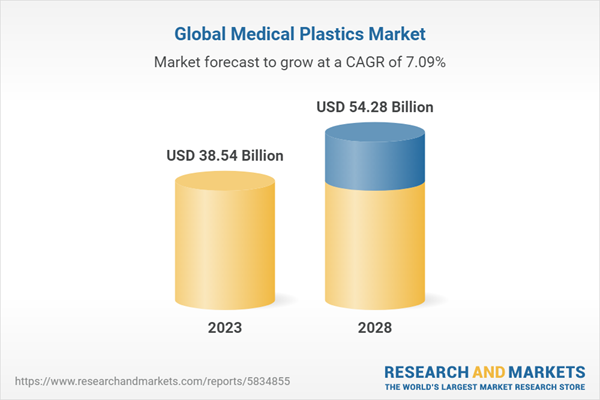

The global medical plastics market in 2022 stood at US$34.95 billion, and is likely to reach US$54.28 billion by 2028. Medical Plastics are a class of materials specifically designed and used in various healthcare applications. They are widely employed in medical devices, equipment, packaging, and even surgical implants. These plastics possess properties that make them suitable for medical use, such as biocompatibility, durability, chemical resistance, and sterilization capabilities.

In recent years, the usage of medical plastics has increased for various reasons, primarily due to its distinct properties. New technological innovations associated with medical plastics makes it more user-friendly. For instance, the use of biometric identification in medical devices. As consumers continue to increase their awareness of lifestyle and diseases associated with it such as diabetes and heart disease, it is expected that the medical plastics market to deepen its offering in specific home healthcare. The global medical plastics market is projected to grow at a CAGR of 7.09% during the forecast period of 2023-2028.

Market Segmentation Analysis:

- By Type: Based on the type, the global medical plastics market can be segmented into six segments: Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene, Silicone, Engineering Plastic and Others. In 2022, polyvinyl chloride (PVC) dominated the market, owing to unique technical properties that make it suitable for a range of life-saving medical applications such as tubing, containers, blood bags, catheters, masks, gloves, and more. During the forecasted period of 2023-2028, polypropylene is the fastest growing segment in medical plastics. Polypropylene (PP) is widely used as single-use plastic in medical industry. It is highly resistant to high temperatures, therefore could undergo extreme steam sterilization and maintains high durability after processing. The anticipated growth is fueled by the growing demand of single use plastics in the healthcare and rising demand for home healthcare among the consumers.

- By Application: The report provides the medical plastics market analysis based on application: Medical Disposals, Drugs Packaging, Medical Instruments, Prosthetics and Implants and Others. The medical disposals segment held the largest share in the market, whereas the medical instruments segment is expected to be the fastest-growing segment in the forecasted period. The most commonly used medical disposals are hypodermic needles, syringes, applicators, bandages and wraps, drug tests, exam gowns and face masks. With newer devices constantly being developed, the need for new components and new specialty materials continues to increase. At the same time, new polymers and polymer formulations available for use continue to grow which would expand the market in the coming years.

- By Region: According to this report, the global medical market can be divided into four major regions: North America (the US, Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain and rest of Europe), Asia Pacific (China, Japan, India, and Rest of the Asia Pacific) and Rest of the World. In 2022, North America dominates the global medical plastics market, driven by rise in geriatric population and the increasing demand for home healthcare services. Within North America, the US dominates the market.

- Europe’s medical plastic market is mainly driven by the demand for single-use healthcare products and surgical procedures. Britain has been at the heart of some of the biggest biomedical breakthroughs of recent decades. All these advancements provide many opportunities for the medical plastics industry to prosper.

- Asia Pacific is anticipated to be the fastest growing region in the medical plastics market. China, Japan, and India are the exclusive contributors to the manufacturing and supply of medical plastics. Japan is known for its advanced healthcare industry. Digital transformation in healthcare is replacing conventional devices and updating devices by inculcating biometric identification and AI.

Global Medical Plastics Market Dynamics:

- Growth Drivers: According to the IMF, the rising GDP per capita in both advanced and developing economies has led to an increase in disposable income, particularly among an expanding middle class. This surge in income has propelled consumer spending on healthcare such as buying home healthcare and specialized devices. Strong purchasing power of people is enabling them to increase their expenditures on personal medical devices, supporting the demand for medical solutions at massive rates. This has resulted in increasing demand for plastics globally needed to manufacture medical devices and instruments. Further, the market is expected to grow owing to increasing surgical treatments, rise in healthcare expenditure, and increase in packaging application etc. in recent years.

- Challenges: The medical plastics market pose a serious threat to the environment. With no proper disposal of medical plastics products, the environment is getting polluted. There is no strict regulations and management regarding the medical waste which eventually leads to rise in diseases causing germs, contaminated air and environmental degradation. Additionally, other factors like regulatory changes, health concerns, etc. are other challenges to the market.

- Market Trends: Digitalization and technological advancements is the ongoing trend which is influencing the medical plastics products. New medical devices are replacing the existing ones with features improving patient-experience. Additionally, use of engineering plastics is highly popularized owing to its enhanced mechanical, thermal, chemical, and electrical properties. With the innovation of 3D printing, prosthetics and mobility aids can be manufactured with ease. More devices and equipment can be produced in a shorter duration of time. More trends in the market are believed to grow the medical plastics market during the forecasted period, which may include, technological innovations, home healthcare, mobility aids, 3D printing, etc.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic has had a profound impact on the healthcare sector, causing significant disruptions, challenges, and transformations. Rising cases of novel coronavirus increased the demand for more healthcare devices and the basic requirement of medical plastics. The global demand for Personal Protective Equipment (PPE), such as masks, gloves, and gowns, surged during the pandemic. Medical plastics, such as polypropylene and polyethylene, are vital components of PPE. The increased demand for PPE to protect healthcare workers and the general population led to a surge in the production and consumption of medical-grade plastics.

The pandemic's transformative changes presented both challenges and opportunities, paving the way for the medical plastics industry's evolution in the post-COVID era. The post-COVID impact on the medical plastics market is expected to result in well-established supply chain, resilient healthcare sector, scaling up innovation, accelerate technology adoption, and address industry challenges collectively.

Competitive Landscape and Recent Developments:

The global medical plastics market is moderately fragmented. This is largely due to the presence of small and large companies on a global scale with vivid medical products and strong distribution networks. Leading companies like Evonik AG and Saint-Gobain are competing against each other by innovating products with new features. Germany based research centers are conducting trials on new products extensively.

The key players in the global medical plastics are:

- SABIC (Saudi Basic Industries Corporation)

- Evonik Industries AG

- Saint-Gobain

- Celanese Corporation

- Mitsubishi Chemical Group Corporation

- Solvay SA

- BASF SE

- Arkema Group (Arkema S.A.)

- Röchling Group,

- Eastman Chemical Company

- Nolato AB

- Covestro AG

Some of the strategies among key players in the market are new launch, mergers, acquisitions, and collaborations. For instance, Formerra acquired Total Polymer Solutions (TPS) in 2023. The acquisition of TPS is to enhance Formerra in the healthcare market and align with the company’s plan of expanding into Europe. On the other hand, Fraunhofer IGD has developed 3D printed prosthetic eye. The 3D-printed prosthetic eye produced in a fraction of the time taken by the conventional process.

Table of Contents

1. Executive Summary

Companies Mentioned

- SABIC (Saudi Basic Industries Corporation)

- Evonik Industries AG

- Saint-Gobain

- Celanese Corporation

- Mitsubishi Chemical Group Corporation

- Solvay SA

- BASF SE

- Arkema Group (Arkema S.A.)

- Röchling Group,

- Eastman Chemical Company

- Nolato AB

- Covestro AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | June 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 38.54 Billion |

| Forecasted Market Value ( USD | $ 54.28 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |