Connected Car Market Analysis:

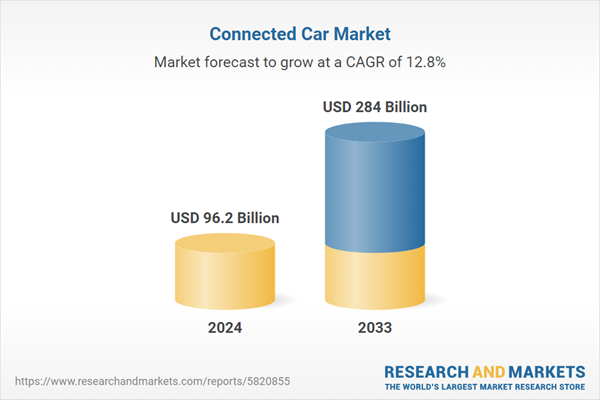

Market Growth and Size: The global connected car market is experiencing robust growth, driven by an increasing demand for advanced connectivity features in vehicles. The market size is expanding significantly as consumers prioritize safety, entertainment, and convenience services in their vehicles.Major Market Drivers: Key drivers include technological advancements such as 4G/LTE, 3G, and 5G connectivity, safety regulations, changing consumer preferences, and a focus on driver assistance and vehicle management services. Besides this, the evolving regulatory landscape, particularly in regions like Europe and North America, plays a crucial role in shaping market dynamics.

Technological Advancements: Continuous technological advancements, especially in connectivity technologies like 5G, are propelling the connected car market forward. These advancements facilitate real-time data exchange, over-the-air updates, and the integration of advanced driver assistance systems (ADAS), contributing to a safer and more connected driving experience.

Industry Applications: Connected car technologies find applications in diverse industry segments, including safety services, entertainment, vehicle management, and mobility management. These applications cater to both original equipment manufacturers (OEMs) and the aftermarket, addressing a wide range of consumer needs and preferences.

Key Market Trends: Key trends include the integration of entertainment services, smart mobility solutions, and embedded connectivity solutions in vehicles. Moreover, the market is also witnessing collaboration between traditional automotive manufacturers and technology companies, emphasizing the importance of partnerships in driving innovation.

Geographical Trends: Geographically, North America leads in the adoption of connected cars due to a tech-savvy consumer base and stringent safety regulations. Asia Pacific is rapidly growing, driven by urbanization and increasing disposable income. Europe benefits from supportive regulatory frameworks, while Latin America and the Middle East witness rising demand driven by infrastructure improvements.

Competitive Landscape: The competitive landscape is characterized by intense rivalry among established automotive manufacturers, tech giants, and telecommunications companies. Concurrent with this, startups specializing in specific connected car solutions contribute to innovation, resulting in a convergence of traditional and disruptive players.

Challenges and Opportunities: Challenges include addressing cybersecurity concerns, ensuring regulatory compliance, and meeting diverse consumer demands. Opportunities lie in continued technological innovation, strategic partnerships, and leveraging connectivity to create new and personalized in-car experiences. The market's evolution also presents opportunities for startups and companies focusing on niche solutions.

Connected Car Market Trends:

Significant advancements in connectivity technologies

The continuous evolution of connectivity technologies represents one of the key factors influencing the global connected car market. The shift from traditional standalone vehicles to interconnected smart cars is fueled by the integration of high-speed internet, 4G and 5G networks, and advanced communication protocols. These technologies enable seamless communication between vehicles and the broader transportation ecosystem, facilitating real-time data exchange. Connected cars leverage these advancements to provide a range of features, including real-time traffic updates, remote diagnostics, over-the-air software updates, and enhanced navigation systems. As these technologies mature, the connected car market is poised to expand further, offering a more immersive and safer driving experience.Rising emphasis on safety and security

Safety and security considerations are key factors strengthening the global connected car market. The integration of ADAS and vehicle-to-everything (V2X) communication plays a pivotal role in enhancing road safety. Connected cars leverage sensors, cameras, and communication modules to collect and transmit data about the vehicle's surroundings, potential hazards, and traffic conditions. This information is not only utilized by the vehicle itself to make informed decisions but is also shared with other connected vehicles and infrastructure, creating a collaborative safety ecosystem. Additionally, connected cars often feature robust cybersecurity measures to protect against potential cyber threats, ensuring the integrity and confidentiality of the data exchanged between vehicles and external systems.Evolving regulatory landscape

Governments and regulatory bodies worldwide are actively contributing to the growth of the connected car market through the formulation and implementation of supportive policies. In line with this, the introduction of stringent regulations mandating the inclusion of certain safety features and connectivity capabilities in new vehicles, such as the European Union's eCall regulation requiring all new cars to be equipped with an emergency call system, is bolstering the market growth. Such regulations drive the adoption of connected car technologies and create a standardized framework that fosters interoperability and compatibility among different vehicles and infrastructure components, providing an impetus to the market growth.Changing consumer preferences and expectations

The rising consumer demand for a more connected, personalized, and convenient driving experience is acting as another significant growth-inducing factor. Connected cars cater to these changing preferences by offering features such as in-car infotainment systems, voice-controlled assistants, and integration with smartphones and smart home devices. The ability to remotely control and monitor various aspects of the vehicle, from climate settings to vehicle diagnostics, resonates well with modern consumers seeking enhanced convenience and control, aiding in market expansion. Furthermore, the concept of connected mobility, which includes services like ride-sharing, predictive maintenance, and automated parking, is gaining traction as consumers become more tech-savvy and accustomed to the conveniences offered by connectivity, which is propelling the market forward.Connected Car Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global connected car market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, connectivity solution, service, and end market.Breakup by Technology:

- 3G

- 4G/LTE

- 5G

4G/LTE accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 3G, 4G/LTE, and 5G. According to the report, 4G/LTE represented the largest segment.Breakup by Connectivity Solutions:

- Integrated

- Embedded

- Tethered

Integrated holds the largest share in the industry

A detailed breakup and analysis of the market based on the connectivity solution have also been provided in the report. This includes integrated, embedded, and tethered. According to the report, integrated accounted for the largest market share.Breakup by Service:

- Driver Assistance

- Safety

- Entertainment

- Vehicle Management

- Mobility Management

- Others

Driver assistance represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the service. This includes driver assistance, safety, entertainment, vehicle management, mobility management, and others. According to the report, driver assistance represented the largest segment.Breakup by End Market:

- Original Equipment Manufacturer (OEMs)

- Aftermarket

Original equipment manufacturer (OEMs) exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end market have also been provided in the report. This includes original equipment manufacturer (OEMs) and aftermarket. According to the report, original equipment manufacturer (OEMs) accounted for the largest market share.Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest connected car market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AT&T Inc.

- Audi AG (Volkswagen AG)

- Bayerische Motoren Werke AG

- Continental AG

- Ford Motor Company

- Mercedes-Benz Group AG

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sierra Wireless

- Tesla Inc.

- TomTom N.V.

- Valeo

- Verizon Communications Inc.

- Vodafone Group Plc

Key Questions Answered in This Report

1. How big is the connected car market?2. What is the future outlook of connected car market?

3. What are the key factors driving the connected car market?

4. Which region accounts for the largest connected car market share?

5. Which are the leading companies in the global connected car market?

Table of Contents

Companies Mentioned

- AT&T Inc.

- Audi AG (Volkswagen AG)

- Bayerische Motoren Werke AG

- Continental AG

- Ford Motor Company

- Mercedes-Benz Group AG

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sierra Wireless

- Tesla Inc.

- TomTom N.V.

- Valeo

- Verizon Communications Inc.

- Vodafone Group Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 96.2 Billion |

| Forecasted Market Value ( USD | $ 284 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |