Processed meat is one of the growing applications of meat-based flavors. Any meat that has changed to enhance flavor or lengthen shelf life is referred to as processed meat. Usually consisting of pork or beef, processed meat can also contain offal, meat, and poultry by-products, including blood. Ham, sausages, corned beef, jerky, salami, bacon, hot dogs, canned meat, chicken nuggets, lunch meat, and sauces using meat as an ingredient are all examples of processed meat products. Therefore, Processed Meat procured $291.7 million revenue in the market in 2022.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2021, Symrise AG partnered with Freddy Hirsch Nigeria to focus on accelerating food innovation and nutrition across West Africa. Additionally, the companies would focus on the development, launch, and commercialization of transformational food products: snacks, bouillon meat, instant noodles, and general seasoning. The partnership would advance the flavor technology platform to offer genuine regional and hyperlocal African flavors and ingredients. Moreover, in April, 2023, Archer Daniels Midland signed an agreement with Believer Meats to work together on product enhancement items through ADM’s ingredients and specialization in nutrition to improve Believer’s cultivated meat process.

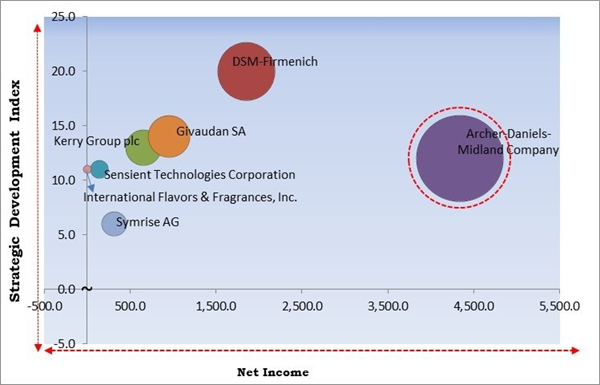

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Archer-Daniels-Midland Company are the forerunners in the Market. In March, 2023, Archer Daniels Midland came into partnership with Air Protein, a company that aims to develop sustainable protein created from thin air. This partnership would help food tech startups create healthy food out of thin air. Furthermore, ADM would offer its ingredients insight, researchers, strategy, and technologies to help Air Protein develop products for commercialization. Companies such as DSM-Firmenich, Givaudan SA and Kerry Group plc are some of the key innovators in Market.Market Growth Factors

Rising trend of veganism increases demand for exotic flavors

One of the major drivers of the market is customers' rising propensity for vegetarianism across the globe. Consumers are turning more and more toward veganism as a result of the excessive or frequent intake of meat as well as meat products. This is because meat and meat products contribute to a number of health problems. For vegans who like the taste of meat, meat tastes are emerging as a healthy alternative.Through foods like soup, sausage, quick noodles, ready-to-eat meals, baked goods, and many more products, meat flavors provide the consumers with both the taste and odor of meat. Hence, the rise in veganism directly influences the growth of the market in the coming years.Rapid use of meat-based flavors in the food service industry

Food chains as well as restaurant menus are increasingly featuring flavorings that make foods more appetizing. The food service sector strives to offer clients fresh, cutting-edge cuisine. To make food look better, the hotel, restaurant, and catering (HoReCa) industry uses a variety of flavors and seasonings. A craving for meaty tastes without genuine meat has arisen due to the move to more plant-based substitutes. By employing meat tastes, specific cooking techniques are used to transform everyday foods into viable meat substitutes. These aspects are anticipated to increase the demand for and growth of market.Market Restraining Factors

Enormous cost of meat-based products like flavors

The high cost of meat-based flavors is one of the main barriers preventing their increased demand. These goods are not affordable for customers from all socioeconomic backgrounds. Additionally, businesses are working hard to roll out affordable plant-based meat substitutes, which can further reduce the demand market share. Moreover, the cost of meat-based flavors also increases because of the numerous processes involved in their production. Concentration, extraction, and blending are complicated procedures for producing meat-based flavors. As a result, the cost of meat-based flavors may increase overall since adhering to these requirements frequently necessitates extra expenditures in quality control procedures, testing, and certifications.Application Outlook

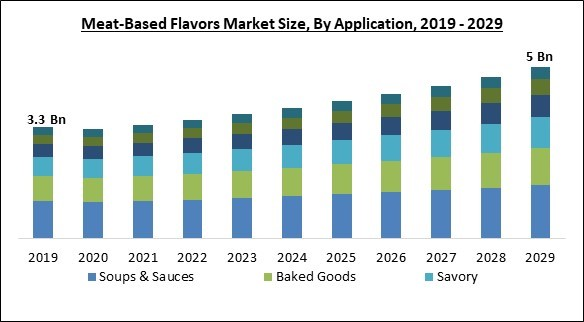

On the basis of application, the market is bifurcated into baked goods, soups & sauces, savory, ready meals, processed meat, and others. The soups and sauces segment garnered the highest revenue share in the market in 2022. As they are used to improve the texture and flavor of meat dishes and are utilized in a variety of ways, including stews and roasts, soups and sauces are crucial parts of the market. Demand for diverse meat-based soups in eateries and fast-food chains has increased as soup becomes a more popular meal on its own.Type Outlook

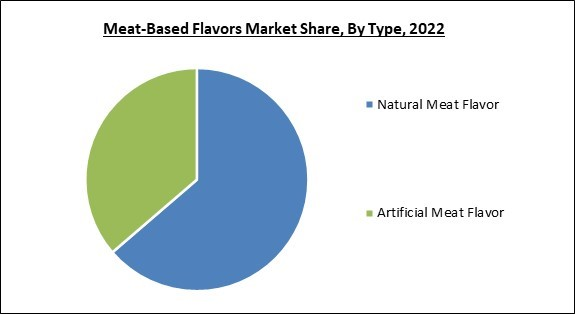

Based on type, the market is segmented into natural meat flavor and artificial meat flavor. The artificial meat flavor segment witnessed a significant revenue share in the market in 2022. Chemicals or other ingredients are incorporated into meat products to create artificial meat flavors, which change the taste of the meat. They can mimic the flavors of various poultry, seafood, meats, or vegetables. The fragrance and smell of meat are mimicked with artificial meat flavoring. It can be found in foods like liver sausages, liverwurst, hamburgers, hot dogs, and more.Flavor Outlook

By flavor, the market is fragmented into chicken, beef, pork, turkey, fish & seafood, and others. The beef segment garnered the maximum revenue share in the market in 2022. Beef, the second most popular meat consumed after chicken, is the term used in cuisine to refer to meat produced by bovine animals. Since there is a strong demand for fresh meat and an insufficient supply due to political and environmental factors, the demand for beef flavors is rising. Food safety difficulties, such as chemical residues and disease detection in other meats as well as beef-based flavors' rising usage, are major contributing factors to the segment's expansion.Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia Pacific and LAMEA. The North America segment recorded the highest revenue share in the market in 2022. People in this region are becoming increasingly aware of the health benefits connected with plant-based components. Additionally, the segmented is expected to increase due to the emphasis on reducing the sugar level in food goods, which has resulted in higher product demand from the North America region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Archer-Daniels-Midland Company, Sensient Technologies Corporation, Essentia Protein Solutions, DSM-Firmenich, Symrise AG, Givaudan SA, H.E. Stringer Flavours Limited, International Flavors & Fragrances Inc, Kerry Group plc, and Nikken Foods Co., Ltd.

Recent Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Mar-2023: Archer Daniels Midland came into partnership with Air Protein, a company that aims to develop sustainable protein created from thin air. This partnership would help food tech startups create healthy food out of thin air. Furthermore, ADM would offer its ingredients insight, researchers, strategy, and technologies to help Air Protein develop products for commercialization.

- Apr-2023: Archer Daniels Midland signed an agreement with Believer Meats, a cultivated meat provider. Under this agreement, Both ADM and Believer Meats work together on product enhancement items through ADM’s ingredients and specialization in nutrition to improve Believer’s cultivated meat process.

- Dec-2022: IFF partnered with Salus Optima, a digitally enabled personalized nutrition, health, and wellness company. Under this partnership, both companies created an artificial intelligence-driven personalized nutrition platform. The platform is developed to help consumers realize their unique metabolic response to supplements, food, activity, and sleep, accessible via wearables and mobile phones.

- Apr-2022: International Flavors & Fragrances collaborated with SimpliiGood by Algaecore Technologies, an Israel-based food tech startup. This partnership aims to make a smoked salmon analog comprehensively out of spirulina. Moreover, both companies could herald a huge step forward in the plant-based meat sector: a meat analog that’s essentially made from one ingredient.

- Feb-2022: Givaudan teamed up with Fiberstar, a US-based company. This collaboration aimed to allow Givaudan to leverage and commercialize Citri-Fi, a natural plant-based texturizing ingredient of Fiberstar, to expand its Taste & Well-being offerings. In addition, the collaboration would also allow Fiberstar to expand its geographical footprint and leverage new R&D opportunities.

- Oct-2021: Symrise AG partnered with Freddy Hirsch Nigeria, a company engaged in the manufacture of spices, ingredients, and flavors. Through this partnership, Symrise AG and Freddy Hirsch Nigeria are focused on accelerating food innovation and nutrition across West Africa. Additionally, the companies would focus on the development, launch, and commercialization of transformational food products: snacks, bouillon meat, instant noodles, and general seasoning. The partnership would advance the flavor technology platform to offer genuine regional and hyperlocal African flavors and ingredients.

- Sep-2021: Royal DSM entered into a partnership with Meatable, a Dutch cell-based meat manufacturer. The partnership aimed to jointly develop affordable growth media for cultivated protein. The partnership focused on the development of meat-like taste & textures a challenge that both fermented and plant-based alternatives have continued to face in the final product.

Product Launches and Product Expansions:

- Mar-2023: Kerry announced the launch of SucculencePB, the solution for plant-based meat alternatives that re-create the delicious, juicy taste of meat craved by consumers everywhere. The product offers an enhanced nutritional profile and environmental impact and, also clears the 'dry mouth' taste issues in cooked plant-based meat alternatives.

- Mar-2023: Sensient Flavors & Extracts Europe introduced Nacre umami booster extract, the taste-enhancing solution for sweet and savory applications. This launch would decrease salt use in snacks, meats, and bread products; covers unwanted tastes in the meat-alternative portfolio, and improve base taste stability and notes in stocks, sauces, and bouillions.

- Nov-2022: International Flavors & Fragrances released Supro Tex, a soy-based plant protein ingredient that can be made into products with a similar texture to chunks of whole-muscle meat. The product would be available as a dried protein, which makes it simple to transport and store.

- May-2022: Givaudan unveiled NaNino+, a patent-pending synergistic blend of natural flavorings and plant-based ingredients which is used as a nitrite replacement in processed meat. The Product is developed with its natural ingredients, which offers a lasting multi-sensorial food experience with enhanced taste, color, and freshness.

- Feb-2022: Givaudan announced the launch of PrimeLock+, a patent-pending, natural, vegan-friendly integrated solution that imitates animal fat cells, allowing food companies to take plant-based product development and consumer satisfaction to the next level. The Product abbreviate secures and locks in both fat and flavor in plant-based meat substitutes, offering a genuine and tasty food experience.

- Jun-2021: Firmenich introduced Dynarome TR, the new addition to its SmartProteins technology offerings, developed to offer a natural and genuine cooking odor for meat analogs in numerous plant-based food formats. The product enables tailored flavor release at high temperatures by customizing the composition of its lipid phase.

- Mar-2021: Royal DSM introduced Maxavor® Fish YE, a new vegan, 100% allergen-free flavor solution. The launched product would be derived from algal oil, this advancement enables food manufacturers to provide a genuine fish taste and mouthfeel in a variety of plant-based fish alternative applications, in addition to fish-based products.

Acquisitions and Mergers:

- Mar-2023: Kerry announced the launch of SucculencePB, the solution for plant-based meat alternatives that re-create the delicious, juicy taste of meat craved by consumers everywhere. The product offers an enhanced nutritional profile and environmental impact and, also clears the 'dry mouth' taste issues in cooked plant-based meat alternatives.

- Mar-2023: Sensient Flavors & Extracts Europe introduced Nacre umami booster extract, the taste-enhancing solution for sweet and savory applications. This launch would decrease salt use in snacks, meats, and bread products; covers unwanted tastes in the meat-alternative portfolio, and improve base taste stability and notes in stocks, sauces, and bouillions.

- Nov-2022: International Flavors & Fragrances released Supro Tex, a soy-based plant protein ingredient that can be made into products with a similar texture to chunks of whole-muscle meat. The product would be available as a dried protein, which makes it simple to transport and store.

- May-2022: Givaudan unveiled NaNino+, a patent-pending synergistic blend of natural flavorings and plant-based ingredients which is used as a nitrite replacement in processed meat. The Product is developed with its natural ingredients, which offers a lasting multi-sensorial food experience with enhanced taste, color, and freshness.

- Feb-2022: Givaudan announced the launch of PrimeLock+, a patent-pending, natural, vegan-friendly integrated solution that imitates animal fat cells, allowing food companies to take plant-based product development and consumer satisfaction to the next level. The Product abbreviate secures and locks in both fat and flavor in plant-based meat substitutes, offering a genuine and tasty food experience.

- Jun-2021: Firmenich introduced Dynarome TR, the new addition to its Smart Proteins technology offerings, developed to offer a natural and genuine cooking odour for meat analogs in numerous plant-based food formats. The product enables tailored flavor release at high temperatures by customizing the composition of its lipid phase.

- Mar-2021: Royal DSM introduced Maxavor® Fish YE, a new vegan, 100% allergen-free flavor solution. The launched product would be derived from algal oil, this advancement enables food manufacturers to provide a genuine fish taste and mouthfeel in a variety of plant-based fish alternative applications, in addition to fish-based products.

Scope of the Study

By Application

- Soups & Sauces

- Baked Goods

- Savory

- Ready Meals

- Processed Meat

- Others

By Type

- Natural Meat Flavor

- Artificial Meat Flavor

By Flavor

- Beef

- Chicken

- Pork

- Turkey

- Fish & Seafood

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Archer-Daniels-Midland Company

- Sensient Technologies Corporation

- Essentia Protein Solutions

- DSM-Firmenich

- Symrise AG

- Givaudan SA

- H.E. Stringer Flavours Limited

- International Flavors & Fragrances Inc

- Kerry Group plc

- Nikken Foods Co., Ltd.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Archer-Daniels-Midland Company

- Sensient Technologies Corporation

- Essentia Protein Solutions

- DSM-Firmenich

- Symrise AG

- Givaudan SA

- H.E. Stringer Flavours Limited

- International Flavors & Fragrances Inc

- Kerry Group plc

- Nikken Foods Co., Ltd.