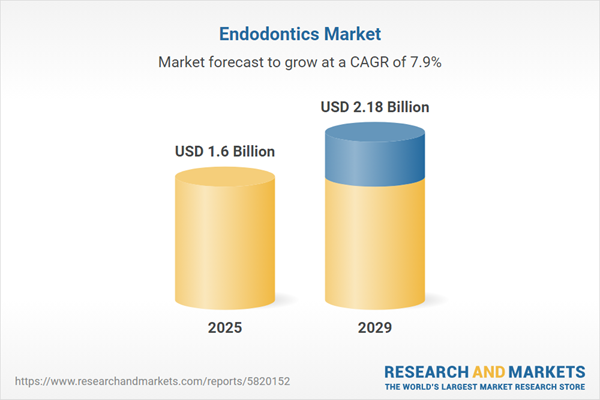

The endodontics market size is expected to see strong growth in the next few years. It will grow to $2.18 billion in 2029 at a compound annual growth rate (CAGR) of 7.9%. The growth in the forecast period can be attributed to increasing focus on minimally invasive procedures, expansion of dental healthcare infrastructure, growing patient preference for aesthetic dentistry, customization and personalization in treatment, and increasing dental disorders in the younger population. Major trends in the forecast period include technological integration in endodontics, advancements in endodontic technology, growth of minimally invasive techniques, and technological advancements in imaging, and regenerative endodontics.

The anticipated rise in the number of dentists and dental practices is expected to drive the growth of the endodontics market. Dentists and dental practices play a crucial role in maintaining oral health by diagnosing and treating conditions affecting the teeth, gums, and mouth. Endodontics, a dental specialty focusing on the study and treatment of dental pulp, employs endodontists to address issues affecting the interior of the tooth. For example, a January 2022 article shared by Express Dentist, a US-based dental service company, reported that dentists comprised 61 per 100,000 people, with a projected increase to 67 per 100,000 people by 2040. Additionally, according to the Bureau of Labor Statistics in September 2022, dentists' total employment is expected to grow by 6% between 2021 and 2031, with an average of 5,100 job opportunities for dentists over the next decade. Thus, the increasing number of dentists and dental practices is a driving force in the growth of the dental consumables market.

The increasing prevalence of dental disorders is also anticipated to boost the growth of the endodontics market. Dental disorders encompass various conditions and abnormalities affecting the teeth and surrounding oral structures. Endodontic procedures focus on diagnosing and treating issues related to the dental pulp, including nerves and blood vessels inside the tooth. For instance, a February 2023 report from the American Society of Clinical Oncology (ASCO) projects around 54,540 new cases of oropharyngeal and oral cavity cancers in the USA, with approximately 11,580 deaths expected in 2023. Among the estimated cases, 39,290 are men and 5,250 are women, with a higher incidence in men than women. Consequently, the increasing prevalence of dental disorders is a key driver for the growth of the dental consumables market.

Technological advancements emerge as a prominent trend driving the endodontics market forward. Major companies in the endodontics sector are dedicated to introducing innovative technologies to maintain their market position. For instance, in April 2022, Sonendo Inc., a US-based dental technology company, unveiled its CleanFlow technology to enhance the doctor and patient experience. The CleanFlowTM procedure tool, designed to work with Sonendo's GentleWave System, offers a less intrusive and more comfortable alternative to traditional root canal therapy. The integration of CleanFlow Technology into the GentleWave procedure results in a simplified workflow and an improved patient experience compared to older procedures. This introduction reflects the company's commitment to ongoing innovation, striving to provide patients with a better, cleaner, and more comfortable root canal experience.

Major companies in the endodontics market are prioritizing the development of innovative products, such as 3mm gold tips, to gain a competitive edge. These 3mm gold tips in endodontics represent tools used in dental procedures, specifically for root canal treatment. For example, in August 2023, Zarc4Endo S.A., a Spain-based manufacturer of endodontics, launched the ‘BlueShaper Pro’ innovative endodontics. Integrated with the ‘Dual Wire’ technology, allowing the combination of two heat treatments in a single file, the BlueShaper Pro endodontics provides clinicians with increased efficiency and greater instrument flexibility. This innovative endodontic solution ensures exceptional precision during root canal treatment, facilitating thorough canal preparation for patients.

In April 2024, Behrman Capital, a private equity firm based in the United States, acquired Vista Apex for an undisclosed sum. This acquisition is intended to strengthen Behrman Capital's investment portfolio by capitalizing on Vista Apex's expertise and capabilities in the technology sector. Vista Apex is a US-based manufacturer specializing in consumable dental products for preventive oral hygiene, endodontics, and restorative dentistry.

Major companies operating in the endodontics market include Coltene Holding AG, Dentsply Sirona Inc., Ivoclar Vivadent AG, Septodont Ltd., FKG Dentaire S.A., Mani Inc., Ultradent Products Inc., Peter Brasseler Holdings L.P., Danaher Corporation, Envista Holdings Corporation, Micro-Mega S.A.S., DiaDent Group International, Voco GmbH, CeramTec GmbH, Kerr Corporation, PreXion Corporation, SybronEndo Corporation, Obtura Spartan Endodontics, Essential Dental Systems, META-BIOMED Co. Ltd., VDW GmbH, Shenzhen Perfect Medical Instruments Co. Ltd., J. Morita Corporation, Dentatus AB, Parkell Inc., DiaRoot Dental, Angelus Dental Products, Premier Dental Products Company, Shofu Dental Corporation, Doxa Dental AB.

North America was the largest region in the endodontics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global endodontics market report during the forecast period. The regions covered in the endodontics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the endodontics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Endodontics is a branch of dentistry focused on the dental pulp and root tissues of a tooth. The term originates from the Greek words 'endo,' meaning 'inside,' and 'odont,' meaning 'tooth.' Endodontic therapy, commonly known as root canal therapy, is the treatment of the delicate pulp tissue within the tooth.

The primary products utilized in endodontics include instruments and consumables employed in various procedures such as root canal treatment, endodontic retreatment, endodontic surgery, traumatic dental injuries, and dental implants. Instruments encompass the tools and devices utilized in root canal therapy, a prevalent dental procedure aimed at addressing tooth decay and infection. These products find application across diverse end-user settings, including dental hospitals, dental clinics, dental academic and research institutes, among others.

The endodontics market research report is one of a series of new reports that provides endodontics market statistics, including endodontics industry global market size, regional shares, competitors with a endodontics market share, detailed endodontics market segments, market trends and opportunities, and any further data you may need to thrive in the endodontics industry. This endodontics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The endodontics market includes revenues earned by entities by periodontitis, dental caries, dentin, and more. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Endodontics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on endodontics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for endodontics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The endodontics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Instruments; Consumables2) By Treatment Type: Root Canal Treatment; Endodontic Retreatment; Endodontic Surgery; Traumatic Dental Injuries; Dental Implants

3) By End User: Dental Hospitals; Dental Clinics; Dental Academic and Research Institutes; Other End Users

Subsegments:

1) By Smoking Cessation: Nicotine Replacement Therapy (NRT); Prescription Medications; Behavioral Therapy2) By Bronchodilators: Short-Acting Beta Agonists (SABAs); Long-Acting Beta Agonists (LABAs); Anticholinergics

3) By Steroids: Inhaled Corticosteroids; Oral Corticosteroids

4) By Leukotriene Modifiers: Montelukast; Zafirlukast

5) By Supplemental Oxygen: Continuous Oxygen Therapy; Oxygen Concentrators

6) By Antibiotics: Macrolides; Fluoroquinolones

7) By Gene Therapy: Gene Editing Techniques; Vector-Based Gene Therapy

8) By Surgery Transplant: Lung Volume Reduction Surgery (LVRS); Lung Transplantation

9) By Other Treatments: Pulmonary Rehabilitation; Nutritional Support; Experimental Therapies

Key Companies Mentioned: Coltene Holding AG; Dentsply Sirona Inc.; Ivoclar Vivadent AG; Septodont Ltd.; FKG Dentaire S.A.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Coltene Holding AG

- Dentsply Sirona Inc.

- Ivoclar Vivadent AG

- Septodont Ltd.

- FKG Dentaire S.A.

- Mani Inc.

- Ultradent Products Inc.

- Peter Brasseler Holdings L.P.

- Danaher Corporation

- Envista Holdings Corporation

- Micro-Mega S.A.S.

- DiaDent Group International

- Voco GmbH

- CeramTec GmbH

- Kerr Corporation

- PreXion Corporation

- SybronEndo Corporation

- Obtura Spartan Endodontics

- Essential Dental Systems

- META-BIOMED Co. Ltd.

- VDW GmbH

- Shenzhen Perfect Medical Instruments Co. Ltd.

- J. Morita Corporation

- Dentatus AB

- Parkell Inc.

- DiaRoot Dental

- Angelus Dental Products

- Premier Dental Products Company

- Shofu Dental Corporation

- Doxa Dental AB.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.18 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |