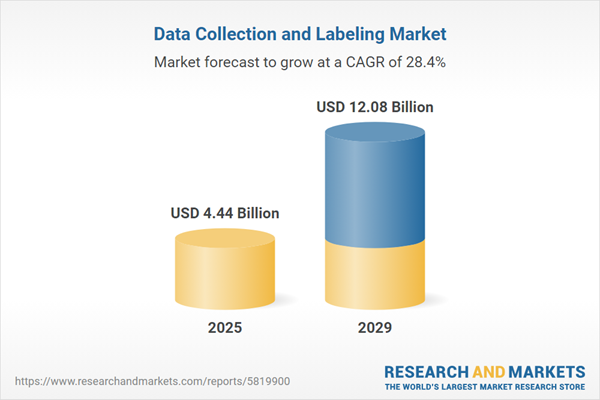

The data collection and labeling market size is expected to see exponential growth in the next few years. It will grow to $12.08 billion in 2029 at a compound annual growth rate (CAGR) of 28.4%. The growth in the forecast period can be attributed to evolving regulations, increasing ai adoption, demand for specialized labeling, rising complexity of data, globalization of data labeling services. Major trends in the forecast period include expansion of training data for ai models, increasing importance of image and video labeling, demand for real-time data labeling, security and privacy considerations, evolution of annotation tools.

The growing adoption of autonomous vehicles is anticipated to drive the expansion of the data collection and labeling market in the coming years. Autonomous vehicles are capable of sensing their environment and navigating without human input. Data collection and labeling play a crucial role in enabling self-driving cars to recognize patterns in data and categorize them correctly, allowing these vehicles to make accurate and safe decisions on the road. This includes responding to various objects and scenarios, such as pedestrians, other vehicles, and traffic signs. For example, in August 2022, the Insurance Information Institute, Inc., a US-based industry association, reported that by 2025, 3.5 million self-driving vehicles are expected to be on U.S. roads, with this number projected to increase to 4.5 million by 2030. As a result, the growing adoption of autonomous vehicles is fueling the growth of the data collection and labeling market.

The burgeoning advancement of machine learning and Artificial Intelligence (AI) is set to propel the expansion of the data collection and labeling market. Machine Learning involves algorithms enabling computers to enhance performance on specific tasks as they encounter more data, without explicit programming. Artificial Intelligence encompasses systems capable of simulating human intelligence. Leveraging AI and ML algorithms streamlines data collection from diverse sources such as sensors, IoT devices, and websites, automating data aggregation and preprocessing. As per the US Bureau of Labor Statistics, the projected 22% growth in employment for machine learning engineers from 2020 to 2030 indicates the significant role of rising AI and machine learning in driving the data collection and labeling market.

Technological advancements serve as a prominent trend fueling the growth of the data collection and labeling market. Companies operating within this market sphere are embracing innovative technologies, such as real-time data monitoring, to fortify their market presence. For instance, Sumake North America, in May 2022, introduced the EA-SC100 tool management system designed for data collection and tool setup. This system integrates a touch screen for real-time result visualization and a remote administration system for efficient tool setup and data retrieval. The EA-SC100 system not only reduces costs and boosts profitability but also streamlines assembly processes and aids businesses in upholding quality standards.

Leading companies in the data collection and labeling market are developing innovative software technologies, such as web-based data labeling tools, to enhance the efficiency, scalability, and accessibility of data annotation processes. A web-based data labeling tool is a software platform that allows users to label, categorize, and annotate data through an online interface. For example, in April 2024, StradVision, a US-based software company, launched Labelit, an advanced web-based data labeling tool designed to optimize the annotation processes required for sophisticated recognition technologies, particularly in driving and parking applications. Labelit automates complex data labeling tasks that were previously performed manually, significantly boosting efficiency through cloud-based processing. A key feature of this tool is its ability to track and analyze user work records, allowing for accurate measurement of task completion times.

In July 2022, Renesas Electronics Corporation, a Japan-based provider of cutting-edge semiconductor solutions, completed the acquisition of Reality AI for an undisclosed sum. This acquisition marks a significant step for Renesas, broadening and enriching its portfolio while diversifying its offerings in software and AI tools. The strategic integration of Reality AI, a US-based software development company specializing in data collection and labeling, strengthens Renesas' capacity to deliver optimized endpoint solutions that seamlessly integrate hardware and software. This acquisition amplifies Renesas' capabilities, enabling the development of highly refined solutions in the realm of data collection and labeling while expanding its overall technological prowess.

Major companies operating in the data collection and labeling market include Reality Analytics Inc., Globalme Localization Inc., Global Technology Solutions Inc., Alegion Inc., Labelbox Inc., Dobility Inc., Scale AI Inc., Trilldata Technologies Pvt. Ltd., Appen Limited, Summa Linguae Technologies SA, SuperAnnotate AI Inc., Keylabs.ai Ltd., V7Labs Ltd., Datasaur Inc., Dataloop Ltd., CloudFactory Limited, Clarifai Inc., International Business Machines Corp., Oracle Corp., TELUS International, Amazon Mechanical Turk, Cogito Corp., iMerit Technology Services Pvt Ltd., Snorkel AI Inc., Hive Digital Technologies Ltd., Samasource Group.

North America was the largest region in the data collection and labeling market in 2024. Asia-Pacific is expected to be the fastest-growing region in the data collection and labeling market report during the forecast period. The regions covered in the data collection and labeling market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data collection and labeling market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Data collection and labeling are crucial processes for gathering and organizing relevant data for use in artificial intelligence (AI) and machine learning (ML) models. In data collection, relevant information is gathered from various sources such as cameras, voice recorders, surveys, and web scraping to create a comprehensive dataset. Data labeling involves attaching labels or context to the collected data to provide information for training AI and ML models.

The primary data types for data collection and labeling include text, image or video, and audio. In text-related applications, labeling and collecting data are essential for training machine learning models to make accurate predictions on new text data. These processes find applications in various areas such as dataset management, security and compliance, data quality control, workforce management, content management, catalog management, sentiment analysis, and more. Different industries, including information technology (IT), automotive, government, healthcare, banking, financial services and insurance (BFSI), retail and e-commerce, leverage these processes for various purposes.

The data collection and labeling market research report is one of a series of new reports that provides data collection and labeling market statistics, including data collection and labeling industry global market size, regional shares, competitors with a data collection and labeling market share, detailed data collection and labeling market segments, market trends and opportunities, and any further data you may need to thrive in the data collection and labeling industry. This data collection and labeling market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The data collection and labeling market includes revenues earned by entities through sensor data labelling and natural language processing (NLP) labeling. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Collection and Labeling Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data collection and labeling market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data collection and labeling ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data collection and labeling market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Data Type: Text; Image or Video; Audio2) by Application: Dataset Management; Security and Compliance; Data Quality Control; Workforce Management; Content Management; Catalogue Management; Sentiment Analysis; Other Applications

3) by Vertical: Information Technology(IT); Automotive; Government; Healthcare; Banking, Financial Services and Insurance (BFSI); Retail and E-commerce; Other Verticals

Subsegments:

1) by Text: Sentiment Analysis; Named Entity Recognition (NER); Text Classification; Annotation For Chatbots2) by Image or Video: Image Classification; Object Detection; Image Segmentation; Video Annotation

3) by Audio: Speech Recognition; Speaker Identification; Sound Event Detection; Transcription Services

Key Companies Mentioned: Reality Analytics Inc.; Globalme Localization Inc.; Global Technology Solutions Inc.; Alegion Inc.; Labelbox Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Data Collection and Labeling market report include:- Reality Analytics Inc.

- Globalme Localization Inc.

- Global Technology Solutions Inc.

- Alegion Inc.

- Labelbox Inc.

- Dobility Inc.

- Scale AI Inc.

- Trilldata Technologies Pvt. Ltd.

- Appen Limited

- Summa Linguae Technologies SA

- SuperAnnotate AI Inc.

- Keylabs.ai Ltd.

- V7Labs Ltd.

- Datasaur Inc.

- Dataloop Ltd.

- CloudFactory Limited

- Clarifai Inc.

- International Business Machines Corp.

- Oracle Corp.

- TELUS International

- Amazon Mechanical Turk

- Cogito Corp.

- iMerit Technology Services Pvt Ltd.

- Snorkel AI Inc.

- Hive Digital Technologies Ltd.

- Samasource Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.44 Billion |

| Forecasted Market Value ( USD | $ 12.08 Billion |

| Compound Annual Growth Rate | 28.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |