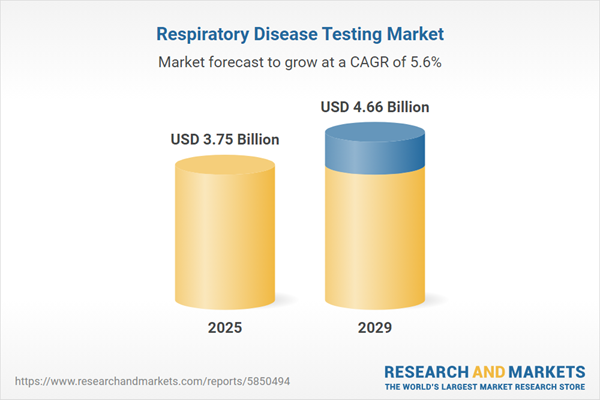

The respiratory disease testing market size is expected to see strong growth in the next few years. It will grow to $4.66 billion in 2029 at a compound annual growth rate (CAGR) of 5.6%. The growth in the forecast period can be attributed to rise in airborne respiratory viruses, focus on home-based testing solutions, increased research in precision medicine, continued environmental health concerns, focus on early intervention and prevention. Major trends in the forecast period include point-of-care testing, integration of artificial intelligence (ai), remote monitoring technologies, telehealth services, customized biomarker panels, enhanced breath analysis techniques.

The upward trajectory in the prevalence of respiratory diseases is poised to significantly boost the respiratory disease testing market in the foreseeable future. Respiratory diseases encompass medical conditions affecting the respiratory system, including the lungs, bronchi, trachea, larynx, pharynx, and nasal passages. The primary purpose of respiratory disease testing is early detection and diagnosis, facilitating prompt treatment and management. This proactive approach not only helps impede disease progression but is also crucial for controlling the transmission of infectious respiratory diseases and reducing the risk of complications. For instance, in September 2022, data from the NCD Alliance revealed that lung cancer ranked as the leading cause of global cancer deaths, with an anticipated 2.2 million new cases and 1.8 million fatalities annually. Chronic respiratory disorders affected 550 million adults globally, resulting in 4.2 million deaths, accounting for 7% of the total. Therefore, the rising prevalence of respiratory diseases is a key driver for the respiratory disease testing market.

The increasing prevalence of tobacco smoking is anticipated to boost the growth of the respiratory disease testing market in the future. Tobacco smoking involves the combustion of dried leaves from the tobacco plant (Nicotiana tabacum) and inhaling the smoke produced. Respiratory disease testing is essential for managing the health of tobacco smokers, as it monitors changes in lung function over time, enabling healthcare professionals to evaluate the success of smoking cessation initiatives and modify treatment plans accordingly. For instance, in September 2024, the Centers for Disease Control and Prevention, a US government agency, reported that tobacco use remains the leading cause of preventable illness and death in the United States. In 2022, around 49.2 million adults, or 19.8% - nearly 1 in 5 - indicated they used tobacco products. Consequently, the rising incidence of tobacco smoking is driving the expansion of the respiratory disease testing market.

Technological advancements are emerging as a prominent trend in the respiratory disease testing market, with major companies focusing on innovative solutions to enhance treatment protocols and elevate patient outcomes. A notable example is Respira Labs, a U.S.-based healthcare technology company, which introduced the AI-powered wearable device, Sylvee, in March 2022. Sylvee, worn as a chest strap, employs artificial intelligence and machine learning algorithms to analyze data from multiple sensors measuring breathing rate, volume, and patterns. This device aids in the early diagnosis and management of conditions such as chronic obstructive pulmonary disease (COPD), asthma, and COVID-19, utilizing advanced AI algorithms to analyze breath sounds and provide real-time feedback on lung function.

Major players in the respiratory disease testing market are actively engaged in developing advanced products, such as pulmonary function testing, to establish a competitive advantage. A case in point is Vitalograph Ltd., a UK-based provider of respiratory diagnostics, which launched the VitaloPFT series in March 2023. This series offers detailed pulmonary function testing options, providing healthcare providers with a cost-effective solution for advanced respiratory diagnostics. Its user-friendly design simplifies the testing process, enhancing accessibility for healthcare professionals.

In January 2023, CAIRE Inc., a prominent U.S.-based medical supply and manufacturing company, completed the acquisition of MGC Diagnostics Holdings for an undisclosed amount. This strategic move is driven by CAIRE Inc.'s objective to expand the scope of its product line, diversify its income streams, and fortify its position as a leading player in the medical technology sector, specifically focusing on respiratory and cardiorespiratory diagnostics. MGC Diagnostics Holdings Inc., the acquired entity, is a U.S.-based medical technology company specializing in offering comprehensive cardiorespiratory diagnostic solutions and respiratory disease testing products.

Major companies operating in the respiratory disease testing market include Medtronic plc, Abbott Laboratories, Seimens Healthineers AG, Koninklijke Philips N.V., ResMed Inc., Thermo Fisher Scientific Inc., Beckton Dickinson And Company, F. Hoffmann-La Roche Ltd., Nihon Kohden Corporation, GE HealthCare Technologies Inc., Fisher And Paykel Healthcare Corporation Limited, Qiagen N.V., Medical Graphics Corporation, COSMED srl, ndd Medizintechnik AG, Vitalograph Ltd., MGC Diagnostics Corporation, Vyaire Medical Inc., Masimo Corporation, Hamilton Medical AG, Drägerwerk AG & Co. KGaA, Schiller AG, Nonin Medical Inc., Natus Medical Incorporated.

North America was the largest region in the respiratory disease testing market in 2024. Asia-Pacific is expected to be the fastest growing region in the global respiratory disease testing market during the forecast period. The regions covered in the respiratory disease testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the respiratory disease testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Respiratory disease testing encompasses the diagnostic process of evaluating various respiratory conditions through physical examinations. This procedure aids in the identification and measurement of lung conditions, assessing the speed at which a patient can exhale air. The results of these tests can assist clinicians in diagnosing respiratory diseases, even before patients exhibit symptoms.

The primary categories of tests involved in respiratory disease testing include imaging tests, mechanical tests, and in-vitro diagnostic tests. Imaging tests constitute a subset of diagnostic procedures that generate detailed images of various bodily regions. These tests utilize products such as lung volume imaging, spirometry, peak flow, blood gas, among others. They find applications in various respiratory conditions such as chronic obstructive pulmonary disease, lung cancer, asthma, and tuberculosis. These tests are typically conducted in hospitals, physician clinics, clinical laboratories, and other healthcare settings.

The respiratory disease testing market research report is one of a series of new reports that provides respiratory disease testing market statistics, including respiratory disease testing industry global market size, regional shares, competitors with a respiratory disease testing market share, detailed respiratory disease testing market segments, market trends and opportunities, and any further data you may need to thrive in the respiratory disease testing industry. This respiratory disease testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The respiratory disease testing market includes revenues earned by entities by providing services such as exhaled nitric oxide tests lung function tests. oxygen therapy, bronchoscopy, ultrasonography, nuclear lung scanning, and pulmonary artery angiography. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Respiratory Disease Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on respiratory disease testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for respiratory disease testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The respiratory disease testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Test Type: Imaging Tests; Mechanical Tests; in-Vitro Diagnostic Tests2) By Products: Lung Volume; Imaging; Spirometry; Peak Flow; Blood Gas; Other Products

3) By Application: Chronic Obstructive Pulmonary Disease; Lung Cancer; Asthma; Tuberculosis Female; Other Application

4) By End-User: Hospitals; Physician clinics; Clinical laboratories; Other End-User

Subsegments:

1) By Imaging Tests: X-rays; Computed Tomography (CT) Scans; Magnetic Resonance Imaging (MRI); Positron Emission Tomography (PET) Scans2) By Mechanical Tests: Spirometry; Peak Flow Measurement; Lung Volume Measurement; Diffusion Capacity Tests

3) By in-Vitro Diagnostic Tests: PCR Tests; Antigen Tests; Antibody Tests; Culture Tests

Key Companies Mentioned: Medtronic plc; Abbott Laboratories; Seimens Healthineers AG; Koninklijke Philips N.V.; ResMed Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Medtronic plc

- Abbott Laboratories

- Seimens Healthineers AG

- Koninklijke Philips N.V.

- ResMed Inc.

- Thermo Fisher Scientific Inc.

- Beckton Dickinson And Company

- F. Hoffmann-La Roche Ltd.

- Nihon Kohden Corporation

- GE HealthCare Technologies Inc.

- Fisher And Paykel Healthcare Corporation Limited

- Qiagen N.V.

- Medical Graphics Corporation

- COSMED srl

- ndd Medizintechnik AG

- Vitalograph Ltd.

- MGC Diagnostics Corporation

- Vyaire Medical Inc.

- Masimo Corporation

- Hamilton Medical AG

- Drägerwerk AG & Co. KGaA

- Schiller AG

- Nonin Medical Inc.

- Natus Medical Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.75 Billion |

| Forecasted Market Value ( USD | $ 4.66 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |