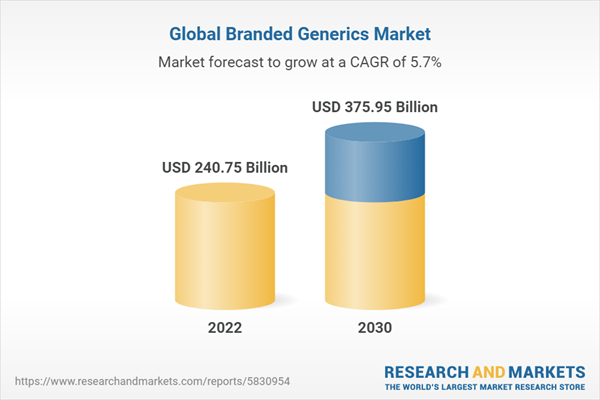

The global branded generics market size is expected to reach USD 375.95 Billion by 2030, registering a CAGR of 5.7% over the forecast period. Factors such as patent expiry of major products, the rising prevalence of chronic diseases, high penetration of generic products, and government initiatives to promote them for reducing the overall healthcare expenditure are among the primary growth drivers.

The patent expiry of branded products primarily fuels industry growth. Drugs, such as Revlimid and Alimta, may cost up to USD 500 a month, which affects the overall healthcare expenditure and affordability for patients suffering from chronic diseases. Eli Lilly & Company’s Alimta is expected to lose its patent protection by May 2022. This expiry of product patents creates opportunities for generics and biosimilar manufacturers.

However, over the past few years, the trend of ANDA approvals for generic drugs had been steadily decreased. It can be observed that the number of ANDA approvals decreased from 1,014 in 2019 to 948 in 2020 and further declined to 776 in 2021. Such factors could slow down industry growth in the coming years.

The growing burden of infectious & non-infectious diseases, coupled with the rising geriatric population, which is more susceptible to chronic diseases such as diabetes, hypertension, and obesity, is expected to positively impact the industry growth. According to an NCBI article, there were 537 million patients suffering from diabetes in 2021 globally.

The COVID-19 pandemic moderately impacted the branded generics space. Due to lockdown situations and stringent government regulations to curb the pandemic, a slowdown and disruption in the supply of pharmaceuticals had been observed in the initial phase of the pandemic. In addition, regulatory operations also affected reimbursement decisions and approvals of new products in the space. However, the market regained its pace by the end of 2020 in most countries.

Companies are introducing novel products to strengthen their product portfolio. In March 2022, Viatris, Inc. received the U. S. FDA’s approval for Breyna, the first generic version of AstraZeneca's Symbicort, intended for the treatment of COPD. Moreover, in February 2019, Mylan N. V. introduced the first generic version of ADVAIR DISKUS (fluticasone propionate and salmeterol inhalation powder) under the brand Wixela Inhub for the treatment of patients with Chronic Obstructive Pulmonary Disease (COPD) or asthma. This branded generic was claimed to be 70% cheaper than the originator product.

The patent expiry of branded products primarily fuels industry growth. Drugs, such as Revlimid and Alimta, may cost up to USD 500 a month, which affects the overall healthcare expenditure and affordability for patients suffering from chronic diseases. Eli Lilly & Company’s Alimta is expected to lose its patent protection by May 2022. This expiry of product patents creates opportunities for generics and biosimilar manufacturers.

However, over the past few years, the trend of ANDA approvals for generic drugs had been steadily decreased. It can be observed that the number of ANDA approvals decreased from 1,014 in 2019 to 948 in 2020 and further declined to 776 in 2021. Such factors could slow down industry growth in the coming years.

The growing burden of infectious & non-infectious diseases, coupled with the rising geriatric population, which is more susceptible to chronic diseases such as diabetes, hypertension, and obesity, is expected to positively impact the industry growth. According to an NCBI article, there were 537 million patients suffering from diabetes in 2021 globally.

The COVID-19 pandemic moderately impacted the branded generics space. Due to lockdown situations and stringent government regulations to curb the pandemic, a slowdown and disruption in the supply of pharmaceuticals had been observed in the initial phase of the pandemic. In addition, regulatory operations also affected reimbursement decisions and approvals of new products in the space. However, the market regained its pace by the end of 2020 in most countries.

Companies are introducing novel products to strengthen their product portfolio. In March 2022, Viatris, Inc. received the U. S. FDA’s approval for Breyna, the first generic version of AstraZeneca's Symbicort, intended for the treatment of COPD. Moreover, in February 2019, Mylan N. V. introduced the first generic version of ADVAIR DISKUS (fluticasone propionate and salmeterol inhalation powder) under the brand Wixela Inhub for the treatment of patients with Chronic Obstructive Pulmonary Disease (COPD) or asthma. This branded generic was claimed to be 70% cheaper than the originator product.

Branded Generics Market Report Highlights

- The anti-hypertensive drug class segment contributed to a significant revenue share of 15.67% in 2022, due to factors such as increasing demand owing to the rising burden of cardiovascular diseases and the growing penetration of generic products

- The oral segment accounted for the largest revenue share of 59.3% in 2022, due to several advantages of oral dosage such as the ease of administration and no nursing requirements, leading to higher patient acceptability and compliance

- The retail pharmacy distribution channel dominated the market at 58.6% in 2022 owing to factors such as the growing presence of retail pharmacy chains and tie-ups of these chains with established hospitals

- Asia Pacific is expected to grow at the highest CAGR during the forecast period, mainly due to the presence of key players, high prescription rate & preference for branded generics, increasing prevalence of chronic diseases, and growing geriatric population

Table of Contents

Chapter 1 Methodology and Scope

1.1 Market Segmentation

1.1.1 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.3.6 List Of Primary Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country - wise market estimation using bottom - up approach

1.7 Global Market: CAGR Calculation

1.8 Research Assumptions

1.9 List of Secondary Sources

1.10 List of Abbreviations

1.11 Objectives

1.11.1 Objective 1

1.11.2 Objective 2

1.11.3 Objective 3

1.11.4 Objective 4

1.1.1 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.3.6 List Of Primary Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country - wise market estimation using bottom - up approach

1.7 Global Market: CAGR Calculation

1.8 Research Assumptions

1.9 List of Secondary Sources

1.10 List of Abbreviations

1.11 Objectives

1.11.1 Objective 1

1.11.2 Objective 2

1.11.3 Objective 3

1.11.4 Objective 4

Chapter 2 Executive Summary

2.1 Market Summary

Chapter 3 Market Variables, Trends, & Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Regulatory Landscape

3.3 Branded Generics Market Dynamics

3.3.1 Market Driver Analysis

3.3.2 Market Restraint Analysis

3.4 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

3.5 Porter’s Five Forces Analysis

3.6 User Perspective Analysis

3.2 Regulatory Landscape

3.3 Branded Generics Market Dynamics

3.3.1 Market Driver Analysis

3.3.2 Market Restraint Analysis

3.4 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

3.5 Porter’s Five Forces Analysis

3.6 User Perspective Analysis

Chapter 4 Branded Generics Market - Segment Analysis, By Drug Class, 2018 - 2030 (USD Billion)

4.1 Branded Generics Market: Drug Class Movement Analysis

4.2 Alkylating Agents

4.2.1 Alkylating Agents Market Estimates and Forecast, 2018 - 2030 (USD Billion)

4.3 Antimetabolites

4.3.1 Antimetabolites Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4 Hormones

4.4.1 Hormones Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5 Anti - Hypertensive

4.5.1 Anti - Hypertensive Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.6 Lipid Lowering Drugs

4.6.1 Lipid Lowering Drugs Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.7 Antidepressants

4.7.1 Antidepressants Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.8 Antipsychotics

4.8.1 Anti - Psychotics Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.9 Antiepileptics

4.9.1 AntiEpileptics Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.10 Others

4.10.1 Others Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.2 Alkylating Agents

4.2.1 Alkylating Agents Market Estimates and Forecast, 2018 - 2030 (USD Billion)

4.3 Antimetabolites

4.3.1 Antimetabolites Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4 Hormones

4.4.1 Hormones Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5 Anti - Hypertensive

4.5.1 Anti - Hypertensive Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.6 Lipid Lowering Drugs

4.6.1 Lipid Lowering Drugs Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.7 Antidepressants

4.7.1 Antidepressants Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.8 Antipsychotics

4.8.1 Anti - Psychotics Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.9 Antiepileptics

4.9.1 AntiEpileptics Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.10 Others

4.10.1 Others Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5 Branded Generics Market - Segment Analysis, By Application, 2018 - 2030 (USD Billion)

5.1 Branded Generics Market: Application Movement Analysis

5.2 Oncology

5.2.1 Oncology Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.3 Cardiovascular Diseases

5.3.1 Cardiovascular Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.4 Neurological Diseases

5.4.1 Neurological Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.5 Acute & Chronic Pain

5.5.1 Acute & Chronic Pain Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.6 Gastrointestinal Diseases

5.6.1 Gastrointestinal Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.7 Dermatological Diseases

5.7.1 Dermatological Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.2 Oncology

5.2.1 Oncology Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.3 Cardiovascular Diseases

5.3.1 Cardiovascular Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.4 Neurological Diseases

5.4.1 Neurological Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.5 Acute & Chronic Pain

5.5.1 Acute & Chronic Pain Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.6 Gastrointestinal Diseases

5.6.1 Gastrointestinal Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.7 Dermatological Diseases

5.7.1 Dermatological Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 6 Branded Generics Market - Segment Analysis, By Route of Administration, 2018 - 2030 (USD Billion)

6.1 Branded Generics Market: Route of Administration Movement Analysis

6.2 Topical

6.2.1 Topical Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.3 Oral

6.3.1 Oral Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.4 Parenteral

6.4.1 Parenteral Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.5 Others

6.5.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.2 Topical

6.2.1 Topical Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.3 Oral

6.3.1 Oral Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.4 Parenteral

6.4.1 Parenteral Market Estimates and Forecast, 2018 - 2030 (USD Billion)

6.5 Others

6.5.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 7 Branded Generics Market - Segment Analysis, By Distribution Channel, 2018 - 2030 (USD Billion)

7.1 Branded Generics Market: Distribution Channel Movement Analysis

7.2 Hospital Pharmacy

7.2.1 Hospital Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.3 Retail Pharmacy

7.3.1 Retail Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.4 Online Pharmacy

7.4.1 Online Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.2 Hospital Pharmacy

7.2.1 Hospital Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.3 Retail Pharmacy

7.3.1 Retail Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.4 Online Pharmacy

7.4.1 Online Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 8 Branded Generics Market - Segment Analysis, By Region, 2018 - 2030 (USD Billion)

8.1 Branded Generics Market, Market Share by Region, 2022 & 2030

8.2 Branded Generics Market: Regional Outlook

8.3 North America

8.2.1 North America Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 U.S. Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.2.2.3 Target Disease Prevalence

8.2.2.5 Competitive Scenario

8.2.2.6 Regulatory Framework

8.2.2.7 Reimbursement Scenario

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Canada Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.2.3.3 Target Disease Prevalence

8.2.3.4 Competitive Scenario

8.2.3.5 Regulatory Framework

8.2.3.6 Reimbursement Scenario

8.3 Europe

8.3.1 Europe Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.3.2 U.K.

8.3.2.1 Key Country Dynamics

8.3.2.2 U.K. Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.2.3 Target Disease Prevalence

8.3.2.4 Competitive Scenario

8.3.2.5 Regulatory Framework

8.3.2.6 Reimbursement Scenario

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.2 Germany Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.3.3 Target Disease Prevalence

8.3.3.4 Competitive Scenario

8.3.3.5 Regulatory Framework

8.3.3.6 Reimbursement Scenario

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 France Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.4.3 Target Disease Prevalence

8.3.4.4 Competitive Scenario

8.3.4.5 Regulatory Framework

8.3.4.6 Reimbursement Scenario

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Italy Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.5.3 Target Disease Prevalence

8.3.5.4 Competitive Scenario

8.3.5.5 Regulatory Framework

8.3.5.6 Reimbursement Scenario

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Spain Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.6.3 Target Disease Prevalence

8.3.6.4 Competitive Scenario

8.3.6.5 Regulatory Framework

8.3.6.6 Reimbursement Scenario

8.3.7 Denmark

8.3.8.1 Key Country Dynamics

8.3.8.2 Denmark Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.3.8 Sweden

8.3.8.1 Key Country Dynamics

8.3.8.2 Sweden Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.3.9 Norway

8.3.8.1 Key Country Dynamics

8.3.8.2 Norway Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.4 Asia Pacific

8.4.1 Asia Pacific Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.4.2 JAPAN

8.4.2.1 Key Country Dynamics

8.4.2.2 Japan Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.2.3 Target Disease Prevalence

8.4.2.4 Competitive Scenario

8.4.2.5 Regulatory Framework

8.4.2.6 Reimbursement Scenario

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 China Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.3.3 Target Disease Prevalence

8.4.3.4 Competitive Scenario

8.4.3.5 Regulatory Framework

8.4.3.6 Reimbursement Scenario

8.4.4 india

8.4.4.1 Key Country Dynamics

8.4.4.2 India Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.4.3 Target Disease Prevalence

8.4.4.4 Competitive Scenario

8.4.4.5 Regulatory Framework

8.4.4.6 Reimbursement Scenario

8.4.5 Australia

8.4.5.1 Key Country Dynamics

8.4.5.2 Australia Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.5.3 Target Disease Prevalence

8.4.5.4 Competitive Scenario

8.4.5.5 Regulatory Framework

8.4.5.6 Reimbursement Scenario

8.4.6 South Korea

8.4.6.1 Key Country Dynamics

8.4.6.2 South Korea Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.6.3 Target Disease Prevalence

8.4.6.4 Competitive Scenario

8.4.6.5 Regulatory Framework

8.4.6.6 Reimbursement Scenario

8.4.7 Thailand

8.4.8.1 Key Country Dynamics

8.4.8.2 Thailand Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.8.3 Target Disease Prevalence

8.4.8.4 Competitive Scenario

8.4.8.5 Regulatory Framework

8.4.8.6 Reimbursement Scenario

8.5 Latin America

8.5.1 Latin America Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Brazil Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.2.3 Target Disease Prevalence

8.5.2.4 Competitive Scenario

8.5.2.5 Regulatory Framework

8.5.2.6 Reimbursement Scenario

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Mexico Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.3.3 Target Disease Prevalence

8.5.3.4 Competitive Scenario

8.5.3.5 Regulatory Framework

8.5.3.6 Reimbursement Scenario

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Argentina Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.4.3 Target Disease Prevalence

8.5.4.4 Competitive Scenario

8.5.4.5 Regulatory Framework

8.5.4.6 Reimbursement Scenario

8.6 Middle East and Africa

8.6.1 Middle East and Africa Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.6.1.1 Target Disease Prevalence

8.6.1.2 Competitive Scenario

8.6.1.3 Regulatory Framework

8.6.1.4 Reimbursement Scenario

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.2 South Africa Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.2.3 Target Disease Prevalence

8.6.2.4 Competitive Scenario

8.6.2.5 Regulatory Framework

8.6.2.6 Reimbursement Scenario

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Saudi Arabia Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.3.3 Target Disease Prevalence

8.6.3.4 Competitive Scenario

8.6.3.5 Regulatory Framework

8.6.3.6 Reimbursement Scenario

8.6.4 UAE

8.6.4.1 Key Country Dynamics

8.6.4.2 UAE Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.4.3 Target Disease Prevalence

8.6.4.4 Competitive Scenario

8.6.4.5 Regulatory Framework

8.6.4.6 Reimbursement Scenario

8.6.5 KUWAIT

8.6.5.1 Key Country Dynamics

8.6.5.2 Kuwait Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.5.3 Target Disease Prevalence

8.6.5.4 Competitive Scenario

8.6.5.5 Regulatory Framework

8.6.5.6 Reimbursement Scenario

8.2 Branded Generics Market: Regional Outlook

8.3 North America

8.2.1 North America Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 U.S. Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.2.2.3 Target Disease Prevalence

8.2.2.5 Competitive Scenario

8.2.2.6 Regulatory Framework

8.2.2.7 Reimbursement Scenario

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Canada Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.2.3.3 Target Disease Prevalence

8.2.3.4 Competitive Scenario

8.2.3.5 Regulatory Framework

8.2.3.6 Reimbursement Scenario

8.3 Europe

8.3.1 Europe Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.3.2 U.K.

8.3.2.1 Key Country Dynamics

8.3.2.2 U.K. Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.2.3 Target Disease Prevalence

8.3.2.4 Competitive Scenario

8.3.2.5 Regulatory Framework

8.3.2.6 Reimbursement Scenario

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.2 Germany Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.3.3 Target Disease Prevalence

8.3.3.4 Competitive Scenario

8.3.3.5 Regulatory Framework

8.3.3.6 Reimbursement Scenario

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 France Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.4.3 Target Disease Prevalence

8.3.4.4 Competitive Scenario

8.3.4.5 Regulatory Framework

8.3.4.6 Reimbursement Scenario

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Italy Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.5.3 Target Disease Prevalence

8.3.5.4 Competitive Scenario

8.3.5.5 Regulatory Framework

8.3.5.6 Reimbursement Scenario

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Spain Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.6.3 Target Disease Prevalence

8.3.6.4 Competitive Scenario

8.3.6.5 Regulatory Framework

8.3.6.6 Reimbursement Scenario

8.3.7 Denmark

8.3.8.1 Key Country Dynamics

8.3.8.2 Denmark Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.3.8 Sweden

8.3.8.1 Key Country Dynamics

8.3.8.2 Sweden Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.3.9 Norway

8.3.8.1 Key Country Dynamics

8.3.8.2 Norway Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.3.8.3 Target Disease Prevalence

8.3.8.4 Competitive Scenario

8.3.8.5 Regulatory Framework

8.3.8.6 Reimbursement Scenario

8.4 Asia Pacific

8.4.1 Asia Pacific Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.4.2 JAPAN

8.4.2.1 Key Country Dynamics

8.4.2.2 Japan Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.2.3 Target Disease Prevalence

8.4.2.4 Competitive Scenario

8.4.2.5 Regulatory Framework

8.4.2.6 Reimbursement Scenario

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 China Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.3.3 Target Disease Prevalence

8.4.3.4 Competitive Scenario

8.4.3.5 Regulatory Framework

8.4.3.6 Reimbursement Scenario

8.4.4 india

8.4.4.1 Key Country Dynamics

8.4.4.2 India Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.4.3 Target Disease Prevalence

8.4.4.4 Competitive Scenario

8.4.4.5 Regulatory Framework

8.4.4.6 Reimbursement Scenario

8.4.5 Australia

8.4.5.1 Key Country Dynamics

8.4.5.2 Australia Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.5.3 Target Disease Prevalence

8.4.5.4 Competitive Scenario

8.4.5.5 Regulatory Framework

8.4.5.6 Reimbursement Scenario

8.4.6 South Korea

8.4.6.1 Key Country Dynamics

8.4.6.2 South Korea Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.6.3 Target Disease Prevalence

8.4.6.4 Competitive Scenario

8.4.6.5 Regulatory Framework

8.4.6.6 Reimbursement Scenario

8.4.7 Thailand

8.4.8.1 Key Country Dynamics

8.4.8.2 Thailand Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.4.8.3 Target Disease Prevalence

8.4.8.4 Competitive Scenario

8.4.8.5 Regulatory Framework

8.4.8.6 Reimbursement Scenario

8.5 Latin America

8.5.1 Latin America Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Brazil Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.2.3 Target Disease Prevalence

8.5.2.4 Competitive Scenario

8.5.2.5 Regulatory Framework

8.5.2.6 Reimbursement Scenario

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Mexico Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.3.3 Target Disease Prevalence

8.5.3.4 Competitive Scenario

8.5.3.5 Regulatory Framework

8.5.3.6 Reimbursement Scenario

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Argentina Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.5.4.3 Target Disease Prevalence

8.5.4.4 Competitive Scenario

8.5.4.5 Regulatory Framework

8.5.4.6 Reimbursement Scenario

8.6 Middle East and Africa

8.6.1 Middle East and Africa Branded Generics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

8.6.1.1 Target Disease Prevalence

8.6.1.2 Competitive Scenario

8.6.1.3 Regulatory Framework

8.6.1.4 Reimbursement Scenario

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.2 South Africa Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.2.3 Target Disease Prevalence

8.6.2.4 Competitive Scenario

8.6.2.5 Regulatory Framework

8.6.2.6 Reimbursement Scenario

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Saudi Arabia Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.3.3 Target Disease Prevalence

8.6.3.4 Competitive Scenario

8.6.3.5 Regulatory Framework

8.6.3.6 Reimbursement Scenario

8.6.4 UAE

8.6.4.1 Key Country Dynamics

8.6.4.2 UAE Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.4.3 Target Disease Prevalence

8.6.4.4 Competitive Scenario

8.6.4.5 Regulatory Framework

8.6.4.6 Reimbursement Scenario

8.6.5 KUWAIT

8.6.5.1 Key Country Dynamics

8.6.5.2 Kuwait Branded Generics Market Estimates & Forecasts And Trend Analysis, 2018 - 2030 (USD Million)

8.6.5.3 Target Disease Prevalence

8.6.5.4 Competitive Scenario

8.6.5.5 Regulatory Framework

8.6.5.6 Reimbursement Scenario

Chapter 9 Branded Generics Market - Competitive Analysis

9.1 Company Categarization

9.2 Stragy Mapping

9.2.1 New Product Launch

9.2.2 Partnership

9.2.3 Acquisition

9.2.4 Collaboration

9.2.5 Funding

9.3 KEY Company Market Share Analysis, 2022

9.4 Company PROFILES

9.4.1 TEVA PHARMACEUTICAL INDUSTRIES LTD.

9.4.1.1 Company Overview

9.4.1.2 Financial Performance

9.4.1.3 Product Benchmarking

9.4.1.4 Strategic Initiatives

9.4.2 LUPIN

9.4.2.1 Company Overview

9.4.2.2 Financial Performance

9.4.2.3 Product Benchmarking

9.4.2.4 Strategic Initiatives

9.4.3 SANOFI

9.4.3.1 Company Overview

9.4.3.2 Financial Performance

9.4.3.3 Product Benchmarking

9.4.3.4 Strategic Initiatives

9.4.4 SUN PHARMACEUTICAL INDUSTRIES, LTD.

9.4.4.1 Company Overview

9.4.4.2 Financial Performance

9.4.4.3 Product Benchmarking

9.4.4.4 Strategic Initiatives

9.4.5 DR. REDDY’S LABORATORIES LTD.

9.4.5.1 Company Overview

9.4.5.2 Financial Performance

9.4.5.3 Product Benchmarking

9.4.5.4 Strategic Initiatives

9.4.6 ENDO INTERNATIONAL PLC

9.4.6.1 Company Overview

9.4.6.2 Financial Performance

9.4.6.3 Product Benchmarking

9.4.6.4 Strategic Initiatives

9.4.7 GLAXOSMITHKLINE PLC (GSK)

9.4.7.1 Company Overview

9.4.7.2 Financial Performance

9.4.7.3 Product Benchmarking

9.4.7.4 Strategic Initiatives

9.4.8 PFIZER, INC.

9.4.8.1 Company Overview

9.4.8.2 Financial Performance

9.4.8.3 Product Benchmarking

9.4.8.4 Strategic Initiatives

9.4.9 VIATRIS, INC.

9.4.9.1 Company Overview

9.4.9.2 Financial Performance

9.4.9.3 Product Benchmarking

9.4.9.4 Strategic Initiatives

9.4.10 APOTEX, INC.

9.4.10.1 Company Overview

9.4.10.2 Product Benchmarking

9.4.10.3 Strategic Initiatives

9.2 Stragy Mapping

9.2.1 New Product Launch

9.2.2 Partnership

9.2.3 Acquisition

9.2.4 Collaboration

9.2.5 Funding

9.3 KEY Company Market Share Analysis, 2022

9.4 Company PROFILES

9.4.1 TEVA PHARMACEUTICAL INDUSTRIES LTD.

9.4.1.1 Company Overview

9.4.1.2 Financial Performance

9.4.1.3 Product Benchmarking

9.4.1.4 Strategic Initiatives

9.4.2 LUPIN

9.4.2.1 Company Overview

9.4.2.2 Financial Performance

9.4.2.3 Product Benchmarking

9.4.2.4 Strategic Initiatives

9.4.3 SANOFI

9.4.3.1 Company Overview

9.4.3.2 Financial Performance

9.4.3.3 Product Benchmarking

9.4.3.4 Strategic Initiatives

9.4.4 SUN PHARMACEUTICAL INDUSTRIES, LTD.

9.4.4.1 Company Overview

9.4.4.2 Financial Performance

9.4.4.3 Product Benchmarking

9.4.4.4 Strategic Initiatives

9.4.5 DR. REDDY’S LABORATORIES LTD.

9.4.5.1 Company Overview

9.4.5.2 Financial Performance

9.4.5.3 Product Benchmarking

9.4.5.4 Strategic Initiatives

9.4.6 ENDO INTERNATIONAL PLC

9.4.6.1 Company Overview

9.4.6.2 Financial Performance

9.4.6.3 Product Benchmarking

9.4.6.4 Strategic Initiatives

9.4.7 GLAXOSMITHKLINE PLC (GSK)

9.4.7.1 Company Overview

9.4.7.2 Financial Performance

9.4.7.3 Product Benchmarking

9.4.7.4 Strategic Initiatives

9.4.8 PFIZER, INC.

9.4.8.1 Company Overview

9.4.8.2 Financial Performance

9.4.8.3 Product Benchmarking

9.4.8.4 Strategic Initiatives

9.4.9 VIATRIS, INC.

9.4.9.1 Company Overview

9.4.9.2 Financial Performance

9.4.9.3 Product Benchmarking

9.4.9.4 Strategic Initiatives

9.4.10 APOTEX, INC.

9.4.10.1 Company Overview

9.4.10.2 Product Benchmarking

9.4.10.3 Strategic Initiatives

List of Tables

Table 1 Global Branded Generics Market, By Region, 2018 - 2030 (USD Billion)

Table 2 Global Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 3 Global Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 4 Global Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 5 Global Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 6 North America Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 7 North America Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 8 North America Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 9 North America Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 10 North America Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 11 U.S. Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 12 U.S. Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 13 U.S. Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 14 U.S. Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 15 Canada Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 16 Canada Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 17 Canada Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 18 Canada Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 19 Europe Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 20 Europe Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 21 Europe Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 22 Europe Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 23 Europe Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 24 UK Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 25 UK Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 26 UK Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 27 UK Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 28 Germany Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 29 Germany Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 30 Germany Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 31 Germany Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 32 France Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 33 France Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 34 France Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 35 France Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 36 Italy Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 37 Italy Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 38 Italy Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 39 Italy Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 40 Spain Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 41 Spain Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 42 Spain Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 43 Spain Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 44 Denmark Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 45 Denmark Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 46 Denmark Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 47 Denmark Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 48 Sweden Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 49 Sweden Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 50 Sweden Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 51 Sweden Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 52 Norway Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 53 Norway Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 54 Norway Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 55 Norway Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 56 Asia Pacific Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 57 Asia Pacific Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 58 Asia Pacific Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 59 Asia Pacific Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 60 Asia Pacific Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 61 Japan Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 62 Japan Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 63 Japan Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 64 Japan Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 65 China Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 66 China Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 67 China Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 68 China Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 69 India Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 70 India Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 71 India Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 72 India Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 73 Australia Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 74 Australia Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 75 Australia Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 76 Australia Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 77 South Korea Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 78 South Korea Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 79 South Korea Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 80 South Korea Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 81 Thailand Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 82 Thailand Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 83 Thailand Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 84 Thailand Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 85 Latin America Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 86 Latin America Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 87 Latin America Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 88 Latin America Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 89 Latin America Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 90 Brazil Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 91 Brazil Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 92 Brazil Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 93 Brazil Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 94 Mexico Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 95 Mexico Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 96 Mexico Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 97 Mexico Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 98 Argentina Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 99 Argentina Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 100 Argentina Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 101 Argentina Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 102 Middle East & Africa Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 103 Middle East & Africa Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 104 Middle East & Africa Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 105 Middle East & Africa Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 106 Middle East & Africa Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 107 South Africa Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 108 South Africa Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 109 South Africa Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 110 South Africa Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 111 Saudi Arabia Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 112 Saudi Arabia Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 113 Saudi Arabia Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 114 Saudi Arabia Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 115 UAE Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 116 UAE Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 117 UAE Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 118 UAE Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 119 Kuwait Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 120 Kuwait Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 121 Kuwait Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 122 Kuwait Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 2 Global Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 3 Global Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 4 Global Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 5 Global Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 6 North America Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 7 North America Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 8 North America Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 9 North America Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 10 North America Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 11 U.S. Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 12 U.S. Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 13 U.S. Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 14 U.S. Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 15 Canada Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 16 Canada Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 17 Canada Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 18 Canada Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 19 Europe Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 20 Europe Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 21 Europe Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 22 Europe Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 23 Europe Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 24 UK Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 25 UK Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 26 UK Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 27 UK Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 28 Germany Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 29 Germany Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 30 Germany Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 31 Germany Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 32 France Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 33 France Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 34 France Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 35 France Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 36 Italy Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 37 Italy Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 38 Italy Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 39 Italy Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 40 Spain Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 41 Spain Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 42 Spain Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 43 Spain Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 44 Denmark Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 45 Denmark Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 46 Denmark Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 47 Denmark Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 48 Sweden Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 49 Sweden Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 50 Sweden Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 51 Sweden Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 52 Norway Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 53 Norway Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 54 Norway Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 55 Norway Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 56 Asia Pacific Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 57 Asia Pacific Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 58 Asia Pacific Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 59 Asia Pacific Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 60 Asia Pacific Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 61 Japan Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 62 Japan Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 63 Japan Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 64 Japan Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 65 China Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 66 China Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 67 China Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 68 China Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 69 India Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 70 India Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 71 India Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 72 India Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 73 Australia Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 74 Australia Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 75 Australia Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 76 Australia Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 77 South Korea Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 78 South Korea Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 79 South Korea Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 80 South Korea Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 81 Thailand Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 82 Thailand Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 83 Thailand Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 84 Thailand Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 85 Latin America Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 86 Latin America Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 87 Latin America Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 88 Latin America Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 89 Latin America Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 90 Brazil Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 91 Brazil Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 92 Brazil Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 93 Brazil Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 94 Mexico Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 95 Mexico Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 96 Mexico Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 97 Mexico Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 98 Argentina Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 99 Argentina Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 100 Argentina Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 101 Argentina Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 102 Middle East & Africa Branded Generics Market, By Country, 2018 - 2030 (USD Billion)

Table 103 Middle East & Africa Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 104 Middle East & Africa Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 105 Middle East & Africa Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 106 Middle East & Africa Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 107 South Africa Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 108 South Africa Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 109 South Africa Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 110 South Africa Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 111 Saudi Arabia Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 112 Saudi Arabia Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 113 Saudi Arabia Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 114 Saudi Arabia Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 115 UAE Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 116 UAE Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 117 UAE Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 118 UAE Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 119 Kuwait Branded Generics Market, By Drug Class, 2018 - 2030 (USD Billion)

Table 120 Kuwait Branded Generics Market, By Application, 2018 - 2030 (USD Billion)

Table 121 Kuwait Branded Generics Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 122 Kuwait Branded Generics Market, By Distribution Channel, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Branded generics market segmentation

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value - chain - based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Commodity Flow Analysis

Fig. 10 Branded generics market snapshot

Fig. 11 Penetration and growth prospect mapping

Fig. 12 Branded generics market driver impact

Fig. 13 ANDA approvals in 2022

Fig. 14 Number of deaths attributed to noncommunicable diseases (in million), in 2022

Fig. 15 Branded generics market restraint impact

Fig. 16 Annual savings from generics in the U.S. (USD billion)

Fig. 17 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

Fig. 18 Porter's Five Forces Analysis

Fig. 19 User Perspective Analysis

Fig. 20 Branded generics market: Drug Class Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 21 Branded generics market: Drug class movement analysis

Fig. 22 Alkylating agents market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 23 Antimetabolites market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 24 Hormones market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 25 Anti - hypertensive market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 26 Lipid lowering drugs market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 27 Anti - depressants market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 28 Anti - psychotics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 29 Anti - epileptics generic prescription pattern in India (2020)

Fig. 30 Anti - epileptics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 31 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 32 Branded generics market: Application Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 33 Branded generics market: Application movement analysis

Fig. 34 Oncology market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 35 Cardiovascular diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 36 Neurological diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 37 Acute & chronic pain market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 38 Gastrointestinal diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 39 Dermatological diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 40 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 41 Branded generics market: Route of Administration Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 42 Branded generics market: Route of administration movement analysis

Fig. 43 Topical market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 44 Oral market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 45 Parenteral market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 46 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 47 Branded Generics market: Distribution Channel Outlook, Revenue, USD Billion, 2018 - 2030 and key takeaways

Fig. 48 Branded Generics Market: Distribution Channel Movement Analysis

Fig. 49 Hospital pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 50 Retail pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 51 Online pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 52 Regional marketplace: Key takeaways

Fig. 53 Regional outlook, 2022 & 2030

Fig. 54 North America SWOT Analysis

Fig. 55 North America. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 56 U.S. key country dynamics

Fig. 57 U.S. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 58 Canada key country dynamics

Fig. 59 Canada market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 60 Europe SWOT Analysis

Fig. 61 Europe market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 62 UK key country dynamics

Fig. 63 UK market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 64 Germany key country dynamics

Fig. 65 Germany market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 66 France key country dynamics

Fig. 67 France market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 68 Spain key country dynamics

Fig. 69 Spain market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 70 Italy key country dynamics

Fig. 71 Italy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 72 Denmark key country dynamics

Fig. 73 Denmark market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 74 Sweden key country dynamics

Fig. 75 Sweden market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 76 Norway key country dynamics

Fig. 77 Norway market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 78 Asia - Pacific SWOT Analysis

Fig. 79 Asia - Pacific market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 80 Japan key country dynamics

Fig. 81 Japan market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 82 China key country dynamics

Fig. 83 China. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 84 India key country dynamics

Fig. 85 India market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 86 Australia key country dynamics

Fig. 87 Australia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 88 South Korea key country dynamics

Fig. 89 South Korea market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 90 Thailand key country dynamics

Fig. 91 Thailand market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 92 Latin America SWOT Analysis

Fig. 93 Latin America. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 94 Brazil key country dynamics

Fig. 95 Brazil market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 96 Mexico key country dynamics

Fig. 97 Mexico market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 98 Argentina key country dynamics

Fig. 99 Argentina market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 100 Middle East & Africa SWOT Analysis

Fig. 101 MEA market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 102 South Africa key country dynamics

Fig. 103 South Africa market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 104 Saudi Arabia key country dynamics

Fig. 105 Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 106 UAE key country dynamics

Fig. 107 UAE market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 108 Kuwait key country dynamics

Fig. 109 Kuwait market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value - chain - based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Commodity Flow Analysis

Fig. 10 Branded generics market snapshot

Fig. 11 Penetration and growth prospect mapping

Fig. 12 Branded generics market driver impact

Fig. 13 ANDA approvals in 2022

Fig. 14 Number of deaths attributed to noncommunicable diseases (in million), in 2022

Fig. 15 Branded generics market restraint impact

Fig. 16 Annual savings from generics in the U.S. (USD billion)

Fig. 17 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

Fig. 18 Porter's Five Forces Analysis

Fig. 19 User Perspective Analysis

Fig. 20 Branded generics market: Drug Class Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 21 Branded generics market: Drug class movement analysis

Fig. 22 Alkylating agents market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 23 Antimetabolites market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 24 Hormones market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 25 Anti - hypertensive market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 26 Lipid lowering drugs market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 27 Anti - depressants market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 28 Anti - psychotics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 29 Anti - epileptics generic prescription pattern in India (2020)

Fig. 30 Anti - epileptics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 31 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 32 Branded generics market: Application Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 33 Branded generics market: Application movement analysis

Fig. 34 Oncology market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 35 Cardiovascular diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 36 Neurological diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 37 Acute & chronic pain market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 38 Gastrointestinal diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 39 Dermatological diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 40 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 41 Branded generics market: Route of Administration Outlook, Revenue, USD Billion, 2018 - 2030and key takeaways

Fig. 42 Branded generics market: Route of administration movement analysis

Fig. 43 Topical market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 44 Oral market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 45 Parenteral market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 46 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 47 Branded Generics market: Distribution Channel Outlook, Revenue, USD Billion, 2018 - 2030 and key takeaways

Fig. 48 Branded Generics Market: Distribution Channel Movement Analysis

Fig. 49 Hospital pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 50 Retail pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 51 Online pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 52 Regional marketplace: Key takeaways

Fig. 53 Regional outlook, 2022 & 2030

Fig. 54 North America SWOT Analysis

Fig. 55 North America. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 56 U.S. key country dynamics

Fig. 57 U.S. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 58 Canada key country dynamics

Fig. 59 Canada market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 60 Europe SWOT Analysis

Fig. 61 Europe market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 62 UK key country dynamics

Fig. 63 UK market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 64 Germany key country dynamics

Fig. 65 Germany market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 66 France key country dynamics

Fig. 67 France market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 68 Spain key country dynamics

Fig. 69 Spain market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 70 Italy key country dynamics

Fig. 71 Italy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 72 Denmark key country dynamics

Fig. 73 Denmark market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 74 Sweden key country dynamics

Fig. 75 Sweden market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 76 Norway key country dynamics

Fig. 77 Norway market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 78 Asia - Pacific SWOT Analysis

Fig. 79 Asia - Pacific market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 80 Japan key country dynamics

Fig. 81 Japan market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 82 China key country dynamics

Fig. 83 China. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 84 India key country dynamics

Fig. 85 India market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 86 Australia key country dynamics

Fig. 87 Australia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 88 South Korea key country dynamics

Fig. 89 South Korea market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 90 Thailand key country dynamics

Fig. 91 Thailand market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 92 Latin America SWOT Analysis

Fig. 93 Latin America. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 94 Brazil key country dynamics

Fig. 95 Brazil market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 96 Mexico key country dynamics

Fig. 97 Mexico market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 98 Argentina key country dynamics

Fig. 99 Argentina market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 100 Middle East & Africa SWOT Analysis

Fig. 101 MEA market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 102 South Africa key country dynamics

Fig. 103 South Africa market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 104 Saudi Arabia key country dynamics

Fig. 105 Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 106 UAE key country dynamics

Fig. 107 UAE market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 108 Kuwait key country dynamics

Fig. 109 Kuwait market estimates and forecast, 2018 - 2030 (USD Billion)

Companies Mentioned

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- LUPIN

- SANOFI

- SUN PHARMACEUTICAL INDUSTRIES, LTD.

- DR. REDDY’S LABORATORIES LTD.

- ENDO INTERNATIONAL PLC

- GLAXOSMITHKLINE PLC (GSK)

- PFIZER, INC.

- VIATRIS, INC.

- APOTEX, INC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | May 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 240.75 Billion |

| Forecasted Market Value ( USD | $ 375.95 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |