This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

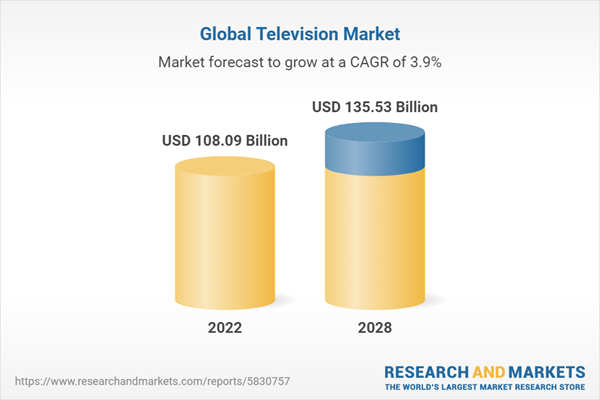

According to the research report, Global Television market Outlook, 2028 the market is anticipated to across USD 135.53 Billion market size by 2028, increasing from USD 108.09 Billion in 2022. The market is projected to grow with 3.92% CAGR by 2023-28. Streaming services have established themselves as dominant participants in the content consumption environment. As more people choose online streaming platforms like Netflix, Amazon Prime Video, and Disney+, traditional cable and satellite subscriptions are declining. Televisions are being developed to integrate seamlessly with streaming platforms, with specific buttons and interfaces for easy access to popular streaming services. In addition, televisions are increasingly serving as central hubs in smart homes, interacting with other IoT devices and smart home systems. Users may use their TVs to manage and monitor numerous connected gadgets thanks to this integration. Users, for example, can use their television interfaces or voice commands to control lighting, thermostats, security cameras, and other smart devices. Furthermore, voice control and smart assistants are rapidly being integrated into televisions, allowing consumers to use voice commands to operate their TVs, search for content, alter settings, and access other smart home devices. Voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri are being integrated into televisions to provide a hands-free and convenient user experience. Furthermore, in the television market, sustainability has become a significant factor. Manufacturers are putting eco-friendly elements into their televisions, including energy-efficient panels, power-saving modes, and recyclable materials.

The Asia-Pacific region is rapidly urbanising, with an increasing number of people migrating from rural to urban areas. This tendency towards urbanisation, along with economic progress, has resulted in the increase of the middle class in countries such as China, India, Indonesia, and Vietnam. The growing middle-class population has increased purchasing power and disposable income, fueling television demand. Furthermore, as the region's wages improve, customers devote a higher percentage of their budgets to entertainment and leisure activities. Televisions are essential components of home entertainment, allowing access to a diverse selection of content and immersive viewing experiences. The Asia-Pacific market's increased emphasis on leisure and entertainment spending has fueled demand for televisions. Furthermore, the Asia-Pacific area has seen a considerable increase in the use of smart TVs and streaming services. Consumers are embracing smart region that provide internet access, streaming capabilities, and a multitude of online entertainment alternatives as high-speed internet connectivity becomes more widely available. The popularity of streaming services such as Netflix, Amazon Prime Video, and local providers has fueled the region's demand for smart TVs. Furthermore, sports events, particularly cricket and football, have a huge fan base in the Asia-Pacific region. Major competitions such as the ICC Cricket World Cup and the FIFA World Cup draw large crowds. As a result, to improve their viewing experiences, people frequently upgrade their televisions to larger displays and higher picture quality. Live sports broadcasts, as well as news and entertainment programming, contribute to the expansion of the television market.

Based on screen type, the market is segmented into full HD TV,HD TV, 4K UHD TV,8K TV, Among them the 4K UHD TV screen is significantly dominating the market of Television globally. 4K UHD TVs offer four times the resolution of Full HD TVs, with a resolution of 3840 x 2160 pixels. This results in incredibly sharp and detailed images, making the viewing experience more immersive and enjoyable. Consumers are increasingly seeking better picture quality, and 4K resolution delivers on that front. Over time, the cost of manufacturing 4K UHD TVs has significantly decreased, making them more affordable and accessible to a wider range of consumers. As prices have become more competitive, the value proposition of 4K TVs has improved, leading to increased adoption. Furthermore, The advancements in display technology, such as High Dynamic Range (HDR) and wider color gamuts, have further enhanced the visual quality of 4K UHD TVs. HDR provides greater contrast and a wider range of colors, resulting in more lifelike and vibrant images. These advancements have played a significant role in attracting consumers to 4K TVs. In addition, with the rise of streaming services like Netflix, Amazon Prime Video, and Disney+, there is now a vast library of 4K content available to consumers. This includes movies, TV shows, documentaries, and sports events specifically produced and optimized for 4K UHD resolution. The availability of content has been a crucial factor in the adoption of 4K TVs.

Based on the screen size, the market includes, below 32 inches, 32-45 inches, 46-55 inches, 56-65 inches, and 65+ inches. Among them the market is significantly dominated by 46-55 inches of screen. Screen sizes within the range of 46-55 inches provide a balanced viewing experience for most consumers. They offer a large enough display to enjoy immersive content without being overwhelming or requiring excessive viewing distances. This size range strikes a good balance between screen real estate and practicality for a typical living room or entertainment setup. Within the television market, there is often a correlation between screen size and price. While larger screen sizes may offer a more immersive experience, they also tend to come with a higher price tag. The 46-55 inches range strikes a balance between an enjoyable viewing experience and affordability for a broader consumer base. Manufacturers typically produce a wide variety of TV models in the 46-55 inches size range due to its popularity. This range benefits from a healthy competition among brands, resulting in a diverse selection of features, technologies, and price points. Consumers can choose from a range of options that suit their preferences, budget, and specific needs within this size category. Content producers and broadcasters often optimize their programming for the most common screen sizes in the market, which includes the 46-55 inches range. When content is specifically designed and calibrated for these screen sizes, it ensures a visually pleasing and well-optimized viewing experience for the majority of consumers.

Companies mentioned in the report:

Samsung Electronics Co., Ltd, LG Corporation, TCL Technology Group Corporation, Sony Corporation, Panasonic Corporation, Hisense Group, Skyworth Group Co., Ltd., Vizio Inc., Xiaomi Corporation, Toshiba Corporation, Koninklijke Philips N.V., Apple Inc., Insignia Products, Sceptre Inc, Sharp Corporation, Micromax Informatics, JVCKenwood Corporation, OnePlus Technology (Shenzhen) Co., Ltd, Westinghouse Electric Corporation, Mirc Electronics Ltd.Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Television market with its value and forecast along with its segments

- Region-wise Television market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

By Screen Type:

- Full HD TV

- HD TV

- 4K UHD TV

- 8K TV

By Screen Size:

- BELOW 32 INCHES

- 32-45 INCHES

- 46-55 INCHES

- 56-65 INCHES

- 65+ INCHES

By Distribution Channel

- Multibranded Stores

- Supermarket

- Brand Stores & Others

- Online

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third party sources such as press releases, annual report of companies, analysing the government generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to Television industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | June 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 108.09 Billion |

| Forecasted Market Value ( USD | $ 135.53 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |