Asia Pacific is one of the major contributors to merchant banking services because of the rising income levels, favorable demographics, and expanding local enterprises might be used as justifications for the growth. Consequently, APAC is expected to witness more than 29% share if the market by 2029. Foreign direct investments in greenfield projects in the region increased significantly in 2021, according to the Foreign Direct Investment (FDI) Annual Report. Famous merchant banking service suppliers have increased their offerings in Asia Pacific after spotting growth potential.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, RBC partnered with Conquest Planning to transform financial planning by offering customized and convenient advice. Under this partnership, RBC would bring next-generation financial planning ability to its financial planners and clients. Additionally, In February, 2023, DBS Bank India came into partnership with eSamudaay to meet the requirements of SMEs and MSMEs and at the same time conduct business via Open Network for Digital Commerce and broaden its digital solutions across traditional banking.

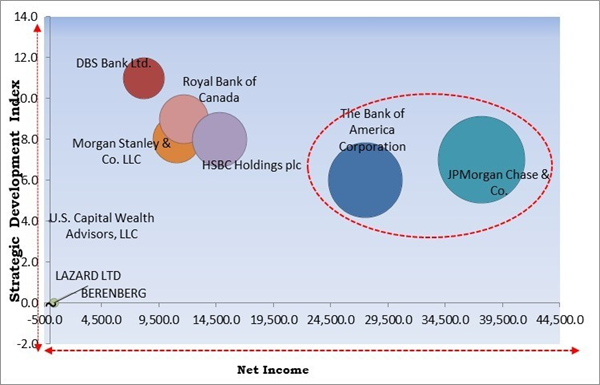

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; JPMorgan Chase & Co. and The Bank of America Corporation are the forerunners in the Market. In March, 2022, Bank of America extended its agreement with Alaska Air Group Inc., a U.S.-based airline holding company. This agreement solidifies a partnership that meaningfully broadened guest benefits and boosted both Bank of America and Alaska Air Group’s strategic growth plans in Crucial West Coast regions. Companies such as DBS Bank Ltd., Morgan Stanley & Co. LLC, HSBC Holdings plc, and Royal Bank of Canada are some of the key innovators in Market.

Market Growth Factors

Increasing foreign investment deals worldwide

According to the Investment Trends Monitor report that was published by United Nations Conference on Trade and Development (UNCTAD) in January, global foreign direct investment (FDI) volumes displayed a strong rebound in 2021. The values climbed to 77% to a predicted $1.65 trillion than $929 billion in 2020 and exceeding their level prior to the COVID-19. The increase in investment flows to developing nations is positive. By far, the largest increase was seen in developed nations, with FDI reaching a projected $777 billion in 2021 - three times the abnormally low amount in 2020. Therefore, the growing flow of FDI is beneficial for the growth of the market.Expansion of corporate financing operations

Every business decision has a financial impact, and any choice involving money usage falls under the corporate financial decision category. The most efficient method of acquiring and employing financial resources is through corporate finance. Controlling the necessary cash and the sources of those funds is an essential part of managing a company's finances. Corporate finance divisions are in charge of directing and supervising their companies' financial operations and capital investment choices. These choices range from whether to proceed with a proposed investment to how to finance it - with equity, debt, or both - and whether shareholders should be paid dividends. Therefore, the market will expand as more companies expand their capital investments.Market Restraining Factors

High cost of merchant banking services

The high expenses connected with merchant banking services make them expensive compared to traditional banking services. Utilizing merchant banks carries several hazards, chief among them the possibility of conflicts of interest, the expense of doing so, and the complexity of such services. Merchant banks typically require significant capital to execute their activities. They may need to deploy substantial funds for underwriting commitments, investments, and financing arrangements. Capital-intensive operations entail costs associated with capital maintenance, liquidity management, and risk management, contributing to the overall cost structure. Hence, the high cost of these services is the primary factor hampering the market's growth.Type Outlook

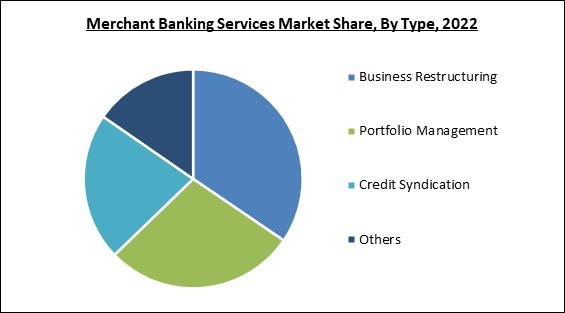

Based on type, the market is characterized into portfolio management, business restructuring, credit syndication, and others. The business restructuring segment garnered the highest revenue share in the market in 2022. In order to increase a company's operational effectiveness and financial position, restructuring entails dramatically modifying its operations, structure, or finance. The need for corporate restructuring to enhance operations, save expenses, and boost efficiency is on the rise, which can be linked to the segment's expansion. In order to better align management and operations with company strategies and modify them to produce more profits, business restructuring services are used.Provider Outlook

On the basis of provider, the market is classified into banks and non-banking institutions. The banks segment acquired the largest revenue share in the market in 2022. The size of operations plays a major role in the banking segment's supremacy. Investors banks frequently carry out such operations in an ideal manner to optimize return on investments due to the trust factor associated with significant names as well as their ability to allocate funds and resources. Furthermore, there are fewer options for oversight, and banks are governed by strict laws.End-user Outlook

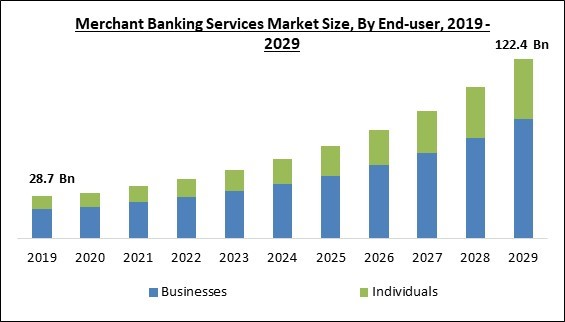

By end-user, the market is divided into businesses and individuals. The individuals segment garnered a remarkable growth rate in the market in 2022. Merchant banks mostly offer portfolio management services to high-net-worth individuals. One of their main duties is to buy and sell the underlying securities in the portfolios while adjusting to market circumstances (market timing). In addition, building and executing investment strategies to achieve specific investment objectives might be credited with the segment's growth.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. Major merchant banking service providers are present throughout the region, which is expected to stimulate industry expansion. Local businesses also look to expand into new markets. The industry is also anticipated to grow due to a robust capital market and corporate environment.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include JPMorgan Chase & Co., The Bank of America Corporation, DBS Bank Ltd., Morgan Stanley & Co. LLC, HSBC Holdings plc, Royal Bank of Canada, BERENBERG, LAZARD LTD, U.S. Capital Wealth Advisors, LLC and Bryant Park Capital.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Apr-2023: RBC partnered with Conquest Planning, a technology platform that aims to transform financial planning by offering customized and convenient advice. Under this partnership, RBC would bring next-generation financial planning ability to its financial planners and clients.

- Feb-2023: DBS Bank India came into partnership with eSamudaay, a platform that brings local businesses & customers together. Through this partnership, DBS Bank India would aim to meet the requirements of SMEs and MSMEs and at the same time conduct business via Open Network for Digital Commerce and broaden its digital solutions across traditional banking.

- Dec-2022: HSBC partnered with Extend, a virtual card and spend management platform. With this partnership, HSBC would provide Extend solutions to its commercial card customer across the U.S. to help companies control expenses with the management of virtual cards.

- Dec-2022: DBS Bank India partnered with Gofrugal Technologies Pvt. Ltd., a provider of Omnichannel ERP solutions. Following this partnership, the company strengthens enterprise customers, consisting of micro, small, and medium enterprises and retail merchants, to adopt Open Network for Digital Commerce (ONDC) and allow them to broaden their digital commerce presence.

- Oct-2022: HSBC came into an agreement with Oracle, a US-based information technology company. This agreement would boost the bank's digital transformation. Additionally, this would upgrade and move select database systems to Oracle Exadata Cloud@Customer, a cloud platform provided as a managed infrastructure service in HSBC’s data centers.

- Aug-2022: Royal Bank of Canada joined hands with ICICI Bank Canada, a wholly-owned subsidiary of ICICI Bank. This collaboration aims to bring combined banking solutions to newcomers migrating to Canada. Furthermore, newcomers would benefit from the assurance of the ICICI Bank brand, combined with RBC's network, portfolio, and scale across Canada.

- Mar-2022: Bank of America extended its agreement with Alaska Air Group Inc., a U.S.-based airline holding company. This agreement solidifies a partnership that meaningfully broadened guest benefits and boosted both Bank of America and Alaska Air Group’s strategic growth plans in Crucial West Coast regions.

- Jan-2021: RBC came into partnership with Alliance Data Systems Corporation, a company engaged in offering data-driven marketing, loyalty, and payment solutions. Under this partnership, Alliance Data Systems' bead division would license its payments technology platform to RBC. This partnership would allow RBC to leverage Bread's digital payments technology to deliver Canadian merchants with PayPlan powered by RBC, a pay-over-time solution provided to customers at point-of-sale.

Product Launches and Product Expansions:

- Apr-2023: DBS Bank India announced the launch of 'digiPortfolio', on its digibank platform. The platform utilizes both technology and human involvement to build a group of investment options organized by Morningstar that identify the risk preferences of various investors. The digiPortfolio is a simple, one-stop solution for customers to invest money with ready-made baskets of mutual funds. DBS Bank aims to rectify the customer experience and make it more smooth by utilizing AI, data, and innovative technologies.

- May-2022: J.P. Morgan’s Securities Services business launched Fusion, a data platform that offers comprehensive data management and reporting solutions for institutional investors. The product would enable clients to smoothly combine and integrate combine data from various sources into one data model that provides the advantages of scale and decreased costs, with the capacity to unlock timely analysis and insights.

- Jun-2021: Royal Bank of Canada introduced RBCx, a full-service platform to boost the entrepreneurial journey at every stage of growth, providing access to capital solutions, advanced products and services, and operational specialization to help technology companies scale. The launched product supports entrepreneurs from the beginning to the whole process, who are transforming business models, industries, and sectors.

Acquisitions and Mergers:

- Mar-2023: J.P. Morgan came into an agreement to acquire Aumni, a company engaged in providing investment analytics software to the venture capital industry. This acquisition strengthens J.P. Morgan’s commitment to creating the leading private markets platform for enterprises, their employees, and investors, and also the trust in the flexibility of the venture-backed ecosystem.

- Mar-2023: HSBC UK Bank plc, a UK ring-fenced subsidiary of HSBC Holdings plc acquired Silicon Valley Bank UK Limited, a subsidiary of Silicon Valley Bank. The acquisition creates sense for its business across the UK. The company solidifies its commercial banking franchise and improves its capacity to serve advanced and emerging firms, consisting of technology and life-science areas across the UK and the world.

- Jan-2022: DBS Bank Ltd completed the acquisition of Citi Consumer Taiwan, the consumer banking business. With this acquisition DBS Bank would be able to offer better consumer banking products and services to customers, leveraging the digital strength of DBS.

- May-2021: U.S. Capital Advisors, LLC announced the merger of fee-based advisory wealth management business Legacy One Financial Advisors, LLC, a Texas-based fee-based advisory firm, to form the U.S. Capital Wealth Advisors, LLC. With this merger, the U.S. Capital Advisors aims to combine their leading financial advisors, and the exceptional offer enhanced client experience. Additionally, the companies would expand the fee-based advisory business.

- Apr-2021: Bank of America took over Axia Technologies, Inc. a company involved in healthcare payment and technology focused on enhancing secure patient payments. This acquisition would deepen and broaden Bank of America’s payment portfolio for healthcare clients and would further boost the bank’s capacity to serve this key vertical.

- Mar-2021: Morgan Stanley acquired Eaton Vance Corp. The acquisition enhances Morgan Stanley's strategic transformation by continuing to add more fee-based revenues to complement its leading, integrated investment bank. Furthermore, with the acquisition of Eaton Vance, Morgan Stanley would oversee $5.4 trillion of client assets in its Wealth Management and Investment Management divisions.

Scope of the Study

By Provider

- Banks

- Non-Banking Institutions

By End-User

- Businesses

- Individuals

By Type

- Business Restructuring

- Portfolio Management

- Credit Syndication

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- JPMorgan Chase & Co.

- The Bank of America Corporation

- DBS Bank Ltd.

- Morgan Stanley & Co. LLC

- HSBC Holdings plc

- Royal Bank of Canada

- BERENBERG

- LAZARD LTD

- U.S. Capital Wealth Advisors, LLC

- Bryant Park Capital

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- JPMorgan Chase & Co.

- The Bank of America Corporation

- DBS Bank Ltd.

- Morgan Stanley & Co. LLC

- HSBC Holdings plc

- Royal Bank of Canada

- BERENBERG

- LAZARD LTD

- U.S. Capital Wealth Advisors, LLC

- Bryant Park Capital