Natural Biomaterials is gaining popularity and growing at a faster rate because of its capacity for integrating and modifying as well as their bio-compatibility with the patient's tissue. Therefore, Natural Biomaterials registered $157.8 million revenue in 2022. According to a recent analysis of Global Burden of Disease (GBD) 2019 statistics, 1.71 billion people worldwide are affected by musculoskeletal diseases such as fractures, osteoarthritis, amputation and other injuries, and arthritis. Most affected are 441 million in high-income countries, 427 million in the WHO Western Pacific Region, and 369 million in the WHO South-East Asia Region. In addition, musculoskeletal diseases are the leading cause of YLDs, accounting for more than 149 million YLDs, or 17 percent of all YLDs globally.

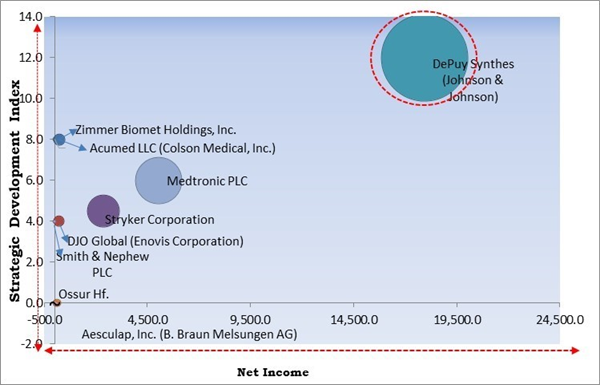

The major strategies followed by the market participants are Acquisitions as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In November, 2020, Stryker acquired Wright Medical Group N.V. to innovate and reach more patients. Additionally, In May, 2023, Zimmer Biomet took over Ossis to build out their partnership and broadening Zimmer Biomet's orthopedic suite with the addition of Ossis' personalized implants. Together with this, Zimmer Biomet Holdings, Inc. acquired Embody, Inc. in February, 2023, to strengthen its growing Sports Medicine suite and supports continued business transformation.

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; DePuy Synthes (Johnson & Johnson) is the forerunner in the Market. In October, 2021, DePuy Synthes introduced Variable Angle Locking Compression Plate, a 2.7 mm Clavicle Plate System, for the treatment of lateral, shaft and medial fractures for small, medium and large clavicles. The launched product provides plate shapes that show the correlation between clavicle size and patient stature to match the bow and contour of the clavicle and contain a wide range of anatomic variability of the clavicle. Companies such as Medtronic PLC, Stryker Corporation and Zimmer Biomet Holdings, Inc. are some of the key innovators in Market.Market Growth Factors

The increasing prevalence of sport injuries

The leading cause of the increase in injuries, especially in young people, is the year-round participation in a particular sport. Nowadays, many athletes opt to specialize in and focus on just one sport. So today, a slight muscle imbalance or dysfunction is far more likely to lead to an overuse injury. Also, athletes under the age of 18 are suffering more injuries, even though they engage in various preventative activities, putting it into action could be difficult. Thus, for these reasons, sports-related injuries are becoming more common, particularly in young people, which is predicted to drive up demand and support market expansion.The growing number of older adults

Population aging, or a country's movement in age distribution toward older ages, has been seen mostly in high-income nations. However, this trend has the biggest influence in low- and middle-income countries. For instance, the population of Japan is over 60% older than the age of 30. Most people over 60 are expected to live in low- and middle-income countries by 2050. An aging population is on the rise due to increased life expectancy. And as older populations are more prone to muscle or joints related complications, which may require implants like upper extremities, implants are expected to drive the market growth.Market Restraining Factors

Complications following implant surgery

Every surgical operation has some risks; the existence of contagious infections can make these risks worse. The danger of infection, blood effusion, and dislocation are the three main risks associated with joint replacement surgery. Dislocation of the implant is a problem that can happen during an inappropriate movement when the muscles surrounding the implant are too weak (particularly in the first three months following the treatment). Avoiding specific motions is crucial to preventing this problem, especially in the first three months following the operation. This will hinder the market growth for upper extremities implants.Type Outlook

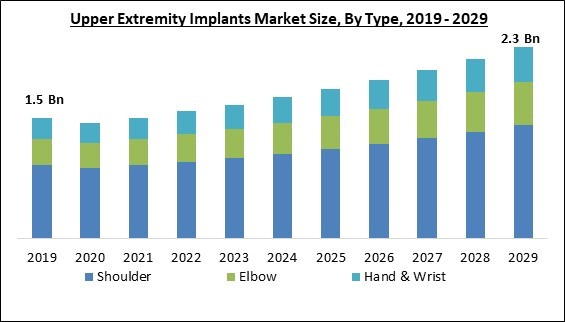

Based on type, the market is segmented into shoulder, elbow and hand & wrist. The shoulder segment held the highest revenue share in the market in 2022. This is due to the increase in sports injuries, shoulder dislocations, an aging population, a growth in osteoarthritis cases, and shoulder fractures, resulting in a rise in demand for products for implanting the upper extremities. In addition, shoulder replacements rank among the most common orthopedic operations for the extremities.End-Use Outlook

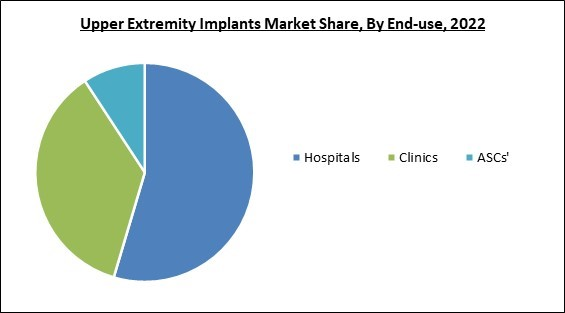

By end-use, the market is classified into hospitals, ASCs’ and clinics. The ASCs’ segment garnered a promising growth rate in the market in 2022. This is due to increased demand for ASCs in upper-extremities procedures, increased new product advancements, and FDA approval. With excellent postoperative pain management, quick patient discharge, few side effects, and overall cost minimization, the ASCs category offers additional benefits to the patient. The above-mentioned factors are anticipated to drive the market segment's growth.Material Outlook

On the basis of material, the market is divided into metallic biomaterials, ceramic biomaterials, polymeric biomaterials and natural biomaterials. The natural biomaterials segment procured a considerable growth rate in the market in 2022. Natural biomaterials have become popular in surgical operations. Also, this biomaterial's scaffolding or support enables cells to begin building new tissue, which provides the segment's growth in the forecasted period.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the market in 2022. This is owing to factors like the increase in shoulder injuries, including fractures, sprains, and strains, as well as dislocations and separations. In addition, the presence of important participants in North America and the rise in sports injuries are driving regional expansion. Also, the need for products has grown significantly as a result of the establishment of healthcare facilities that treat a variety of ailments, such as fractures, dislocations, tendonitis, and arthritis, which is fueling the market growth in the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet Holdings, Inc., Smith & Nephew PLC, Medtronic PLC, Aesculap, Inc. (B. Braun Melsungen AG), DJO Global (Enovis Corporation), Ossur Hf., Acumed LLC (Colson Medical, Inc.) and Arthrex, Inc.

Recent Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- May-2023: Zimmer Biomet took over Ossis, a maker 3D-printed orthopaedic implant. This acquisition would aim to build out their partnership and broadening Zimmer Biomet's orthopedic suite with the addition of Ossis' personalized implants.

- Feb-2023: Zimmer Biomet Holdings, Inc. acquired Embody, Inc., a medical device company focused on soft tissue healing. Under this acquisition, Zimmer Biomet strengthens its growing Sports Medicine suite and supports continued business transformation.

- Jul-2022: Acumed acquired ExsoMed, a provider of advanced solutions for hand surgery. This acquisition of ExsoMed, whose products support an intramedullary approach to treat hand fractures, increase Acumed’s complete suite of upper extremity solutions for easy to complex injuries.

- Jan-2021: DJO, LLC completed the acquisition of Trilliant Surgical®, a national provider of foot and ankle orthopedic implants. Following this acquisition, Trilliant Surgical’s major product technologies and clinical efficacy supports DJO’s focused development into the adjacent high-growth US foot and ankle market.

- Jan-2021: Smith+Nephew completed the acquisition of the Extremity Orthopaedics business of Integra LifeSciences Holdings Corporation, a provider of broader and deeper solutions with an extensive soft tissue reconstruction offering. This acquisition would support Smith+Nephew's strategy to invest in higher growth segments. This would notably strengthen Smith+Nephew's extremities business by adding a combination of a focused sales channel, aligning with shoulder replacement and upper and lower extremities suite.

Product Launches and Product Expansions:

- Oct-2021: DePuy Synthes introduced Variable Angle Locking Compression Plate, a 2.7 mm Clavicle Plate System, for the treatment of lateral, shaft and medial fractures for small, medium and large clavicles. The launched product provides plate shapes that shows the corelation between clavicle size and patient stature to match the bow and contour of the clavicle and contain a wide range of anatomic variability of the clavicle.

- Aug-2021: Johnson & Johnson's DePuy Synthes division announced the launch of the Inhance shoulder system, a fully integrated system that includes both stemmed and stemless implants. The launch enables the surgeon to easily transform from the former to the latter at the time of procedure if required. Additionally, the product is designed to tackle a wide range of cases.

Geographical Expansions:

- Jan-2022: Medtronic plc received a Japan's Ministry of Health, Labour and Welfare for the sale and reimbursement approval of the Micra™ AV Transcatheter Pacing System. This approval broadens the number of patients across Japan eligible to receive Micra TPS, the world's smallest pacemaker.

Approvals and Trials:

- Aug-2022: Stryker opened a new facility in Ireland. The new high-tech facility is a 156,000-square-foot facility, which would reinforce the company's market position in additive manufacturing.

Scope of the Study

By Material

- Metallic Biomaterials

- Ceramic Biomaterials

- Polymeric Biomaterials

- Natural Biomaterials

By Type

- Shoulder

- Elbow

- Hand & Wrist

By End-use

- Hospitals

- Clinics

- ASCs'

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew PLC

- Medtronic PLC

- Aesculap, Inc. (B. Braun Melsungen AG)

- DJO Global (Enovis Corporation)

- Ossur Hf.

- Acumed LLC (Colson Medical, Inc.)

- Arthrex, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew PLC

- Medtronic PLC

- Aesculap, Inc. (B. Braun Melsungen AG)

- DJO Global (Enovis Corporation)

- Ossur Hf.

- Acumed LLC (Colson Medical, Inc.)

- Arthrex, Inc.