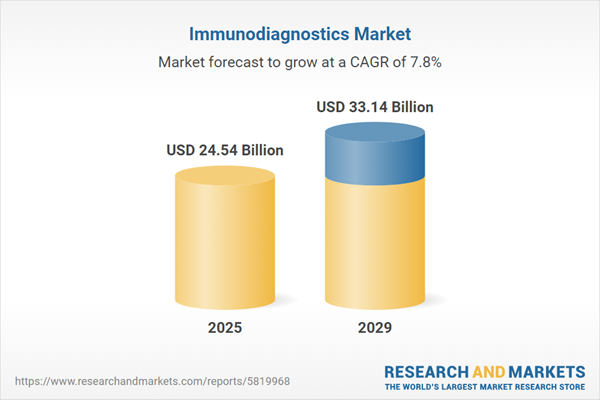

The immunodiagnostics market size is expected to see strong growth in the next few years. It will grow to $33.14 billion in 2029 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to pandemic preparedness and response, personalized medicine and biomarker discovery, growing healthcare infrastructure in emerging markets, integration with laboratory information systems, rising burden of chronic diseases. Major trends in the forecast period include multiplexing technologies, point-of-care testing (POCT), biomarker discovery and personalized medicine, the rise of digital immunodiagnostics, shift toward liquid biopsy.

The rising prevalence of infectious diseases is anticipated to drive the growth of the immunodiagnostics market in the coming years. Infectious diseases are illnesses caused by germs such as viruses, bacteria, fungi, or parasites that can be transmitted between individuals. Immunodiagnostic assays are utilized to detect the presence of viruses in blood samples. For example, in March 2024, the Centers for Disease Control and Prevention (CDC), a U.S. government agency, reported that the number of tuberculosis cases increased from 8,320 in 2022 to 9,615 in 2023, representing an increase of 1,295 cases. Therefore, the growing prevalence of infectious diseases is expected to significantly boost the immunodiagnostics market.

The increasing healthcare expenditure is expected to propel the growth of the immunodiagnostics market in the future. Healthcare expenditure refers to the total spending on healthcare costs, encompassing all money spent on healthcare-related goods and services within a specific healthcare system or economy. This expenditure is vital for fostering the development and accessibility of immunodiagnostic solutions. For example, in November 2023, the Canadian Institute for Health Information, a non-profit organization based in Canada, projected that total health expenditure would reach $344 billion in 2023, indicating a modest growth of 2.8% compared to the previous year. Therefore, the rising healthcare expenditure is driving the expansion of the immunodiagnostics market.

Leading companies in the immunodiagnostics market are focused on creating innovative solutions, such as the S. pneumoniae antigen immunodiagnostic assay, to assist in diagnosing pneumococcal pneumonia infections. This assay is used to detect the presence of Streptococcus pneumoniae antigens in bodily fluids, facilitating the diagnosis of pneumococcal infections. For instance, in September 2024, DiaSorin S.p.A., an Italy-based biotechnology company, introduced the LIAISON S. pneumoniae antigen immunodiagnostic assay. This diagnostic test is specifically designed for the qualitative detection of Streptococcus pneumoniae antigens in urine samples from adults suspected of having pneumococcal pneumonia. The assay provides a high-throughput solution, enabling healthcare providers to rapidly diagnose and differentiate pneumococcal pneumonia from other respiratory infections. When utilized with LIAISON CLIA analyzers, the test delivers results in just 35 minutes, promoting timely and targeted antimicrobial therapy. Additionally, its capability to identify 91 serotypes enhances clinical decision-making and supports effective antibiotic stewardship, representing a significant advancement in the immunodiagnostics field for community-acquired pneumonia.

Major companies in the immunodiagnostics market are increasingly forming partnerships to drive revenues. Collaborations involving medical experts, academic entities, and IT firms can significantly contribute to market expansion by fostering innovation and accelerating clinical immunodiagnostics. For example, in October 2022, Telix Pharmaceuticals Limited, an Australia-based radiopharmaceutical company, partnered with GE Healthcare, a US-based medical technology company, to combine Telix's investigational PET imaging radiotracers with GE Healthcare's immuno-diagnostic range. This collaboration aims to improve therapy selection and patient monitoring in immunotherapy trials.

In May 2023, Freenome, a biotechnology company based in the U.S., acquired Oncimmune for an undisclosed amount. This acquisition is intended to enhance Freenome's capabilities in early cancer detection by incorporating Oncimmune's innovative technology and expertise in immune profiling. The move aims to strengthen Freenome's position in the oncology diagnostics market and expand its portfolio of liquid biopsy solutions. Oncimmune, located in the UK, specializes in developing technologies for immune profiling and biomarker discovery to aid in cancer diagnosis and monitoring.

Major companies operating in the immunodiagnostics market include Abbott Laboratories, Arkray Inc., bioMérieux Inc., Immunodiagnostic Systems Holdings Plc (IDS), Bio-Rad Laboratories Inc., DiaSorin S.p.A., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Siemens AG, Sysmex Corporation, Thermo Fisher Scientific Inc., Danaher Corporation, Qiagen N.V., Tecan Trading AG, PerkinElmer Inc., Merck KGaA, Becton Dickinson and Company, Grifols S.A., Ortho Clinical Diagnostics, Beckman Coulter Inc., Bio-Techne Corporation, Creative Diagnostics, Fujirebio Holdings Inc., Gold Standard Diagnostics Corp., Hologic Inc., Luminex Corporation, Myriad Genetics Inc., Natera Inc., OraSure Technologies Inc., Quidel Corporation.

North America was the largest region in the immunodiagnostics market in 2024. The regions covered in the immunodiagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the immunodiagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Immunodiagnostics is a diagnostic approach that relies primarily on the antigen-antibody response for detecting serum insulin. These tests are employed to identify antibodies and parasite antigens.

The principal products in the field of immunodiagnostics include reagents and consumables, instruments and software, and services. Reagents are substances used to initiate chemical reactions with other substances to detect the presence of specific substances, while consumables refer to traceable items utilized in the execution of analysis techniques. The technologies involved encompass enzyme-linked immunosorbent assay, chemiluminescence immunoassay, fluorescent immunoassay, radioimmunoassay, rapid tests, and others. These technologies find applications in various medical fields such as infectious diseases, oncology, endocrinology, bone and mineral diseases, autoimmunity disorders, cardiac biomarkers, drug monitoring, and more. The end-users of immunodiagnostics include hospitals, clinics, diagnostic laboratories, academic and research institutes, among others.

The immunodiagnostics market research report is one of a series of new reports that provides immunodiagnostics market statistics, including immunodiagnostics industry global market size, regional shares, competitors with immunodiagnostics market share, detailed immunodiagnostics market segments, market trends, and opportunities, and any further data you may need to thrive in the immunodiagnostics industry. This immunodiagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The immunodiagnostics market consists of revenues earned by entities by providing agglutination, nephelometry, immunoprecipitation, and radial immunodiffusion test services. The market value includes the value of related goods sold by the service provider or included within the service offering. The immunodiagnostics market also includes sales of anti-streptolysin-O latex, infectious mononucleosis slide, rheumatoid factor, and syphilis serology reagent. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Immunodiagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on immunodiagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for immunodiagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The immunodiagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Reagents and Consumables; Instruments; Software and Services2) By Technology: Enzyme-Linked Immunosorbent Assay; Chemiluminescence Immunoassay; Fluorescent Immunoassay; Radioimmunoassay; Rapid Test; Other Technologies

3) By Application: Infectious Diseases; Oncology and Endocrinology; Bone and Mineral Diseases; Autoimmunity Disorders; Cardiac Biomarkers; Drug Monitoring; Other Applications

4) By End User: Hospitals; Clinics; Diagnostic Laboratories; Academic and Research Institutes; Other End Users

Subsegments:

1) By Reagents and Consumables: Antibodies; Assay Kits; Buffers and Substrates2) By Instruments: Immunoassay Analyzers; Flow Cytometers; ELISA Readers

3) By Software and Services: Laboratory Information Management Systems (LIMS); Data Analysis Software; Maintenance and Support Services

Key Companies Mentioned: Abbott Laboratories; Arkray Inc.; bioMérieux Inc.; Immunodiagnostic Systems Holdings Plc (IDS); Bio-Rad Laboratories Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Immunodiagnostics market report include:- Abbott Laboratories

- Arkray Inc.

- bioMérieux Inc.

- Immunodiagnostic Systems Holdings Plc (IDS)

- Bio-Rad Laboratories Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services Inc.

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Qiagen N.V.

- Tecan Trading AG

- PerkinElmer Inc.

- Merck KGaA

- Becton Dickinson and Company

- Grifols S.A.

- Ortho Clinical Diagnostics

- Beckman Coulter Inc.

- Bio-Techne Corporation

- Creative Diagnostics

- Fujirebio Holdings Inc.

- Gold Standard Diagnostics Corp.

- Hologic Inc.

- Luminex Corporation

- Myriad Genetics Inc.

- Natera Inc.

- OraSure Technologies Inc.

- Quidel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 24.54 Billion |

| Forecasted Market Value ( USD | $ 33.14 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |