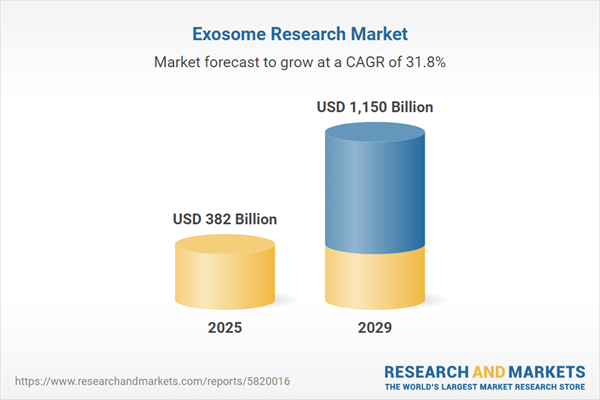

The exosome research market size is expected to see exponential growth in the next few years. It will grow to $1.15 trillion in 2029 at a compound annual growth rate (CAGR) of 31.8%. The growth in the forecast period can be attributed to clinical translation of exosome-based therapeutics, expansion of liquid biopsy applications, increased industry collaboration in research, rising interest in extracellular vesicles, and focus on standardization and quality control. Major trends in the forecast period include clinical applications and therapeutics, technological advancements in isolation and analysis, biomarker discovery and diagnostics, standardization and quality control, collaborations and partnerships.

The anticipated growth in the exosome research market is attributed to the increased incidence of chronic medical diseases. Chronic diseases, lasting three months or longer and often worsening over time, include common ailments such as cancer, heart disease, stroke, diabetes, and arthritis. The release of exosomes can be exploited by infections to avoid immune system detection, highlighting the significance of exosome research in understanding and addressing various diseases, including cancer, neurodegenerative disorders, and inflammatory conditions. For instance, a report from the Centers for Disease Control and Prevention in July 2022 revealed that 6 out of 10 Americans suffer from chronic diseases, with 4 out of 10 adults experiencing more than two chronic conditions, such as chronic lung disease, heart disease, stroke, and diabetes. Consequently, the increased incidence of chronic medical diseases is set to drive the growth of the exosome research market.

The expected rise in funding for life sciences research is another factor contributing to the growth of the exosome research market. Funding for life sciences research involves financial support provided to scientists, researchers, and organizations for conducting studies in the life sciences field. This increased funding has generated a growing interest in exosome research, particularly in the realms of disease diagnosis and therapeutic applications. The availability of funds has facilitated innovative approaches to exosome research, leveraging advanced technologies and methodologies to explore exosome biology and function. For instance, statistics from the National Center for Science and Engineering in September 2023 indicated a 13.6% increase in federal agency commitments for research and experimental development (R&D) in FY 2021, reaching an all-time high of $190.2 billion (in current dollars) from $167.4 billion in FY 2020. Thus, the rising funding for life sciences research is a driving force behind the growth of the exosome research market.

Product innovations emerge as a prominent trend gaining traction in the exosome research market, with major companies actively introducing inventive products to foster market growth. A case in point is the November 2022 launch by Cell Guidance Systems, a UK-based company, of Instant Exosomes and the LipoQ assay. Instant Exosomes, a subtype of extracellular vesicles (EV), are lipid membrane-enclosed compartments within the 50 to 1,000 nm diameter range. These EVs, released from various cell types and tissues, exhibit highly diverse contents. The LipoQ assay, based on the sulfo-phospo-vanillin method, facilitates the measurement of lipid content, particularly unsaturated fatty acids, within a given sample.

Major players in the exosome research market are strategically focusing on technological innovations, including the development of exosome characterization platforms, to gain a competitive advantage. These platforms encompass a set of tools and techniques dedicated to analyzing the physical, molecular, and functional properties of exosomes. Creative Biolabs Inc., a US-based biotech products and services provider, exemplifies this strategy by launching the Nanosight platform in August 2022. The Nanosight platform, designed specifically for exosome characterization, enhances accessibility and efficiency in exosome research for global researchers. It proves invaluable for researchers exploring the potential applications of exosomes in diverse fields such as medicine, diagnostics, and drug delivery.

In August 2024, BioIVT LLC, a U.S.-based provider of biospecimen solutions, acquired ZenBio Inc. for an undisclosed amount. This acquisition enables BioIVT to strengthen its expertise in cell and tissue models, broadening its range of high-quality biological products for research and drug development. ZenBio Inc., also based in the U.S., is a biotechnology company specializing in human exosome research products.

Major companies operating in the exosome research market include Thermo Fisher Scientific Inc., System Biosciences LLC, QIAGEN N.V., Exosome Diagnostics Inc., Bio-Techne Corporation, Hitachi Ltd., Aethlon Medical Inc., NanoSomiX Inc., Malvern Panalytical Ltd., Sistemic Scotland Limited, NX PharmaGen Corporation, Miltenyi Biotec GmbH, AMS Biotechnology (Europe) B.V., Norgen Biotek Corp., Novus Biologicals LLC, Lonza Group AG, Sistem-Bio S.A.S., Izon Science Ltd, Evomic Science LLC, New England Biolabs Inc., Evox Therapeutics Limited, Codiak BioSciences Inc., MagBio Genomics Inc., Cell Guidance Systems Ltd., Aruna Biomedical PBC, Capricor Therapeutics Inc., Stemcell Technologies Inc., ExoCoBio Inc., Creative Biolabs, Nanovex Biotechnologies S.L.

North America was the largest region in the exosome research market in 2024. The regions covered in the exosome research market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the exosome research market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Exosomes, the smallest extracellular vesicles (EVs), hold significant relevance in the tumor microenvironment (TME), where they play a direct role in facilitating angiogenesis, tumor metastasis, and immunosuppression. EVs, which encompass exosomes, can be categorized into three primary groups based on their size, biogenesis, and function.

The primary components of exosome research comprise kits and reagents, as well as instruments and other related tools. Kits and reagents are specialized test kits designed for use in laboratory settings or field environments to detect specific compounds. These kits find applications in various indications such as cancer, neurodegenerative diseases, cardiovascular diseases, infectious diseases, among others. Additionally, they serve different purposes such as biomarker identification, vaccine development, tissue regeneration, and more. End-users of these products include academic and research institutes, pharmaceutical and biotechnology companies, as well as hospitals and clinical testing laboratories.

The exosome research market research report is one of a series of new reports that provides exosome research market statistics, including exosome research industry global market size, regional shares, competitors with an exosome research market share, detailed exosome research market segments, market trends and opportunities, and any further data you may need to thrive in the exosome research industry. This exosome research market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The exosome research market consists of sales of exosome research tools, exosome isolation and detection tools, exosome marker antibodies, and exosome biomarkers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Exosome Research Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on exosome research market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for exosome research? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The exosome research market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Kits and Reagents; Instruments; Other Products2) By Indication: Cancer; Neurodegenerative Diseases; Cardiovascular Diseases; Infectious Diseases; Other Indications

3) By Application: Biomarkers; Vaccine Development; Tissue Regeneration; Other Applications

4) By End User: Academic and Research Institutes; Pharmaceutical and Biotechnology Companies; Hospitals and Clinical Testing Laboratories

Subsegments:

1) By Kits and Reagents: Isolation Kits; Purification Kits; Detection Kits; Labeling Reagents2) By Instruments: Ultracentrifuges; Flow Cytometers; Nanosight Instruments; PCR Systems

3) By Other Products: Exosome Standards; Microfluidic Devices; Software For Data Analysis

Key Companies Mentioned: Thermo Fisher Scientific Inc.; System Biosciences LLC; QIAGEN N.V.; Exosome Diagnostics Inc.; Bio-Techne Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermo Fisher Scientific Inc.

- System Biosciences LLC

- QIAGEN N.V.

- Exosome Diagnostics Inc.

- Bio-Techne Corporation

- Hitachi Ltd.

- Aethlon Medical Inc.

- NanoSomiX Inc.

- Malvern Panalytical Ltd.

- Sistemic Scotland Limited

- NX PharmaGen Corporation

- Miltenyi Biotec GmbH

- AMS Biotechnology (Europe) B.V.

- Norgen Biotek Corp.

- Novus Biologicals LLC

- Lonza Group AG

- Sistem-Bio S.A.S.

- Izon Science Ltd

- Evomic Science LLC

- New England Biolabs Inc.

- Evox Therapeutics Limited

- Codiak BioSciences Inc.

- MagBio Genomics Inc.

- Cell Guidance Systems Ltd.

- Aruna Biomedical PBC

- Capricor Therapeutics Inc.

- Stemcell Technologies Inc.

- ExoCoBio Inc.

- Creative Biolabs

- Nanovex Biotechnologies S.L.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 382 Billion |

| Forecasted Market Value ( USD | $ 1150 Billion |

| Compound Annual Growth Rate | 31.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |