Low cost airlines, also known as budget airlines or no-frills carriers, are airlines that offer air travel at significantly lower fares compared to traditional full-service airlines. They usually operate with a focus on cost efficiency, offering stripped-down services and charging additional fees for amenities such as checked baggage, in-flight meals, and seat selection.

They often target price-sensitive travelers and aim to attract a large volume of passengers by providing affordable air travel options. They achieve cost savings through measures such as simplified fare structures, operating from secondary airports, utilizing a single aircraft type, and maximizing aircraft utilization. As a result, the business model of low cost airlines has revolutionized the airline industry by making air travel more accessible to a wider range of consumers.

The increasing demand for affordable air travel among price-sensitive consumers will stimulate the growth of the market during the forecast period. Low cost airlines cater to a large segment of travelers who prioritize cost savings over additional amenities and services. Moreover, the deregulation of the aviation industry in various countries has created opportunities for new entrants and increased competition. In line with this, the emergence of low cost airlines as viable alternatives to traditional carriers, challenging their dominance and offering consumers more choices, is positively influencing the market growth.

Apart from this, the proliferation of online booking platforms and the rise of digital marketing that facilitates the distribution and promotion of low cost airline tickets, making it easier for consumers to access and compare fares, has catalyzed market growth. Furthermore, the rapid expansion of secondary airports, which are often less congested and have lower operating costs, providing low cost airlines with more options for route development and cost savings is contributing to the market growth.

Low Cost Airlines Market Trends/Drivers:

Rise in cost-conscious consumers

The increasing demand from cost-conscious consumers is a key driver for the global market. Many travelers, particularly leisure travelers and those with flexible travel plans prioritize affordability over additional services and amenities. These airlines cater to this demand by offering lower fares compared to traditional carriers. These airlines adopt a no-frills approach, charging extra for services like checked baggage, in-flight meals, and seat selection.By focusing on cost efficiency and offering competitive fares, they attract a significant segment of price-sensitive travelers who may otherwise choose alternative modes of transportation or forgo travel altogether. The affordability factor is particularly appealing for short-haul flights, where low-cost carriers have established a strong market presence.

Increase in liberalization of the aviation industry

The deregulation and liberalization of the aviation industry in many countries have created opportunities for new entrants and increased competition, driving the market growth. Deregulation policies have relaxed restrictions on routes, pricing, and market entry, allowing low-cost carriers to enter the market and operate with more flexibility. This has broken the monopoly of traditional carriers and introduced competition, leading to reduced fares and increased choices for consumers. Market liberalization promotes innovation and efficiency as low cost airlines strive to differentiate themselves and attract customers. The increased competition has forced traditional carriers to adapt by introducing their low-cost subsidiaries or adopting elements of the low-cost business model.Surge in technological advancements

Technological advancements in aircraft design and operations have positively influenced the growth of the market. Modern aircraft are more fuel-efficient, leading to reduced operating costs for airlines. This allows low-cost carriers to offer competitive fares while maintaining profitability. Advanced navigation systems and flight management technologies also improve operational efficiency, optimizing routes and reducing fuel consumption. Furthermore, technological advancements have transformed the booking and distribution process.Online platforms and mobile applications have simplified the ticketing process, allowing travelers to search for, compare, and book flights with ease. This accessibility has expanded the customer base for low cost airlines and facilitated their global reach. Additionally, technology is vital in enhancing the overall customer experience, from online check-in systems to onboard entertainment options, further adding value to the offerings.

Low Cost Airlines Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global low cost airlines market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on purpose, distribution channel and destination.Breakup by Purpose:

- Leisure Travel

- VFR

- Business Travel

- Other.

Leisure travel dominates the market

The report has provided a detailed breakup and analysis of the market based on the purpose. This includes leisure travel, VFR, business travel, and others. According to the report, leisure travel represented the largest segment.Leisure travel refers to travel activities undertaken for recreational or personal purposes, such as vacations, holidays, sightseeing, visiting friends or relatives, or engaging in leisure activities. It is a significant segment of the travel industry and plays a crucial role in fueling the demand. The dominance of leisure travel as a purpose segment can be attributed to its affordability as cost-conscious leisure travelers seek affordable travel options, and low cost airlines cater to this demand by offering competitive fares.

Moreover, leisure travelers often have more flexibility in terms of travel dates and destinations compared to business travelers. This flexibility aligns well with the low cost airline model, which typically operates on multiple routes and offers frequent flights to popular leisure destinations, thereby propelling the segment growth. Furthermore, the prevalence of short-haul destinations is also contributing to the expansion of the market.

Breakup by Distribution Channel:

- Online

- Travel Agency

- Others

The online distribution channel has revolutionized the way travel products and services are marketed and sold. It encompasses various platforms such as airline websites, online travel agencies (OTAs), and metasearch engines. It offers various options, customer reviews, and personalized recommendations. Travel agencies act as intermediaries between travelers and airlines, assisting with travel planning and bookings and providing expert advice. They have established relationships with airlines and access to negotiated fares, package deals, and exclusive offers. They offer expertise and destination knowledge and can customize travel itineraries according to individual preferences.

Apart from online and travel agency channels, other distribution channels contribute to airline ticket sales. These include direct sales at airport counters, call centers, corporate travel departments, and consolidators.

Breakup by Destination:

- Domestic

- Internationa.

Domestic holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international. According to the report, domestic represented the largest segment.A domestic destination refers to a location within the same country where travelers undertake their trips, whether for leisure or business purposes. Domestic travel is often more cost-effective compared to international travel, as it eliminates expenses such as visas, long-haul flights, and currency exchange. In addition, the surging adoption of low cost airlines that caters to price-sensitive travelers by offering competitive fares for domestic routes, making air travel an accessible and affordable option for domestic trips is positively influencing the segment growth.

Moreover, low cost airlines usually operate on multiple domestic routes and connect to secondary airports, providing travelers with a wide range of options and greater flexibility in terms of departure and arrival locations, thereby accelerating the product adoption rate. Furthermore, the rising diversity of landscapes, historical sites, natural attractions, and vibrant cities in many countries has augmented the demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Europe exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe was the largest market.Europe held the largest market share since the region boasts a dense network of airports, making it easier for low-cost carriers to establish extensive route networks and offer convenient connections. This accessibility has allowed budget airlines to penetrate various European markets, attracting a large customer base. Moreover, significant deregulation and liberalization in the aviation industry of Europe, enabling low-cost carriers to operate more freely and competitively, is propelling market growth in the region.

Additionally, the expanding geographic proximity of Europe to popular tourist destinations has accelerated the adoption of low cost airlines as it offers convenient and affordable travel options for both leisure and business travelers. Moreover, rapid growth in the Europe tourism industry and the presence of major tourist attractions have attracted a steady influx of visitors, thereby driving the demand for low-cost air travel.

Competitive Landscape:

The market is experiencing a lower-than-anticipated demand compared to pre-pandemic levels; however, this is likely to witness a paradigm shift over the next decade, with companies in the market continuously implementing strategies to maintain their competitiveness and attract more customers. Key players are focusing on cost efficiency by adopting various measures, such as operating a single aircraft type, minimizing turnaround times, and optimizing fuel consumption. They are also leveraging digital marketing strategies to reach a broader customer base and promote special offers and discounts.Furthermore, many low-cost carriers are focusing on route expansion, continuously adding new destinations and increasing frequency on popular routes to attract a wider range of travelers. They are also striving to maintain high operational reliability and punctuality to build customer trust and loyalty. We expect the market to witness new entrants, consolidation of portfolio, and increased collaborations to drive healthy competition within the domain.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Air Arabia PJSC

- Alaska Airlines Inc.

- Capital A Berhad (Tune Group Sdn Bhd)

- EasyJet plc

- Go Airlines (Wadia Group)

- IndiGo

- Jetstar Airways Pty Ltd (Qantas Airways Limited)

- Norwegian Air Shuttle ASA

- Ryanair Holdings PLC

- Southwest Airlines Co.

- SpiceJet Limited

- Spirit Airlines Inc.

- WestJet Airlines Ltd.

Key Questions Answered in This Report

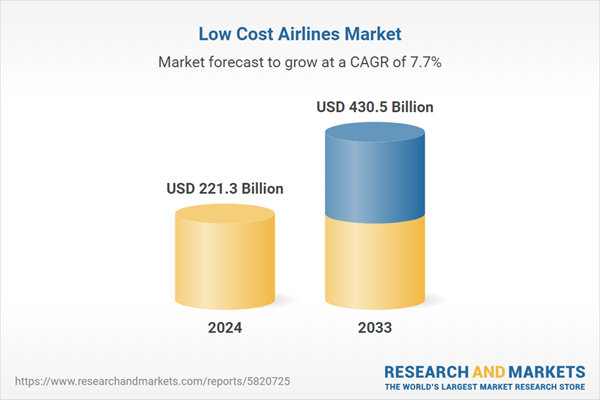

- What was the size of the global low cost airlines market in 2024?

- What is the expected growth rate of the global low cost airlines market during 2025-2033?

- What has been the impact of COVID-19 on the global low cost airlines market?

- What are the key factors driving the global low cost airlines market?

- What is the breakup of the global low cost airlines market based on the purpose?

- What is the breakup of the global low cost airlines market based on the destination?

- What are the key regions in the global low cost airlines market?

- Who are the key players/companies in the global low cost airlines market?

Table of Contents

Companies Mentioned

- Air Arabia PJSC

- Alaska Airlines Inc.

- Capital A Berhad (Tune Group Sdn Bhd)

- easyJet plc

- Go Airlines (Wadia Group)

- IndiGo

- Jetstar Airways Pty Ltd (Qantas Airways Limited)

- Norwegian Air Shuttle ASA

- Ryanair Holdings PLC

- Southwest Airlines Co.

- SpiceJet Limited

- Spirit Airlines Inc.

- WestJet Airlines Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 221.3 Billion |

| Forecasted Market Value ( USD | $ 430.5 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |