BFSI is the major vertical of the AI as a Service as this sector has regularly embraced AI technology to improve operational effectiveness and enable a great user experience. The adoption of chatbots by banks is compelling other financial institutions to make comparable competitive technological investments. The dominance of AI over all other developments will continue. Thereby, the BFSI sector is anticipated to capture approximately 2/5thshare of the market by 2029.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, SAP SE came into collaboration with IBM to embed IBM Watson technology with its solutions to offer new AI-driven insights and automation which would create more efficient and effective user experiences. Additionally, In May, 2023, SAP SE came into collaboration with IBM to offer new AI-driven insights and automation which would create more efficient and effective user experiences. In March, 2023, Amazon Web Services, Inc. joined hands with NVIDIA to develop generative AI applications and the most scalable, on-demand artificial intelligence (AI) infrastructure.

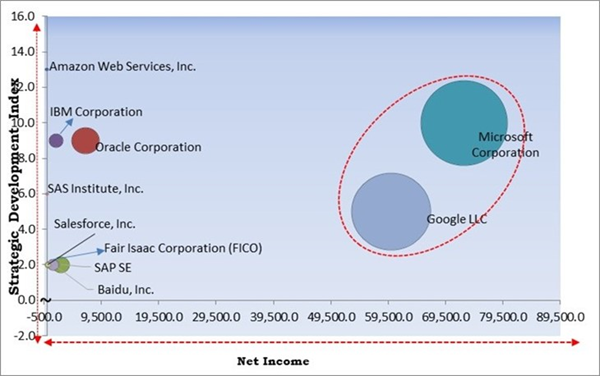

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In April, 2023, Microsoft Corp. expanded the collaboration with Epic Systems Corporation, an American healthcare software company. The collaboration is aimed to integrate generative AI-powered solutions with Epic's EHR to enhance patient care, productivity and improve the financial integrity of health systems globally. Companies such as Amazon Web Services, Inc., IBM Corporation, Oracle Corporation are some of the key innovators in Market.

Market Growth Factors

Increasing significance of data-driven and influential decision-making in business

The utilization of decision-making influenced by enormous amounts of data in businesses is experiencing a notable surge in significance, with AI-as-a-Service (AIaaS) playing a pivotal role in this domain. The utilization of machine learning algorithms in AIaaS solutions allows for the identification of trends and patterns in data that may not be discerned through manual means. This capability enables end users to make more informed decisions in a timely manner. The utilization of these solutions is on the rise among major industries, including finance, healthcare, and manufacturing. Hence, the use of AIaaS in decision-making by many industries and companies is propelling the growth of the market throughout the forecast period.Growing demand for intelligent AI business applications

Chatbots evaluate vast amounts of customer data and reply to inquiries. Thus, by implementing chatbots, a variety of organizations can gain advantages like Return on Investment (ROI) and business process automation, which will help them maintain their competitiveness in the market. A framework for chatbots and intelligent assistants is provided by service providers. Therefore, the necessity for incorporating the latest technologies to increase the automation and optimization of business processes demands greater use of AI. This, in turn, is beneficial for the expansion of the market.Market Restraining Factors

Significant absence of trained personnel

The main challenge that the majority of firms encounter when integrating ML and AI into their business operations is the scarcity of analytical skills. Organizations are nevertheless concerned about the shortage of deep analytical talent. The need for experts who are able to track analytical content is thus growing. Many businesses now place a lot of emphasis on attracting and keeping technical talent. However, to create and carry out analytics initiatives, including sophisticated methods like ML, there are insufficiently skilled individuals. So, it is anticipated that a major barrier to the expansion of the market will be the lack of skilled workers.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Technology Outlook

Based on technology, the market is characterized into machine learning, natural language processing, context awareness, and computer vision. The computer vision segment procured a considerable growth rate in the market in 2022. Extensive usage of computer vision is accountable for the rise of the segment. Self-driving cars, medical imaging, and surveillance systems are just a few areas where computer vision is applied. Businesses may effortlessly upload, analyze, and train models to carry out difficult tasks, like object detection, picture recognition, and video analysis, by utilizing cloud-based computer vision platforms.Cloud Type Outlook

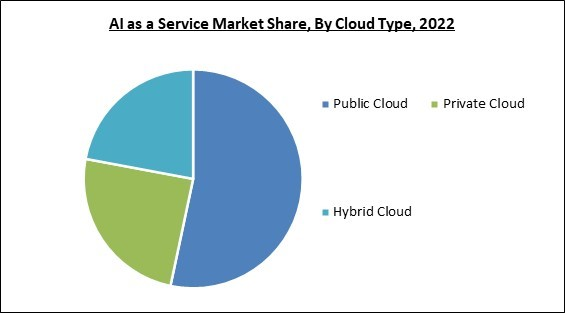

On the basis of cloud type, the market is classified into public cloud, hybrid cloud, and private cloud. The hybrid cloud segment recorded a significant revenue share in the market in 2022. Utilizing large amounts of data is made possible by hybrid cloud technology, providing accurate, cost-effective computing. It helps companies manage their data effectively by offering strategic insights and recommendations, exposing patterns and trends in the data, enhancing customer experiences, and automating activities.Organization Size Outlook

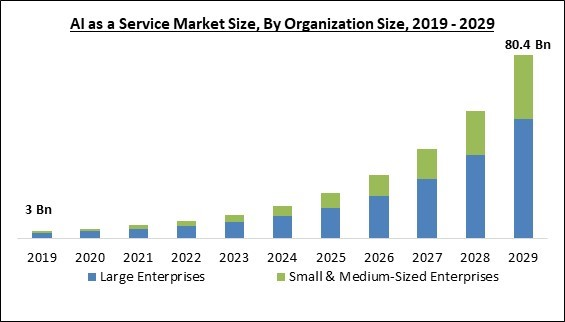

By organization size, the market is divided into small & medium-sized enterprises and large enterprises. The large enterprises segment witnessed the maximum revenue share in the market in 2022. Large enterprises have a notably large deployment of AI due to the scale of their business processes, which is responsible for the development of the segment. In functional areas like supply chains, manufacturing, warehouses, and processes, many multinational businesses utilize AI to automate routine tasks. Additionally, AI is quickly being used by banking & financial platforms to provide services quickly, broadly, securely, and robustly without having to pay for the creation and upkeep of infrastructure.Offering Outlook

Based on offering, the market is segmented into infrastructure as a service, platform as a service, and software as a service. The platform as a service segment acquired a substantial revenue share in the market in 2022. Businesses are now looking to AI Platforms as a Service (AIPaaS) to address their cloud issues by reducing cloud waste, lowering expenses, and streamlining operations. Image, text, as well as speech recognition, are just a few of the business apps and services that are AI-powered and are combined into one interface by AIPaaS.Vertical Outlook

On the basis of vertical, the market is classified as banking, financial services, & insurance, retail & eCommerce, healthcare & life sciences, IT & telecom, government & defense, manufacturing, energy & utilities, and others. The healthcare & life sciences segment garnered a significant revenue share in the in 2022. The need for AIaaS in the medical industry is fueled by several issues, including the need to handle data more efficiently and optimize healthcare costs, expanding public-private partnerships, and rising regional healthcare spending.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the maximum revenue share in the market in 2022. The creation and expansion of the market have been significantly influenced by North America. This region is home to several well-known AI businesses making significant investments in the field of study and development. These enterprises have been offering AI tools and services to companies and organizations of all kinds, allowing them to make use of the potential of AI without having to spend money on pricy gear or software.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Google LLC (Alphabet Inc.), Fair Isaac Corporation (FICO), Baidu, Inc., SAS Institute, Inc., SAP SE and Salesforce, Inc.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- May-2023: SAP SE came into collaboration with IBM, a global hybrid cloud and AI, and consulting expertise provider. With the help of this partnership, the company would embed IBM Watson technology with its solutions to offer new AI-driven insights and automation which would create more efficient and effective user experiences.

- Apr-2023: Microsoft Corp. expanded the collaboration with Epic Systems Corporation, an American healthcare software company. The collaboration is aimed to integrate generative AI-powered solutions with Epic's EHR to enhance patient care, and productivity and improve the financial integrity of health systems globally.

- Mar-2023: Amazon Web Services, Inc. joined hands with NVIDIA, an integrated circuits developer Through this collaboration, the company is aimed to develop generative AI applications and the most scalable, on-demand artificial intelligence (AI) infrastructure.

- Mar-2023: Baidu, Inc. entered into a partnership with Pixellot, an AI sports technology firm. Through this partnership, the company aimed to strengthen its presence in China’s sports sector.

- Mar-2023: Salesforce formed a partnership with OpenAI, an artificial intelligence company, for making the advancement in AI. The partnership is aimed to Launch ChatGPT-like Tool for Enterprises. Salesforce customers can connect their external models to Einstein GPT so that they can generate content that is updated with real-time customer data.

- Feb-2023: Google entered into a partnership with Anthropic, an AI-based startup to develop reliable and Credible AI systems. This partnership would enable Google to utilize Anthropic capabilities in providing cloud-driven solutions and integrate with Google's expertise in the training and deployment of AI systems, to build AI-enabled systems.

- Jan-2023: Microsoft expanded its partnership with OpenAI, an artificial intelligence company, for making the advancement in AI. With this expansion, Microsoft's expertise in providing AI-driven solutions and OpenAI's research on AI Alignment would be combined to build an advanced framework for the secure deployment of Microsoft's AI technologies.

- Oct-2022: Oracle extended its multiyear partnership with Nvidia. The partnership involves supporting customers in accelerating the use of AI. Additionally, the partnership agreement brings Nvidia's computing stack ranging from systems to software to Oracle's Oracle Cloud Infrastructure (OCI).

- Jul-2022: SAS formed a partnership with Moro Hub, a subsidiary of Digital DEWA. The partnership would enable the company to leverage Moro Hub’s multiple cloud services on a single platform to increase the scalability and security of its solutions for data management. This would help clients manage their high volumes of data in a streamlined manner and cost-effectively.

- May-2022: IBM Corporation signed an agreement with Amazon Web Services (AWS), a subsidiary of Amazon that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments. This agreement would deliver IBM's clients easy and rapid access to IBM Software that covers Data and AI, Security, Sustainability, and Automation abilities.

- Sep-2021: Microsoft extended its existing partnership with HONOR, smart devices provider. This partnership focused on the company's aim to pursue a more innovative experience for end users. The companies would partner on Microsoft cloud adoption, personal & mobile computing as well as other technologies.

- Jul-2021: Amazon came into a partnership with Hugging Face, an open-source provider of natural language processing (NLP) technologies. This partnership aimed to make it easier for enterprises to use State of Art Machine Learning models, and ship cutting-edge NLP features quicker. Following this partnership, Hugging Face would use Amazon Web Services as its Preferred Cloud Provider to provide services to its users.

- Mar-2021: FICO came into a partnership with Intermatica, one of the main Italian players in the TLC field. This partnership aims to deliver a variety of FICO’s solutions for AI-powered decision optimization to Italian companies. In this partnership, FICO and Intermatica will provide the market solutions for data-driven business transformation utilizing robust mathematical models. FICO’s predictive analytic and optimization tools help companies to take better decisions within a small timeframe, control business performance, and know their customers to deliver what they want.

Product Launches and Product Expansions:

- Apr-2023: Amazon Web Services (AWS) revealed four innovations including Amazon Bedrock, Amazon EC2 Inf2 instances powered by AWS Inferentia2 chips, New Trn1n instances, powered by AWS Trainium chips, and Free access to Amazon CodeWhisperer for individual developers across its machine learning portfolio Through the launch of these new tools, the company aimed to offer powerful tools and technologies for developers to make intelligent applications without requiring extensive expertise in machine learning.

- Nov-2022: Amazon Web Services, Inc. released new features and enhancements across its portfolio of AI services The new capabilities include transcribe Call Analytics, Textract Analyze Lending, and Amazon Kendra Amazon HealthLake Imaging. The enhancement to the portfolio of AI services is aimed to offer vertical markets and horizontal functions with deeper, real-time insights and cost-saving efficiencies.

- Oct-2022: IBM introduced three libraries in the Embeddable AI product portfolio. These three new libraries allow IBM's independent software partners and their development teams a trouble-free path to develop AI solutions through pre-trained models and runtime orchestration.

- Nov-2021: Oracle Corporation unveiled Oracle Cloud Infrastructure (OCI) AI services The new AI service enable developers to leverage already trained out-of-the-box models on business-oriented data or custom training the services based on their business’s own data.

- May-2021: Google Cloud unveiled Vertex AI, a managed machine learning platform. This platform would enable organizations to boost the deployment and management of AI models.

- Apr-2020: Amazon Web Services unveiled the Amazon Augmented Artificial Intelligence (A2I). It is a fully handled service that makes it easy to add a human review to machine learning predictions to enhance model and application precision by persistently identifying and bettering low confidence predictions.

Acquisitions and Mergers:

- Dec-2022: Oracle Corporation took over Newmetrix, a cloud-based platform that uses artificial intelligence to highlight construction problems focused on project safety. Through this acquisition, Oracle Corporation would be able to able to fasten its abilities in utilizing Machine Learning and AI to construct more predictive behaviors.

- Jul-2022: IBM took over Databand.ai, a leader in data observability software. With this acquisition, the company aimed to strengthen its software portfolio through automation, data, and AI in order to address the full spectrum of observability.

- Mar-2022: Microsoft acquired Nuance Communications, a US-based company that provides speech recognition solutions, healthcare AI solutions and omnichannel customer engagement. This acquisition enables healthcare services providers a better opportunity to provide economical, attainable healthcare services, and allows organizations in other industries to better serve the needs of their clients.

- Jan-2021: SAS completed the acquisition of Boemska, a company providing investment analytics solutions. This acquisition would improve SAS Viya, an analytics platform. This would add new features that promote the goal of SAS in helping customer migration to the cloud and assisting the entire analytics life cycle.

Scope of the Study

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises

By Offering

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Technology

- Machine Learning

- Natural Language Processing

- Context Awareness

- Computer Vision

By Cloud Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- BFSI

- IT & Telecom

- Retail & eCommerce

- Manufacturing

- Healthcare & Life Sciences

- Government & Defense

- Energy & Utilities

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Google LLC (Alphabet Inc.)

- Fair Isaac Corporation (FICO)

- Baidu, Inc.

- SAS Institute, Inc.

- SAP SE

- Salesforce, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Google LLC (Alphabet Inc.)

- Fair Isaac Corporation (FICO)

- Baidu, Inc.

- SAS Institute, Inc.

- SAP SE

- Salesforce, Inc.