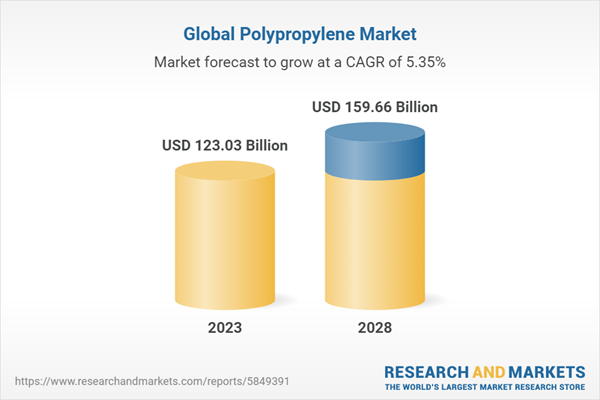

Polypropylene (PP), a polyolefin film created by polymerizing propylene, is one of the most widely employed plastics globally (behind polypropylene), owing to its many highly advantageous characteristics that make it suitable for a wide range of applications. Since polypropylene is a thermoplastic polymer that melts to a liquid at its melting point, it is elementary to mold. It can be reheated and molded into different shapes without severe material deterioration. The global polypropylene market in 2022 was valued at US$116.79 billion and is foreseen to reach US$159.66 billion by 2028. In 2022, the global polypropylene market witnessed a demand of 86.74 million tons, while the global production capacity reached 97.86 million tons.

The global polypropylene market recorded growth in the past few years due to various reasons such as increasing utilization of polypropylene and its wide scale industry in several industry verticals. Growing demand for packaging material and rising use of polypropylene in automotive sector also boosted the global polypropylene market. The polypropylene market is projected to grow at a CAGR of 5.35%, during the forecast period of 2023-2028.

Market Segmentation Analysis:

- By Type: The report splits the global polypropylene market into two different product type: Homopolymer Polypropylene, & Copolymer Polypropylene. Homopolymer polypropylene refers to a polymer composed of propylene units only, resulting in a polymer chain made up of a single type of monomer. It is the most common and widely used form of polypropylene. Homopolymer polypropylene offers excellent stiffness and strength properties, making it suitable for applications that require structural integrity and dimensional stability, such as automotive parts, packaging, and consumer goods.

- By Industry: The report divides the global polypropylene market into eight industrial verticals: Packaging, Automotive, Infrastructure & Construction, Consumer Goods/Lifestyle, Electrical & Electronics, Agriculture, Healthcare & Pharmaceuticals and Others. Packaging segment held the maximum share in the global polypropylene market. The growing food and beverages industry and growing concern towards the environment is primarily boosting the demand for polypropylene packaging.

- By Application: The global polypropylene market demand can be divided into six segments on the basis of application: Injection Molding, Film & Sheet, Raffia, Fiber, Blow Molding and Other. Film & sheet segment is anticipated to grow at the fastest CAGR during the forecasted period. Polypropylene films and sheets are widely used in packaging applications, including food packaging, labeling, and wrapping. These films and sheets provide excellent clarity, stiffness, and moisture resistance. The growth of the e-commerce industry, the need for sustainable packaging materials, and the demand for flexible packaging solutions are key factors driving the growth of this segment.

- By Region: According to this report, the global polypropylene market can be divided into four major regions: Asia Pacific (China, Japan, India, South Korea and Rest of Asia Pacific), North America (The US, Canada and Mexico), Europe (Germany, UK, France, Spain, Italy and Rest of Europe), and Rest of the World. The Asia Pacific dominated the market in 2022, primarily owing to inexpensive and affordable quality of polypropylene to most producers who use polypropylene as a raw material for other plastic products. While China continues to be a prominent region of Asia Pacific’s polypropylene market, accounting for the rising trend of online purchase of goods and rapid industrialization leading to a surge in demand for packaging material.

Global Polyethylene Market Dynamics:

- Growth Drivers: One of the key drivers of the market's expansion is the upsurge in e-commerce sales. The upsurge in e-commerce sales has emerged as a significant driving factor for the polypropylene market. The rapid growth of online shopping has led to increased demand for packaging materials, and polypropylene has become a preferred choice for e-commerce packaging. Polypropylene offers several advantages that make it ideal for e-commerce applications. It is lightweight, durable, and provides excellent protection to products during transit. Its flexibility allows for the creation of custom shapes and sizes, catering to the diverse range of products sold online. Further, the market is expected to increase due to escalating automobile production, rapid urbanization, upsurge in demand for plastic, increase in demand for packaged food and surge in disposable income.

- Challenges: However, some challenges are impeding the growth of the market such as fluctuating crude oil prices and availability of substitutes. Polypropylene is obtained by the polymerization of propylene gas, which is derived from petroleum crude oil. The supply and price of crude oil have been oscillating due to volatile political scenarios in the Middle East, as well as in the other oil-producing countries. The inconsistencies in the pricing of crude oil affect the cost structure of the final product, which can have a negative effect on the growth of the market. The use of crude oil as a raw material in the manufacturing of polypropylene indicates that any changes in price of crude oil would impact demand and price of polypropylene.

- Trends: A major trend gaining pace in polypropylene market is technological advancements in production processes. Manufacturers are continuously investing in research and development to improve the efficiency, quality, and flexibility of polypropylene production. One key area of advancement is the development and utilization of metallocene catalysts. Metallocene catalysts offer enhanced control over the polymerization process, resulting in polypropylene with improved properties and more consistent quality. These catalysts enable the production of high-performance grades of polypropylene, tailored to specific applications. More trends in the market are believed to augment the growth of polypropylene market during the forecasted period include surging application of polypropylene in agriculture, growing focus on sustainability, etc.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic had a significant impact on the polypropylene market. The widespread global lockdowns and reduced economic activity led to a decline in demand for polypropylene products across various industries such as automotive, packaging, and construction. Supply chain disruptions, logistical challenges, and fluctuating raw material prices further affected the market. As economic activities resume, there has been a rebound in demand for polypropylene across various sectors. Industries such as automotive, construction, and consumer goods picked up pace, driving the demand for polypropylene-based products and applications.

The post-COVID era emphasizes sustainability and environmental consciousness. Polypropylene, being a recyclable material, is well-positioned to benefit from the growing demand for sustainable solutions. Initiatives promoting the circular economy and recycling of plastics are expected to drive the adoption of recycled polypropylene in various applications.

Competitive Landscape and Recent Developments:

The polypropylene market is fragmented with the presence of large number of players operating worldwide. Strategic partnerships, capacity expansions, and new polymer type developments are popular strategies adopted by a majority of the players operating in the global polypropylene industry. Recently, researchers at the University of Tokyo have developed a material called isotactic polar polypropylene (iPPP), which in comparison to traditional polypropylene has high isotacticity.

Key players of the polypropylene market are:

- LyondellBasell Industries

- SABIC

- Repsol Group

- ExxonMobil Corporation

- Mitsubishi Chemical Group Corporation

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- Braskem S.A

- Ensinger GmbH

- China National Petroleum Corp (CNPC)

- RTP Company

In December 2020, LyondellBasell launched Beon3D, an innovative PP product range that provides unique design and allow the production of high-quality, complex 3D printed objects within one step. This product was produced by combining polymer technologies and additive manufacturing. This product range serves transportation, industrial, building & construction, and consumer goods markets.

Table of Contents

1. Executive Summary

Companies Mentioned

- LyondellBasell Industries

- SABIC

- Repsol Group

- ExxonMobil Corporation

- Mitsubishi Chemical Group Corporation

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- Braskem S.A

- Ensinger GmbH

- China National Petroleum Corp (CNPC)

- RTP Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | July 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 123.03 Billion |

| Forecasted Market Value ( USD | $ 159.66 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |