Mobile Imaging Services Market Analysis:

Market Growth and Size: The market is witnessing moderate growth, which can be attributed to the increasing demand for telemedicine and remote diagnostic services. In addition, aging population and the need for quick and accessible healthcare services are contributing to the market growth.Technological Advancements: Innovations, including portable and high-resolution imaging devices, are improving the efficiency and quality of mobile imaging services. The integration of artificial intelligence (AI) for image analysis and interpretation is further enhancing diagnostic accuracy.

Industry Applications: Mobile imaging services find applications in healthcare activities, veterinary medicine, industrial inspection, and environmental monitoring.

Geographical Trends: North America leads the market, on account of the presence of advanced healthcare infrastructure. However, Asia Pacific is emerging as a fast-growing market, driven by the expanding healthcare infrastructure and increasing healthcare awareness.

Competitive Landscape: Key players in the market are actively engaged in several strategic initiatives. They are innovating their mobile imaging equipment and technology, focusing on enhancing image quality, portability, and ease of use.

Challenges and Opportunities: While the market faces challenges, such as data security and privacy concerns, it also encounters opportunities in expanding services to underserved regions and developing cost-effective solutions for emerging markets.

Future Outlook: The future of the mobile imaging services market looks promising, with advancements in technology and the increasing need for remote healthcare services. Moreover, key players are expanding into emerging markets and diversifying service offerings, which is expected to propel the market growth.

Mobile Imaging Services Market Trends:

Expansion of preventive and wellness services

The increasing focus on preventive healthcare and wellness programs is catalyzing the demand for mobile imaging services. Mobile imaging services play a crucial role in early detection and risk assessment, allowing individuals to monitor their health proactively. Many people are opting for preventive health check-ups and screenings to identify potential health issues before they become serious. Mobile imaging services provide a convenient and accessible way to perform these screenings at workplaces, community centers, or at home. They also offer breast cancer screenings in remote or underserved areas, promoting early detection and reducing mortality rates. Additionally, employers and insurance providers are incorporating preventive health programs that include mobile imaging services as part of their benefits packages, encouraging individuals to take charge of their health.Increasing demand for telemedicine

The growing demand for telemedicine services, especially in remote or underserved areas, is offering a favorable market outlook. Telemedicine relies on mobile imaging to provide remote diagnosis, consultations, and monitoring of patients. The convenience and accessibility of mobile imaging services are becoming essential in delivering healthcare to individuals who may not have easy access to traditional medical facilities. Furthermore, the adoption of telemedicine is increasing the need for mobile imaging solutions to support remote healthcare delivery. As telemedicine is expanding and becoming a mainstream healthcare option, there is a rise in the demand for mobile imaging services, with a focus on enhancing the quality and accessibility of healthcare services worldwide.Aging population and rising chronic illnesses

The aging population worldwide is supporting the growth of the market. As people are aging, there is an increase in the prevalence of chronic illnesses and conditions that require regular medical imaging for diagnosis, monitoring, and treatment planning. Mobile imaging services play a crucial role in delivering healthcare to elderly patients who may have limited mobility or difficulty accessing traditional medical facilities. Moreover, the aging demographic often requires ongoing and frequent medical evaluations, making the convenience of mobile imaging services invaluable. This trend is further fueled by the increasing incidence of chronic diseases, such as cardiovascular conditions, cancer, and diabetes. These conditions often necessitate frequent imaging procedures for disease management and early detection.Technological advancements in imaging devices

Continuous advancements in mobile imaging technology are bolstering the growth of the market. Mobile imaging devices are becoming more compact, portable, and sophisticated, enabling healthcare providers to offer high-quality diagnostic services outside of traditional clinical settings. These technological improvements include the development of handheld ultrasound devices, portable X-ray machines, and mobile MRI units. Besides this, the integration of artificial intelligence (AI) into mobile imaging devices is positively influencing the market. AI-driven image analysis and interpretation enhance the speed and accuracy of diagnosis, making mobile imaging services more valuable. These technological innovations not only improve the quality of patient care but also enable healthcare providers to perform a wider range of imaging procedures on-site.Mobile Imaging Services Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. The report categorizes the market based on product type, patient type and end user.Breakup by Product Type:

- X-Ray

- CT

- Ultrasound

- MRI

- Mammography

- Nuclear Imaging

- Others

X-ray accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes X-ray, CT, ultrasound, MRI, mammography, nuclear imaging, and others. According to the report, X-ray represented the largest segment due to its versatility and wide range of applications. It is commonly used for diagnosing bone fractures, chest conditions, and dental issues. It is highly portable, making it suitable for emergency medical situations, nursing homes, and remote locations. The ability of X-ray to quickly capture images makes it invaluable for trauma and critical care scenarios.CT mobile imaging services offer detailed cross-sectional images of the body, making them ideal for diagnosing a wide range of medical conditions, including cancers, vascular diseases, and trauma-related injuries. Mobile CT units are equipped with advanced technology, allowing for rapid scans and precise imaging. They are often used in hospitals, clinics, and during surgeries to guide interventions.

Ultrasound mobile imaging services are non-invasive and widely used for examining organs, pregnancies, and soft tissues. These services are known for their safety and effectiveness in monitoring fetal development and diagnosing various medical conditions. Mobile ultrasound units are commonly utilized in obstetrics and gynecology clinics, as well as in remote or rural healthcare settings.

MRI mobile imaging services provide detailed images of soft tissues and are crucial for diagnosing neurological, musculoskeletal, and abdominal conditions. Mobile MRI units are less common due to their size and complexity but are used in larger medical facilities and hospitals where there is a need for comprehensive imaging capabilities.

Mammography mobile imaging services focus on breast cancer screening and early detection. These services are often deployed in mobile mammography units to reach underserved populations and provide women with accessible breast health screenings. Mammography remains a critical tool in the healthcare of women and breast cancer prevention.

Nuclear imaging mobile services use radioactive tracers to visualize the function of organs and tissues. They are particularly valuable in cardiology, oncology, and neurology for diagnosing and monitoring diseases. Mobile nuclear imaging units are used in hospitals and specialized medical centers for various diagnostic and therapeutic purposes.

Breakup by Patient Type:

- Adult

- Pediatrics

Adult holds the largest share in the industry

A detailed breakup and analysis of the market based on the patient type have also been provided in the report. This includes adult and pediatrics. According to the report, adult accounted for the largest market share.Adult mobile imaging services encompass a wide range of medical imaging modalities, such as X-ray, CT, MRI, and ultrasound, to address various health conditions prevalent in adult patients. Common applications include the detection and monitoring of cardiovascular diseases, cancer, musculoskeletal disorders, and neurological conditions. They are often provided in hospitals, clinics, and mobile units that can travel to healthcare facilities, workplaces, and community centers to serve the adult demographic.

Pediatrics mobile imaging services are tailored specifically to meet the unique diagnostic requirements of pediatric patients, including infants, children, and adolescents. These services use child-friendly equipment and imaging protocols to minimize radiation exposure and ensure the comfort of young patients. Common applications include assessing developmental milestones, diagnosing congenital conditions, and monitoring childhood illnesses.

Breakup by End User:

- Hospitals and Clinics

- Home Healthcare

- Others

Hospitals and clinics represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, home healthcare, and others. According to the report, hospitals and clinics represented the largest segment as these facilities rely on mobile imaging services to augment their diagnostic capabilities and improve patient care. Mobile units equipped with various imaging modalities, such as X-ray, CT, MRI, and ultrasound, are deployed within hospital campuses and outpatient clinics. They are essential for emergency cases, surgeries, inpatient care, and outpatient diagnostics. Hospitals and clinics benefit from the convenience and versatility of mobile imaging services, which allow them to serve a broader patient base and reduce the need for patient transfers to off-site imaging centers.Home healthcare is an emerging segment in the mobile imaging services market, providing diagnostic imaging services directly to patients in the comfort of their homes. These services are particularly valuable for individuals with mobility challenges, elderly patients, and those requiring long-term care. Home healthcare mobile imaging units offer portable X-ray, ultrasound, and other imaging modalities, enabling healthcare professionals to perform assessments, monitor chronic conditions, and provide timely diagnostics without requiring patients to travel to medical facilities.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest mobile imaging services market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share, driven by the presence of advanced healthcare infrastructure, high healthcare expenditure, and a rising demand for innovative medical technologies. The United States and Canada have well-established mobile imaging service providers that serve a wide range of healthcare institutions. The aging population and emphasis on early disease detection are contributing significantly to the growth of the market in North America.The Asia Pacific region is experiencing rapid growth in the market, due to the expanding healthcare infrastructure, increasing healthcare awareness, and rising prevalence of chronic diseases. Countries like China, India, and Japan are witnessing substantial investments in healthcare, making mobile imaging services more accessible to a larger population.

Europe has a well-developed market, benefiting from a strong healthcare system and technological advancements in medical imaging. The aging population and need for efficient diagnostic solutions contribute to the steady growth of the market. Countries in Europe are prioritizing preventive healthcare, which is further catalyzing the demand for diagnostic imaging services.

Latin America is experiencing growth in the market due to improving healthcare infrastructure and increasing healthcare spending. Mobile imaging services are crucial for reaching underserved populations in remote and rural areas, where access to traditional medical facilities may be limited.

The Middle East and Africa are emerging markets for mobile imaging services, propelled by efforts to enhance healthcare access and improve diagnostic capabilities. The growing investments in healthcare infrastructure and the expansion of healthcare facilities in urban and rural areas are key factors contributing to the market growth.

Leading Key Players in the Mobile Imaging Services Industry:

Key players in the market are actively engaged in several strategic initiatives. They are innovating their mobile imaging equipment and technology, focusing on enhancing image quality, portability, and ease of use. These companies are also investing in artificial intelligence (AI) and machine learning (ML) for automated image analysis and interpretation, enabling faster and more accurate diagnoses. Additionally, they are expanding their service offerings by partnering with healthcare institutions and facilities to provide a broader range of mobile imaging solutions, including X-ray, CT, MRI, ultrasound, and mammography. These efforts are meeting the evolving needs of the healthcare industry and ensuring that mobile imaging remains a vital component of modern healthcare delivery.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accurate Imaging Diagnostics

- Atlantic Medical Imaging

- DMS Health Technologies Inc.

- Front Range Mobile Imaging Inc.

- InHealth Group

- Interim Diagnostic Imaging LLC

- Nuffield Health

- RadNet Inc.

- Shared Medical Services

- TridentCare LLC

Key Questions Answered in This Report

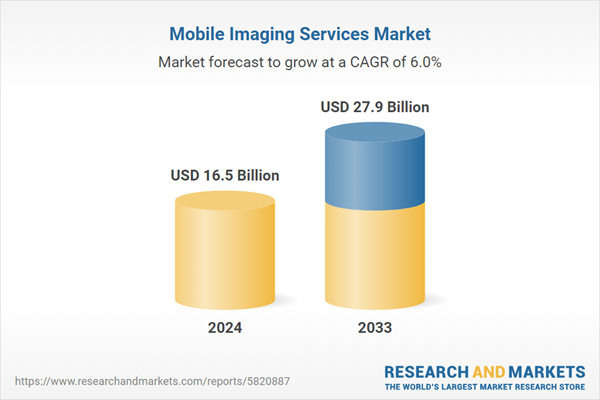

1. What was the size of the global mobile imaging services market in 2024?2. What is the expected growth rate of the global mobile imaging services market during 2025-2033?

3. What are the key factors driving the global mobile imaging services market?

4. What has been the impact of COVID-19 on the global mobile imaging services market?

5. What is the breakup of the global mobile imaging services market based on the product type?

6. What is the breakup of the global mobile imaging services market based on the patient type?

7. What is the breakup of the global mobile imaging services market based on the end user?

8. What are the key regions in the global mobile imaging services market?

9. Who are the key players/companies in the global mobile imaging services market?

Table of Contents

Companies Mentioned

- Accurate Imaging Diagnostics

- Atlantic Medical Imaging

- DMS Health Technologies Inc.

- Front Range Mobile Imaging Inc.

- InHealth Group

- Interim Diagnostic Imaging LLC

- Nuffield Health

- RadNet Inc.

- Shared Medical Services

- TridentCare LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 16.5 Billion |

| Forecasted Market Value ( USD | $ 27.9 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |