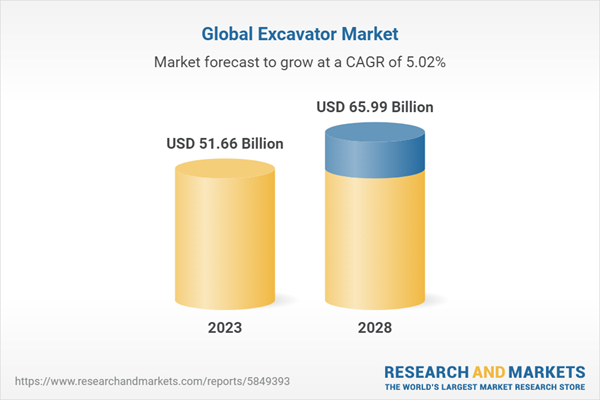

Excavators are heavy construction machines that are primarily used for digging and moving large amounts of soil, rocks, and other materials. They are commonly seen on construction sites, road works, mining operations, and various other projects where large-scale digging and earthmoving tasks are required. Excavators consist of a powerful boom, bucket, and cab mounted on a rotating platform known as the "house" or "upper structure." In 2022, the global excavator market was valued at US$49.19 billion, and is probable to reach US$65.99 billion by 2028.

The type of excavator demanded often varies depending on their size, digging depth, reach, specialized attachments, mobility and terrain adaptability, and application-specific features. Excavators with greater digging depth and reach are in demand for tasks such as deep foundation digging, trenching, and excavation in larger construction projects. Excavators with tracks or specialized undercarriages are preferred for working on rough or uneven terrain, while wheeled excavators are suitable for urban areas and projects with smoother surfaces. The growth of the excavator market is primarily driven by several factors. The ongoing global infrastructure development projects, such as the construction of roads, bridges, railways, and urban infrastructure, played a significant role in fueling the demand for excavators. Secondly, the construction industry's growth, both residential and commercial and rising mining activities were major drivers of the excavator market in the past years. The global excavator market value is projected to grow at a CAGR of 5.02%, during the forecast period of 2023-2028.

Market Segmentation Analysis:

- By Type: According to the report, the global excavator market is segmented into four types: Crawler Excavator, Wheeled excavator, Mini Excavator and Others. Crawler excavator segment acquired majority of share in the market in 2022, as they are better suited for challenging terrains, such as muddy or uneven surfaces, slopes, or rough terrains. Therefore, this allows them to operate effectively in various conditions, including construction sites, agricultural fields, and mining areas. Wheeled excavator is the fastest growing segment, as urban construction projects are rising and they offer versatility, ease of transportation, and the ability to work in urban areas where space may be limited.

- By Application: On the basis of application, the report bifurcates the global excavator market into two segments: Construction and Others. Construction segment acquired majority of share in 2022 and is expected to have the highest CAGR in the future because there is a growing need for infrastructure development and urbanization globally, leading to increased construction activities. Secondly, excavators are versatile and efficient machines that significantly enhance productivity, allowing construction companies to complete projects faster and more cost-effectively.

- By Region: The report provides insight into the excavator market based on the geographical operations, namely Asia Pacific, (China, Japan, India, and Rest of Asia Pacific), North America (the US, Canada, and Mexico), Europe (Germany, UK, Italy, and rest of Europe), and rest of the world (ROW). Asia Pacific excavator market enjoyed the highest market share in 2022 and is expected to grow at the highest CAGR, driven by increasing regional business diversities. Asia Pacific excavator market would be primarily driven by reasons such as increasing demand for new residential and commercial structures to meet population demand, rapid adoption of technologies like automated machinery, rising construction and maintenance activities in power distribution, and significant investment and funding by governments of various countries for infrastructure development. China is the Asia Pacific’s strongest market for excavator. The country is marked by the presence of a large number of small-to big-sized players serving the market. India is expected to grow at a faster pace as the combination of government investments in infrastructure, urbanization trends, supportive policies, and technological advancements is expected to drive the growth of the excavator market in India.

Global Excavator Market Dynamics:

- Growth Drivers: Rising smart city projects has the potential to boost the growth of the excavator market. This is because, Smart cities prioritize the development of advanced infrastructure, including smart grids, intelligent transportation systems, efficient waste management, and sustainable buildings. Excavators are essential for the construction and installation of these infrastructure components, such as digging trenches for utility lines, creating foundations for smart buildings, and preparing the groundwork for smart infrastructure. These projects may result in an increase in excavator demand, as well as market growth overall. Further, the market is expected to increase due to rapid urbanization, rising infrastructural development, increasing oil and gas projects, increased investment in construction and real estate sector, etc.

- Challenges: High installation and maintenance cost can present several challenges for the excavator market. Excavators are capital-intensive equipment, and their high initial cost poses a challenge for potential buyers. They require regular maintenance and upkeep, including servicing, repairs, and parts replacement. The associated costs, along with fuel and labor expenses, can add up significantly over the lifespan of the equipment. The other challenge that excavator market faces is environmental regulations and emissions standards.

- Trends: A major trend gaining pace in excavator market is rental excavator. By opting to rent instead of purchasing, companies can achieve significant cost savings by eliminating upfront investment, ongoing maintenance expenses, and storage costs. Additionally, renting excavators provides project-specific flexibility, allowing contractors to choose the most suitable equipment for each job without being tied to long-term ownership. Rental companies often maintain a well-maintained fleet of modern excavators, providing access to the latest models and technologies without the burden of frequent equipment upgrades. More trends in the market are believed to augment the growth of excavator market during the forecasted period include mini excavators, electric and hybrid excavators and cutting-edge technology equipped excavators.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic has initially had negative impact on the global excavator market. As construction activities were severely affected as lockdown measures and social distancing protocols were implemented, leading to project delays, cancellations, and reduced demand for excavators. The financial constraints and uncertainty brought about by the pandemic resulted in decreased investments in new construction projects, further dampening the demand for excavators. Further, the outbreak of pandemic resulted in decreased mineral production, which aggravated the decline of excavator market.

However, the post-COVID impact on the excavator market is expected to result in increased demand for excavator in areas such as construction projects.

Competitive Landscape and Recent Developments:

The global excavator market is fragmented owing to the presence of large number of players and a long tail of smaller, local, and niche manufacturers. Caterpillar, Komatsu, Liebherr, Hitachi, John Deere, and Kobelco are significant industry players. Manufacturers of excavators are primarily focus on new research & development initiatives to expand their product lines by utilizing techniques like rentals, alliances with component suppliers. The players are also focusing on expanding their geographical footprint to serve a wider customer base.

The major players of global excavator market are:

- Caterpillar Inc

- Hitachi Construction Machinery Co. Ltd.

- Volvo Construction Equipment

- Escorts Kubota Limited

- CNH Industrial

- Sumitomo Construction Machinery Co. Ltd.

- John Deere

- KOBELCO Group (KOBELCO Construction Machinery Co., Ltd.)

- Komatsu

- Liebherr Group

- JCB Heavy Construction Machine Manufacturer & Supplier

- SANY Heavy Industry Co. Ltd

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

The key players of the market are taking part in mergers and acquisitions and also launch new products to expand their reach internationally. For example, Tata Hitachi recently launched 5 tonne wheel loader ZW225 and unveiled mini excavator, NX30 and as part of its environmental commitment, Tata Hitachi also plans to unveiled the CNG variant of Backhoe loader. In August 2022, caterpillar Inc. launched the new Cat 350 hydraulic excavator for industrial and construction projects. In 2020, JCB has developed the construction industry’s first ever hydrogen powered excavator as it continues to lead the sector on zero and low carbon technologies.

Table of Contents

1. Executive Summary

Companies Mentioned

- Caterpillar Inc

- Hitachi Construction Machinery Co. Ltd.

- Volvo Construction Equipment

- Escorts Kubota Limited

- CNH Industrial

- Sumitomo Construction Machinery Co. Ltd.

- John Deere

- KOBELCO Group (KOBELCO Construction Machinery Co., Ltd.)

- Komatsu

- Liebherr Group

- JCB Heavy Construction Machine Manufacturer & Supplier

- SANY Heavy Industry Co. Ltd

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | July 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 51.66 Billion |

| Forecasted Market Value ( USD | $ 65.99 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |