Next generation diabetes therapy and drug delivery procedure focuses on the introduction of insulin into the patient’s body in a minimally invasive manner to reduce the risk of skin irritation from frequent needle usage. This patient-friendly approach aims to effectively manage the disease while reducing healthcare costs by utilizing innovative technologies including wearable sensors, micro-needles, and inhalable insulin. Advanced therapies, such as continuous glucose monitoring systems (CGMS), artificial pancreas, and insulin patches, are also employed to improve blood sugar level management that minimize the risks of diabetic-related complications. In addition, the procedure facilitates easy calculation of the dose volume, checking the blood glucose levels in real-time, and delivers insulin into the body painlessly, which, in turn, helps to maintain the dosage time. Some of the advantages of this therapy and drug delivery practice includes improved patient outcomes, enhanced treatment efficiency, and minimized burden of diabetes management for patients, leading to more targeted treatment plans.

Next Generation Diabetes Therapy and Drug Delivery Market Trends:

The global market is primarily driven by the rising prevalence of diabetes, particularly type-2 diabetes, among the masses. This can be attributed to the increasing consumption of unhealthy diets, sedentary lifestyles and reduced physical activity. In line with this, the augmenting demand for personalized and patient-centric care according to individual needs, lifestyle, and treatment goals is resulting in a higher product uptake. Moreover, continual technological advancements, such as the development of smart insulin pens, closed-loop systems, and implantable devices with fewer side effects, is providing an impetus to the market. In addition to this, the increasing emphasis on minimally invasive and pain-free treatment options among individuals is also acting as a significant growth-inducing factor for the market. The market is further driven by the increasing healthcare expenditure, along with an enhanced focus on value-based medical care solutions. However, the growing cost restrains, lack of awareness and less variability in products in the developing regions are acting as major growth-restraining factors for the market. Conversely, the implementation of favorable government initiatives and reimbursement policies regarding preventive healthcare and early intervention is creating a positive outlook for the market. Apart from this, the growing geriatric population that is more susceptible to developing chronic diseases is impacting the market favorably. Some of the other factors contributing to the market include rapid urbanization, increasing awareness regarding the associated complications of traditional diabetes treatment, rising adoption of telehealth and digital health solutions, inflating disposable income levels and extensive research and development (R&D) activities conducted by key players.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global next generation diabetes therapy and drug delivery market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type, demographic, indication, and end user.Product Type Insights:

- Inhalable Insulin

- Oral Insulin

- Insulin Patches

- CGM Systems

- Artificial Pancreas

Demographic Insights:

- Adult Population (>14 Years)

- Child Population (14 Years)

Indication Insights:

- Type 1 diabetes

- Type 2 diabetes

End User Insights:

- Diagnostic/Clinics

- Intensive Care Units (ICUs)

- Home Healthcare

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global next generation diabetes therapy and drug delivery market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Abbott Laboratories, Dexcom Inc., Eli Lilly and Company, Enteris BioPharma Inc. (Swk Holdings Corporation), GlySens Incorporated, MannKind Corporation, Medtronic plc, Sanofi, Senseonics, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global next generation diabetes therapy and drug delivery market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global next generation diabetes therapy and drug delivery market?

- What is the impact of each driver, restraint, and opportunity on the global next generation diabetes therapy and drug delivery market?

- What are the key regional markets?

- Which countries represent the most attractive global next generation diabetes therapy and drug delivery market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the global next generation diabetes therapy and drug delivery market?

- What is the breakup of the market based on the demographic?

- Which is the most attractive demographic in the global next generation diabetes therapy and drug delivery market?

- What is the breakup of the market based on the indication?

- Which is the most attractive indication in the global next generation diabetes therapy and drug delivery market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the global next generation diabetes therapy and drug delivery market?

- What is the competitive structure of the global next generation diabetes therapy and drug delivery market?

- Who are the key players/companies in the global next generation diabetes therapy and drug delivery market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Dexcom Inc.

- Eli Lilly and Company

- Enteris BioPharma Inc. (Swk Holdings Corporation)

- GlySens Incorporated

- MannKind Corporation

- Medtronic plc

- Sanofi

- Senseonics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | March 2025 |

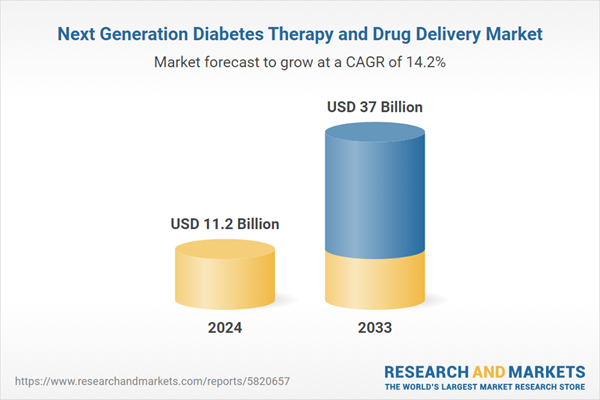

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11.2 Billion |

| Forecasted Market Value ( USD | $ 37 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |