Reciprocating chiller adoption is growing, and it is the most widely used kind of water chiller. The evaporator and condenser coils are filled with refrigerant using a piston-style compressor. Following further compression, the refrigerant is sent back to the condenser. As long as the target temperature is not attained, this procedure continues. Reciprocating chillers are more affordable than various kinds of chillers. Therefore, Reciprocating chillers attained $342.3 million revenue in the market in 2022. Some of the factors impacting the market are rising urbanization and cooling requirements worldwide, durability and improved efficiency in terms of energy consumption, and high cost of installation and maintenance.

The demand is predicted to expand quickly because of the rise in the number of commercial buildings like hotels, offices, airports, schools, and hospitals. Because of its increased efficiency and longer lifespan, a water chiller system can benefit by lowering energy and maintenance expenses. As more hospitals, clinics, colleges, and schools worldwide increase, the demand for cooling will rise further. Compared to other cooling systems and devices, water-cooled air chillers frequently use less energy. The ambient dry-bulb temperature controls the refrigerant's temperature condensing in an air-cooled water chiller. In a water-cooled chiller, the condenser water temperature, determined by the outside wet bulb temperature, determines the condensing temperature.

However, a significant barrier is, however, the increased price of water chillers. Since cooling towers, as well as condenser water pumps, are not required as part of the construction of air chillers, they are less expensive than water chillers. Additionally, in humid situations, water chillers perform worse than air chillers. This is because humidity raises the wet-bulb temperature, a measurement of how effectively water absorbs heat. Hence, all these factors limit the expansion of the market.

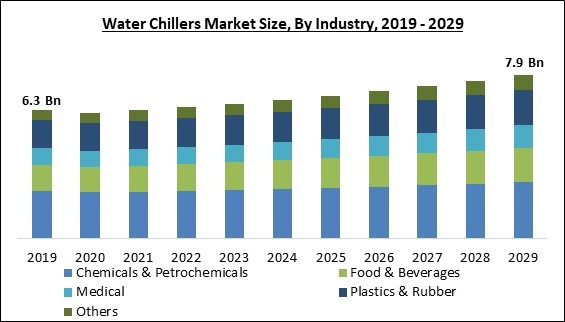

Industry Outlook

On the basis of end-user industry, the market is classified into chemicals & petrochemicals, food & beverages, plastics & rubber, medical, and others. The food and beverages segment witnessed a significant revenue share in the market in 2022. The food & beverage industry's explosive growth is responsible for the segment's increasing growth. The use of water chillers is increasing rapidly in order to maintain the working environment of factories, which is another important reason. Various market participants in the food & beverage industry use industrial air chillers to safeguard food and beverage goods against contamination.Capacity Outlook

By capacity, the market is divided into 0-100 kW, 101-350 kW, 351-700 kW, and >700 kW. The >700 kW segment garnered the maximum revenue share in the market in 2022. In order to accelerate the growth of the segment, major firms are creating cutting-edge, low-energy chillers. Large-capacity water chillers often incorporate advanced technologies and design features that optimize energy efficiency. As a result, they can achieve higher Coefficient of Performance (COP) values, providing greater cooling output per unit of energy consumed. This efficiency can lead to cost savings in energy bills and reduced environmental impact.System Outlook

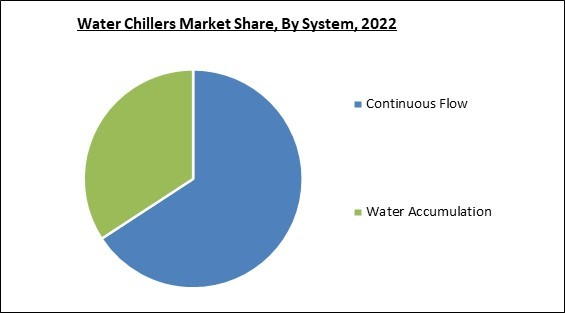

Based on the system, the market is segmented into water accumulation and continuous flow. The water accumulation segment recorded a substantial revenue share in the market in 2022. Water accumulation systems reduce the frequency of chiller cycling, which helps extend the lifespan of the chiller equipment. Cycling refers to the repetitive start-stop operation of the chiller unit. By storing and utilizing chilled water from the accumulation system, the chiller can operate for longer durations, reducing wear and tear on the equipment and minimizing maintenance requirements. They help lower greenhouse gas emissions associated with electricity generation, reduce strain on the electrical grid, and promote more efficient use of resources.Type Outlook

Based on type, the market is characterized into absorption chiller, reciprocating chiller, screw chiller, scroll chiller, centrifugal chiller, and others. The screw chiller segment garnered the highest revenue share in the market in 2022. When conducting the vapor-compression refrigeration process, a screw chiller uses two rotating helical screws. Screw chillers are less bulky, quieter, and equipped with fewer parts than other chillers; as a result, their market is expanding at an accelerated rate. For both industrial processes and cooling systems, screw chillers provide cooling solutions. The cooling capacity of the screw chillers ranges from 20 tons to up to 1,000 tons, and they are lightweight and small.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed the largest revenue share in the market in 2022. Rapid urbanization, strong economic growth, and a sizable population base all play a vital role in the market expansion in the Asia Pacific region. In addition, a rise in construction and maintenance activity in developing nations like India, Vietnam, China, and Indonesia is a major driver of the need for water chillers.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Carrier Global Corporation, Mitsubishi Electric Corporation, Daikin Industries, Ltd., Dimplex Thermal Solutions, Inc. (Glen Dimplex Ireland), LG Electronics (LG Corporation), Johnson Controls International PLC, Gree Electric Appliances, Inc. of Zhuhai, Thermax Limited, Midea Group Co., Ltd., and Trane Technologies PLC.

Scope of the Study

By Industry

- Chemicals & Petrochemicals

- Food & Beverages

- Medical

- Plastics & Rubber

- Others

By Capacity

- >700 kW

- 351-700 kW

- 101-350 kW

- 0-100 kW

By System

- Continuous Flow

- Water Accumulation

By Type

- Screw Chiller

- Scroll Chiller

- Centrifugal Chiller

- Absorption Chiller

- Reciprocating Chiller

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- Dimplex Thermal Solutions, Inc. (Glen Dimplex Ireland)

- LG Electronics (LG Corporation)

- Johnson Controls International PLC

- Gree Electric Appliances, Inc. of Zhuhai

- Thermax Limited

- Midea Group Co., Ltd.

- Trane Technologies PLC

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- Dimplex Thermal Solutions, Inc. (Glen Dimplex Ireland)

- LG Electronics (LG Corporation)

- Johnson Controls International PLC

- Gree Electric Appliances, Inc. of Zhuhai

- Thermax Limited

- Midea Group Co., Ltd.

- Trane Technologies PLC