Wood-plastic composites (WPC) are a type of composite material composed of wood fibers or flour combined with thermoplastic polymers. They offer a versatile alternative to traditional wood or plastic materials. They are highly durable and resistant to rot, decay, and insect damage. They can withstand harsh weather conditions and are less prone to splintering or cracking, ensuring a longer lifespan than traditional wood. They require minimal maintenance, eliminating the need for staining, sealing, or painting. WPC reduces reliance on virgin resources using recycled materials, such as wood fibers and plastic waste. It helps manage waste, reduces carbon footprint, and promotes sustainability in various industries. While wood-plastic composites may have a higher upfront cost than traditional wood, their long-term benefits, such as low maintenance and extended lifespan, result in cost savings over time. They are often slip-resistant, making them safer for applications such as decking or walkways, especially in areas prone to moisture or wet conditions.

The global market is majorly driven by the growing awareness and emphasis on sustainability. Furthermore, WPC materials require minimal maintenance, such as sealing, staining, or painting, which reduces long-term costs and attracts consumers looking for convenient and hassle-free options, thus catalyzing the market. Apart from this, the widespread product applications in decking, fencing, cladding, furniture, and automotive components are propelling the market. Moreover, the WPC materials offer a natural wood-like appearance, allowing consumers to enjoy the aesthetic benefits of wood while benefiting from the durability and low maintenance of composites, which is strengthening the market. Besides, the increasing resistance of the product to environmental factors is creating a positive outlook for the market. Additionally, the continuous improvements in manufacturing processes, such as extrusion and injection molding, have led to better quality and consistency in wood-plastic composites, creating a positive outlook for the market.

Wood-plastic Composites Market Trends/Drivers:

Increasing product demand in the construction industry

The increasing product demand in the construction industry is significantly contributing to the market. As the construction industry expands globally, there is a growing preference for sustainable and durable materials that offer long-term performance. Wood-plastic composites fulfill these requirements and are a viable alternative to traditional wood materials. Furthermore, wood-plastic composites find extensive applications in the construction industry, including decking, railing, cladding, and fencing. Their durability, resistance to environmental factors, and low maintenance requirements make them highly suitable for residential and commercial construction projects. Moreover, the versatility of wood-plastic composites allows for color, texture, and size customization, providing architects and builders with design flexibility. Besides, the construction industry's shift towards eco-friendly practices and the adoption of green building certifications further drive the demand for wood-plastic composites. These materials fulfill sustainability criteria by utilizing recycled content and reducing environmental impacts. Additionally, wood-plastic composites offer dimensional stability, moisture resistance, and improved safety features, making them an attractive choice for construction applications. As the construction industry continues to grow, the demand for wood-plastic composites is expected to rise due to their inherent benefits and alignment with sustainable construction practices. Manufacturers in the wood-plastic composites market actively cater to this demand, investing in research and development to enhance product quality, durability, and design options.Rapid urbanization and industrialization in developing economies

Rapid urbanization and industrialization in developing economies are positively influencing the market. As these economies experience significant population growth and urban expansion, there is a rising demand for construction materials that can meet the increasing infrastructure needs. Wood-plastic composites offer several advantages that align with the requirements of developing economies. They provide a sustainable and cost-effective alternative to traditional materials, such as solid wood, and can be used in various construction applications, including decking, fencing, and cladding. Furthermore, the versatility and durability of wood-plastic composites make them well-suited for the construction of residential and commercial buildings in developing economies. Their resistance to moisture, rot, and insects ensures long-lasting performance, while their low maintenance requirements are particularly attractive in regions where resources and labor may be limited. Moreover, using wood-plastic composites supports sustainable development goals by reducing reliance on natural resources and promoting eco-friendly practices. This factor resonates with the increasing focus on environmental sustainability in developing economies, wherein there has been a growing awareness of the need for greener construction materials. Manufacturers in the market are recognizing this trend and investing in expanding their production capacities, developing new product formulations, and establishing strategic partnerships to cater to the growing market opportunities in these regions.Rising awareness regarding the benefits offered by the product

The rising awareness regarding the benefits offered by wood-plastic composites is catalyzing the market. As consumers and industries become more informed about the advantages of these materials, their demand and adoption continue to increase. They are made from recycled materials, such as wood fibers or sawdust, and thermoplastic polymers. This eco-friendly attribute resonates with environmentally conscious consumers who seek sustainable alternatives to traditional materials. Furthermore, they resist rot, decay, and insect damage and do not require regular sealing, staining, or painting. This appeals to homeowners, construction professionals, and infrastructure developers looking for long-lasting, cost-effective solutions. Moreover, wood-plastic composites also offer enhanced dimensional stability, moisture resistance, and improved safety features compared to traditional wood. These benefits make them attractive for applications in decking, outdoor furniture, and other exterior structures. Manufacturers in the wood-plastic composites market are actively promoting the benefits of their products through marketing campaigns, product demonstrations, and collaborations with industry stakeholders. This increased awareness, coupled with the growing demand for sustainable and durable materials, is propelling the growth of the market globally.Wood-plastic Composites Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global wood-plastic composites market report, along with forecasts at the global and regional, levels from 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- Polyethylene

- Polyvinylchloride

- Polypropylene

- Others

Polyethylene dominates the wood-plastic composites market

The report has provided a detailed breakup and analysis of the wood-plastic composites market based on type. This includes polyethylene, polyvinylchloride, polypropylene, and others. According to the report, polyethylene represented the largest segment.Polyethylene is a thermoplastic polymer that offers several advantages for manufacturing wood-plastic composites. It is widely produced and easily accessible, making it a preferred choice for manufacturers. The lower cost of polyethylene compared to other polymers contributes to its market dominance. Furthermore, polyethylene-based wood-plastic composites exhibit excellent mechanical properties, including high strength, durability, and resistance to impact. This makes them suitable for various construction, automotive, and packaging applications.

Moreover, polyethylene-based wood-plastic composites have good resistance to moisture, chemicals, and U.V. radiation. This property enhances its performance in outdoor applications, such as decking and fencing, where exposure to harsh environmental conditions is common. Besides, the market dominance of polyethylene in the wood-plastic composites segment also stems from its compatibility with wood fibers or flour. Blending polyethylene with wood particles results in a homogenous mixture with good processing characteristics, allowing for the efficient production of high-quality composites.

Additionally, manufacturers in the wood-plastic composites market continue to innovate and improve the properties of polyethylene-based products. They invest in research and development to enhance the material's strength, impact resistance, and sustainability.

Breakup by Application:

- Building and Construction

- Automotive

- Industrial and Consumer Goods

- Others

Building and construction hold the largest share in the market

A detailed breakup and analysis of the wood-plastic composites market based on the application have also been provided in the report. This includes building and construction, automotive, industrial and consumer goods, and others. According to the report, building and construction accounted for the largest market share.The building and construction segment holds the largest share due to the extensive use of wood-plastic composites in various construction applications. Wood-plastic composites offer a range of benefits that align with the requirements of the building and construction industry. They are durable, resistant to rot and decay, and exhibit dimensional stability, making them ideal for outdoor structures such as decking, railing, and cladding. These materials offer an attractive alternative to traditional wood materials, offering superior performance and requiring minimal maintenance.

Additionally, wood-plastic composites contribute to sustainable construction practices. They are often made from recycled materials, reducing the reliance on virgin resources and supporting environmentally friendly initiatives. As the construction industry increasingly prioritizes sustainable building materials, the demand for wood-plastic composites continues to rise.

Moreover, the versatility of wood-plastic composites allows for a wide range of applications in the building and construction segment. They can be molded into different shapes and sizes, providing architects and builders with design flexibility. This adaptability contributes to market growth as wood-plastic composites find use in residential buildings and commercial and infrastructure projects.

As the building and construction segment continues to expand globally, driven by rapid urbanization, infrastructure development, and renovation projects, the demand for wood-plastic composites is expected to increase. Manufacturers are actively developing new formulations and enhancing product performance to cater to the specific needs of this segment.

Breakup by Region:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, the Middle East and Africa, and Latin America.North America accounts for the majority of the global market due to the thriving construction sector in the region. The demand for wood-plastic composites in residential and commercial construction projects is substantial, driven by rapid urbanization, infrastructure development, and renovation activities. The region's focus on sustainable building practices further supports the adoption of wood-plastic composites, which offer eco-friendly alternatives to traditional materials.

Moreover, North America has a well-established manufacturing infrastructure for wood-plastic composites. The presence of leading manufacturers and suppliers in the region ensures a reliable supply chain and facilitates the distribution of products to meet market demand. Furthermore, favorable government regulations and initiatives promoting sustainable construction practices in North America play a crucial role in propelling the market growth of wood-plastic composites. These regulations encourage using environmentally friendly materials, offering a significant advantage to wood-plastic composites due to their sustainable attributes.

Competitive Landscape:

Top wood-plastic composites companies play a crucial role in driving the growth of the market through their strategic initiatives, technological advancements, and market presence. These companies are heavily investing in research and development to introduce innovative products with enhanced performance characteristics. They focus on improving the durability, strength, and sustainability aspects of wood-plastic composites, which drives the market growth by meeting the evolving demands of consumers and industries. Moreover, these companies have strong marketing and distribution networks, allowing them to effectively promote and distribute their wood-plastic composite products across various regions. Their extensive reach helps increase market penetration and accessibility, driving market growth. Furthermore, top companies often engage in strategic collaborations and partnerships with key stakeholders in the value chain. These collaborations enable the development of new applications, expand product portfolios, and foster technological advancements, all of which contribute to the market growth. Additionally, leading wood-plastic composites companies actively participate in industry associations and trade organizations. They contribute to the development of industry standards, regulations, and sustainability initiatives, which further promote the adoption of wood-plastic composites growth. Besides, top companies continuously invest in expanding their manufacturing capacities to meet the growing demand for wood-plastic composites. By increasing production capabilities, they ensure a stable supply of products and cater to the needs of various industries, including construction, automotive, and packaging.The report has provided a comprehensive analysis of the competitive landscape in the global wood-plastic composites market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Trex Company, Inc.

- Axion Structural Innovations LLC

- Beologic N.V.

- Oldcastle Architectural Inc.

- CertainTeed Corporation

- Fiberon, LLC

- Fkur Kunststoff GmbH

- Guangzhou Kindwood Co. Ltd.

- Jelu-Werk Josef Ehrler GmbH & Co. KG

- Woodmass

- PolyPlank AB

- Renolit

- TAMKO Building Products, Inc.

- TimberTech

- Universal Forest Product

Key Questions Answered in This Report:

- How has the global wood-plastic composites market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global wood-plastic composites market?

- What is the impact of each driver, restraint, and opportunity on the global wood-plastic composites market?

- What are the key regional markets?

- Which countries represent the most attractive wood-plastic composites market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the wood-plastic composites market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the wood-plastic composites market?

- What is the competitive structure of the global wood-plastic composites market?

- Who are the key players/companies in the global wood-plastic composites market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Wood-Plastic Composites Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Type

5.5 Market Breakup by Application

5.6 Market Breakup by Region

5.7 Market Forecast

5.8 SWOT Analysis

5.8.1 Overview

5.8.2 Strengths

5.8.3 Weaknesses

5.8.4 Opportunities

5.8.5 Threats

5.9 Value Chain Analysis

5.9.1 Overview

5.9.2 Raw Material Procurement

5.9.3 Manufacturing

5.9.4 Distribution

5.9.5 Export

5.9.6 End-Use

5.10 Porters Five Forces Analysis

5.10.1 Overview

5.10.2 Bargaining Power of Buyers

5.10.3 Bargaining Power of Suppliers

5.10.4 Degree of Competition

5.10.5 Threat of New Entrants

5.10.6 Threat of Substitutes

6 Market Breakup by Type

6.1 Polyethylene

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Polyvinylchloride

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Polypropylene

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Application

7.1 Building and Construction

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Automotive

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Industrial and Consumer Goods

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Region

8.1 North America

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Asia Pacific

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Europe

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Middle East and Africa

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Latin America

8.5.1 Market Trends

8.5.2 Market Forecast

9 Wood-Plastic Composites Manufacturing Process

9.1 Product Overview

9.2 Raw Material Requirements

9.3 Manufacturing Process

9.4 Key Success and Risk Factors

10 Competitive Landscape

10.1 Market Structure

10.2 Key Players

10.3 Profiles of Key Players

10.3.1 Trex Company, Inc.

10.3.2 Axion Structural Innovations LLC

10.3.3 Beologic N.V.

10.3.4 Oldcastle Architectural Inc.

10.3.5 CertainTeed Corporation

10.3.6 Fiberon, LLC

10.3.7 Fkur Kunststoff GmbH

10.3.8 Guangzhou Kindwood Co. Ltd.

10.3.9 Jelu-Werk Josef Ehrler GmbH & Co. KG

10.3.10 Woodmass

10.3.11 PolyPlank AB

10.3.12 Renolit

10.3.13 TAMKO Building Products, Inc.

10.3.14 TimberTech

10.3.15 Universal Forest Product

List of Figures

Figure 1: Global: Wood-Plastic Composites Market: Major Drivers and Challenges

Figure 2: Global: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019-2024

Figure 3: Global: Wood-Plastic Composites Market: Value Trends (in Billion USD), 2019-2024

Figure 4: Global: Wood-Plastic Composites Market: Breakup by Type (in %), 2024

Figure 5: Global: Wood-Plastic Composites Market: Breakup by Application (in %), 2024

Figure 6: Global: Wood-Plastic Composites Market: Breakup by Region (in %), 2024

Figure 7: Global: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 8: Global: Wood-Plastic Composites Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 9: Global: Wood-Plastic Composites Industry: SWOT Analysis

Figure 10: Global: Wood-Plastic Composites Industry: Value Chain Analysis

Figure 11: Global: Wood-Plastic Composites Industry: Porter’s Five Forces Analysis

Figure 12: Global: Wood-Plastic Composites (Polyethylene) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 13: Global: Wood-Plastic Composites (Polyethylene) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 14: Global: Wood-Plastic Composites (Polyvinylchloride) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 15: Global: Wood-Plastic Composites (Polyvinylchloride) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 16: Global: Wood-Plastic Composites (Polypropylene) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 17: Global: Wood-Plastic Composites (Polypropylene) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 18: Global: Wood-Plastic Composites (Others) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 19: Global: Wood-Plastic Composites (Others) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 20: Global: Wood-Plastic Composites (Building and Construction) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 21: Global: Wood-Plastic Composites (Building and Construction) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 22: Global: Wood-Plastic Composites (Automotive) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 23: Global: Wood-Plastic Composites (Automotive) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 24: Global: Wood-Plastic Composites (Industrial and Consumer Goods) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 25: Global: Wood-Plastic Composites (Industrial and Consumer Goods) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 26: Global: Wood-Plastic Composites (Other Applications) Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 27: Global: Wood-Plastic Composites (Other Applications) Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 28: North America: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 29: North America: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 30: Asia Pacific: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 31: Asia Pacific: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 32: Europe: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 33: Europe: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 34: Middle East and Africa: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 35: Middle East and Africa: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 36: Latin America: Wood-Plastic Composites Market: Volume Trends (in Million Tons), 2019 & 2024

Figure 37: Latin America: Wood-Plastic Composites Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 38: Wood-Plastic Composites Manufacturing: Detailed Process Flow

List of Tables

Table 1: Global: Wood-Plastic Composites Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Wood-Plastic Composites Market Forecast: Breakup by Type (in Million Tons), 2025-2033

Table 3: Global: Wood-Plastic Composites Market Forecast: Breakup by Application (in Million Tons), 2025-2033

Table 4: Global: Wood-Plastic Composites Market Forecast: Breakup by Region (in Million Tons), 2025-2033

Table 5: Wood-Plastic Composites Manufacturing: Raw Material Requirements

Table 6: Global: Wood-Plastic Composites Market: Competitive Structure

Table 7: Global: Wood-Plastic Composites Market: Key Players

Companies Mentioned

- Trex Company Inc.

- Axion Structural Innovations LLC

- Beologic N.V.

- Oldcastle Architectural Inc.

- CertainTeed Corporation

- Fiberon LLC

- Fkur Kunststoff GmbH

- Guangzhou Kindwood Co. Ltd.

- Jelu-Werk Josef Ehrler GmbH & Co. KG

- Woodmass

- PolyPlank AB

- Renolit

- TAMKO Building Products Inc.

- TimberTech and Universal Forest Product

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

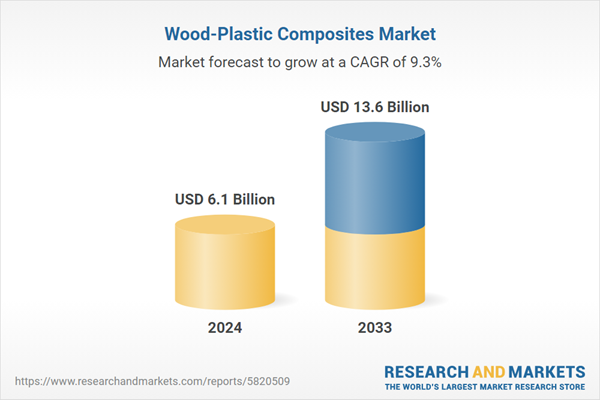

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 13.6 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |