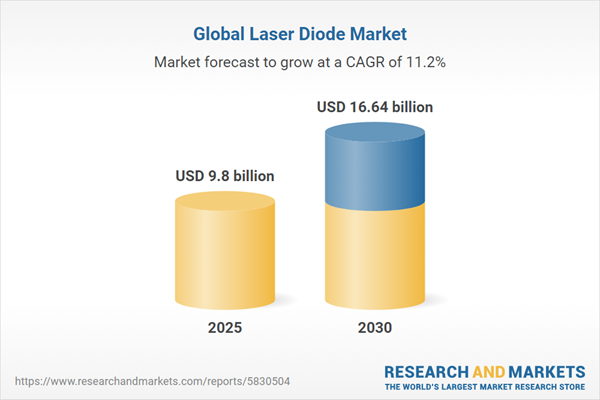

The global laser diode market is experiencing robust growth driven by increasing demand across consumer electronics, healthcare, automotive, and industrial manufacturing sectors. Laser diodes, semiconductor devices that produce coherent and directional light via stimulated emission, are valued for their compact size, energy efficiency, and versatility. This summary outlines key growth drivers and market segmentation trends, focusing on current dynamics and applications as of 2025.

Market Growth Drivers

Demand from End-User Industries

The telecommunication, medical, and industrial sectors are fueling laser diode market expansion due to the devices' lightweight design, low power consumption, and small volume. Telecommunications relies on laser diodes for high-speed data transmission, while industrial applications leverage their precision for manufacturing processes. The medical sector increasingly adopts laser diodes for their non-invasive and precise capabilities, driving innovation and market growth.Automotive Industry Expansion

The automotive sector, particularly the rise of autonomous and electric vehicles, significantly contributes to market growth. Laser diodes are integral to LIDAR and radar systems, enabling 3D mapping, GPS navigation, and sensor-based distance measurement for self-driving cars. The global surge in electric vehicle production amplifies the need for these systems, boosting laser diode adoption.Medical Applications

Laser diodes are critical in medical devices, supporting applications such as surgery, dermatology, and ophthalmology due to their precision and non-invasive nature. They are employed in procedures like skin rejuvenation, hair removal, and vascular lesion treatment, as well as advanced diagnostic techniques such as optical coherence tomography (OCT) and laser-induced breakdown spectroscopy (LIBS). The growing reliance on these technologies in healthcare continues to drive market demand.Regional Growth in North America

North America is poised to maintain a significant market share, propelled by the defense, aerospace, medical, and consumer electronics industries. The U.S. Department of Defense's substantial investments in laser-based systems, including directed energy weapons, underscore the region's demand for advanced laser diode technologies. Additionally, the increasing integration of laser diodes in medical devices and consumer electronics further strengthens North America's market position.Market Segmentation Analysis

The laser diode market is segmented by application and end-user industry, with notable growth in telecommunications, healthcare, automotive, and industrial sectors. The development of innovative laser diode designs, such as multi-chip modules and advanced epitaxy techniques, enhances performance and reliability, catering to diverse industry needs. Manufacturers are focusing on technological advancements to meet the demand for high-power, efficient, and bright laser light sources.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Global Laser Diodes Market Segmentation

By Type

- VCSEL Diode

- Quantum Well Laser Diode

- Quantum Cascade Laser Diode

- Distributed Feedback Laser Diode

- Others

By Material

- Gallium Nitride (GaN)

- Gallium Arsenide (GaAs)

- Aluminum Gallium Indium Phosphide (AIGaInP)

- Indigium Gallium Nitride (InGaN)

- Others

By Wavelength

- Up to 500 nm

- 500 to 700 nm

- 700 to 1,000 nm

- Greater than 1,000 nm

By End-User

- Automotive

- Aerospace & Defense

- Healthcare

- Electronics

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Coherent Inc.

- Cutting Edge Optronics Inc. (Northrop Grumman Corporation)

- IPG Photonics Corporation

- ams-OSRAM AG

- Trumpf SE + Co. KG

- Sharp Corporation (Hon Hai Precision Industry)

- Sumitomo Electric Industries, Ltd.

- ROHM Co. Ltd

- Frankfurt Laser Company

- OSI Laser Diode Inc.

- Ushio Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 9.8 billion |

| Forecasted Market Value ( USD | $ 16.64 billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |