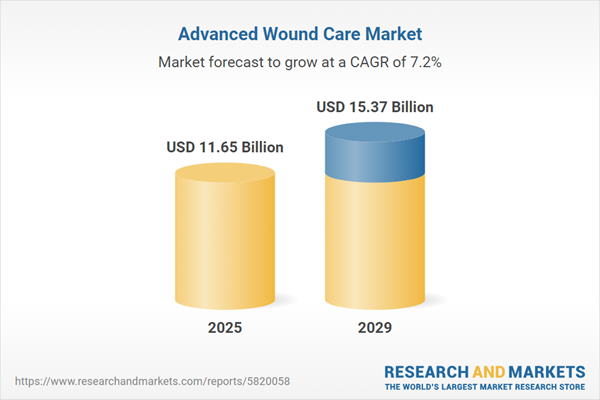

The advanced wound care market size is expected to see strong growth in the next few years. It will grow to $15.37 billion in 2029 at a compound annual growth rate (CAGR) of 7.2%. The growth in the forecast period can be attributed to increasing incidence of chronic wounds, telemedicine and remote patient monitoring, personalized and precision medicine, regulatory support for innovation, value-based healthcare. Major trends in the forecast period include integration of smart technologies, smart wound dressings with monitoring capabilities, integration of telemedicine in wound care, bioactive and antimicrobial dressings, advanced wound closure techniques.

The rise in the number of surgeries is anticipated to drive the growth of the advanced wound care market in the future. A surgical procedure involves a medical intervention that requires cutting or penetrating the body's tissues to treat diseases, conditions, or injuries, as well as to modify bodily functions or enhance appearance. Advanced wound care products support surgeries by facilitating faster healing and minimizing the risk of complications such as infections. For example, in March 2023, the British Association of Aesthetic Plastic Surgeons, a UK-based surgical organization, reported that there were 31,057 cosmetic surgeries performed in the UK in 2022, reflecting a significant 102% increase from the previous year. Therefore, the increasing rate of surgeries is driving the advanced wound care market.

An increasing number of road accidents, trauma incidents, and burn cases is expected to drive the growth of the advanced wound care market. A road accident is defined as an incident involving at least one vehicle on a public road that results in injury or death. Burns refer to injuries affecting the skin or other human tissues caused by exposure to heat, radiation, radioactivity, electricity, friction, or chemicals. Trauma denotes a physical injury that harms internal organs, creates wounds, or fractures bones. Advanced wound care treatment products are primarily utilized to address complex wounds resulting from car accidents, trauma situations, and burns. Specialized wound care solutions are essential to reduce the severity of these injuries, enhance blood flow, and support the body's natural repair and healing processes. These factors will contribute to the growth of the advanced wound care market. For instance, in March 2024, Eurostat, the statistical office of the European Union, reported that in 2022, there were 20,653 fatalities in Europe due to road accidents, reflecting a 3.7% increase compared to 19,917 in 2021. Additionally, the American Burn Association (ABA), a US-based member organization focused on health, states that there are 450,000 major burn injuries annually in the USA. Moreover, the World Health Organization (WHO), a Switzerland-based health agency, estimates that around 4.4 million individuals worldwide die from injuries each year, whether intentional or due to violence, accounting for nearly 8% of all fatalities. Therefore, the rising number of road accidents, trauma cases, and burns is driving the advanced wound care market.

An emerging trend in the advanced wound care market is product innovation, which is gaining substantial traction. Leading companies in this sector prioritize developing innovative products tailored to meet patient needs and address unmet clinical requirements in surgical, chronic wounds, and burns. Such innovations afford these market players a competitive edge. For instance, in October 2023, DuPont de Nemours, Inc., a US-based chemical company, launched Liveo MG 7-9960 Soft Skin Adhesive. This soft elastomeric silicone adhesive is specifically designed to affix medical devices to the skin, boasting high adhesion force, prolonged wear time, and gentle removal. Developed with low content cyclosiloxanes, the product caters to advanced wound care and wearable device Original Equipment Manufacturers (OEMs), enhancing dressing and patch offerings with improved wear performance and design flexibility.

Major corporations within the advanced wound care market are directing their efforts toward pioneering technologies such as Aquacel Hydrofiber Technology, aiming to cater to healthcare providers and patients' needs. Aquacel Hydrofiber Technology represents a pliable, absorbent material that undergoes a gel transformation upon contact with wound fluid. For instance, in January 2023, Convatec Group plc, a UK-based medical device company, introduced ConvaFoam, an advanced foam dressing. Tailored to tackle the challenge of healing-resistant wounds, which pose significant economic, clinical, and societal burdens expected to escalate, ConvaFoam stands out as the sole foam dressing incorporating superabsorbent fibers and AQUACEL Hydrofiber technology. Moreover, it's designed to optimize wear duration with a silicone adhesive specifically engineered for an ideal balance of adhesive strength, skin compatibility, and breathability.

In March 2022, Convatec Group Plc, a medical device company based in the UK, acquired Triad Life Sciences Inc. for an undisclosed sum. This acquisition allows Convatec to improve its advanced wound care portfolio by integrating Triad's innovative products and technologies. Triad Life Sciences Inc. is a biotechnology company located in the US that specializes in advanced wound care products.

Major companies operating in the advanced wound care market include Integra Lifesciences Corp., Molnlycke Health Care, Johnson And Johnson Services Inc., Medline Industries Inc., Medtronic plc, Organogenesis Holdings Inc., Smith & Nephew plc, B. Braun Melsungen AG, Coloplast A/S, ConvaTec Group plc, Hollister Incorporated, URGO Medical Ltd., Lohmann And Rauscher GmbH & Co. KG, MiMedx Group Inc., Zimmer Biomet Holdings Inc., Misonix Inc., Cardinal Health Inc., BSN medical GmbH, Paul Hartmann AG, Nestlé Health Science SA, AstraZeneca plc, Johnson & Johnson Medical Devices group, Becton, Dickinson and Company, Lohmann & Rauscher International, Beiersdorf AG, Hologic Inc.

North America was the largest region in the advanced wound care market in 2024. Asia-Pacific is expected to be the fastest-growing region in the advanced wound care market report during the forecast period. The regions covered in the advanced wound care market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the advanced wound care market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Advanced wound care involves the treatment of chronic or complex wounds using specialized products that are not readily available over the counter. This approach offers various advantages, including the regulation of body temperature, prevention of infections, removal of dead tissue, avoidance of scar formation, and alleviation of discomfort during dressing changes. It is particularly beneficial for healing complex or difficult-to-treat wounds.

The primary types of advanced wound care devices include moist, antimicrobial, and active variants. Antimicrobial devices incorporate agents designed to eliminate or prevent the growth of microorganisms such as bacteria, spores, or protozoa, specifically targeting bacterial presence in wounds. These devices find applications in treating both chronic and acute wounds and are utilized by various end-users, including hospitals, specialty clinics, home healthcare settings, and others.

The advanced wound care market research report is one of a series of new reports that provides advanced wound care market statistics, including advanced wound care industry global market size, regional shares, competitors with an advanced wound care market share, detailed advanced wound care market segments, market trends and opportunities, and any further data you may need to thrive in the advanced wound care industry. This advanced wound care market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The advanced wound care market consists of sales of advanced wound dressings, and infection prevention dressings. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Advanced Wound Care Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on advanced wound care market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for advanced wound care ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The advanced wound care market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Moist; Antimicrobial; Active2) by Application: Chronic Wounds; Acute Wounds

3) by End User: Hospitals; Specialty Clinics; Home Healthcare; Other Types

Subsegments:

1) by Moist: Hydrocolloid Dressings; Hydrogels; Foam Dressings2) by Antimicrobial: Silver-Infused Dressings; Honey-Infused Dressings; Iodine-Containing Dressings

3) by Active: Negative Pressure Wound Therapy (NPWT); Bioengineered Skin Substitutes; Electrical Stimulation Devices

Key Companies Mentioned: Integra Lifesciences Corp.; Molnlycke Health Care; Johnson and Johnson Services Inc.; Medline Industries Inc.; Medtronic plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Advanced Wound Care market report include:- Integra Lifesciences Corp.

- Molnlycke Health Care

- Johnson And Johnson Services Inc.

- Medline Industries Inc.

- Medtronic plc

- Organogenesis Holdings Inc.

- Smith & Nephew plc

- B. Braun Melsungen AG

- Coloplast A/S

- ConvaTec Group plc

- Hollister Incorporated

- URGO Medical Ltd.

- Lohmann And Rauscher GmbH & Co. KG

- MiMedx Group Inc.

- Zimmer Biomet Holdings Inc.

- Misonix Inc.

- Cardinal Health Inc.

- BSN medical GmbH

- Paul Hartmann AG

- Nestlé Health Science SA

- AstraZeneca plc

- Johnson & Johnson Medical Devices group

- Becton, Dickinson and Company

- Lohmann & Rauscher International

- Beiersdorf AG

- Hologic Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.65 Billion |

| Forecasted Market Value ( USD | $ 15.37 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |