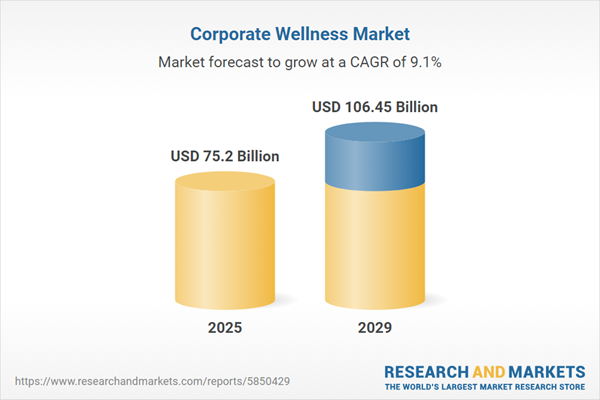

The corporate wellness market size is expected to see strong growth in the next few years. It will grow to $106.45 billion in 2029 at a compound annual growth rate (CAGR) of 9.1%. The growth in the forecast period can be attributed to personalized wellness programs, remote work challenges, global expansion of corporate wellness, holistic well-being approach, return on investment (ROI) focus. Major trends in the forecast period include technology integration, flexible and customizable programs, incentivization and gamification, strategic well-being metrics, innovations in wellness technology.

The increasing occurrence of chronic illnesses among corporate employees is anticipated to drive the expansion of the corporate wellness market in the near future. Chronic illnesses are defined as medical conditions that typically persist for three months or longer and may worsen over time. As the incidence of chronic diseases rises among corporate workers, the corporate wellness market grows, as companies implement wellness programs designed to improve employee health through various services aimed at reducing chronic health issues. For example, a report from the Centers for Disease Control in February 2024 revealed that a growing number of Americans are experiencing multiple chronic conditions, with 42% affected by two or more and 12% by at least five. These conditions account for nearly 90% of the $4.1 trillion spent annually on healthcare related to chronic diseases and mental health issues. Thus, the increasing rate of chronic illnesses among corporate workers is a key factor propelling the growth of the corporate wellness market.

The increasing healthcare costs are anticipated to stimulate the growth of the corporate wellness market in the near future. Healthcare costs encompass the overall expenses associated with medical services, treatments, and products aimed at maintaining or enhancing an individual’s health. As healthcare expenses rise, companies are motivated to invest in wellness programs as a proactive strategy to lower medical costs. For example, a report from the Office for National Statistics in May 2024 indicated that total healthcare expenditure increased by 5.6% in nominal terms from 2022 to 2023, a notable rise compared to the 0.9% growth observed in 2022. Consequently, the escalating healthcare costs are a driving force behind the expansion of the corporate wellness market.

Technological advancements have emerged as a prominent trend in the corporate wellness market, with major companies in the sector actively developing innovative solutions to strengthen their market positions. In September 2022, Virgin Pulse, a US-based provider of employee well-being solutions, introduced VP Activate - a sophisticated intelligent communication solution. VP Activate is designed to facilitate quick and proactive outreach by companies and health systems to their audiences. This data-driven, multi-channel communication solution identifies and connects with individuals at risk of a care gap, determining the most effective approach to engage key groups and promote action. By assessing individual needs and identifying obstacles to wellness activities, VP Activate employs a surround-sound strategy through both online and offline channels to achieve positive results.

Leading companies in the corporate wellness market are also channeling their efforts into developing innovative programs, such as advanced preventative care initiatives. An advanced preventative care program involves a comprehensive healthcare initiative that integrates cutting-edge medical technologies. For example, in November 2023, WELL Health Technologies Corp., a Canada-based digital health company, launched the 'WELL Longevity+ Program.' This progressive initiative is designed to enhance preventative health by integrating AI technologies and precision diagnostic testing. The program enables early diagnosis and identification of various health conditions, including heart disease, cancer, and neurodegenerative diseases.

In September 2022, Telus Corporation, a Canada-based company offering employee well-being solutions and telecommunications services, acquired LifeWorks Inc. for approximately $1.69 billion. This acquisition expanded TELUS Health's global reach, now serving corporate clients in over 160 countries and covering 50 million people worldwide. LifeWorks Inc., based in Canada, specializes in providing employee wellness and human resources services and technology.

Major companies operating in the corporate wellness market include ComPsych Corporation, Wellness Corporate Solutions LLC, Virgin Pulse Inc., Provant Health Solutions LLC, Exos, Marino Wellness, Privia Health Group Inc., Vitality Group International Inc., Wellsource Inc., Central Corporate Wellness, SOL Wellness LLC, Well Nation, Aduro Inc., Beacon Health Options Inc., Fitbit Inc., Bupa Wellness Pty Ltd., The Vitality Group Inc., Truworth Health Technologies Pvt. Ltd., Sodexo Group, Quest Diagnostics Incorporated, 1to1help.net Pvt. Ltd., CHC Wellbeing lnc., Wellness 360 Technologies Inc., Premise Health, Kinema Fitness lnc., Health Advocate Inc., Onlife Health, TotalWellness Health, HealthCheck360, RedBrick Health, Corporate Fitness Works Inc.

North America was the largest region in the corporate wellness market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global corporate wellness market during the forecast period. The regions covered in the corporate wellness market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the corporate wellness market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Corporate wellness, commonly referred to as workplace wellness, encompasses a broad spectrum of initiatives, plans, and organizational guidelines designed to foster positive behavior in the workplace. This employer-funded program is strategically developed to aid employees in adopting and sustaining practices that mitigate health risks, improve the quality of life, enhance productivity, and positively impact an organization's overall financial performance.

Key categories of corporate wellness services include health risk assessment, fitness programs, smoking cessation support, health screening, nutrition and weight management, stress management, and other related offerings. A health risk assessment (HRA), also known as a health appraisal or health assessment, serves as a screening tool that helps individuals identify and understand their health risks while monitoring their health condition over time. Various delivery models, such as onsite and offsite, involve specialists such as fitness and nutrition consultants, psychological therapists, and organizations or employers. These services cater to diverse end users, including the private sector, public sector, and other entities.

The corporate wellness market research report is one of a series of new reports that provides corporate wellness market statistics, including corporate wellness industry global market size, regional shares, competitors with a corporate wellness market share, detailed corporate wellness market segments, market trends and opportunities, and any further data you may need to thrive in the corporate wellness industry. This corporate wellness market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The corporate wellness market revenues earned by entities by offering remote working arrangements, financial education, work-life balance, on-site fitness accommodations, and de-stressing activities. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Corporate Wellness Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on corporate wellness market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for corporate wellness? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The corporate wellness market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Health Risk Assessment; Fitness; Smoking Cessation; Health Screening; Nutrition and Weight Management; Stress Management; Other Services2) By Delivery Model: Onsite; Offsite

3) By Category: Fitness and Nutrition Consultants; Psychological Therapists; Organizations or Employers

4) By End User: Private Sector; Public Sector; Other End Users

Subsegments:

1) By Health Risk Assessment: Online Assessments; in-Person Assessments2) By Fitness: On-Site Fitness Classes; Fitness Challenges; Personal Training

3) By Smoking Cessation: Counseling Programs; Support Groups; Pharmacotherapy

4) By Health Screening: Biometrics Screening; Preventive Health Screenings

5) By Nutrition and Weight Management: Nutritional Counseling; Weight Loss Programs

6) By Stress Management: Stress Reduction Workshops; Mindfulness Training; Counseling Services

7) By Other Services: Employee Assistance Programs (EAP); Wellness Incentives; Health Education Programs

Key Companies Mentioned: ComPsych Corporation; Wellness Corporate Solutions LLC; Virgin Pulse Inc.; Provant Health Solutions LLC; Exos

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- ComPsych Corporation

- Wellness Corporate Solutions LLC

- Virgin Pulse Inc.

- Provant Health Solutions LLC

- Exos

- Marino Wellness

- Privia Health Group Inc.

- Vitality Group International Inc.

- Wellsource Inc.

- Central Corporate Wellness

- SOL Wellness LLC

- Well Nation

- Aduro Inc.

- Beacon Health Options Inc.

- Fitbit Inc.

- Bupa Wellness Pty Ltd.

- The Vitality Group Inc.

- Truworth Health Technologies Pvt. Ltd.

- Sodexo Group

- Quest Diagnostics Incorporated

- 1to1help.net Pvt. Ltd.

- CHC Wellbeing lnc.

- Wellness 360 Technologies Inc.

- Premise Health

- Kinema Fitness lnc.

- Health Advocate Inc.

- Onlife Health

- TotalWellness Health

- HealthCheck360

- RedBrick Health

- Corporate Fitness Works Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 75.2 Billion |

| Forecasted Market Value ( USD | $ 106.45 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |