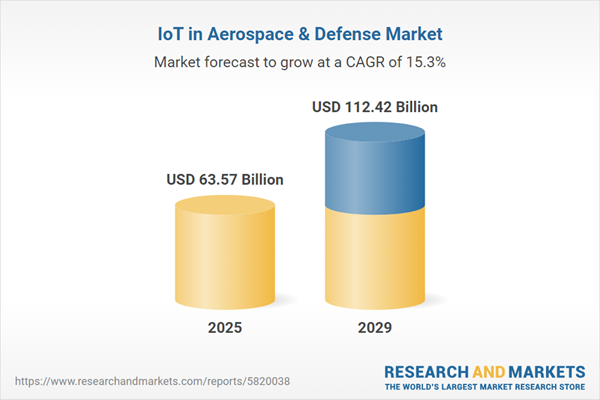

The IoT in aerospace & defense market size is expected to see rapid growth in the next few years. It will grow to $112.42 billion in 2029 at a compound annual growth rate (CAGR) of 15.3%. The growth in the forecast period can be attributed to increased emphasis on cybersecurity, rise of unmanned systems, focus on fleet management, advancements in edge computing, integration of 5g networks. Major trends in the forecast period include advancements in IoT sensors and connectivity, rapid adoption of edge computing, increased emphasis on cybersecurity, integration of AI and machine learning, advancements in IoT sensors and connectivity, focus on predictive maintenance.

The IoT in the aerospace and defense market is poised for growth, driven by an increase in cyber-attacks targeting the aviation industry. Cyberattacks involve unauthorized attempts to access computer systems for various malicious purposes, posing a significant threat to the security of aviation systems. Implementing IoT authentication in the aviation sector can enhance cybersecurity measures, mitigating the risk of cyber-attacks. As of February 2023, the Australian Cyber Security Centre reported a 13% increase in cybercrime reports in 2022, reaching 76,000. This surge in cyber threats is a key factor propelling the growth of the IoT in the aerospace and defense market.

The rise in geopolitical tensions is anticipated to drive the growth of the IoT in the aerospace and defense market in the future. Geopolitical tensions refer to political conflicts, rivalries, or disputes among nations or regions, often stemming from issues related to territory, resources, power, or ideology. Such geopolitical uncertainties heighten the demand for real-time intelligence gathering, interoperability among allied forces, and the resilience of critical infrastructure. IoT technologies play a crucial role in enhancing crisis response, supporting autonomous systems, and fostering innovation in national security. For example, in March 2023, a report published by ReliefWeb, an Austria-based digital service for the Coordination of Humanitarian Affairs (OCHA), revealed that terrorist attacks became more lethal in 2022, resulting in an average of 1.7 deaths per attack compared to 1.3 deaths per attack in 2021. Consequently, the increase in geopolitical tensions is propelling the growth of the IoT in the aerospace and defense market.

Product innovation is a prominent trend gaining traction in the IoT within the aerospace and defense market. Major companies in this sector are concentrating on developing new products. For example, in March 2024, OnAsset Intelligence, a US-based aerospace and defense technology firm, launched the world’s first dedicated aircraft Internet of Things (IoT) gateway, called the Sentry 600 FlightSafe. This groundbreaking device aims to transform aircraft into virtually connected warehouses, significantly improving the visibility and management of air cargo operations. By incorporating Bluetooth sensors throughout the aircraft, OnAsset enables continuous monitoring of aircraft subsystems and cargo conditions.

Leading companies in the IoT aerospace and defense market are creating new firmware security solutions to gain a competitive advantage. Firmware security involves the measures and practices implemented to protect the firmware - the permanent software installed in a device's read-only memory (ROM) or flash memory - from unauthorized access, modifications, or malicious actions. For instance, in March 2023, OP[4], a US-based security solutions provider, launched a cybersecurity platform. This innovative security platform is designed to automatically discover and address N-Day and 0-Day vulnerabilities in Internet-of-Things (IoT) devices and embedded systems. OP[4] plans to offer industry-specific versions tailored for the Consumer IoT, Aerospace & Defense, and Telecommunications markets. By simulating the operation of devices, the platform differentiates between active and inactive code to evaluate risk at the binary level. With a fully automated system, OP[4] efficiently detects, isolates, validates, classifies, prioritizes, and remediates vulnerabilities, allowing product development teams to concentrate on critical issues and improve time-to-market efficiency. The platform emphasizes enhancing the developer experience by providing targeted insights and risk prioritization throughout the product development lifecycle.

In February 2024, Cicor, a Switzerland-based electronics firm, acquired TT Electronics IoT Solutions Ltd. for an undisclosed sum. This acquisition aligns with Cicor's broader strategy to enhance its capabilities in the medical technology, industrial, aerospace, and defense sectors. TT Electronics IoT Solutions Ltd. is a UK-based company that provides Internet of Things (IoT) solutions in the aerospace and defense fields.

Major companies operating in the IoT in aerospace & defense market include AeroVironment Inc., AT&T Intellectual Property, FreeWave Technologies Inc., General Atomics Aeronautical Systems Inc., Honeywell International Inc., Northrop Grumman Corporation, Elbit Systems Ltd., Radisys Corporation, Textron Systems Corporation, Airbus SE, Boeing Company, BAE Systems plc, SAP SE, General Electric Company, Bombardier Inc., CACI International Inc., Collins Aerospace, Cubic Corporation, Curtiss-Wright Corporation, Dassault Aviation SA, Embraer SA, General Dynamics Corporation, L3Harris Technologies Inc., Leonardo SpA, Lockheed Martin Corporation, Moog Inc., RTX Corporation, Saab AB, Safran SA, Thales Group, United Technologies Corporation, Woodward Inc.

North America was the largest region in the IoT in the Aerospace and Defense market in 2024. The regions covered in the iot in aerospace & defense market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the iot in aerospace & defense market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

IoT in aerospace and defense refers to the application of Internet of Things solutions to enhance operational efficiencies and product quality across various activities within the aerospace and defense sector. This technology plays a pivotal role in improving overall flight safety and control, aiming for maximum operating efficiency through features such as predictive maintenance, data analytics, and smart surveillance.

The primary components of IoT in aerospace and defense encompass hardware, software, and services. Hardware involves the physical components and devices that facilitate connectivity, utilizing various technologies such as cellular, Wi-Fi, satellite communication, and radio frequency, deployed in on-premise and cloud environments. The diverse applications of IoT in aerospace and defense include fleet management, inventory management, equipment maintenance, security, and others, catering to space systems, ground vehicles, and various other areas.

The IoT in aerospace & defense market research report is one of a series of new reports that provides IoT in aerospace & defense market statistics, including IoT in aerospace & defense industry global market size, regional shares, competitors with an IoT in aerospace & defense market share, detailed IoT in aerospace & defense market segments, market trends and opportunities, and any further data you may need to thrive in the IoT in aerospace & defense industry. This IoT in aerospace & defense market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The IoT in aerospace and defense market consists of revenues earned by entities by providing IoT-based solutions such as predicting aircraft failure, real-time mission-critical data sharing, improving vehicle maintenance, and safety applications. The market value includes the value of related goods sold by the service provider or included within the service offering. The IoT in aerospace and defense market also includes sales of climate control, wearable technology, and radio frequency identification are used in providing IoT-based solutions. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

IoT in Aerospace & Defense Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on iot in aerospace & defense market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for iot in aerospace & defense ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The iot in aerospace & defense market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Hardware; Software; Services2) by Connectivity Technology: Cellular; Wi-Fi; Satellite Communication; Radio Frequency

3) by Deployment Mode: on-Premise; Cloud

4) by Application: Fleet Management; Inventory Management; Equipment Maintenance; Security; Other Applications

5) by End User: Space Systems; Ground Vehicles; Other Users

Subsegments:

1) by Hardware: Sensors; Embedded Systems; Connectivity Devices; Drones and UAVs (Unmanned Aerial Vehicles)2) by Software: IoT Platforms; Data Analytics and Visualization Software; Security Software; Fleet Management Software

3) by Services: Consulting Services; Integration Services; Maintenance and Support Services; Training and Development Services

Key Companies Mentioned: AeroVironment Inc.; AT&T Intellectual Property; FreeWave Technologies Inc.; General Atomics Aeronautical Systems Inc.; Honeywell International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this IoT in Aerospace & Defense market report include:- AeroVironment Inc.

- AT&T Intellectual Property

- FreeWave Technologies Inc.

- General Atomics Aeronautical Systems Inc.

- Honeywell International Inc.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- Radisys Corporation

- Textron Systems Corporation

- Airbus SE

- Boeing Company

- BAE Systems plc

- SAP SE

- General Electric Company

- Bombardier Inc.

- CACI International Inc.

- Collins Aerospace

- Cubic Corporation

- Curtiss-Wright Corporation

- Dassault Aviation SA

- Embraer SA

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Moog Inc.

- RTX Corporation

- Saab AB

- Safran SA

- Thales Group

- United Technologies Corporation

- Woodward Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 63.57 Billion |

| Forecasted Market Value ( USD | $ 112.42 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |