Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

On December 2023: a recent report from the Cabinet’s Information and Decision Support Center (IDSC) revealed that the artificial intelligence (AI) market in medical imaging in Egypt was valued at USD 4 million in 2022. The report forecasts a robust growth trajectory with a compound annual growth rate of 36.9% from 2022 to 2030, projecting the market to reach USD52 million.

AI adoption in medical imaging is rapidly expanding across Egypt, including Cairo, Alexandria, Upper Egypt, and the Red Sea Governorate. Healthcare providers are leveraging AI for automated analysis of medical images, enhancing diagnostic precision, and reducing diagnosis times. The Egyptian government plays a proactive role in fostering healthcare innovation and supports healthcare providers in integrating AI-based medical imaging technologies. These initiatives are aimed at advancing healthcare delivery and enhancing diagnostic capabilities nationwide.

Government initiatives aimed at modernizing healthcare facilities and improving diagnostic capabilities have played a crucial role in market expansion. Private investments in healthcare have also contributed significantly, fostering competition and innovation in imaging technologies. The adoption of digital imaging systems has streamlined diagnostic processes, enhancing efficiency and diagnostic accuracy. Egyptian diagnostic imaging market is poised for further development with anticipated advancements in AI and machine learning applications in medical imaging, which promise to revolutionize diagnostics by improving speed, accuracy, and cost-effectiveness. Overall, the market's trajectory reflects a positive outlook driven by technological advancements, healthcare infrastructure expansion, and increasing healthcare awareness among the population.

Key Market Drivers

Rising Chronic Disease Burden

The rising chronic disease burden in Egypt significantly impacts the diagnostic imaging market, driving increased demand for advanced medical imaging technologies. Chronic diseases such as cardiovascular diseases, cancer, diabetes, and respiratory disorders are becoming more prevalent due to several interconnected factors. For instance, The World Health Organization reports that Noncommunicable diseases (NCDs) such as cardiovascular diseases, diabetes, cancer, and chronic respiratory diseases are the primary cause of death in Egypt. NCDs are responsible for 82% of all deaths and 67% of premature deaths in the country.The lifestyle changes associated with urbanization, including sedentary lifestyles, unhealthy diets, and tobacco use, contribute to the rise in chronic diseases. These factors lead to conditions like hypertension, obesity, and diabetes, which often necessitate regular monitoring and early detection through diagnostic imaging. Egypt's aging population is growing, increasing the incidence of age-related chronic conditions such as cardiovascular diseases and certain cancers. As people age, they require more frequent health screenings and diagnostic tests to detect diseases early when treatment outcomes are generally better.

The environmental factors such as air pollution and exposure to carcinogens contribute to the prevalence of respiratory diseases and cancers, further fueling the need for diagnostic imaging services for accurate diagnosis and monitoring. The economic impact of chronic diseases is also significant, placing a burden on healthcare systems and driving investments in medical technologies, including diagnostic imaging equipment.

Healthcare providers and policymakers recognize the importance of early detection and management of chronic diseases to reduce healthcare costs and improve patient outcomes, thereby driving the adoption of advanced imaging technologies. The rising burden of chronic diseases in Egypt underscores the critical role of diagnostic imaging in disease management and prevention. It highlights the need for continued advancements in imaging technology and healthcare infrastructure to meet the growing demand for early diagnosis and effective treatment planning.

Key Market Challenges

Infrastructure Disparities

Infrastructure disparities pose a significant challenge to the Egyptian diagnostic imaging market, creating uneven access to advanced healthcare services across different regions of the country. Urban areas such as Cairo and Alexandria generally benefit from better healthcare infrastructure, including modern hospitals and diagnostic imaging centers equipped with state-of-the-art technology like MRI, CT scans, and digital radiography. These facilities cater to a larger population with easier access to specialized healthcare services, including timely and accurate diagnostic imaging.The rural and underserved areas face substantial infrastructure deficits. Healthcare facilities in these regions often lack essential diagnostic imaging equipment or have outdated technology. This disparity limits the availability and quality of diagnostic services, forcing residents to travel long distances or forego necessary medical tests altogether. This situation is exacerbated by limited financial resources allocated for healthcare infrastructure outside major urban centers.

The reasons behind these infrastructure disparities are multifaceted. Historically, healthcare investments in Egypt have been concentrated in urban areas, where population density and economic activity are higher. Rural areas, on the other hand, face challenges such as insufficient funding, inadequate healthcare planning, and difficulties in attracting and retaining skilled healthcare professionals.

Addressing infrastructure disparities requires concerted efforts from the government, healthcare providers, and private sector. This includes strategic investments in healthcare infrastructure in underserved areas, improving transportation networks to facilitate patient access, and implementing policies to incentivize healthcare professionals to work in rural settings. Bridging these disparities is crucial for ensuring equitable access to diagnostic imaging services and improving overall healthcare outcomes across Egypt.

Key Market Trends

Adoption of Advanced Imaging Technologies

The adoption of advanced imaging technologies in Egypt's healthcare sector has been driven by several key factors, reflecting a shift towards more precise diagnostic capabilities and improved patient care. Advanced imaging technologies such as MRI (Magnetic Resonance Imaging), CT (Computed Tomography) scans, ultrasound, and digital radiography offer significant advantages over traditional imaging methods. One primary reason for the adoption of these technologies is their ability to provide higher resolution images with greater detail, allowing healthcare providers to visualize and diagnose conditions more accurately.For example, MRI and CT scans are essential for detailed imaging of soft tissues, organs, and structures within the body, aiding in the diagnosis of complex conditions such as tumors, neurological disorders, and cardiovascular diseases. These advanced technologies offer faster scanning times and reduced radiation exposure compared to older equipment, enhancing patient safety and comfort during procedures. Digital imaging systems enable immediate access to images, facilitating timely diagnosis and treatment planning. This capability is crucial in emergency situations and for managing chronic diseases where quick intervention can significantly impact outcomes.

The integration of advanced imaging technologies with other healthcare innovations, such as AI (Artificial Intelligence) and machine learning, is further enhancing diagnostic accuracy and efficiency. AI algorithms can assist radiologists in interpreting images, detecting subtle abnormalities, and predicting disease progression based on imaging data. The demand for advanced imaging technologies in Egypt is also driven by a growing prevalence of chronic diseases, increasing healthcare infrastructure investments, and rising patient expectations for quality healthcare services. These factors collectively underscore the importance of continuous technological advancements and investments in healthcare to meet the evolving needs of patients and healthcare providers alike.

Key Market Players

- Nile Medical Group

- Metamed (TechnoScan Egypt)

- FUJIFILM Healthcare Middle East S.A.E

- Siemens Healthineers Egypt

- Allengers Medical Systems (Egypt)

- Philips Healthcare Egypt

- Epigenomics Egypt

- BioMérieux Egypt

- Roche Diagnostics LLC

- Abbott Egypt

Report Scope:

In this report, the Egypt Diagnostic Imaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Egypt Diagnostic Imaging Market, By Type:

- X-Ray Imaging Solutions

- Ultrasound Systems

- MRI Systems

- CT Scanners

- Nuclear Imaging Solutions

- Mammography

- Others

Egypt Diagnostic Imaging Market, By Mobility:

- Portable

- Standalone

Egypt Diagnostic Imaging Market, By Source:

- Domestic

- Import

Egypt Diagnostic Imaging Market, By Application:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

Egypt Diagnostic Imaging Market, By End Users:

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Care Centers

- Others

Egypt Diagnostic Imaging Market, By Region:

- Cairo

- Alexandria

- Giza

- Qalyubia

- Port Said

- Suez

- Rest of Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Egypt Diagnostic Imaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nile Medical Group

- Metamed (TechnoScan Egypt)

- FUJIFILM Healthcare Middle East S.A.E

- Siemens Healthineers Egypt

- Allengers Medical Systems (Egypt)

- Philips Healthcare Egypt

- Epigenomics Egypt

- BioMérieux Egypt

- Roche Diagnostics LLC

- Abbott Egypt

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | September 2025 |

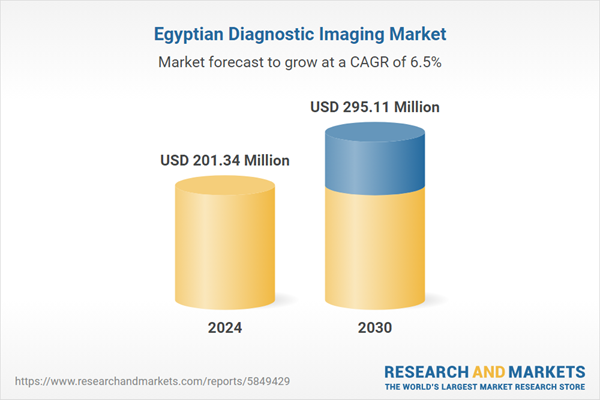

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 201.34 Million |

| Forecasted Market Value ( USD | $ 295.11 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Egypt |

| No. of Companies Mentioned | 10 |