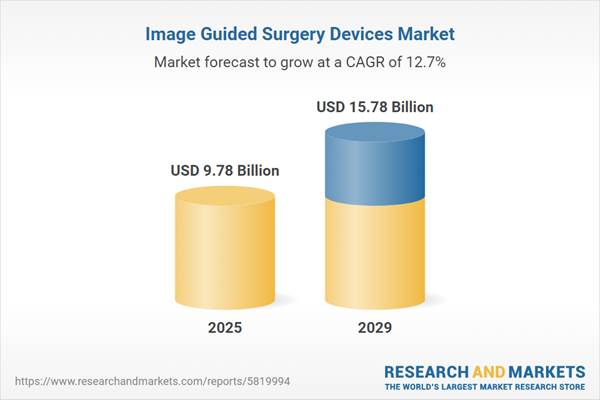

The image guided surgery devices market size is expected to see rapid growth in the next few years. It will grow to $15.78 billion in 2029 at a compound annual growth rate (CAGR) of 12.7%. The growth in the forecast period can be attributed to market expansion in emerging economies, patient preference for minimally invasive procedures, customization and personalization of treatments, global health challenges and preparedness, collaborations and partnerships. Major trends in the forecast period include continued technological innovations, integration with artificial intelligence, technological advancements, global market expansion, increasing adoption of robotics.

The anticipated increase in neurological disorders is set to drive the growth of the image-guided surgery devices market in the coming years. Neurological disorders, impacting both the central and peripheral nervous systems, can be effectively addressed using image-guided surgery devices. These devices play a crucial role in performing minimally invasive surgeries for conditions such as brain tumors and brain biopsies. According to the European Academy of Neurology in May 2022, one in three individuals is expected to be affected by a neurological disease at some point in their lives, with a nearly 40% increase in deaths due to neurological conditions over the past 30 years. This rise in neurological disorders is a significant factor propelling the expansion of the image-guided surgery devices market.

The growing preference for minimally invasive surgeries (MIS) is anticipated to drive the expansion of the image-guided surgery devices market in the coming years. MIS refers to surgical procedures that are performed with minimal disruption to the body, in contrast to traditional open surgeries. The incorporation of image-guided surgery devices in these minimally invasive procedures enhances precision, safety, and patient outcomes while also reducing recovery time, making them essential tools in contemporary surgical practices. For example, a report from The Aesthetic Society, a U.S.-based organization focused on plastic surgery and cosmetic medicine, noted that Americans spent over $11.8 billion on aesthetic procedures in total, reflecting a 2% increase from the previous year. Thus, the increasing preference for minimally invasive surgeries is driving the growth of the image-guided surgery devices market.

Technological advancements emerge as a significant trend in the image-guided surgery devices market, with major players focusing on introducing advanced technologies to strengthen their market position. In March 2022, Siemens Healthineers unveiled innovative devices, including MAGNETOM Free. Star and NAEOTOM Alpha. MAGNETOM Free. Star, a helium-free scanner, employs DryCool technology, utilizing digitalization and artificial intelligence (AI) to simplify complex MRI technologies and deliver high-quality results in MRI scans. The NAEOTOM Alpha, equipped with the QuantaMax detector, provides high-resolution images at a lower dose, offering improved contrast at lower noise for precise, non-invasive diagnoses in cardiology, pulmonology, cancer, and emergency medicine.

Prominent companies in the image-guided surgery devices market are placing a strategic focus on innovative products such as the mobile C-arm system to boost their revenues. The mobile C-arm system serves as a medical imaging device crucial for capturing real-time X-ray images during surgical and interventional procedures. In May 2023, Koninklijke Philips N.V., a health technology company based in the Netherlands, introduced the Zenition 10, showcasing advanced flat panel detector technology. This technology not only enhances the affordability of therapy but also improves patient outcomes. The Zenition 10 system offers individualized user profiles, application-specific protocols, exceptional C-arm mobility, and a low-dose pediatric mode. Designed to handle high patient throughput with speed and efficiency, the system is also versatile enough to meet the specific requirements of trauma, orthopedics, and other surgical specialties, optimizing its usage. As an affordable imaging option for routine surgery, it provides the necessary speed and efficiency to manage a high patient flow.

In July 2024, GE Healthcare, a medical technology company based in the U.S., acquired Intelligent Ultrasound Group plc for an undisclosed sum. This acquisition is intended to bolster GE Healthcare's ultrasound capabilities by integrating Intelligent Ultrasound's cutting-edge AI technology, which aims to improve diagnostic accuracy and streamline workflows for healthcare professionals. Intelligent Ultrasound Group plc, located in the UK, specializes in developing artificial intelligence and software solutions for ultrasound imaging, enhancing the accuracy and efficiency of ultrasound procedures across various medical applications.

Major companies operating in the image guided surgery devices market include General Electric Company, Medtronic Plc., Olympus Corporation, Siemens Healthineers, Koninklijke Philips N.V., Brainlab AG, Karl Storz Gmbh & Co. KG, Stryker Corporation, Varian Medical Systems Inc., Hitachi Medical Corporation, Analogic Corporation, Zimmer Biomet Holdings Inc., Smith and Nephew Plc, FUJIFILM Holdings Corporation, Shimadzu Corporation, Intuitive Surgical Inc., Canon Medical Systems Corporation, Synaptive Medical, Accuray Incorporated, ClaroNav Inc., Merge Healthcare Inc., CureMetric Health Tech, Mirada Medical Ltd., Elekta AB, XION GmbH, Northern Digital Inc., Fiagon AG Medical Technologies.

North America was the largest region in the image guided surgery devices market in 2024. The regions covered in the image guided surgery devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the image guided surgery devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Image-guided surgery devices are tools employed for performing surgeries with the aid of highly sophisticated computerized systems that generate three-dimensional images of the patient's anatomy. Surgeons utilize these devices to obtain real-time images of the internal structures during surgical procedures.

The primary components of image-guided surgery devices encompass the devices themselves and the accompanying software. Image-guided surgery devices are specifically designed to assist surgeons in navigating a patient's anatomy in three dimensions (3D) in real-time. Various devices involved in this process include CT, ultrasound, MRI, X-ray, fluoroscopy, endoscopes, PET, and SPECT. These devices find applications in a range of surgical fields such as cardiac surgery, neurosurgery, orthopedic surgery, urology, oncology surgery, gastroenterology, and other medical specialties. The end-users of these devices include hospitals, ambulatory surgical centers, specialty clinics, as well as research and academic institutions.

The image guided surgery devices market research report is one of a series of new reports that provides image guided surgery devices market statistics, including image guided surgery devices industry global market size, regional shares, competitors with image guided surgery devices market share, detailed image guided surgery devices market segments, market trends, and opportunities, and any further data you may need to thrive in the image guided surgery devices industry. This image guided surgery devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The image guided surgery devices market includes revenues earned by entities by providing ultrasound, and angiography integration software. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included. The image guided surgery devices market also consists of sales of surgical navigation equipment, tracking tools, and IGS systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Image Guided Surgery Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on image guided surgery devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for image guided surgery devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The image guided surgery devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Image Guided Surgery Devices; Image Guided Surgery Software2) By Device Type: CT; Ultrasound; MRI; X-Ray; Fluoroscopy; Endoscopes; PET; SPECT;

3) By Application: Cardiac Surgery; Neurosurgery; Orthopedic Surgery; Urology; Oncology Surgery; Gastroenterology; Other Applications

4) By End User: Hospitals; Ambulatory Surgical Centers; Specialty Clinics; Research and Academic Institutions

Subsegments:

1) By Image Guided Surgery Devices: Optical Tracking Systems; Electromagnetic Tracking Systems; Ultrasound-Based Systems2) By Image Guided Surgery Software: Pre-Operative Planning Software; Intra-Operative Imaging Software; Post-Operative Analysis Software

Key Companies Mentioned: General Electric Company; Medtronic Plc.; Olympus Corporation; Siemens Healthineers; Koninklijke Philips N.V.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- General Electric Company

- Medtronic Plc.

- Olympus Corporation

- Siemens Healthineers

- Koninklijke Philips N.V.

- Brainlab AG

- Karl Storz Gmbh & Co. KG

- Stryker Corporation

- Varian Medical Systems Inc.

- Hitachi Medical Corporation

- Analogic Corporation

- Zimmer Biomet Holdings Inc.

- Smith and Nephew Plc

- FUJIFILM Holdings Corporation

- Shimadzu Corporation

- Intuitive Surgical Inc.

- Canon Medical Systems Corporation

- Synaptive Medical

- Accuray Incorporated

- ClaroNav Inc.

- Merge Healthcare Inc.

- CureMetric Health Tech

- Mirada Medical Ltd.

- Elekta AB

- XION GmbH

- Northern Digital Inc.

- Fiagon AG Medical Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.78 Billion |

| Forecasted Market Value ( USD | $ 15.78 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |