Automotive sector utilizes Cloud Database and DBaaS to manage data, streamline operations, and improve consumer experiences. Hence, Automotive captured $694.4 million revenue in 2022. Automobile manufacturers may store and process enormous amounts of data from their vehicles, clients, and operations using cloud databases. By storing and processing data from various sources, such as sensors, IoT devices, and consumer interactions, cloud databases and DBaaS solutions can assist businesses in making better decisions based on the gathered data.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2023, Google Cloud formed a partnership with MongoDB to serve its customers by allowing them to build rich applications using the combined service of the two companies. Moreover, in November, 2022, Amazon web services has entered into partnership with Couchbase, Inc and aims at providing the customers with technology integrations by integrating Couchase DBaaS with AWS edge services. The partnership enhances how AWS serves its customers.

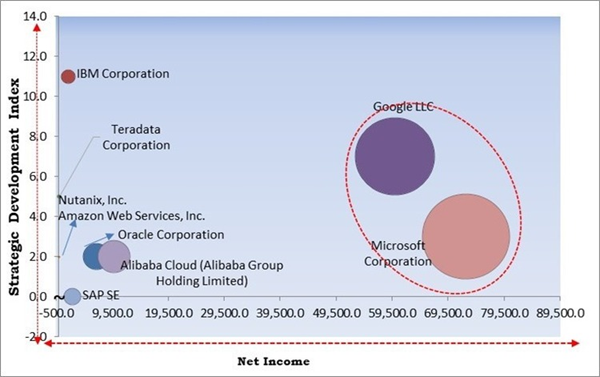

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Microsoft Corporation and Google LLC. are the forerunners in the Market. In May, 2023, Google has partnered with Gitlab to provide protected AI offerings to different companies. Through this partnership, Google will be able to serve its customers better by providing them with generative AI capability. Companies such as Alibaba Cloud (Alibaba Group Holding Limited), Oracle Corporation, IBM Corporation are some of the key innovators in Market.Market Growth Factors

Rising introduction of autonomous database

The demand for autonomous databases is rising rapidly. This is due to its capability to automate common database chores, including database optimization, security, backups, and upgrades using machine learning. Additionally, the COVID-19 pandemic raised the workloads, which is another factor boosting the demand for autonomous databases. Because it eliminates DBA errors, which has a negative impact on an application's functionality, availability, and security, there has been an increase in the demand for database as a service. Additionally, cloud computing technology is in great demand because it lowers the total price of infrastructure, and this factor is anticipated to fuel market expansion in the coming years.Advantages of DBaaS over installing a database management system

Companies require an internal administrative team to operate and maintain a database on-premises. With database-as-a-service, the cloud provider handles every part of management. As a result, the current IT employees can work on innovation and applications since DBaaS relieves them of administrative duties. To access an on-premise database system, technical and development teams often go through IT, which might take days or weeks. Contrarily, with DBaaS, developers have access to database functionalities and can quickly spin up and set up a database that is prepared to be integrated with their application. Therefore, the market will expand significantly, owing to all these factors.Market Restraining Factors

Safety concerns for cloud-based data storage

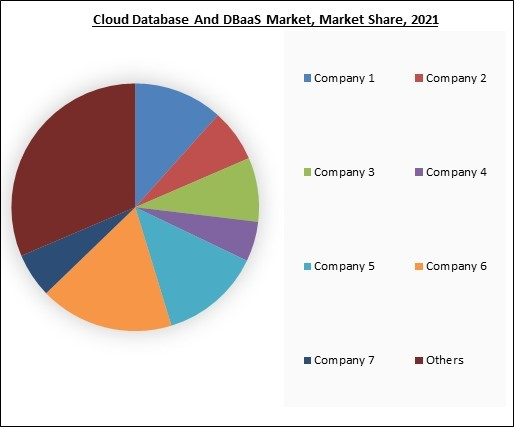

Today's data-driven workplaces for organizations raise the danger of sophisticated cyberattacks, data breaches, as well as phishing efforts. In addition, the security risks to the data are increased due to the data being spread over numerous systems and due to several issues. Furthermore, unlike other industries, the healthcare sector has greater data breaches. This is among the main causes of the delayed uptake of cloud-based solutions. Users refuse these solutions because they are concerned about losing important data due to compilation or update issues with the data. The market's growth is therefore being restricted by this problem.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Component Outlook

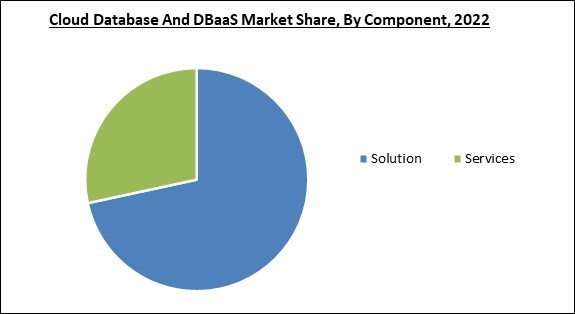

Based on component, the market is characterized into solution and services. The solution segment garnered the highest revenue share in the market in 2022. The solution describes the assortment of services that companies give their clients to satisfy their unique database requirements. Data migration, backup and recovery, security, performance tuning, and scalability are just a few of the services offered by the solution segment. These services assist companies in reducing expenses, increasing efficiency, and optimizing their database architecture.Solution Type Outlook

By solution type, the market is further divided into database management and storage. The storage segment acquired the largest revenue share in the market in 2022. Instead of requiring manual database instance failover as instances are upgraded, the system scales gracefully, saving the consumer/end-user time and effort. When a customer's demand changes, a DBaaS may automatically scale to meet that need. For instance, if storage is 90% full, it may add more read replicas or expand its storage capacity.Database type Outlook

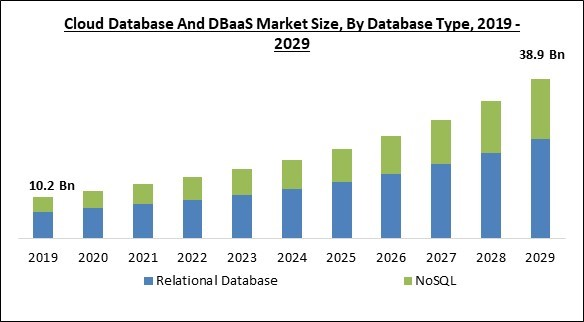

On the basis of database type, the market is classified into NoSQL and relational database. The relational database segment procured the highest revenue share in the market in 2022. Due to their prevalence in contemporary applications, relational databases have acted as a catalyst for creating cloud databases. Since companies and organizations have started to rely more and more on data, there has been a sharp increase in demand for effective data storage solutions. Cloud databases offer an excellent response to this issue, which provide the flexibility to scale in response to sudden changes in data.Deployment Outlook

By deployment, the market is divided into public, private, and hybrid. The hybrid segment recorded the largest revenue share in the market in 2022. Because hybrid cloud databases give businesses the freedom to employ both on-premises as well as cloud-based databases, they are growing in popularity. The hybrid strategy enables businesses to take advantage of the cost savings and scalability that come with cloud-based databases while retaining control over their confidential data and adhering to data sovereignty laws.Organization Size Outlook

Based on organization size, the market is segmented into large enterprises and small & medium enterprises. The small and medium enterprises (SMEs) segment procured a significant revenue share in the market in 2022. Database-as-a-Service (DBaaS) and cloud database solutions are being adopted by SMEs more and more. Without costly on-premises infrastructure, cloud databases and DBaaS systems can give SMEs an affordable, scalable, and dependable alternative to handle their data. Managing data more affordably is one of the main advantages of cloud databases and DBaaS for SMEs.Industry Outlook

On the basis of industry, the market is classified into IT & telecom, BFSI, healthcare & life sciences, government & public sector, manufacturing, automotive, retail & eCommerce, media & entertainment, and others. The BFSI segment recorded a remarkable growth rate in the market in 2022. One of the industries that are most focused on data is the banking, financial services, and insurance (BFSI) vertical, where massive amounts of databases are created exponentially. The development of the database in the financial industry is anticipated to be influenced by several things.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the largest revenue share in the market in 2022. In recent years, there has been a sharp rise in demand in North America. The rising use of cloud-based technology across numerous industries and the development of big data & analytics are two factors responsible for this surge. Another important aspect influencing the rise of cloud databases in this region is the development of cloud computing.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Google LLC (Alphabet Inc.), Nutanix, Inc., Oracle Corporation, IBM Corporation, SAP SE, Microsoft Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Alibaba Cloud (Alibaba Group Holding Limited), Teradata Corporation, and Ninox Software GmbH.

Recent Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- May-2023: Google has partnered with Gitlab, a software company based in the United States, to provide protected AI offerings to different companies. Through this partnership, Google will be able to serve its customers better by providing them with generative AI capability.

- Mar-2023: Google Cloud formed a partnership with MongoDB, a software company headquartered in the United States. The partnership aims at expanding the unification between the two companies’ products. Through this partnership, Google Cloud is well positioned to serve its customers by allowing them to build rich applications using the combined service of the two companies.

- Nov-2022: Amazon web services has entered into partnership with Couchbase, Inc., a cloud database platform provider. The partnership aims at providing the customers with technology integrations by integrating Couchase DBaaS with AWS edge services. The partnership enhances how AWS serves its customers.

- Jul-2022: Oracle has partnered with Microsoft, a technology MNC based in the United States, to integrate Oracle database services with Microsoft Azure. The partnership allows the two companies to serve their customers in a better way by providing them with solutions for multi-cloud.

- Jun-2021: Nutanix entered into a partnership with Hewlett Packard, an IT company based in the United States, to increase the pace of multi-cloud adoption by combining Nutanix Era with HPE Greenlake. Through this partnership, Nutanix will be able to serve its customers better by providing them with hybrid cloud services.

Product Launches and Product Expansions:

- Mar-2023: Microsoft revealed Azure Communications Gateway. Azure communications gateway is a cloud-based voice gateway that allows the combining of Teams phones with operator networks. The benefits of the service include time and cost savings, enhancing communication and security.

- Feb-2022: Nutanix has unveiled the Nutanix Cloud Platform. Nutanix Cloud Platform provides solutions for executing multi-cloud strategies. The Nutanix Cloud Platform features Nutanix cloud infrastructure, Nutanix cloud manager, Nutanix unified storage, Nutanix database service, and Nutanix end-user computing solutions.

- Aug-2022: Teradata has unveiled Vantage cloud lake. Vantage cloud lake is based on Teradata's cloud-native architecture and is used to utilize object storage services. The benefits of the product include Smat scaling, modernizing, management, analytics, and flexibility.

Acquisitions and Mergers:

- Apr-2023: IBM took over Ahana, a SaaS solutions provider. The acquisition complements IBM's strategy for growth in open-source foundations. With this acquisition, IBM has now become the premier solutions provider to open-source communities.

- Jul-2021: IBM took over Bluetab Solutions Group, an IT consulting and services firm. With this acquisition, IBM focused on widening its portfolio of data and hybrid cloud consulting services. The acquisition propelled customers' cloud migration and aided them in realizing the importance of the cloud through their mission-critical data.

Scope of the Study

By Database Type

- Relational Database

- NoSQL

By Industry

- Telecom & IT

- BFSI

- Manufacturing

- Retail & eCommerce

- Government & Public Sector

- Healthcare & Life Sciences

- Automotive

- Media & Entertainment

- Others

By Component

- Solution

- Storage

- Database Management

- Services

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Deployment

- Hybrid

- Public

- Private

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Google LLC (Alphabet Inc.)

- Nutanix, Inc.

- Oracle Corporation

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Alibaba Cloud (Alibaba Group Holding Limited)

- Teradata Corporation

- Ninox Software GmbH

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Google LLC (Alphabet Inc.)

- Nutanix, Inc.

- Oracle Corporation

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Alibaba Cloud (Alibaba Group Holding Limited)

- Teradata Corporation

- Ninox Software GmbH