Military Land Vehicles Market Analysis:

Major Market Drivers: Increasing defense budgets across the globe drive the demand for military land vehicles. Additionally, the growing demand for advanced and technologically up-to-date vehicles is propelling the market growth.Key Market Trends: The deployment of unmanned ground into an automation era to mitigate the risk of human interference and facilitate robotic movements is one of the major trends. Land army forces continue to channel funds to promote ground automatic operations, prompting an escalation and market growth.

Geographical Trends: With large reserves in the defense budget and advancement in technology, North America holds the major military land vehicles market share. Geographically, the Asia-Pacific region is experiencing significant growth in the military due to mounting geopolitical tensions and the large military modernization programs that have been initiated.

Competitive Landscape: The market is dominated by companies such as General Dynamics, BAE Systems, and Rheinmetall, among others. The key market players are adopting the strategy of strategic collaboration, mergers, and acquisitions to enhance their market presence and to enhance their technological capabilities.

Challenges and Opportunities: High costs for development and maintenance are major challenges in scaling of market. Nevertheless, the rising demand for autonomous and electric military vehicles is providing substantial opportunities to the market players.

Military Land Vehicles Market Trends:

Technological advancements and modernization initiatives

One of the major factors driving the global military land vehicles market is continued investment in technological advancements and modernization. Countries around the globe are spending on improving their armor fleets with new technologies of autonomous driving, armor protection improvement, and the development of new weaponry. These capabilities are designed to enhance the operational capabilities, survival, and combat capacity of the armed forces. For instance, the applications of artificial intelligence (AI) and machine learning within vehicle systems are improving battlefield awareness and automating decision-making. According to a market research report, the military robotics and autonomous systems market size reached US$ 11.2 Billion in 2023. The publisher expects the market to reach US$ 31.8 Billion by 2032, exhibiting a growth rate (CAGR) of 11.9% during 2024-2032. In addition, hybrid or electric propulsion systems are under development, demonstrating an interest in increasing fuel efficiency and decreasing logistic footprint. These advancements keep military land vehicles relevant to defense strategies and prepared for the demands of contemporary warfare.Geopolitical tensions and defense spending

The accelerating geopolitical conflict and consequent increase in defense expenditure are the major factors driving the military land transport vehicle market. Countries that prioritize expanding and modernizing their military capabilities in areas facing territorial disputes, political tensions, and border disputes devote substantial budgets to strengthening their armed forces and, for the most part, focus on acquiring and improving ground vehicles. In confluence with this, conflicts in the Middle East, Eastern Europe, and the South China Sea highlight the urgent need for robust and technologically advanced military vehicles This trend is further strengthened by route agreements comply with operational and security agreements, allowing nations to invest in state-of-the-art ground vehicles to ensure preparedness and deterrence against potential threats. Therefore, this is significantly expanding the military land vehicles market size.Rising asymmetric warfare and counterinsurgency operations

Another important factor propelling the growth of the market is the rising practice of irregular warfare, asymmetric warfare, and counterinsurgency operations. In modern conflicts, non-state actors and other militant groups often use irregular tactics. In addition, specialized land vehicles allow militaries to increase their mobility, protection, and versatility, capabilities that are critical in responding to the threat types outlined above. Some of these include mine-resistant ambush-protected (MRAP) vehicles, light tactical vehicles, and unmanned ground vehicles (UGVs) built for a broad spectrum of environments and different mission profiles. This includes vehicles for reconnaissance, troop transport, and direct fire in an irregular warfare environment. Moreover, asymmetric tactics particularly require vehicles that deploy quickly, adapt readily, and survive, and the escalating demand in Afghanistan and Iraq has put pressure on Western militaries to improve the capabilities of their land including their vehicles and aircraft.Military Land Vehicles Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global military land vehicles market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on the offering, product type, and application.Breakup by Offering:

- Platforms

- Services

Services accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the military land vehicles market based on the offering. This includes platforms and services. According to the report, services represented the largest segment.In the military land vehicles market, the services are the largest offering segment, as they are required for the ongoing maintenance, training, and support of military land vehicles. These services ensure that military vehicles are always operationally ready and have a long service life, from regular maintenance and spare parts deliveries to full-service training programs for military personnel. Moreover, with current military land vehicles becoming ever more complex and technologically advanced, they require ongoing support and technical backup, providing an even greater incentive to sell a full-service package. In addition, defense agencies increasingly outsourcing maintenance and support activities to third-party contractors is creating a positive market outlook.

Breakup by Product Type:

- Infantry Fighting Vehicles

- Armoured Personnel Carriers

- Main Battle Tank

- Light Multi-Role Vehicles

- Tactical Trucks

- Others

Infantry fighting vehicles holds the largest share of the industry

A detailed breakup and analysis of the military land vehicles market based on the product type has also been provided in the report. This includes infantry fighting vehicles, armoured personnel carriers, main battle tank, light multi-role vehicles, tactical trucks, and others. According to the report, infantry fighting vehicles accounted for the largest market share.Infantry fighting vehicles dominate the military ground vehicle market as the largest product category, primarily due to their vital role in modern combat operations. IFVs are designed to carry infantry on the battlefield, provide direct fire support, and enhance cavalry mobility, protection, and firepower. Their ability to be used in a variety of combat situations makes them an independent asset. Additionally, continued improvements in defense, weaponry, and transport IFVs further contribute to their widespread acceptance. Furthermore, ongoing geopolitical conflicts and modernization policies in various countries are driving significant investments in IFVs, reinforcing their position as the most sought-after military ground vehicles.

Breakup by Application:

- Defense

- Transportation

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest military land vehicles market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for military land vehicles.North America is the largest region segment of the military land vehicles market, supported by well-defined defense budgets maintaining a focus on innovation in technologies. Being the biggest and most essential contributor to this category, the US is responsible for vast resources dedicated to synchronizing the advantages of both strategic and tactical capability in its advanced military vehicles. Along with this, continual new-land-vehicle introduction is made possible by the region's strong defense industrial base and substantial research and development projects. According to the military land vehicles market report, the advent of autonomous and hybrid vehicles is also spiraling modernization initiatives in North America, thus benefiting the region to hold a dominant position. The region is home to leading defense contractors and manufacturers as well, which fastens the market, which in turn, results in continuous development of high-technology military land vehicles.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the military land vehicles industry include:

- Ashok Leyland Ltd. (Hinduja Group Ltd.)

- BAE Systems Plc

- General Dynamics Corporation

- Hyundai Rotem Company (Hyundai Motor Group)

- IVECO S.p.A. (Iveco Group)

- Krauss-Mafeeo Wegman GmbH & Co. KG (KMW+ Nexter Defense Systems N.V.)

- Oshkosh Defense LLC (Oshkosh Corporation)

- Rheinmetall AG

- ST Engineering Ltd.

Key Questions Answered in This Report:

- How has the global military land vehicles market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global military land vehicles market?

- What is the impact of each driver, restraint, and opportunity on the global military land vehicles market?

- What are the key regional markets?

- Which countries represent the most attractive military land vehicles market?

- What is the breakup of the market based on the offering?

- Which is the most attractive offering in the military land vehicles market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the military land vehicles market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the military land vehicles market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global military land vehicles market?

Table of Contents

Companies Mentioned

- Ashok Leyland Ltd. (Hinduja Group Ltd.)

- BAE Systems Plc

- General Dynamics Corporation

- Hyundai Rotem Company (Hyundai Motor Group)

- IVECO S.p.A. (Iveco Group)

- Krauss-Mafeeo Wegman GmbH & Co. KG (KMW+ Nexter Defense Systems N.V.)

- Oshkosh Defense LLC (Oshkosh Corporation)

- Rheinmetall AG

- ST Engineering Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | March 2025 |

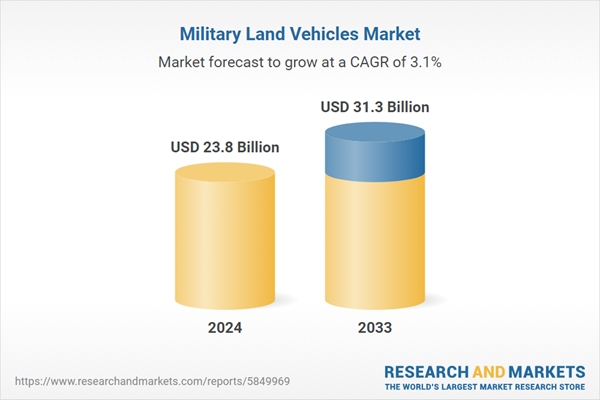

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23.8 Billion |

| Forecasted Market Value ( USD | $ 31.3 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |