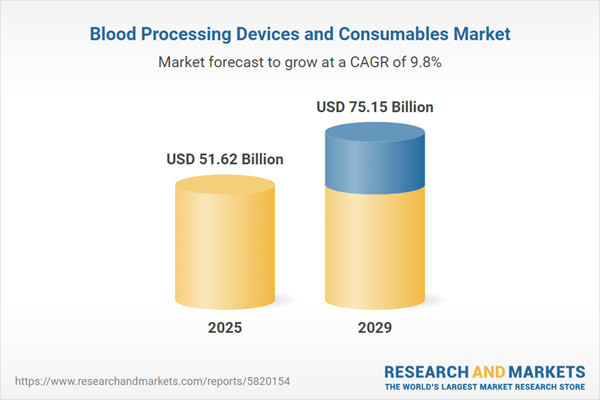

The blood processing devices and consumables market size is expected to see strong growth in the next few years. It will grow to $75.15 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to increasing demand in emerging economies, rising geriatric population, point-of-care blood processing, increasing focus on autologous blood transfusions, demand for apheresis procedures, collaborations for research and development. Major trends in the forecast period include technological integration for data management, technological innovations in blood processing, automation and robotics integration, advancements in apheresis technology, rise of point-of-care blood processing.

The increasing incidence of infectious diseases is expected to drive growth in the blood processing devices and consumables market. Infectious diseases are illnesses caused by pathogens, including bacteria, viruses, fungi, or parasites, which can be transmitted from one person to another or from animals to humans. Several factors contribute to the rise in infectious diseases, such as urbanization, globalization, climate change, increased travel, and antibiotic resistance. These elements facilitate the spread of pathogens and make populations more susceptible to infections. Blood processing devices and consumables are essential in combating the rise of infectious diseases, as they ensure safe blood transfusions and effective diagnostics. These tools are crucial for screening blood for infectious agents, thereby reducing the risk of transmission during medical procedures and enhancing patient safety. For instance, in March 2024, the Centers for Disease Control and Prevention (CDC), a U.S.-based government agency, reported that tuberculosis cases increased from 8,320 in 2022 to 9,615 in 2023, an increase of 1,295 cases. Therefore, the growing incidence of infectious diseases is anticipated to propel the blood processing devices and consumables market forward.

The burgeoning prevalence of chronic diseases is expected to fuel the expansion of the blood processing devices and consumables market. These enduring health conditions, often manageable but not curable, necessitate the use of blood processing devices and consumables in various treatments. They facilitate safe blood sample collection, processing, storage, and transportation for managing chronic diseases. For example, anticipated cancer diagnoses of around 2 million in 2022 in the United States, a significant rise from the 1 million reported cases in 2021, emphasize the growing demand for such devices and consumables. This trend signifies a driving force for the market, courtesy of the increased need for blood transfusion due to the growing disease burden.

Major companies in the blood processing devices and consumables sector are concentrating on technological advancements, such as the development of blood collection devices to improve efficiency. A blood collection device is a medical instrument specifically designed to obtain blood samples for diagnostic testing, transfusions, or research purposes. For example, in May 2024, Becton, Dickinson, and Company, a U.S.-based medical technology firm, launched UltraTouch, a device engineered to streamline the blood sample collection process while minimizing patient discomfort. This device employs advanced technology to facilitate quick and efficient venipuncture, ensuring high accuracy in sample collection. With a user-friendly interface and ergonomic design, UltraTouch is suitable for healthcare professionals across various settings, including hospitals, clinics, and laboratories. It is particularly beneficial for patients who experience anxiety during blood draws, as its innovative design helps reduce pain and enhance the overall experience. Additionally, the device incorporates safety features to minimize the risk of needle-stick injuries, making it a preferred choice in modern medical practice.

Key companies in the blood processing devices and consumables market concentrate on technological innovations, such as needle-free blood collection devices, to strengthen their market presence. These devices, designed to collect blood sans traditional needles or syringes, represent a significant advancement. In November 2023, Becton, Dickinson and Company (BD), a US-based medical device manufacturer, launched the 'PIVO Pro Needle-free Blood Collection Device.' Integrated with long peripheral IV catheters, this compact device facilitates direct blood sample extraction from a patient's peripheral IV line. Its clinical advantages include reduced catheter complications and extended dwell times, marking a notable leap in blood collection technology.

In June 2023, ASP Global, a U.S.-based medical device company, acquired MediCore for an undisclosed amount. This acquisition aims to bolster ASP Global's position in the infection prevention market by integrating MediCore's innovative products and expertise, enhancing its capacity to deliver comprehensive solutions that improve patient safety and healthcare outcomes. MediCore, also based in the U.S., specializes in the manufacturing and distribution of blood collection products.

Major companies operating in the blood processing devices and consumables market include Thermogenesis Holdings Inc., Maco Pharma International GmbH, Immucor Inc., Bio-Rad Laboratories Inc., Grifols S.A., Abbott Laboratories, Terumo BCT Inc., Beckman Coulter Inc., Becton Dickinson and Company, Biomerieux SA, Danaher Corporation, Global Scientific Company, Haemonetics Corporation, Sigma Laborzentrifugen GmbH, SARSTEDT AG & Co K, Roche Holdings AG, Beurer GmbH, Cardinal Health Inc., Fresenius Kabi AG, Lmb Technologie GmbH, Fenwal Inc., Kawasumi Laboratories Inc., F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Poly Medicure Ltd, Medtronic plc., Nipro Corporation, Sekisui Chemical Co Ltd, Greiner Bio-One International GmbH.

North America was the largest region in the blood processing devices and consumables market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global blood processing devices and consumables market report during the forecast period. The regions covered in the blood processing devices and consumables market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the blood processing devices and consumables market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Blood processing devices and consumables encompass a range of equipment and supplies pivotal in collecting, isolating, managing, and preserving blood components essential for various medical procedures. These tools are integral in facilitating procedures such as blood transfusions, therapeutic apheresis, and other clinical interventions reliant on blood products.

The primary types of products within blood processing devices and consumables include the devices themselves and the consumable elements. Blood processing devices pertain to instruments employed in the collection, separation, processing, and storage of blood and its components. This category further segments into various devices, such as blood bank freezers, blood grouping analyzers, blood warmers, blood cell processors, and other similar apparatuses facilitating blood processing. Additionally, blood processing devices and consumables are further classified by consumable items, such as blood bags, lancets for blood collection, vials for storage, blood administration sets, and other essential consumables used in the process. These tools find application among diverse end-users, including hospitals, diagnostic centers, clinics, academic institutes, and blood banks, supporting their essential roles in healthcare and research settings.

The blood processing devices and consumables market research report is one of a series of new reports that provides blood processing devices and consumables market statistics, including blood processing devices and consumables industry global market size, regional shares, competitors with a blood processing devices and consumables market share, detailed blood processing devices and consumables market segments, market trends and opportunities, and any further data you may need to thrive in the blood processing devices and consumables industry. This blood processing devices and consumables market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The blood processing devices and consumables market consists of sales of equipment, maintenance, repairs, and supplies such as blood bags, needles, blood group typing reagents, and other diagnostic kits. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blood Processing Devices and Consumables Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blood processing devices and consumables market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blood processing devices and consumables? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blood processing devices and consumables market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Devices; Consumables2) By Devices: Blood Bank Freezers; Blood Grouping Analyzers; Blood Warmer; Blood Cell Processers; Other Devices

3) By Consumables: Blood Bags; Blood Lancets; Vials; Blood Administration Sets; Other Consumables

4) By End User: Hospitals; Diagnostic Centers; Clinics; Academic Institutes; Blood Banks

Subsegments:

1) By Devices: Blood Collection Devices; Blood Separation Devices; Blood Transfusion Devices; Blood Storage Devices; Automated Blood Processing Systems2) By Consumables: Blood Collection Tubes; Blood Filters; Blood Bags; Reagents and Chemicals; Anticoagulants; Blood Processing Kits

Key Companies Mentioned: Thermogenesis Holdings Inc.; Maco Pharma International GmbH; Immucor Inc.; Bio-Rad Laboratories Inc.; Grifols S.A.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermogenesis Holdings Inc.

- Maco Pharma International GmbH

- Immucor Inc.

- Bio-Rad Laboratories Inc.

- Grifols S.A.

- Abbott Laboratories

- Terumo BCT Inc.

- Beckman Coulter Inc.

- Becton Dickinson and Company

- Biomerieux SA

- Danaher Corporation

- Global Scientific Company

- Haemonetics Corporation

- Sigma Laborzentrifugen GmbH

- SARSTEDT AG & Co K

- Roche Holdings AG

- Beurer GmbH

- Cardinal Health Inc.

- Fresenius Kabi AG

- Lmb Technologie GmbH

- Fenwal Inc.

- Kawasumi Laboratories Inc.

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Poly Medicure Ltd

- Medtronic plc.

- Nipro Corporation

- Sekisui Chemical Co Ltd

- Greiner Bio-One International GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 51.62 Billion |

| Forecasted Market Value ( USD | $ 75.15 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |