Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to data from the Food and Agriculture Organization, global tuna trade volume rose by 28 percent in 2024 compared to the previous year, a surge attributed to escalating demand for canned varieties. Despite this positive trajectory, the sector encounters considerable hurdles related to sustainable sourcing and overfishing; mounting regulatory pressures and environmental worries regarding fish stock levels threaten to interrupt supply chains and escalate operational expenses for manufacturers.

Market Drivers

The growing consumer appetite for convenient, ready-to-eat meal options is a major engine for market growth, fueled by rapid urbanization and the demanding schedules of contemporary households. As a crucial pantry staple offering high protein and long shelf stability with minimal preparation requirements, canned tuna appeals strongly to time-poor consumers. This dependence on processed seafood for quick meals is driving significant trade activity; according to the '2024 Seafood Export Report' by the Vietnam Association of Seafood Exporters and Producers in February 2025, Vietnam’s canned tuna exports increased by 17 percent in 2024, achieving a value of USD 299 million due to consistent international orders, while the product's versatility in dishes like salads and pasta secures its leadership in the shelf-stable category.Concurrently, the increasing demand for eco-certified and sustainably sourced seafood is fundamentally altering industry operations and supply chain transparency. Retailers and informed consumers are prioritizing products with credible eco-labels, forcing manufacturers to meet rigorous sourcing standards to retain market access. According to the International Seafood Sustainability Foundation's 'Status of the Stocks' report from March 2025, roughly 87 percent of the global commercial tuna catch now comes from stocks at healthy abundance levels, reflecting the industry's dedication to environmental stewardship. This pivot toward responsible sourcing is especially influential in Europe; the Vietnam Association of Seafood Exporters and Producers noted in 2025 that tuna exports to Portugal skyrocketed by 313 percent, highlighting the intense demand for high-quality, compliant seafood in markets with strict import rules.

Market Challenges

Sustainable sourcing issues and overfishing pose significant obstacles to the stability and growth of the Global Canned Tuna Market. As environmental anxieties rise, regulatory authorities are implementing tighter compliance standards and catch limits to avert the exhaustion of marine resources. These essential measures introduce volatility into the supply chain, forcing manufacturers to deal with unpredictable variations in raw material availability. Consequently, inconsistent fish landings compel processors to manage unstable procurement costs, which directly affects operational margins and hinders the ability to sustain production levels necessary to satisfy global demand.This instability in supply is highlighted by recent statistics regarding the severity of stock depletion. According to the International Seafood Sustainability Foundation, approximately 10 percent of the global commercial tuna catch in 2024 was derived from overfished stocks. This data suggests that a substantial segment of the raw material supply depends on fragile ecosystems, thereby raising the probability of future regulatory restrictions. Such reliance on compromised stocks forces companies to absorb increased costs associated with certification and traceability, placing further strain on the industry’s financial potential without ensuring long-term security in production volume.

Market Trends

To counter commoditization and attract flavor-seeking consumers, manufacturers are increasingly diversifying their portfolios by expanding seasoned and flavor-infused tuna options. Moving beyond traditional brine and oil formulations, companies are launching culinary-inspired varieties such as lemon pepper, spicy chili, and basil-infused tuna, positioning the product as a premium, standalone snack rather than a mere ingredient. This strategic shift toward higher-margin items is generating tangible financial gains; Thai Union’s '2024 Annual Review', published in February 2025, reported a 5.2 percent year-over-year sales increase in their value-added category for 2024, largely attributed to the success of these innovative, ready-to-eat lines.In parallel, the industry is experiencing a structural shift from traditional metal cans to flexible pouch packaging, driven by consumer usability and logistical efficiency. Flexible pouches provide a lightweight, shelf-stable solution that requires no draining, catering to modern on-the-go consumption habits while lowering freight costs for exporters. This transition in packaging is gaining significant momentum in key global markets; according to Atuna’s August 2025 report, 'US Pouch Importers Anticipated Effects Of Upcoming Tariffs', the United States saw a 12 percent rise in tuna pouch imports during the first half of 2025 compared to the same period the prior year, indicating a continued departure from rigid containers.

Key Players Profiled in the Canned Tuna Market

- Frinsa Del Noroeste S.A

- Century Pacific Group, Inc.

- Jesus Alonso, S.A.

- Thai Union Group PCL.

- FCF Co., Ltd.

- CALVO DISTRIBUCIoN ALIMENTARIA SLU

- Wild Planet Foods, Inc.

- PT. Aneka Tuna Indonesia

- American Tuna, Inc.

- Ocean Brands GP.

Report Scope

In this report, the Global Canned Tuna Market has been segmented into the following categories:Canned Tuna Market, by Tuna Species:

- Skipjack Canned Tuna

- Albacore Canned Tuna

- Yellowfin Canned Tuna

- Bluefin Canned Tuna

- Others

Canned Tuna Market, by Flavor:

- Lemon

- Spicy

- Tomato

- Picante

- Clover Leaf

- Others

Canned Tuna Market, by Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Food Specialty Stores

- Online

- Others

Canned Tuna Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Canned Tuna Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Canned Tuna market report include:- Frinsa Del Noroeste S.A

- Century Pacific Group, Inc.

- Jesus Alonso, S.A.

- Thai Union Group PCL.

- FCF Co., Ltd

- CALVO DISTRIBUCIoN ALIMENTARIA SLU

- Wild Planet Foods, Inc.

- PT. Aneka Tuna Indonesia

- American Tuna, Inc

- Ocean Brands GP.

Table Information

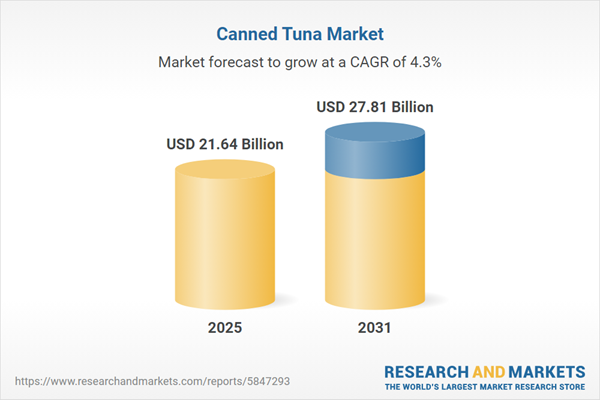

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 21.64 Billion |

| Forecasted Market Value ( USD | $ 27.81 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |