Hemoglobinopathies are a group of genetic disorders that affect the hemoglobin molecule, which is crucial for the proper function of red blood cells in carrying oxygen throughout the body. These disorders can be categorized mainly into two types: thalassemias and abnormal hemoglobin variants, such as sickle cell anemia. Thalassemias result from mutations that reduce the production of one of the globin chains that make up hemoglobin, leading to an imbalance and subsequent anemia. On the other hand, conditions such as sickle cell anemia are caused by mutations that lead to abnormal shapes or functions of the hemoglobin molecule itself. The abnormal shapes can cause red blood cells to become rigid, making it difficult for them to travel through small blood vessels, thereby affecting oxygen distribution. They are often inherited and can result in symptoms ranging from mild to severe, including fatigue, weakness, and in extreme cases, organ damage.

The growing public awareness majorly drives the global market. Organizations focused on hemoglobinopathies are increasingly effective at lobbying for policy changes, funding, and improved patient care. They are also crucial in educating the public, thereby increasing early diagnosis and treatment. As healthcare systems become more robust and accessible, the capability to diagnose and treat specialized conditions, such as hemoglobinopathies also increases. New clinics and hospitals are being equipped with advanced diagnostic technologies, thereby reaching a larger patient population. Along with this, strategic collaborations and partnerships among pharmaceutical companies, healthcare providers, and research institutions are also driving the growth of the hemoglobinopathies industry. In addition, the growing emphasis on personalized medicine is another factor that impacts the hemoglobinopathies market positively. Personalized medicine involves tailoring medical treatment to individual patient characteristics. The shift toward personalized medicine is influencing the demand for specialized diagnostic tests and treatments, further driving market growth. Moreover, the implementation of regulatory support and favorable reimbursement policies is creating a positive market outlook.

Hemoglobinopathies Market Trends/Drivers:

Increasing prevalence of hemoglobin disorders

One of the most significant drivers propelling the hemoglobinopathies industry is the rising prevalence of hemoglobin disorders such as sickle cell anemia, thalassemias, and other rare variants. These disorders are prevalent in specific ethnic groups and geographical regions, but due to global migration patterns, they are increasingly found in a more widespread population. Countries with historically low incidence rates are now reporting more cases, necessitating improved healthcare infrastructure to manage these conditions. As awareness grows and diagnosis rates increase, there is a corresponding rise in demand for specialized treatments, diagnostics, and management plans. Additionally, more healthcare providers are being trained to recognize and treat hemoglobinopathies, further facilitating market growth. All these factors contribute to increased needs for medication, diagnostics equipment, genetic testing kits, and specialized healthcare services tailored for hemoglobinopathies, thereby driving the industry's growth.Technological advancements in diagnosis and treatment

Another significant driver for the hemoglobinopathies industry is the technological advancements in both diagnostic methods and treatments. Earlier diagnosis through newborn screenings and sophisticated diagnostic tools including High-Performance Liquid Chromatography (HPLC) and molecular techniques have led to better management of the condition. Along with this, advancements in treatment methods, including gene therapy, CRISPR technology, and improved drug formulations, are also paving the way for more effective management of hemoglobin disorders. These innovations not only enhance patient outcomes but also provide an impetus for market players to invest in research and development. As the technology evolves, we can anticipate more accurate, quicker diagnostic tools and potentially curative therapies, driving greater demand and expansion in the industry.Government Initiatives and Funding

Governmental efforts are also significant market drivers for the hemoglobinopathies industry. Various governments worldwide are increasingly acknowledging the public health impact of hemoglobin disorders and are setting up targeted programs to deal with them. In addition, funding for research, public awareness campaigns, and inclusion of hemoglobinopathy screening in national healthcare plans are examples of such initiatives. These steps not only increase the rate of diagnosis but also make treatments more accessible to a larger population. Special grants and financial support for pharmaceutical companies and research institutions for developing treatments are also available. Such initiatives and financial injections into the sector significantly bolster both demand and supply, facilitating market growth.Hemoglobinopathies Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on type, treatment, test type and end user.Breakup by Type:

- Thalassemia

- Alpha Thalassemia

- Beta Thalassemia

- Sickle Cell Disease

- Others

Sickle cell disease accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes thalassemia (alpha thalassemia and beta thalassemia), sickle cell disease, and others. According to the report, sickle cell disease represented the largest segment.The market for treating sickle cell disease (SCD), a type of hemoglobinopathy, is experiencing robust growth due to the rising incidence and awareness of SCD, particularly in African, Middle Eastern, and South Asian populations. Additionally, advancements in diagnostic techniques, including high-performance liquid chromatography (HPLC) and genetic screening are enabling earlier and more accurate detection, increasing the demand for targeted treatments. In addition, government initiatives have also played a pivotal role by incorporating SCD screenings in national healthcare plans and providing funding for research. In addition, the emergence of innovative treatment options such as gene therapies and CRISPR technology offer potential curative solutions, attracting significant investment in the sector. Furthermore, positive regulatory frameworks and reimbursement policies make treatments more accessible, thereby expanding the market.

Breakup by Treatment:

- Blood Transfusion

- Stem-cell Transplantation

- Analgesics

- Antibiotics

- ACE Inhibitors

- Hydroxyurea

- Others

The demand for blood transfusion treatment in the hemoglobinopathies industry is primarily driven by its essential role in managing severe cases of disorders, such as thalassemia and sickle cell disease. Along with this, the increasing prevalence of these conditions amplifies the need for regular transfusions, thereby fueling market growth. In addition, technological advancements in blood screening and storage have also contributed to safer and more efficient transfusion processes. Governmental initiatives, such as organized blood donation campaigns and reimbursement policies, make this treatment more accessible and cost-effective for patients. In addition, the growing interest in stem-cell transplantation as a potentially curative treatment for hemoglobinopathies, including thalassemia and sickle cell disease is a notable market driver. Moreover, technological advancements have made these procedures safer and more effective, drawing increased investment and research focus. Governmental backing in the form of grants and regulatory approval fast-tracks also bolster this sector.

On the other hand, the growing awareness and advocacy for advanced treatment options have led to higher demand for stem-cell transplantation, further propelling market growth in the hemoglobinopathies industry. Apart from this, the demand for analgesics in the hemoglobinopathies industry is driven by chronic pain. Increasing awareness and diagnosis rates further provide a boost to this market segment. The need for antibiotics in the hemoglobinopathies industry is driven by frequent bacterial infections in patients, thereby stimulating the demand for effective treatment options. Furthermore, the market for ACE inhibitors in the hemoglobinopathies industry is propelled by their role in managing kidney complications in patients.

Breakup by Test Type:

- Red Blood Cell (RBC) Count

- Genetic Testing

- High Performance Liquid Chromatography (HPLC)

- Hemoglobin Isoelectric Focusing (Hb IEF)

- Hemoglobin Electrophoresis (Hb ELP)

- Hemoglobin Solubility Test

In the hemoglobinopathies industry, the market drivers for the red blood cell (RBC) count test type are significant. Hemoglobinopathies, including conditions, such as sickle cell anemia and thalassemia, necessitate frequent monitoring of RBC counts to assess disease severity and treatment efficacy. As awareness of these disorders grows, so does the demand for accurate diagnostic tools. Moreover, advancements in healthcare technology have led to more accessible and cost-effective RBC count testing methods. The combination of increased disease awareness and improved diagnostic capabilities positions the RBC count test as a critical component of the hemoglobinopathies industry, driving its market growth. Along with this, genetic testing is a key market driver in the hemoglobinopathies industry, enabling precise disease identification and personalized treatment strategies, and fostering growth and innovation.

On the other hand, high-performance liquid chromatography (HPLC) is a crucial driver in the hemoglobinopathies industry, providing precise hemoglobin analysis, enhancing diagnostics, and fostering industry advancement. Apart from this, hemoglobin isoelectric focusing (Hb IEF) plays a pivotal role in the hemoglobinopathies industry by offering precise hemoglobin analysis, driving diagnostic accuracy, and industry growth. In confluence with this, hemoglobin electrophoresis (Hb ELP) is a cornerstone in the hemoglobinopathies industry, providing precise hemoglobin analysis, driving diagnostic accuracy, and fostering industry growth. Furthermore, hemoglobin solubility testing is a critical driver in the hemoglobinopathies industry, offering efficient diagnosis and aiding in disease management, contributing to industry growth.

Breakup by End User:

- Hospitals and Clinics

- Diagnostics Laboratories

- Others

Diagnostics laboratories serve as a pivotal end user in the hemoglobinopathies industry, driving growth due to their central role in disease diagnosis and management. In addition, the increasing prevalence of hemoglobinopathies worldwide necessitates a higher volume of diagnostic tests, including hemoglobin analysis and genetic testing. Furthermore, ongoing research and development efforts focus on enhancing the accuracy and efficiency of diagnostic tools, further elevating the significance of diagnostics laboratories. Their expertise and technology contribute significantly to advancing our understanding of hemoglobin disorders and tailoring treatment approaches, solidifying their status as key market drivers in this industry.

On the contrary, hospitals and clinics represent crucial end users in the hemoglobinopathies industry, actively driving growth and advancement. These healthcare facilities are frontline providers of care to individuals affected by hemoglobin disorders. The growing awareness of these conditions, coupled with an increasing patient population, leads to a higher demand for diagnostic tests, genetic counseling, and specialized treatments. Hospitals and clinics play a pivotal role in providing comprehensive care, driving the need for improved diagnostic tools and therapeutic interventions. Their prominence as end users reinforces their impact as significant market drivers in the hemoglobinopathies industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest hemoglobinopathies market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America stands as a dynamic and influential region in the hemoglobinopathies industry, driven by the region's commitment to healthcare excellence and rigorous standards. It fuels the demand for cutting-edge diagnostic tools and therapeutic interventions. The prevalence of hemoglobin disorders, particularly sickle cell disease, within diverse populations, including African Americans and Hispanic communities, places North America at the forefront of research, diagnosis, and treatment.

Additionally, the region's robust research and development ecosystem, consisting of academic institutions, pharmaceutical companies, and biotechnology firms, fosters innovation in hemoglobinopathy diagnostics and therapies. This research-driven environment continually introduces novel diagnostic methods and treatment modalities, stimulating market growth. Furthermore, advocacy efforts and government initiatives aimed at improving healthcare access for individuals with hemoglobinopathies amplify the demand for diagnostic testing and specialized care. These initiatives include newborn screening programs and policies supporting early diagnosis and intervention.

Competitive Landscape:

The key players are investing heavily in research and development to discover new diagnostic tests, therapies, and treatment modalities. They aim to enhance the accuracy of diagnostic tools and develop innovative treatments that can improve the quality of life for individuals with hemoglobin disorders. Along with this, companies are continually developing and improving diagnostic tests for hemoglobinopathies, including advancements in techniques, such as genetic testing, high-performance liquid chromatography (HPLC), hemoglobin electrophoresis (Hb ELP), and hemoglobin isoelectric focusing (Hb IEF) is positively influencing the market. In addition, pharmaceutical companies in the hemoglobinopathies market work on the development of new therapies, including gene therapies, gene editing technologies (e.g., CRISPR), and small molecule drugs, which act as another growth-inducing factor. Furthermore, the widespread adoption of cutting-edge technologies, such as artificial intelligence and machine learning, for data analysis and improving diagnostic accuracy is contributing to the market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bio-Rad Laboratories Inc.

- bluebird bio Inc.

- Bristol-Myers Squibb Company

- Danaher Corporation

- Emmaus Life Sciences Inc.

- Gamida-Cell Ltd.

- Global Blood Therapeutics Inc.

- Novartis AG

- PerkinElmer Inc.

- Pfizer Inc.

- Prolong Pharmaceuticals LLC

- Sangamo Therapeutics Inc.

- Sysmex Corporation

Key Questions Answered in This Report

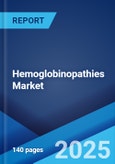

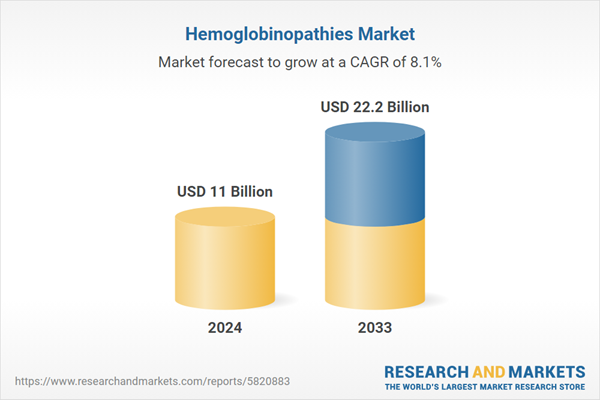

1. What was the size of the global hemoglobinopathies market in 2024?2. What is the expected growth rate of the global hemoglobinopathies market during 2025-2033?

3. What has been the impact of COVID-19 on the global hemoglobinopathies market?

4. What are the key factors driving the global hemoglobinopathies market?

5. What is the breakup of the global hemoglobinopathies market based on the type?

6. What is the breakup of the global hemoglobinopathies market based on the treatment?

7. What are the key regions in the global hemoglobinopathies market?

8. Who are the key players/companies in the global hemoglobinopathies market?

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories Inc.

- bluebird bio Inc.

- Bristol-Myers Squibb Company

- Danaher Corporation

- Emmaus Life Sciences Inc.

- Gamida-Cell Ltd.

- Global Blood Therapeutics Inc.

- Novartis AG

- PerkinElmer Inc.

- Pfizer Inc.

- Prolong Pharmaceuticals LLC

- Sangamo Therapeutics Inc. and Sysmex Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 22.2 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |