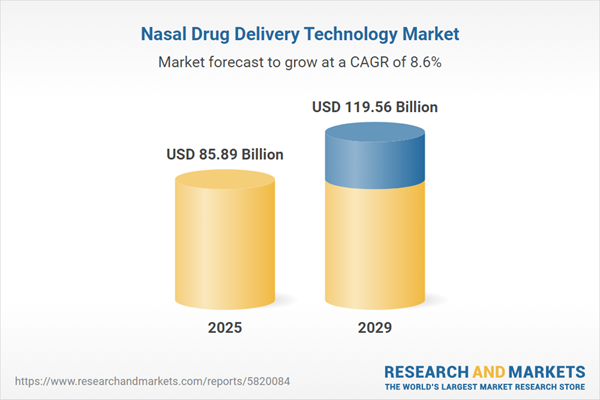

The nasal drug delivery technology market size is expected to see strong growth in the next few years. It will grow to $119.56 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to rise in biologics and peptide therapies, focus on pediatric and geriatric patient needs, partnerships and collaborations in the pharma industry, expansion of over-the-counter (OTC) nasal products, increased focus on precision medicine. Major trends in the forecast period include advancements in formulation technology, increased focus on patient-friendly devices, expansion of therapeutic areas, biologics and peptides delivery, innovations in nasal spray technologies.

The rising prevalence of chronic diseases is projected to stimulate growth in the nasal drug delivery technology market. Chronic diseases are defined as health conditions that persist for a year or more and necessitate continuous medical care, potentially limiting daily activities. Nasal drug delivery technologies are utilized to manage chronic rhinosinusitis, enhancing bacterial biofilm management and mucociliary clearance through a therapeutic approach tailored for the intricate structure of the nasal cavity. For example, a report by the American College of Cardiology, a nonprofit medical association based in the United States, published in August 2022, indicates that all four primary cardiovascular risk factors are expected to rise from 2025 to 2060. Among these, diabetes is anticipated to experience the most significant increase, rising by 39.3% to reach 55 million individuals. This is followed by dyslipidemia (up 27.6% to 126 million), hypertension (up 25.1% to 162 million), and obesity (up 18.3% to 126 million). Furthermore, substantial rises in cardiovascular disease rates are expected, including stroke (33.8% increase to 15 million) and heart failure (33.4% increase to 13 million), with ischemic heart disease (up 30.7% to 29 million) and heart attack (up 16.9% to 16 million) not far behind. As a result, the increasing prevalence of chronic diseases is fueling the expansion of the nasal drug delivery systems market.

The growth of the nasal drug delivery technology market is anticipated to be driven by the increasing global geriatric population. The geriatric population consists of individuals who are generally 65 years old and above. This drug delivery method is favored among older adults due to its ease of use and improved patient adherence, helping to overcome difficulties associated with pill swallowing in this age group. For example, in January 2024, the Population Reference Bureau, a nonprofit organization in the US that focuses on collecting and providing statistics, projected that the number of Americans aged 65 and older will grow from 58 million in 2022 to 82 million by 2050, representing a 47% increase. Additionally, the proportion of the population aged 65 and older is expected to rise from 17% to 23%. Consequently, the increase in the geriatric population worldwide will contribute to the expansion of the nasal drug delivery technology market.

Product innovation stands as a pivotal trend shaping the landscape of nasal drug delivery technology. Leading pharmaceutical companies are actively engaged in developing novel drug administration methods to bolster their market positions. For instance, in January 2023, AptarGroup, Inc. introduced APF Futurity, the first recyclable, metal-free, multidose nasal spray designed for nasal saline and equivalent OTC formulations. This innovative product's recyclability design has garnered Class AA certification, promoting greater recycling efficiency.

Collaborative efforts aimed at technological advancements highlight the strategic focus within the nasal drug delivery sector. Notably, in November 2023, Hovione collaborated with Industrial Design Consultancy (IDC) to develop advanced nasal powder delivery devices. These devices offer precise drug delivery options for local, systemic, or nose-to-brain applications, showcasing versatility and reliability. The collaboration's objective is to expedite the release of two innovative nasal powder delivery devices, catering to diverse drug delivery needs while streamlining drug product development and manufacturing processes.

In May 2022, Medtronic plc, a US-based medical device firm, acquired Intersect ENT Inc. for an undisclosed sum. The acquisition will add novel products used in sinus operations to enhance post-operative outcomes and treat nasal polyps to Medtronic's entire ear, nose, and throat (ENT) portfolio. Intersect ENT Inc. is a US-based medical device firm operating in ear, nose, and throat medical technology.

Major companies operating in the nasal drug delivery technology market include AptarGroup Inc., Becton Dickinson and Company, GlaxoSmithKline plc, Johnson & Johnson Private Limited, Novartis AG, Pfizer Inc., 3M Company, Cadila Healthcare Limited, Neurelis Inc., OptiNose Inc., Bausch Health Companies Inc., Naveh Pharma Ltd., Teva Pharmaceutical Industries Ltd., Consort Medical plc, Douglas Pharmaceuticals Ltd., ENT Technologies Pty. Ltd., Merck & Co. Inc., Sanofi SA, AstraZeneca plc, Boehringer Ingelheim International GmbH, Bayer AG, Abbott Laboratories, Eli Lilly and Company, Bristol-Myers Squibb Company, Takeda Pharmaceutical Company Limited, Amgen Inc., Gilead Sciences Inc., Biogen Inc., Roche Holding AG, Allergan plc, Regeneron Pharmaceuticals Inc., Alexion Pharmaceuticals Inc.

North America was the largest region in the nasal drug delivery technology market in 2024. The regions covered in the nasal drug delivery technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the nasal drug delivery technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Nasal drug delivery technology involves administering pharmaceuticals through the nasal cavity, aiming to rapidly achieve therapeutic drug levels in the bloodstream and potentially enable direct drug delivery to the brain via olfactory neurons. This method bypasses the blood-brain barrier (BBB) and undergoes minimal processing in the liver and intestines.

Key dosage forms for this technology include nasal spray, nasal drops, nasal gels, ointments, powders, and others. Nasal spray devices expel numerous tiny liquid drops to cleanse the nose or deliver medication to the body. They are available in pressurized and non-pressurized containers and are applied across diverse uses such as allergic and non-allergic rhinitis, nasal congestion, asthma, vaccination, and more. These products are accessible through various distribution channels such as hospital pharmacies, retail outlets, and online pharmacies, and are utilized by end-users including home care settings and hospitals.

The nasal drug delivery technology market research report is one of a series of new reports that provides nasal drug delivery technology market statistics, including nasal drug delivery technology industry global market size, regional shares, competitors with a nasal drug delivery technology market share, detailed nasal drug delivery technology market segments, market trends, and opportunities, and any further data you may need to thrive in the nasal drug delivery technology industry. This nasal drug delivery technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The nasal drug delivery technology market consists of revenues earned by entities by providing services such as intranasal drug delivery services, brain-targeted therapy, and mucosal vaccination. The market value includes the value of related goods sold by the service provider or included within the service offering. The nasal drug delivery technology market also includes sales of catheter-delivered drugs, nebulizers, and pressurized metered-dose inhalers (PMDIs) equipment which are used in providing nasal drug delivery technology services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Nasal Drug Delivery Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on nasal drug delivery technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for nasal drug delivery technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The nasal drug delivery technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Dosage Form: Nasal Spray; Nasal Drops; Nasal Gels and Ointments; Nasal Powders; Other Dosage Forms2) By Container Type: Pressurized Containers; Non-Pressurized Containers

3) By Therapeutic Application: Allergic and Non-Allergic Rhinitis; Nasal Congestion; Asthma; Vaccination; Other Therapeutic Applications

4) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Pharmacies

5) By End User: Home Care Settings; Hospitals

Subsegments:

1) By Nasal Spray: Metered-Dose Spray; Non-Metered-Dose Spray2) By Nasal Drops: Liquid Nasal Drops; Gel-Based Nasal Drops

3) By Nasal Gels and Ointments: Hydrogel Formulations; Oil-Based Ointments

4) By Nasal Powders: Dry Powder Inhalers (DPI); Spray-Dried Powders

5) By Other Dosage Forms: Nasal Patches; Nasal Inserts

Key Companies Mentioned: AptarGroup Inc.; Becton Dickinson and Company; GlaxoSmithKline plc; Johnson & Johnson Private Limited; Novartis AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- AptarGroup Inc.

- Becton Dickinson and Company

- GlaxoSmithKline plc

- Johnson & Johnson Private Limited

- Novartis AG

- Pfizer Inc.

- 3M Company

- Cadila Healthcare Limited

- Neurelis Inc.

- OptiNose Inc.

- Bausch Health Companies Inc.

- Naveh Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Consort Medical plc

- Douglas Pharmaceuticals Ltd.

- ENT Technologies Pty. Ltd.

- Merck & Co. Inc.

- Sanofi SA

- AstraZeneca plc

- Boehringer Ingelheim International GmbH

- Bayer AG

- Abbott Laboratories

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Gilead Sciences Inc.

- Biogen Inc.

- Roche Holding AG

- Allergan plc

- Regeneron Pharmaceuticals Inc.

- Alexion Pharmaceuticals Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 85.89 Billion |

| Forecasted Market Value ( USD | $ 119.56 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |