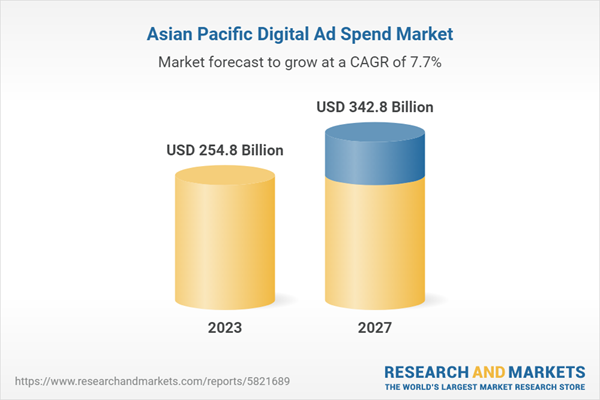

Medium to long term growth story of Digital Advertising Spend in Asia Pacific remains medium. Digital Advertising Spend adoption is expected to grow steadily over the forecast period, recording a CAGR of 7.7% during 2023-2027. The Digital Advertising Spend Value in the country will increase from US$236,201.6 million in 2022 to reach US$342,775.6 million by 2027.

The online ad spending industry has been recording strong growth over the last few years. The global pandemic outbreak drove marketing dollars to digital channels, including platforms like TikTok, in the Asia Pacific region. The emergence of new-age startups has also aided the growth of the online ad spending industry, as firms are seeking to tap into their potential customers by engaging with them on social channels.

The trend is projected to further continue over the next five years, and as a result, the publisher maintains a robust growth outlook for the sector across the Asia Pacific region. However, in 2023, the publisher expects the industry to record muted growth, owing to the macroeconomic environment and the funding winter faced by new-age startups. In Asia Pacific, India and China are expected to lead the market growth going forward.

The majority of the ad spending will shift to online channels in China over the next five years

China is one of the leading online ad spending markets in the Asia Pacific region, and the domestic market is projected to record further over the next five years, as the majority of the marketing dollars will be spent on digital channels. ByteDance and Meituan are expected to attract a large chunk of marketing dollars, taking away market share from firms like Alibaba and Tencent.Over the last few years, ByteDance-owned TikTok has grown into significant popularity worldwide, and not just in China. The rising adoption of the social platform has resulted in stiff competition for players like Google and Meta, who have long dominated the online ad spending industry globally. Alongside TikTok and Meituan, on-demand streaming platforms are also expected to record strong growth in online ad revenue in China over the next three to four years.

In 2023, the easing market conditions and business recovery cycle are also expected to aid the industry growth, as consumer demand improves gradually after the pandemic-led decline in 2021 and 2022.

Southeast Asian markets recorded strong growth in digital ad spending in 2022

Across the Southeast Asian region, including in markets like Indonesia, Singapore, Malaysia, and Thailand, internet access and smartphone penetration has been increased significantly over the last few years. This had resulted in higher digital ad spending from brands and businesses that are seeking to meet their potential customers on online channels such as Social Media and on-demand streaming platforms.- According to a report from Nielsen, digital ad spending has increased across different Southeast Asian markets. In Indonesia, the spending increased by 5.02% to reach US$19.2 billion in 2022. In the Philippines, the spending reported a growth of 3.87% to reach US$18.8 billion during the same period. Thailand, Singapore, and Malaysia reported a growth of 9.12%, 10.17%, and 8.05%, respectively.

Google and Facebook are expected to face stiff competition from domestic firms in India

Both Google and Facebook have long enjoyed a duopoly in the Indian online ad spending market. During the pandemic outbreak, the two firms recorded strong growth as more and more Indians were found spending increased time on the platforms. As a result, a higher amount of marketing dollars was queued up on YouTube, Instagram, and Facebook.In 2023, though, Google and Facebook are expected to face stiff competition from domestic firms in India. Flipkart and JioCinema, for instance, are attracting a large chunk of the population and marketers are taking note of it. With JioCinema being the digital host of the Indian Premier League, the on-demand sports streaming platform is expected to generate significant revenue in the digital advertisement in 2023. JioCinema is also streaming the biggest sporting league in India for free to its viewers.

This means that the reach will be wider, and therefore, the platform is expected to be a lucrative bet for digital advertisers. Alongside domestic firms, foreign players like Amazon are also expected to take the competition to Google and Facebook in India in 2023.

This regional report provides a detailed analysis of Digital Ad Spend (Digital Ad Spend) industry at global and country level, covering market opportunities and risks across a range of retail categories. With over 75 KPIs at country level, this report provides a comprehensive understanding of Digital Ad Spend market dynamics, market size and forecast, and market share statistics.

It breaks down market opportunity by type of business model, sales channels (offline and online), and distribution models. In addition, it provides a snapshot of consumer behaviour and retail spend dynamics. KPIs in both value and volume term help in getting in-depth understanding of end market dynamics.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view on emerging business and investment market opportunities.

This title is a bundled offering, combining the following 16 reports (855 tables and 1005 figures):

1. Asia Pacific Digital Ad Spend Insight, Brief

2. Asia Pacific Digital Ad Spend Business and Investment Opportunities (2019-2028) Databook

3. Australia Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

4. China Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

5. India Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

6. Indonesia Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

7. Japan Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

8. Malaysia Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

9. Philippines Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

10. Singapore Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

11. Thailand Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

12. Vietnam Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

13. Bangladesh Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

14. Taiwan Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

15. New Zealand Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

16. South Korea Digital Ad Spend Business and Investment Opportunities (2018-2028) Databook

Scope

Country reports in this bundled offering provide in-depth analysis of Digital Ad Spend industry. Below is a summary of key market segments offered at country level:This title is a bundled offering, combining the following 47 reports, covering 2679 tables and 3149 figures:

Asia Pacific Digital Ad Spend Market Size and Forecast 2018-2028

Asia Pacific Digital Ad Spend Market Size by Advertising Channel 2018-2028

- Television Advertising

- Print Advertising

- Radio Advertising

- Outdoor Advertising

- Online Advertising

- Direct Mail Advertising

- Event Sponsorship

- Others

Asia Pacific Digital Ad Spend Market Size by Online Ad Spend Market 2018-2028

- Search Engine Sites

- Ecommerce Sites

- News & Media Sites

- Social Media

- Gaming Platforms

- Forums & Classifieds

- Others

Asia Pacific Digital Ad Spend Market Size by Social Media Platform 2018-2028

- Line

- Tik Tok

- Others

Asia Pacific Digital Ad Spend Market Size by Gaming Platforms 2018-2028

- Around Games Environment Ad Spend

- In Game Environment Ad Spend

- In Game Immersive Ad Spend

- Exclusive Advertising Games Spend

Asia Pacific Digital Ad Spend Market Size by Format & Media 2018-2028

- Video

- Display

- Influencer Marketing

- Blogging and Podcasting

Asia Pacific Digital Ad Spend Market Size by Platform 2018-2028

- Mobile

- Desktop and Laptop

Asia Pacific Digital Ad Spend Market Size by Pricing Model 2018-2028

- Cost Per Mile (CPM)

- Cost Per Click (CPC)

- Performance-Based Advertising

- Others

Asia Pacific Digital Ad Spend Market Size by Marketing Objective 2018-2028

- Branding

- Increase Traffic

- Direct Online Sales

- Lead Generation

- Product Launch

Asia Pacific Digital Ad Spend Market Size by Industry 2018-2028

- Technology

- Increase Travel & Hospitality

- FMCG

- Automotive

- Media & Entertainment

- Telecommunications

- Retail & Consumer Goods

- Business and Financial Services

- Pharmaceutical and Healthcare

- Public Sector

- Construction and Real Estate

- Education

- Home Appliances and Furniture

- Other Industries

Reasons to buy

- Get a comprehensive understanding of market dynamics for Digital Ad Spend: Identify market opportunities, major trends, and forecasting (2018-2028). Understand market trends through crucial KPIs like Gross Merchandise Value, Volume, and Average Value per Transaction, to stay ahead of the curve.

- Insights by end-use sectors: Evaluate new opportunities across multiple end-use sectors, and obtain market dynamics by end-use sectors in order to swiftly catch up with the latest and upcoming developments in Digital Ad Spend markets.

- Market-specific strategies: Identify growth segments focused on specific opportunities, and analysing market-specific risks and important trends in the Digital Ad Spend sector with our exclusive blend of quantitative forecasting and innovative insights.

- Gain knowledge of consumer attitudes and actions: This report identifies and interprets important Digital Ad Spend KPIs, such as spend by age, gender, and income level, using data from a proprietary survey.

- Develop proactive and lucrative business strategies through market intelligence and forward-looking analysis of Digital Ad Spend market spend and major opportunities in Asia Pacific.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 1215 |

| Published | May 2023 |

| Forecast Period | 2023 - 2027 |

| Estimated Market Value ( USD | $ 254.8 Billion |

| Forecasted Market Value ( USD | $ 342.8 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Asia Pacific |