Digital X-ray devices are advanced medical equipment used for diagnostic purposes. They use electronic sensors instead of traditional photographic film to capture images of internal body parts. They produce high-quality images in real-time, making them an essential tool for doctors and radiologists. One of the main advantages of digital X-ray devices is their ability to produce images almost immediately, which allows for faster diagnosis and treatment. They are also more efficient, as there is no need to manually develop X-ray film, reducing the time and resources required for processing. Digital X-rays also produce less radiation, which is beneficial for both patients and medical staff. As a result, they find extensive applications in dental, mammography, and orthopedic imaging. They are also commonly used in emergency rooms for fast and accurate diagnosis. Moreover, as they are more compact and portable, they enable healthcare professionals to provide quality care in remote locations. Owing to these properties, digital X-ray devices have become a critical tool in modern medicine to make accurate diagnoses and improve patient outcomes.

Digital X-ray Devices Market Trends:

The market is primarily driven by the growing prevalence of chronic diseases such as urological, cancer, cardiovascular disorders (CVDs), lung, neurovascular, and other disorders. This is escalating the demand for digital X-ray devices as they are often used to diagnose and monitor these conditions. In addition, the rising geriatric population that is more susceptible to such ailments represents another growth-inducing factor. Besides this, various technological advancements have improved the efficiency, accuracy, and safety of these devices, accelerating their adoption across hospitals and diagnostic centers. This, coupled with the rising investments by governing authorities of numerous countries for the development of healthcare infrastructure, is positively influencing the market growth. Moreover, digital X-ray devices offer several advantages over traditional X-ray systems, including better image quality, faster processing times, and lower radiation exposure, which makes them an attractive option for healthcare providers. Furthermore, the leading market players are launching advanced product variants to strengthen their market foothold. For instance, Canon Medical System Inc. launched the OMNERA 500A Digital Radiography system with an advanced intelligent auto-positioning feature to improve the workflow. On account of these factors, the market is expected to witness positive growth in the coming years.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global digital X-ray devices market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on portability, system, application, and end use.Portability Insights:

- Fixed

- Mobile

System Insights:

- Retrofit Digital X-ray Systems

- New Digital X-ray Systems

Application Insights:

- Cardiovascular Imaging

- Chest Imaging

- General Radiography

- Dental

- Mammography

- Orthopedic

- Others

End Use Insights:

- Hospitals

- Diagnostic Imaging Centers

- Dental Care Centers

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global digital X-ray devices market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Agfa-Gevaert Group, Canon Medical Systems Corporation (Canon Inc.), Carestream Health, Fujifilm Holdings Corporation, GE HealthCare Technologies Inc. (General Electric Company), Hologic Inc., Koninklijke Philips N.V., Samsung Healthcare (Samsung Electronics Co. Ltd.), Shimadzu Corporation, Siemens Healthineers (Siemens AG), etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global digital X-ray devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global digital X-ray devices market?

- What is the impact of each driver, restraint, and opportunity on the global digital X-ray devices market?

- What are the key regional markets?

- Which countries represent the most attractive digital X-ray devices market?

- What is the breakup of the market based on portability?

- Which is the most attractive portability in the digital X-ray devices market?

- What is the breakup of the market based on the system?

- Which is the most attractive system in the digital X-ray devices market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the digital X-ray devices market?

- What is the breakup of the market based on end use?

- Which is the most attractive end use in the digital X-ray devices market?

- What is the competitive structure of the global digital X-ray devices market?

- Who are the key players/companies in the global digital X-ray devices market?

Table of Contents

Companies Mentioned

- Agfa-Gevaert Group

- Canon Medical Systems Corporation (Canon Inc.)

- Carestream Health

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc. (General Electric Company)

- Hologic Inc.

- Koninklijke Philips N.V.

- Samsung Healthcare (Samsung Electronics Co. Ltd.)

- Shimadzu Corporation

- Siemens Healthineers (Siemens AG)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | March 2025 |

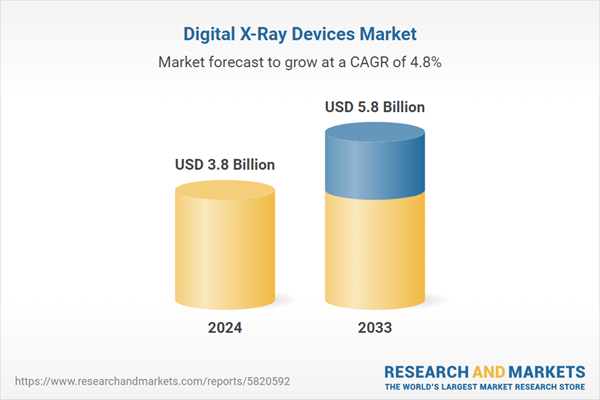

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 5.8 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |