Autologous stem cell therapy is a medical procedure in which a patient's stem cells are used to repair damaged tissues and organs or treat various diseases. The procedure involves harvesting stem cells from a patient's body, usually from bone marrow or adipose tissue, and then processing and injecting them back into the body. Non-stem cell-based therapies, on the other hand, involve using cells that are not stem cells, such as immune cells, fibroblasts, and muscle cells, to repair or regenerate damaged tissues or organs. Autologous stem cell therapy is used to treat cardiovascular diseases, neurodegenerative diseases, and autoimmune disorders, while non-stem cell-based therapies are employed in treating chronic wounds, heart disease, and Parkinson's disease.

Autologous Stem Cell and Non-Stem Cell Based Therapies Market Trends:

The growth of the global autologous stem cell and non-stem cell based therapies market is primarily driven by the increasing prevalence of cancer, diabetes, cardiovascular disorders, and neurodegenerative diseases due to smoking, poor diet, and sedentary lifestyles of consumers. Besides this, the rising geriatric population and the growing demand for autologous stem and non-stem cell based therapies are creating a positive outlook for the market. Moreover, the ongoing development of innovative autologous stem cell therapies for regenerative medicine and the widespread demand for personalized therapies are presenting remunerative growth opportunities for the market. In addition to this, the surging popularity of minimally invasive treatments, the expanding acceptance of stem cell therapies, and the implementation of favorable government initiatives, such as financial and regulatory support for stem cell research, are aiding in market expansion. Furthermore, continuous advancements in stem cell technologies have enabled researchers to better control the differentiation of stem cells and develop improved and effective treatments, which, in turn, is acting as a significant growth-inducing factor. Besides this, the bolstering growth of the healthcare sector, extensive research and development (R&D) activities, the escalating health consciousness among consumers, and favorable reimbursement policies are contributing to the market growth.Key Market Segmentation:

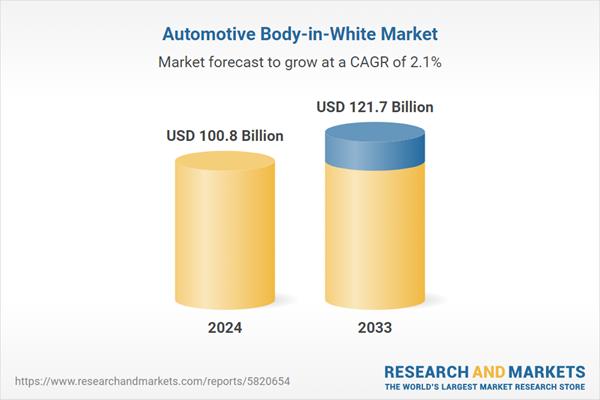

The publisher provides an analysis of the key trends in each segment of the global automotive body-in-white market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on the material type, vehicle type, propulsion type, and joining technique.Type Insights:

- Autologous Stem Cells

- Autologous Non-Stem Cells

Application Insights:

- Cancer

- Neurodegenerative Disorders

- Cardiovascular Disease

- Orthopedic Diseases

- Others

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Research Facilities

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global autologous stem cell and non-stem cell based therapies market. Detailed profiles of all major companies have also been provided. Some of the companies covered include BrainStorm Cell Limited, Cytori Therapeutics Inc., Holostem Terapie Avanzate S.r.l., Lisata Therapeutics, U.S. Stem Cell Inc., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

How has the global autologous stem cell and non-stem cell based therapies market performed so far, and how will it perform in the coming years?What are the drivers, restraints, and opportunities in the global autologous stem cell and non-stem cell based therapies market?

What is the impact of each driver, restraint, and opportunity on the global autologous stem cell and non-stem cell based therapies market?

What are the key regional markets?

Which countries represent the most attractive autologous stem cell and non-stem cell based therapies market?

What is the breakup of the market based on the type?

Which is the most attractive type in the autologous stem cell and non-stem cell based therapies market?

What is the breakup of the market based on the application?

Which is the most attractive application in the autologous stem cell and non-stem cell based therapies market?

What is the breakup of the market based on the end user?

Which is the most attractive end user in the autologous stem cell and non-stem cell based therapies market?

What is the competitive structure of the global autologous stem cell and non-stem cell based therapies market?

Who are the key players/companies in the global autologous stem cell and non-stem cell based therapies market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- Benteler International AG

- CIE Automotive

- Dura Automotive Systems

- Gestamp Automocion S.A.

- Kuka AG

- Magna International Inc.

- Martinrea International Inc.

- Norsk Hydro ASA

- Tata Steel Limited

- TECOSIM Group

- thyssenkrupp AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 100.8 Billion |

| Forecasted Market Value ( USD | $ 121.7 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |