Healthcare facilities management (HFM) refers to the coordination and organization of the healthcare environment to ensure efficiency, safety, and optimal functioning. It encompasses hard and soft services, such as mechanical and electrical necessities, cleaning, security, and administrative tasks. Healthcare facilities management is widely used for equipment maintenance, space planning, energy management, waste disposal, security measures, patient comfort, regulatory compliance, infection control, asset management, and risk mitigation. It aids in reducing costs, improving efficiency, enhancing patient experience, maintaining compliance, increasing safety, optimizing resource use, promoting environmental sustainability, and streamlining operations.

The rising adoption of healthcare facilities management owing to the increasing focus on reducing operational costs without compromising quality is propelling the market growth. Furthermore, the growing management demand to ensure that patients have a positive experience through well-maintained, clean, and comfortable surroundings is positively influencing the market growth. Along with this, the increasing emphasis on environmental sustainability is facilitating the demand for healthcare facilities management as it aids in implementing energy-saving measures, reducing waste, and employing eco-friendly materials and processes. Besides this, the emerging trends of outsourcing, which allow healthcare providers to focus on core medical tasks and ensure that facilities are managed proficiently, are contributing to the market growth. Other factors, including rising investment in healthcare infrastructure, increasing focus on hygiene and infection control, and shifting trend towards integrated service delivery, are anticipated to drive the market growth.

Healthcare Facilities Management Market Trends/Drivers:

The rising demand for healthcare

The escalating demand for healthcare owing to the rising geriatric population, coupled with a growing number of patients seeking medical care, is propelling the market growth. In line with this, healthcare facilities management aids in efficiently managing medical care systems and ensuring all resources are utilized proficiently without any wastage. Furthermore, the widespread prevalence of chronic conditions, such as heart disease, diabetes, cancer, obesity, neurological disorders, and respiratory problems, which require specialized and robust healthcare facilities, is acting as another growth-inducing factor. In addition, the growing demand for an optimal healing environment among patients and healthcare providers is facilitating the adoption of healthcare facilities management, as it provides an array of specialized services that cater to the unique needs of healthcare systems and different patient demographics.Rapid technological advancements

The integration of technology within healthcare facilities management, such as the Internet of Things (IoT), automation, and artificial intelligence (AI), is revolutionizing the way services are delivered. These technologies allow predictive maintenance of critical medical equipment, intelligent energy management, and enhanced security protocols, which enables more precise, timely, and cost-effective facilities management. Furthermore, the emerging trends of digitalization, which provide real-time insights into facility performance, and assist in proactive measures to prevent potential issues, are supporting the market growth. In addition, the utilization of IoT devices to monitor everything from temperature and humidity to patient flow within a facility, thus allowing administrators to make data-driven decisions, is acting as another growth-inducing factor. Moreover, these innovative technologies offer capabilities to ensure that the physical environment of healthcare institutions meets the needs of patients and healthcare professionals.The increasing regulatory compliance

Healthcare is a highly regulated sector, with stringent laws and standards governing every aspect of patient care, including the facilities in which care is provided. Healthcare providers adhere to a complex web of regulations that cover aspects such as safety, accessibility, hygiene, and environmental sustainability. In line with this, professional healthcare facilities management plays a pivotal part in ensuring that healthcare institutions comply with these regulations. It aids in maintaining the infrastructure, managing waste, controlling infections, and ensuring the overall safety and functionality of the facility. Furthermore, healthcare facilities management also assists healthcare professionals in navigating the ever-changing regulatory landscape. As a result, adherence to compliance not only mitigates legal risks but enhances the quality of care, thus affirming the importance of facilities management in the healthcare sector.Healthcare Facilities Management Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global healthcare facilities management market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type, business model, and end user.Breakup by Service Type:

- Property Services

- Cleaning Services

- Security Services

- Catering Services

- Support Services

- Environmental Management Services

Support services dominate the market

The report has provided a detailed breakup and analysis of the market based on the service type. This includes property services, cleaning services, security services, catering services, support services, and environmental management services. According to the report, support services represented the largest segment.Support services are dominating the market as it includes cleaning, catering, security, and administrative support that are essential to the daily operations of any healthcare institution. Furthermore, they aid in enhancing patient satisfaction and experience by ensuring optimal comfort and convenience through timely management of food and beverage (F&B), housekeeping, and concierge services. Apart from this, support services handle cleaning and waste management, which plays a crucial role in maintaining a sanitary environment and improving patient health and safety. Moreover, outsourcing support services allows healthcare providers to focus on their core competencies and achieve operational efficiency without the need to manage non-medical tasks in-house. In addition, these services ensure that healthcare facilities comply with various regulations regarding hygiene, safety, and environmental standards.

Breakup by Business Model:

- Outsourced

- In-House

Outsourced hold the largest share in the market

A detailed breakup and analysis of the market based on the business model has also been provided in the report. This includes outsourced and in-house. According to the report, outsourced accounted for the largest market share.The outsourced business model is dominating the market as it allows healthcare providers to concentrate on their core competencies by entrusting non-core tasks, such as facilities management. In addition, outsourcing provides access to expert services without the associated overhead costs of hiring, training, and maintaining an internal team. It also allows healthcare providers to pay for services as needed, thus contributing to overall cost savings. Furthermore, outsourcing offers immediate access to experienced professionals with specialized skills in healthcare facilities management. These experts are well-versed in current best practices, regulations, and technologies, which aids in ensuring high-quality service. Apart from this, outsourced providers have extensive knowledge of the complex regulatory landscape in healthcare. As a result, they can manage compliance with these regulations more effectively, thus mitigating potential legal and financial risks.

Breakup by End User:

- Hospitals and Clinics

- Long-term Healthcare Facilities

- Others

Hospitals and clinics comprise multifaceted environments that encompass various departments, specialized equipment, and diverse patient needs. Managing such complexity requires professional facilities management to ensure smooth operations. Furthermore, these establishments serve a high volume of patients daily, thus necessitating continuous maintenance and management of spaces to ensure safety, hygiene, and comfort. Moreover, hospitals and clinics are subject to stringent regulatory guidelines concerning patient care, safety, and environmental standards, which require adept facilities management to navigate the intricate legal landscape.

Long-term healthcare facilities are witnessing considerable growth due to the escalating geriatric population and increasing number of patients requiring long-term care. In line with this, healthcare facilities management aids in effectively managing all aspects of the facilities and ensuring the specific needs of various patient demographics are met. Additionally, long-term healthcare facilities cater to patients with varied and complex healthcare needs. The multifaceted nature of these requirements makes facilities management critical to provide personalized, continuous care in a safe and comfortable environment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest healthcare facilities management market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America has a well-established and advanced healthcare system comprising state-of-the-art hospitals and medical facilities that require sophisticated management and maintenance. Furthermore, the region's readiness to adopt new technologies, such as automation, IoT, and AI, which have enabled the integration of innovative solutions into facilities management, is positively influencing the market growth. In addition, the imposition of stringent standards and regulations by the regional governments dictating the quality and safety of healthcare facilities is propelling the market growth. Besides this, the escalating investment in healthcare by the public and private sectors to ensure efficient management of healthcare facilities is positively influencing the market growth. Moreover, the escalating geriatric population in the region, which requires specialized care and facilities, is contributing to the market growth.

Competitive Landscape:

The leading healthcare facilities management companies are developing innovative solutions, such as predictive maintenance tools, energy management systems, and digital platforms, to enhance efficiency and client satisfaction. Furthermore, they are engaging in mergers and acquisitions to increase their market penetration and strengthen their existing position. In addition, they are expanding their service offerings to cater to diverse healthcare needs, such as specialized infection control and patient-centric services. Apart from this, companies are aligning with global sustainability goals, implementing eco-friendly practices in waste management, energy conservation, and resource utilization to meet regulatory requirements and attract environmentally conscious clients. Moreover, several key players are offering comprehensive compliance management services to ensure that healthcare facilities adhere to all relevant laws and standards, thus reducing legal risks and enhancing reputation.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABM Industries Inc.

- Aramark Corporation

- Compass Group PLC

- Ecolab Inc.

- International Business Machines Corporation

- ISS A/S

- Jones Lang LaSalle Incorporated

- Mitie Group plc

- OCS Group limited.

- Oracle Corporation

- Serco Group plc

- Sodexo.

Key Questions Answered in This Report

1. How big is the healthcare facilities management market?2. What is the future outlook of the healthcare facilities management market?

3. What are the key factors driving the healthcare facilities management market?

4. Which region accounts for the largest healthcare facilities management market share?

5. Which are the leading companies in the global healthcare facilities management market?

Table of Contents

Companies Mentioned

- ABM Industries Inc.

- Aramark Corporation

- Compass Group PLC

- Ecolab Inc.

- International Business Machines Corporation

- ISS A/S

- Jones Lang LaSalle Incorporated

- Mitie Group plc

- OCS Group limited

- Oracle Corporation

- Serco Group plc

- Sodexo.

Table Information

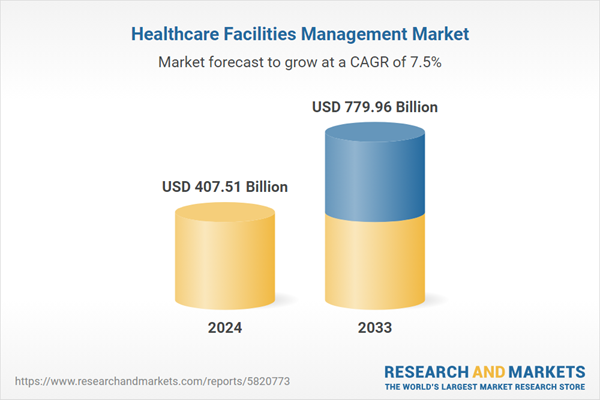

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 407.51 Billion |

| Forecasted Market Value ( USD | $ 779.96 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |