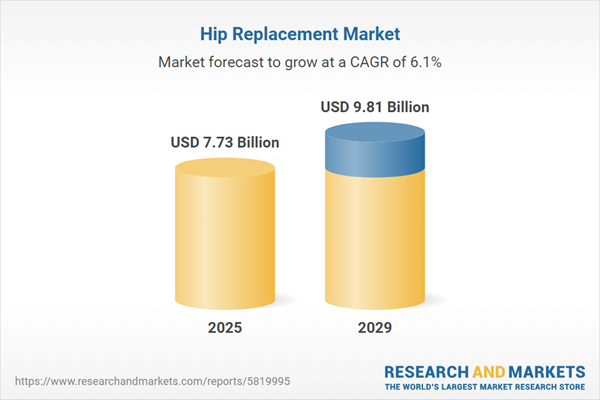

The hip replacement market size is expected to see strong growth in the next few years. It will grow to $9.81 billion in 2029 at a compound annual growth rate (CAGR) of 6.1%. The growth in the forecast period can be attributed to rising aging population, prevalence of chronic conditions, global healthcare infrastructure improvement, regulatory support, patient preference for minimally invasive procedures. Major trends in the forecast period include technological advancements, rising aging population, outpatient procedures on the rise, personalized medicine and 3d printing, value-based healthcare.

The rise in the number of hip injuries is expected to fuel the growth of the hip replacement market in the future. Hip injuries occur when one of the muscles supporting the hip joint is overstretched or damaged. Individuals suffering from conditions like arthritis, avascular necrosis, or other forms of hip joint degeneration may experience pain and stiffness that can be alleviated through hip replacement surgery. For example, in August 2024, the National Library of Medicine, a U.S. government agency, projected that annual incidences could reach between 3 and 11 million by 2030 and potentially rise to between 5 and 21 million by 2050, depending on various estimating assumptions. Thus, the increasing occurrence of hip injuries is driving the growth of the hip replacement market in the coming years.

The escalating prevalence of obesity is also expected to contribute to the growth of the hip replacement market. Obesity, characterized by an excessive accumulation of body fat, can negatively impact health, causing hip joint issues. Hip replacement surgery emerges as a beneficial solution for obese individuals, offering pain relief, improved mobility, enhanced functionality, and an overall better quality of life. Additionally, obesity can lead to uneven pressure on hip joints, accelerating wear and tear. For instance, in May 2023, the Government Digital Service in the UK projected a 25.9% obesity rate among individuals aged 18 and older in 2021-2022, reflecting a 25.2% increase. Thus, the rising prevalence of obesity is a key driver of the hip replacement market.

Technological advancements represent a noteworthy trend gaining traction in the hip replacement market. Companies in this sector are adopting innovative technologies to maintain their market position. For example, in July 2022, Enovis, a US-based medical technology company, introduced ARVIS, an augmented reality technology designed to enhance both total hip and knee replacement surgeries. This technology provides surgeons with improved information and a more enhanced surgical experience, eliminating the need for intrusive and unnecessary equipment.

Major players in the hip replacement market are concentrating on developing innovative products such as the dual mobility system to boost their revenues. The dual mobility system is an artificial hip joint designed to minimize the risk of dislocation, commonly used in high-risk patients. In August 2023, Smith & Nephew plc, a UK-based medical equipment manufacturing company, launched the OR3O dual mobility system. This system features characteristics that simplify the dual mobility method, including easy acetabular cup selection and liner insertion and removal. The OR3O system incorporates an insert made of highly cross-linked polyethylene and an oxidized, diffusion-hardened zirconium acetabular liner (OR3O liner), utilizing the latest OXINIUM DH advanced bearing technology for enhanced stability.

In July 2022, Enovis, a US-based medical technology company, completed the acquisition of Insight Medical Systems, Inc for an undisclosed amount. This strategic acquisition aims to improve patient outcomes in orthopedic surgery by leveraging next-generation augmented reality surgical guidance. Insight Medical Systems, Inc., a US-based medical technology company, offers a fresh perspective on surgical procedures.

Major companies operating in the hip replacement market include Johnson & Johnson, Stryker Corporation, Smith & Nephew PLC, B. Braun Melsungen AG, ConforMIS Inc., Exactech Inc, MicroPort Scientific Corporation, Zimmer Biomet Holdings Inc., Corin Group PLC, Gruppo Bioimpianti S.R.L., Integra LifeSciences, Medacta International, Merete GmbH, Microport Orthopedics Inc., DJO Global Inc., Waldemar Link GmbH & Co. KG, Peter Brehm GmbH, Synimed Synergie Ingénierie Médicale S.A.R.L., Elite Surgical Industries, Corentec Co. Ltd., Arthrex Inc., Evolutis, FH Ortho S.A.S, In2Bones Global Inc.

North America was the largest region in the hip replacement market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global hip replacement market report during the forecast period. The regions covered in the hip replacement market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hip replacement market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Hip replacement is a surgical intervention wherein an orthopedic surgeon substitutes the compromised elements of the hip joint with new artificial ones, eliminating the diseased components. When conditions such as arthritis, avascular necrosis, or other issues lead to damage in the hip joint, hip replacement becomes a viable solution to alleviate pain and stiffness.

The primary types of hip replacement procedures include total hip replacement, partial hip replacement, revision hip replacement, and hip resurfacing. Hip hemiarthroplasty involves the replacement of the femoral head to address specific femoral neck fractures. Various materials, such as metal-on-metal, metal-on-polyethylene, ceramic-on-polyethylene, ceramic-on-metal, and ceramic-on-ceramic, are utilized by diverse end-users such as hospitals, specialty clinics, and ambulatory surgery centers.

The hip replacement market research report is one of a series of new reports that provides hip replacement market statistics, including hip replacement industry global market size, regional shares, competitors with a hip replacement market share, detailed hip replacement market segments, market trends and opportunities, and any further data you may need to thrive in the hip replacement industry. This hip replacement market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The hip replacement market includes revenues earned by entities by partial hip replacement, hip revision surgery, hip arthroplasty, hip resurfacing, minimally invasive hip surgery, posterior hip replacement, and anterior hip replacement approaches. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hip Replacement Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hip replacement market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hip replacement? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hip replacement market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Procedure: Total Hip Replacement; Partial Hip Replacement; Revision Hip Replacement; Hip Resurfacing2) By Material: Metal-on-Metal; Metal-on-Polyethylene; Ceramic-on-Polyethylene; Ceramic-on-Metal; Ceramic-on-Ceramic

3) By End-User: Hospitals; Specialty Clinics; Ambulatory Surgery Centers

Subsegments:

1) By Total Hip Replacement: Cemented Total Hip Replacement; Cementless Total Hip Replacement2) By Partial Hip Replacement: Hemiarthroplasty; Bipolar Hip Replacement

3) By Revision Hip Replacement: Acetabular Component Revision; Femoral Component Revision

4) By Hip Resurfacing: Metal-on-Metal Hip Resurfacing; Ceramic-on-Ceramic Hip Resurfacing

Key Companies Mentioned: Johnson & Johnson; Stryker Corporation; Smith & Nephew PLC; B. Braun Melsungen AG; ConforMIS Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew PLC

- B. Braun Melsungen AG

- ConforMIS Inc.

- Exactech Inc

- MicroPort Scientific Corporation

- Zimmer Biomet Holdings Inc.

- Corin Group PLC

- Gruppo Bioimpianti S.R.L.

- Integra LifeSciences

- Medacta International

- Merete GmbH

- Microport Orthopedics Inc.

- DJO Global Inc.

- Waldemar Link GmbH & Co. KG

- Peter Brehm GmbH

- Synimed Synergie Ingénierie Médicale S.A.R.L.

- Elite Surgical Industries

- Corentec Co. Ltd.

- Arthrex Inc.

- Evolutis

- FH Ortho S.A.S

- In2Bones Global Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.73 Billion |

| Forecasted Market Value ( USD | $ 9.81 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |