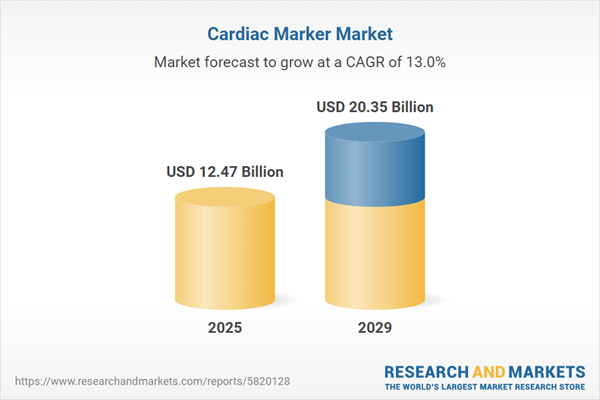

The cardiac marker market size is expected to see rapid growth in the next few years. It will grow to $20.35 billion in 2029 at a compound annual growth rate (CAGR) of 13%. The growth in the forecast period can be attributed to rising burden of lifestyle-related diseases, remote monitoring and telemedicine, personalized medicine and precision diagnostics, point-of-care testing (poct) adoption, collaborations and partnerships in healthcare. Major trends in the forecast period include biomarker discovery and validation, personalized medicine approaches, technological advancements in assay platforms, integration of high-sensitivity troponin tests, rise in cardiovascular disease prevalence.

The projected surge in the cardiac marker market is strongly driven by the escalating prevalence of cardiac diseases. This category comprises conditions affecting the heart's structure or functionality, leading to a spectrum of medical issues. Cardiac markers serve as crucial tools in diagnosing and monitoring various heart-related conditions such as heart attacks, angina, heart failure, and other cardiovascular diseases. Consequently, the demand for diagnostic tests involving cardiac markers has seen a notable increase. For instance, the British Heart Foundation reported an alarming increase of 30,000 deaths from coronary heart disease in England from the pandemic's onset to August 2022. Moreover, a staggering 346,000 individuals were on cardiac waiting lists by August 2022. Hence, the escalating prevalence of cardiac diseases significantly fuels the growth of the cardiac marker market.

The escalating demand within diagnostic centers stands as a pivotal driver for the cardiac marker market's growth trajectory. Diagnostic centers, specialized healthcare facilities, play a crucial role in conducting a range of medical tests and procedures aimed at identifying and monitoring health conditions. The incorporation of cardiac markers in these centers offers critical insights for timely and accurate diagnoses, risk assessment, and tailored treatment strategies, ultimately leading to improved cardiovascular health outcomes. For instance, according to GOV.UK, the year 2022 witnessed 73 diagnostic centers conducting an additional 30,000 tests per week, with projections suggesting a potential increase to 160 community diagnostic centers by 2025. Consequently, the surging demand within diagnostic centers is steering the growth of the cardiac marker market.

Innovation emerges as a significant trend gaining traction within the cardiac marker market, with major players focusing on pioneering solutions to fortify their market presence. For example, MiRxes, a Singapore-based biotechnology firm, recently validated a microRNA-based diagnostic test designed for early detection and diagnosis of illnesses. The forthcoming commercialization of this test will complement MiRxes' portfolio of blood tests for various conditions, aiming to alleviate the mounting clinical and socioeconomic burdens associated with life-threatening diseases, including cancer and cardio-pulmonary disorders.

Leading companies in the cardiac marker market prioritize innovative products, such as high-sensitivity troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers, to drive market revenue. These biomarkers play crucial roles in diagnosing, categorizing, and treating cardiovascular ailments. For instance, in October 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., a prominent China-based medical equipment and solutions provider, launched troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers. The hs-cTn assay surpasses minimal sensitivity, accuracy, and reliability requirements, aiding in identifying myocardial damage. These advanced products aim to enhance treatment approaches for cardiovascular diseases, offering dependable solutions to improve patient outcomes in both cardiovascular and related health contexts.

In April 2023, Abbott Laboratories, a US-based healthcare company acquired Cardiovascular Systems Inc. for an undisclosed amount. With this acquisition, Abbott will be able to better serve patients with peripheral and coronary artery disease by offering a novel and cutting-edge therapy for those with complicated cardiovascular disease. Through this acquisition, Abbott is able to expand the range of cutting-edge vascular devices it offers doctors, giving them more resources to assist patients. Cardiovascular Systems Inc. a US-based medical technology company.

Major companies operating in the cardiac marker market include Abbott Laboratories Inc., Siemens AG, Danaher Corporation, BioMérieux SA, F. Hoffmann-La Roche AG, Beckman Coulter Inc., Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Guangzhou Wondifo Biotech Co. Ltd., Creative Diagnostics, PerkinElmer Inc., Tosoh Corporation, Quidel Corporation, Randox Laboratories Ltd., Getinge Group, LSI Medience Corporation, Ortho Clinical Diagnostics, DiaSorin, 3M Company, Atom Medical Corporation, Bionet America Inc., Bistos Inc., CareFusion Corporation, Clinical Innovations LLC, Abcam plc, General Electric Company.

North America was the largest region in the cardiac marker market in 2024. The regions covered in the cardiac marker market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cardiac marker market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cardiac markers are biomolecules released into the bloodstream in response to heart muscle damage or stress, serving as crucial tools for diagnosing and monitoring a spectrum of cardiac ailments such as heart attacks, angina, and heart failure.

The primary types of cardiac markers encompass troponin, creatine kinase-MB (CK-MB), B-type natriuretic peptide (BNP), myoglobin, and various other biomarkers. Troponin, a protein released upon heart muscle damage, stands as a pivotal marker widely used for diagnosing and monitoring heart-related conditions. Diverse products in the realm of cardiac markers include reagents, instruments, and various detection methodologies such as chemiluminescence, immunofluorescence, immunochromatography, and ELISA. These markers find application across multiple indications, including myocardial infarction, congestive heart failure, acute coronary syndrome, among others. End users encompass laboratory testing facilities, hospital labs, reference labs, contract testing labs, point-of-care testing facilities, and academic institutions, where these markers play a vital role in cardiac diagnostics and monitoring.

The cardiac marker market research report is one of a series of new reports that provides Cardiac marker market statistics, including global market size, regional shares, competitors with a cardiac marker market share, detailed cardiac marker market segments, market trends and opportunities, and any further data you may need to thrive in the cardiac marker industry. This cardiac marker market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cardiac marker market consists of sales of C-reactive protein (CRP) and Ischemia-modified albumin (IMA). Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cardiac Marker Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cardiac marker market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cardiac marker? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cardiac marker market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Biomarker: Troponin; Creatine Kinase-MB (CK-MB); B-type Natriuretic Peptide (BNP); Myoglobin; Other Biomarkers2) By Product: Reagent; Instrument; Chemiluminescence; Immunofluorescence; Immunochromatography; ELISA

3) By Indication: Myocardial Infarction; Congestive Heart Failure; Acute Coronary Syndrome; Other Indications

4) By End User: Laboratory Testing Facilities; Hospital Labs; Reference Labs; Contract Testing Labs; Point-of-Care Testing Facilities; Academic Institutions

Subsegments:

1) By Troponin: Troponin I; Troponin T; Troponin Diagnostic Kits2) By Creatine Kinase-MB (CK-MB): CK-MB Test Kits; CK-MB Diagnostic Panels

3) By B-Type Natriuretic Peptide (BNP): BNP Test Kits; NT-ProBNP Test Kits; BNP Diagnostic Panels

4) By Myoglobin: Myoglobin Test Kits; Myoglobin Diagnostic Panels

5) By Other Biomarkers: Ischemia Modified Albumin (IMA); Heart Fatty Acid Binding Protein (HFABP); C-Reactive Protein (CRP)

Key Companies Mentioned: Abbott Laboratories Inc.; Siemens AG; Danaher Corporation; BioMérieux SA; F. Hoffmann-La Roche AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Cardiac Marker market report include:- Abbott Laboratories Inc.

- Siemens AG

- Danaher Corporation

- BioMérieux SA

- F. Hoffmann-La Roche AG

- Beckman Coulter Inc.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Guangzhou Wondifo Biotech Co. Ltd.

- Creative Diagnostics

- PerkinElmer Inc.

- Tosoh Corporation

- Quidel Corporation

- Randox Laboratories Ltd.

- Getinge Group

- LSI Medience Corporation

- Ortho Clinical Diagnostics

- DiaSorin

- 3M Company

- Atom Medical Corporation

- Bionet America Inc.

- Bistos Inc.

- CareFusion Corporation

- Clinical Innovations LLC

- Abcam plc

- General Electric Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 12.47 Billion |

| Forecasted Market Value ( USD | $ 20.35 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |