Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & DRIVERS

Increasing Potential for Electric Tractors

There is certainly increasing potential for electric tractors in Austria, as the country has been actively promoting the adoption of electric vehicles in recent years. The government has set a goal of achieving 100% renewable electricity by 2030, and part of this effort is offering various incentives and subsidies for the purchase of electric vehicles. The Austria tractor market has around eighty electric vehicle startups, like Kreisel Electric and Fronius International. In December 2021, John Deere signed an agreement with Kreisel Electric, a battery technology provided and based in Austria.Growth in Agricultural Productivity & Exports

Austria has been experiencing significant agricultural productivity and export growth in recent years. The growth has been driven by a combination of factors, including adopting new technologies and farming practices, investment in research and development, and increased demand for high-quality food products domestically and internationally. One of Austria's main drivers of agricultural productivity has been adopting sustainable and environmentally friendly farming practices. This includes using organic farming methods, which have become increasingly popular recently.INDUSTRY RESTRAINTS

Rising Demand for Used & Rental Tractors

One of the reasons for the rising demand for used and rented tractors in Austria is that it has become increasingly difficult for many farmers to afford to buy new tractors as their price has risen in recent years. As a result, many people are switching to used tractors as a more cost-effective choice. Used tractors are frequently more affordable than new ones and can still be highly reliable and productive for agricultural tasks. Such factors are projected to hamper the growth of the Austria tractor market.SEGMENTATION INSIGHTS

INSIGHTS BY HORSEPOWER

Tractors in the power range of 50 HP-100 HP are likely to be the largest contributors to the Austria tractor market growth. Some factors that favor the sales of tractors in the 50 HP-100 HP range are as follows: versatility, presence of hard soil in Austria, and increase in purchasing power of farmers due to better minimum support price (MSP) and crop realization. Stakeholders in food production, including public and private bodies and farmers, focus on closing the yield gap and substantial increments in the amount of food produced as the global challenge regarding food shortage mirrors in the country. Tractors will play a pivotal role in operating all new-age, technologically advanced equipment to fulfill the increased farm output needs.Segmentation by Horsepower

- Less Than 50 HP

- 50 HP-100 HP

- Above 100 HP

INSIGHTS BY DRIVE TYPE

The Austria tractor market is categorized into the following segments based on the drive type of tractors 2-wheel drive and 4-wheel drive. The industry is dominated by mid-range HP 2WD tractors, as 2WD tractors are the most preferred tractors by farmers in the country. The low relative cost of ownership and numerous features and haulage power make 2WD tractors more popular among farmers. Popular brands, including John Deere, CNH Industrial, and AGCO, are the preferred choices for 2WD tractors among farmers in the country.Segmentation by Wheel Drive

- 2-Wheel-Drive

- 4-Wheel-Drive

REGIONAL ANALYSIS

The Lower Austria region held the most substantial Austria tractor market share in 2022. The Lower Austria region leads the nation in adopting and penetrating farm mechanization practices. The major regions in the Lower Austria region are Waldviertel, Mostviertel, Industrieviertel, and Weinviertel. In Lower Austria, Waldviertel is a high-potential industry for new tractors and advanced agricultural tools. Further, with a focus on premium goods and environmentally friendly farming methods, Lower Austria’s agricultural sector is diverse and productive overall. The area contributes significantly to Austria’s agricultural production due to its rich soil, pleasant temperature, and market accessibility.Segmentation by Geography

- Lower Austria

- Styria

- Carinthia

- Burgenland

- Others

COMPETITIVE LANDSCAPE

CNH, AGCO, and John Deere dominated the Austria tractor market. These players focus on innovations to compete in the industry. They invest in developing advanced agriculture tractor technology for precision farming and machine automation. Further, the industry has many established players that provide their products in open fields, vineyards, and others.Key Company Profiles

- John Deere

- Kubota

- AGCO

- CNH Industrial

- Steyr Traktoren

Other Prominent Vendors

- Arbos

- CLAAS

- Iseki

- SDF

- Yanmar

KEY QUESTIONS ANSWERED:

- What are the expected units sold in the Austria tractor market by 2028?

- What is the growth rate of the Austria tractor market?

- How big is the Austria tractor market?

- Which region holds the largest Austria tractor market share?

- Who are the key companies in the Austria tractor market?

Table of Contents

Companies Mentioned

- John Deere

- Kubota

- AGCO

- CNH Industrial

- Steyr Traktoren

- Arbos

- CLAAS

- Iseki

- SDF

- Yanmar

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

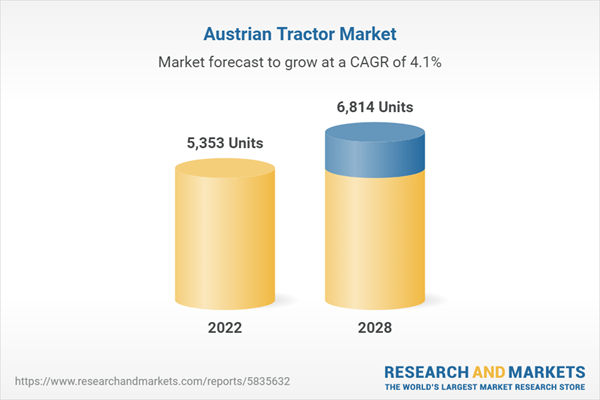

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 5353 Units |

| Forecasted Market Value by 2028 | 6814 Units |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Austria |

| No. of Companies Mentioned | 10 |