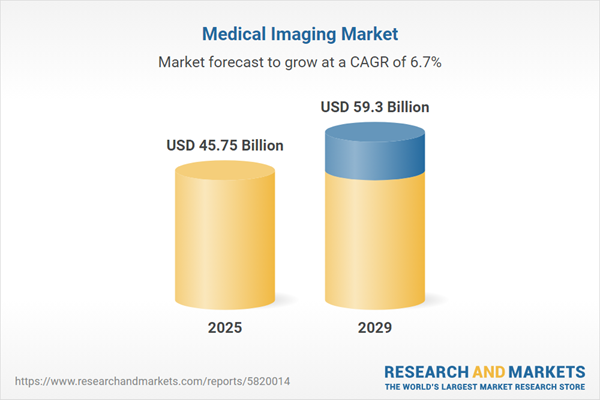

The medical imaging market size is expected to see strong growth in the next few years. It will grow to $59.3 billion in 2029 at a compound annual growth rate (CAGR) of 6.7%. The growth in the forecast period can be attributed to personalized medicine approaches, emerging modalities and hybrid imaging, global health challenges and preparedness, integration with electronic health records (EHRs), patient-centric care and experience. Major trends in the forecast period include telemedicine and remote imaging, artificial intelligence (AI) integration, advancements in technology, advancements in 3D and 4D imaging, increasing use of portable and point-of-care imaging devices.

The growing prevalence of chronic illnesses is anticipated to fuel the expansion of the medical imaging market in the near future. Chronic illness refers to a medical condition that persists for three months or longer and has the potential to worsen over time. Older adults are more susceptible to chronic illnesses, which can typically be managed but not cured. The rising incidence of chronic conditions supports the medical imaging market, as imaging techniques are essential for diagnosing and detecting these ailments. For example, a January 2023 report from the National Center for Biotechnology Information (NCBI), a US-based National Library of Medicine, predicts that by 2050, the number of individuals aged 50 and older with at least one chronic illness will increase by 99.5%, rising from 71.522 million in 2020 to 142.66 million. Consequently, the escalating prevalence of chronic illnesses is a key driver of growth in the medical imaging market.

Rising healthcare expenditure is projected to drive the growth of the medical imaging market in the future. Healthcare expenditure encompasses the total amount spent on healthcare goods and services, including personal health care - such as curative, rehabilitative, and long-term care, as well as ancillary services and medical goods - and collective services like prevention and public health initiatives, excluding investments. Healthcare spending significantly impacts medical imaging services by aiding medical decision-making and enhancing patient care. The growing variety of new imaging technologies has increased the demand for cost-effectiveness modeling in diagnostic imaging. For instance, a report from May 2023 by the Office for National Statistics, a UK government department, revealed that healthcare spending in the UK rose by 5.6% between 2022 and 2023, compared to a growth of just 0.9% in 2022. In 2023, the UK’s healthcare expenditure was approximately $317.63 billion (£292 billion). Thus, the increase in healthcare expenditure is a key factor propelling the growth of the medical imaging market.

Major companies in the medical imaging market are concentrating on technological advancements, such as mobile connectivity, which allows remote experts to assist with scanning and diagnostics. This mobile connectivity enables healthcare professionals to monitor and control MRI scans from a distance, access patient data, and receive notifications about scan statuses or emergencies. For example, in November 2022, Siemens Healthcare, a Germany-based healthcare company, introduced a new mobile magnetic resonance imaging scanner, the Magnetom Viato.Mobile. This latest MRI scanner is optimized for mobile use, providing exceptional flexibility with its 70-centimeter patient bore and trailer setup, which facilitates easy mobility and on-site deployment. It supports remote operation and service through fixed internet or 4G, making it usable in various locations. This feature reduces the need for on-site staffing while allowing specialists to assist with scans and maintenance remotely. The Magnetom Viato.Mobile MRI scanner thus combines flexibility with advanced remote capabilities, enhancing its application in diverse settings.

Major companies in the medical imaging market are focusing on introducing advanced solutions, such as AI-based tools, to gain a competitive advantage. AI-based medical imaging tools are transforming healthcare by utilizing artificial intelligence to analyze medical images, identify intricate patterns, and provide a quantitative assessment of radiographic features. For example, in October 2022, Google LLC, a US-based technology corporation, introduced a suite of tools aimed at enhancing the interoperability of medical images and aiding institutions in developing machine learning and artificial intelligence models. Google's Medical Imaging Suite includes AI-assisted annotation, offering automated image labeling, cloud-based file storage with secure data exchange capabilities, and tools for constructing training datasets for algorithms. This suite aims to expedite the development of scalable machine learning models with minimal coding requirements, contributing to advancements in medical imaging technology.

In July 2022, Canon Medical Systems USA, Inc., a US-based manufacturer of medical equipment, acquired NXC Imaging for an undisclosed amount. This acquisition is intended to bolster Canon Medical's position in the medical imaging market, broaden its product portfolio, and improve its customer outreach. NXC Imaging is a US-based medical device company specializing in medical imaging equipment.

Major companies operating in the medical imaging market include Hitachi Medical Corporation, General Electric Company, Medtronic PLC, Siemens Healthcare GmbH, Fujifilm Holdings Corporation, Koninklijke Philips N V, Hologic Inc., Mindray Medical International Limited, PerkinElmer Inc., Shimadzu Corporation, Varian Medical Systems Inc., Agfa-Gevaert Group, Neusoft Medical Systems Co Ltd., Carestream Health Inc., Esaote SpA, Analogic Corporation, Samsung Medison Co Ltd., Canon Medical Systems Corporation, TomTec Imaging Systems GmbH, IBM Watson Health, Ziehm Imaging GmbH, MIM Software Inc., SuperSonic Imagine SA, EOS Imaging SA, Cubresa Inc., Planmed Oy, CurveBeam LLC, ContextVision AB, Koning Health, Intrasense SA.

North America was the largest region in the medical device market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global medical imaging market report during the forecast period. The regions covered in the medical imaging market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical imaging market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Medical imaging encompasses a range of technologies used to produce images of the body to diagnose, monitor, or treat medical conditions. Each imaging modality provides unique information about the body, aiding in the detection and treatment of illnesses or injuries.

In medical imaging, the main product types include X-ray devices, magnetic resonance imaging (MRI) machines, ultrasound machines, computed tomography (CT) scanners, nuclear imaging devices, and mammography machines. These imaging technologies have diverse applications in healthcare, including obstetrics and gynecology health, orthopedics and musculoskeletal imaging, neuro and spine imaging, cardiovascular and thoracic imaging, general imaging, oncology imaging, urology imaging, breast health, and others. These devices are used in various healthcare settings such as hospitals, specialty clinics, diagnostic imaging centers, and others.

The medical imaging market research report is one of a series of new reports that provides medical imaging market statistics, including medical imaging industry global market size, regional shares, competitors with a medical imaging market share, detailed medical imaging market segments, market trends and opportunities, and any further data you may need to thrive in the medical imaging industry. This medical imaging market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical imaging market consists of sales of different kinds of medical imaging equipment such as PET machines, fluoroscopy, electroencephalograms, and digital subtraction angiography machines. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Imaging Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical imaging market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical imaging? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical imaging market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: X-Ray Devices; Magnetic Resonance Imaging (MRI); Ultrasound; Computed Tomography; Nuclear Imaging; Mammography2) By Application: Obstetrics and Gynecology Health; Orthopedics and Musculoskeletal; Neuro and Spine; Cardiovascular and Thoracic; General Imaging; Oncology; Urology; Breast Health; Other Applications

3) By End User: Hospitals; Specialty Clinics; Diagnostic Imaging Centers; Other End Users

Subsegments:

1) By X-Ray Devices: Conventional X-Ray Systems; Digital Radiography Systems; Portable X-Ray Machines2) By Magnetic Resonance Imaging (MRI): Closed MRI Systems; Open MRI Systems; Functional MRI (fMRI)

3) By Ultrasound: Diagnostic Ultrasound Systems; 3D/4D Ultrasound Systems; Portable Ultrasound Devices

4) By Computed Tomography (CT): Spiral/Helical CT Scanners; Cone Beam CT Scanners; Multi-Slice CT Scanners

5) By Nuclear Imaging: Positron Emission Tomography (PET) Scanners; Single Photon Emission Computed Tomography (SPECT) Scanners

6) By Mammography: Digital Mammography Systems; 3D Tomosynthesis Mammography Systems; Screening and Diagnostic Mammography Systems

Key Companies Mentioned: Hitachi Medical Corporation; General Electric Company; Medtronic PLC; Siemens Healthcare GmbH; Fujifilm Holdings Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Hitachi Medical Corporation

- General Electric Company

- Medtronic PLC

- Siemens Healthcare GmbH

- Fujifilm Holdings Corporation

- Koninklijke Philips N V

- Hologic Inc.

- Mindray Medical International Limited

- PerkinElmer Inc.

- Shimadzu Corporation

- Varian Medical Systems Inc.

- Agfa-Gevaert Group

- Neusoft Medical Systems Co Ltd.

- Carestream Health Inc.

- Esaote SpA

- Analogic Corporation

- Samsung Medison Co Ltd.

- Canon Medical Systems Corporation

- TomTec Imaging Systems GmbH

- IBM Watson Health

- Ziehm Imaging GmbH

- MIM Software Inc.

- SuperSonic Imagine SA

- EOS Imaging SA

- Cubresa Inc.

- Planmed Oy

- CurveBeam LLC

- ContextVision AB

- Koning Health

- Intrasense SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 45.75 Billion |

| Forecasted Market Value ( USD | $ 59.3 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |