Food & Beverages is the major application of Textured Soy Protein because of the increased popularity of vegetarianism and veganism, as well as the growing desire for dairy and meat substitutes. Also, the preference for healthy and quick meals is expanding. Thus, the Food and Beverages sector contributed more than 75% share of the market in 2022. For instance, about 70% of Indians prioritized their dietary changes in 2021 in order to boost their overall health, strengthen their immune systems, and lessen stress and worry. Some of the factors impacting the market are health advantages, increases in soybean production and consumption and unpleasant Soy flavor hindering its adoption.

Soybeans are an excellent source of high-quality protein for vegans and vegetarians because they contain all amino acids absent from other plant foods. Therefore, soy is considered a "complete protein." Numerous health advantages associated with textured soy protein will likely increase its consumption, thereby driving market expansion. Soy products, such as textured soy proteins, are more accessible due to the expansion of soy production in regions such as Asia-Pacific and South America and the soybean industry. Increased demand, coupled with lower production costs, would assist suppliers in propelling market expansion. However, the flavor of soy components, which can be attributed to the action of the lipoxygenase enzyme on soybean oil, is one of the primary reasons soy products have been utilized less frequently in Western nations. Thus, factors like unpleasant flavor and the increasing availability of alternatives will likely hinder market growth.

Product Outlook

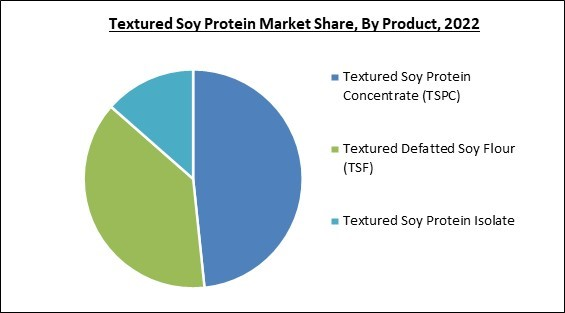

Based on product, the market is segmented into textured defatted soy flour (TSF), textured soy protein concentrate (TSPC) and textured soy protein isolate. The textured soy protein concentrate (TSPC) segment dominated the market with maximum revenue share in 2022. This is due to the high protein content and growing demand for textured soy protein concentrated in the food and beverage industry. Consequently, manufacturers offer a variety of TSPC for end-use applications. More than half of protein-containing high-protein treats are made with TSPC. It is commonly used to extend meat in canned products and effectively replace up to one-fourth of minced beef.Type Outlook

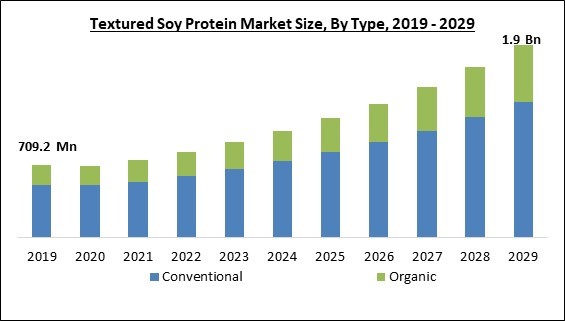

On the basis of type, the market is divided into organic and conventional. The conventional segment held the highest revenue share in the market in 2022. This is due to the associated health benefits of textured soy protein consumption due to its nutritional composition. Vitamin K, folate, riboflavin, vitamin B6, thiamin, and vitamin C are found in soybeans. In addition, they contain substantial amounts of iron, potassium, copper, magnesium, zinc, phosphorus, selenium, and calcium. The primary factor fueling the growth of the conventional type is the nutrient composition of textured soy proteins.Application Outlook

By application, the market is classified into food & beverages and animal feed. The animal feed segment garnered a prominent revenue share in the market in 2022. This is due to the fact that in the fattening phase, soy-based products are fed to cattle to promote rapid growth. This is because it increases the fat deposits in the carcass, enhancing the quality and appeal of the food to consumers. In addition, grass of low nutritional quality must be supplemented with high-energy or high-protein feeds to meet the nutritional requirements of grass-fed cattle, especially grass-fed beef. These factors are anticipated to expand the segment during the projected period.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the market in 2022. This is due to the fact that the most significant product segments in the market in North America are textured defatted soy flour (TSF) and textured soy protein concentrate (TSPC). This can be ascribed to the growing fitness consciousness of consumers, which is anticipated to drive demand for functional foods and beverages over the forecast period.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, International Flavors & Fragrances, Inc., Wilmar International Limited, Linyi Shansong Biological Products Co., Ltd., Bremil Group, Sonic Biochem Extractions Pvt. Ltd., Shandong Yuxin Bio-Tech Co.,Ltd. and Crown Soya Protein Group Company.

Recent Strategies Deployed in the Market

- Mar-2023: ADM signed a joint venture agreement with Marel, an Iceland-based provider of equipment, systems, and services intended for the fish, meat, and poultry industry. The joint venture involves building an innovation center. The innovation center will be built in the Netherlands. The innovation center is intended for food manufacturers to work simultaneously with food scientists, and culinary professionals to experiment on developing new alternative protein products.

- Jan-2023: Cargill acquired Owensboro Grain Company, a US-based producer of oil. The acquisition of Owensboro boosts and supports the acquiring company's production capacity.

- Nov-2022: International Flavors & Fragrances introduced SUPRO TEX, a plant-based protein. The new protein is based on soy protein and eradicates the need for a cold supply chain since it's a dry product.

- Sep-2022: ADM expanded its geographical footprint by establishing a new plant in so protein extrusion facility. The new facility expands the company's non-GMO textured soy protein production capacity.

- Aug-2022: ADM came into partnership with Benson Hill, a food tech company. The partnership involves scaling innovative soy ingredients that would support meeting the evolving demand for plant-based proteins.

- Aug-2022: Archer Daniels Midland came into partnership with Benson Hill, a US-based food technology company. The partnership involves scaling Benson's ultra-high protein soybeans and would enable ADM to commercialize ingredients derived from Benson's UHP soybeans.

- Nov-2021: ADM took over Sojaprotein, a Serbia-based company engaged in processing soybean products. The addition of Sojaprotein reinforces the acquiring company's plant-based protein capabilities. Together, the companies possess the ability to cater to the needs of European clients who are in search of locally-sourced, non-GMO plant-based ingredients.

- Dec-2019: Cargill introduces Radipure pea protein for the Asian market. The pea protein features, low allergenic content, is non-GMO, and label friendly. Radipure can be used in RTD beverages, meat alternatives, and dairy, among others.

Scope of the Study

By Type

- Conventional

- Organic

By Application

- Food & Beverages

- Animal Feed

By Product

- Textured Soy Protein Concentrate (TSPC)

- Textured Defatted Soy Flour (TSF)

- Textured Soy Protein Isolate

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International Limited

- Linyi Shansong Biological Products Co., Ltd.

- Bremil Group

- Sonic Biochem Extractions Pvt. Ltd.

- Shandong Yuxin Bio-Tech Co.,Ltd.

- Crown Soya Protein Group Company

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International Limited

- Linyi Shansong Biological Products Co., Ltd.

- Bremil Group

- Sonic Biochem Extractions Pvt. Ltd.

- Shandong Yuxin Bio-Tech Co.,Ltd.

- Crown Soya Protein Group Company