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The surgical dressing market consists of sales of gauze, foam, transparent film, hydrocolloid, and hydrogel. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Surgical Dressing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on surgical dressing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for surgical dressing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The surgical dressing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Primary Dressing; Secondary Dressing; Other Products2) by Application: Diabetes Based surgeries; Cardiovascular Disease; Ulcers; Burns; Transplant Sites; Other Applications

3) by End-Use: Hospitals; Specialty Clinics; Home Healthcare; Ambulatory Surgery Centers; Other End-Uses

Subsegments:

1) by Primary Dressing: Adhesive Bandages; Gauze Pads; Hydrocolloid Dressings; Transparent Films; Foam Dressings2) by Secondary Dressing: Adhesive Tapes; Retention Bandages; Compression Wraps

3) by Other Products: Antimicrobial Dressings; Alginate Dressings; Silicone Dressings; Hydrogel Dressings

Key Companies Mentioned: 3M Company; Smith & Nephew plc; Mölnlycke Health Care AB; Convatec Group Plc.; Johnson & Johnson

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Surgical Dressing market report include:- 3M Company

- Smith & Nephew plc

- Mölnlycke Health Care AB

- Convatec Group Plc.

- Johnson & Johnson

- Coloplast Corp

- Medtronic plc

- Cardinal Health Inc.

- Medline Industries LP

- Advancis Medical

- B. Braun SE

- Baxter International Inc.

- Derma Sciences Inc.

- Organogenesis Holdings Inc.

- Essity Aktiebolag

- BSN Medical GmbH

- DeRoyal Industries Inc.

- Lohmann & Rauscher GmbH & Co. KG

- Paul Hartmann AG

- Winner Medical Co. Ltd.

- Hartmann USA Inc.

- McKesson Medical-Surgical Inc.

- M Health Care Ltd.

- Hollister Incorporated

- Integra LifeSciences Corporation

- DermaRite Industries LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.92 Billion |

| Forecasted Market Value ( USD | $ 5.04 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |