Hybrid mode is gaining more traction in this market as the firms employ a hybrid approach to maintain sensitive data on-premise, while using the improved scalability & accessibility of cloud-based storage for other data. Data is saved across many locations and may be promptly retrieved during a disaster, making a hybrid approach a strong disaster recovery solution. Thereby, this deployment mode captured $317.8 million revenue in the market in 2022. Some of the factors impacting the growth of the market are the rising need to identify customer need to know future trends, growing popularity of social media marketing, and a limited number of available professionals.

Artificial intelligence is very adept at spotting patterns in data and extending patterns to forecast outcomes. A platform for smart content intelligence can help users decide what to write about in the future and track changes in social media usage and marketing efficiency. Content intelligence must work closely with the content management system because it depends on a substantial amount of data to function. Any SEO plan now requires social media marketing. The rise of various social media platforms has given marketers better options to grow their companies and boost brand recognition. Moreover, a website's search engine ranking can significantly impact a company's success, resulting in greater customer acquisition & inevitably improved website conversion rates.

However, Staff with specialized skill sets is required for businesses to properly develop, manage, and use content intelligence systems because it is a challenging technology. For example, employees whose employment needs them to communicate with artificial intelligence systems should be knowledgeable about computer concepts like cognitive computing, deep learning and machine learning, and image recognition.

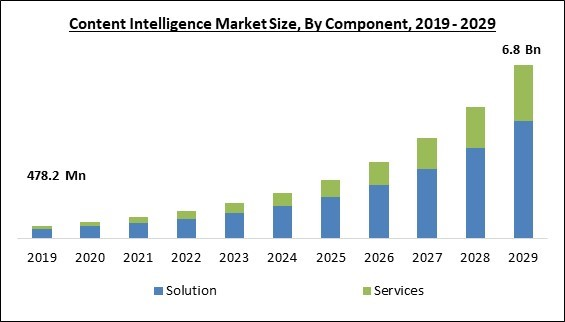

Component Outlook

Based on component, the market is segmented into solutions, and services. In 2022, the services segment garnered a significant revenue in the market. Vendors provide various services to their clients, including support, consulting & expertise, managed services, and training & education. These services speed up deployment, reduce delays, facilitate integration, and offer personalized training. The relevance of services lies in their ability to increase Return on Investment (RoI) and facilitate the efficient application of content intelligence.Deployment Type Outlook

By deployment type, the market is fragmented into cloud, on-premise, and hybrid. In 2022, the cloud segment witnessed the largest revenue share in the market. Businesses use cloud-based content intelligence solutions to increase mobility and decentralize data storage and computing. Security issues are a barrier to the adoption of cloud services. This issue is, however, quickly being resolved by enlisting third parties to do meticulous security checks to the highest standards.Enterprises Size Outlook

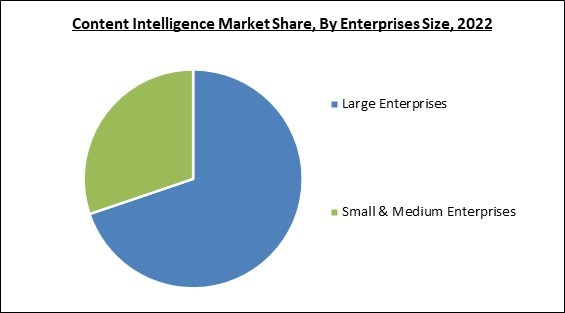

On the basis of Enterprises Size, the market is bifurcated into SMEs, and large enterprises. In 2022, the SMEs segment acquired a substantial revenue share in the market. This is due to the utilization of emerging technology to enhance the performance of SMEs and assist businesses in overcoming size-related constraints. There are a lot of small and medium-sized firms in almost every country in the world.Vertical Outlook

Based on vertical, the market is categorized into BFSI, government & public sector, healthcare & life science, IT & telecommunication, manufacturing, media & entertainment, retail & consumer goods, travel & hospitality and others. In 2022, the BFSI segment recorded a remarkable revenue share in the market. The increase in content analytics use across several BFSI applications, such as risk management, customer profiling, fraud detection, and marketing, can be credited with the growth. Additionally, the increasing use of social media platforms has allowed banks to track and analyze data from various sources, including website content, blog articles published on a bank's website, and Blogspot blogs with a sizable volume of organic traffic.Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. Companies in North America are making significant investments in customer experience & digital marketing activities, as well as in cutting-edge technologies like AI, ML, NLP, big data, and others. Comparatively to other regions, this region has a disproportionately high percentage of smartphone users, social media users, and advertisers. Due to the growing rate of mobile device use in the US, marketers now have a reliable route to reach potential clients.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Adobe, Inc., OpenText Corporation, M-Files, Curata, Inc., Scoop.it (Meltwater N.V), Emplifi, Inc., OneSpot, Rad Technologies, Inc., Vennli, Inc., and Optimizely, Inc.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- May-2023: M-Files teamed up with Microsoft, a global Information Technology company. Following this collaboration, M-Files aligns with Microsoft Solutions and allow its customers to focus on the work that matters most by delivering a secure and compliant way to enhance daily workflows and business processes.

- Apr-2023: Rad Technologies Inc. collaborated with LNDMRK, a visual marketing agency. Under this partnership, both companies would release a new product, RAD Visual Arts, which enables striking creatives to team up with brands to advance cultural moments, content, and community through AI-informed visual art.

- Mar-2023: Adobe came into partnership with IBM Corporation, a global Information Technology company. Through this partnership, both companies would help marketing and creative enterprises advance their content supply chain.

- Feb-2022: OpenText signed a partnership with Google Cloud, an infrastructure for cloud computing, data analytics & machine learning. Under this partnership, OpenText Xore content would be available on Google Cloud, allowing quick, secure access to the OpenText platform.

Product Launches and Product Expansions:

- May-2023: Adobe launched Adobe PDF Accessibility Auto-Tag API, Adobe's AI, and machine learning framework. The launched API would help enterprises save hours, days, or even weeks and millions of dollars - all at the time enhancing compliance and delivering better customer and employee experiences.

- Mar-2023: Adobe introduced Firefly, an artificial intelligence visual tool. The launch aims to offer end-to-end customer experience and that machine learning and AI would be important to Adobe products that help these companies.

- Mar-2023-Mar Adobe enhanced Adobe Experience Cloud, the latest features consist of Adobe Sensei GenAI, the scale, and agility to deliver and design customized experiences that perform well customized for their brand, Adobe Mix Modeler, and Advanced AI Modeling in Adobe Marketo Measure.

- Apr-2021: OpenText announced the launch of BrightCloud® Cloud Service Intelligence, allowing Cloud Access Security Brokers and other security and technology vendors to impose data-centric security policies and prevent undesirable interactions with cloud services and associated applications.

- Apr-2021: OpenText added new capabilities in OpenText™ Magellan Text Mining, a developing economy identified by analysts. The product would be extended to include managing and building models and taxonomies in an easy, user-friendly manner.

Acquisitions and Mergers:

- Feb-2023: M-Files took over Ment, a no-code document automation platform. This acquisition would enhance the ability of Ment to help enterprises maximize productivity and enhance their bottom line by decreasing time-consuming manual work processes.

- Dec-2021: Optimizely acquired Welcome, a provider of marketing resource management (MRM), content marketing platforms (CMP), and digital asset management (DAM) together in a single solution. With this acquisition, Optimizely would innovate its digital experience, and empower marketers to plan, build, offer, and enhance content and campaigns through a single, end-to-end solution.

- Oct-2021: Adobe acquired Frame.io, a cloud-based video collaboration platform. This acquisition brings Adobe Creative Cloud's collaboration service to video and would make it simple for teams to join hands across Adobe Illustrator, Adobe Photoshop, Adobe Premiere Pro, and other Adobe Creative Cloud applications.

- Apr-2021: M-Files completed the acquisition of Hubshare, a powerful portal, and secure file-sharing platform. With this acquisition, M-Files would boost external content sharing and collaboration and provide a better digital client experience.

- Mar-2021: Optimizely took over Zaius Inc., a provider of the artificial intelligence-powered customer data platform. Through this acquisition, Optimizely would extend its available features for marketing campaigns and managing websites.

Scope of the Study

By Component

- Solution

- Services

By Deployment Mode

- Cloud

- On-premise

- Hybrid

By Enterprises Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- IT & Telecom

- Retail & Consumer Goods

- Healthcare

- Manufacturing

- Government & Public Sector

- Travel & Hospitality

- BFSI

- Media & Entertainment

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Adobe, Inc.

- OpenText Corporation

- M-Files

- Curata, Inc.

- it (Meltwater N.V)

- Emplifi, Inc.

- OneSpot

- Rad Technologies, Inc.

- Vennli, Inc.

- Optimizely, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Adobe, Inc.

- OpenText Corporation

- M-Files

- Curata, Inc.

- Scoop.it (Meltwater N.V)

- Emplifi, Inc.

- OneSpot

- Rad Technologies, Inc.

- Vennli, Inc.

- Optimizely, Inc.