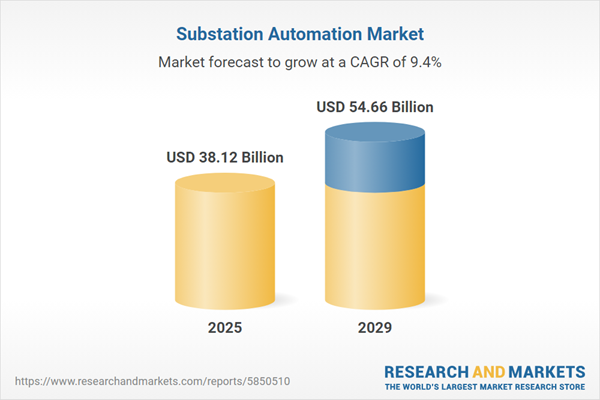

The substation automation market size is expected to see strong growth in the next few years. It will grow to $54.66 billion in 2029 at a compound annual growth rate (CAGR) of 9.4%. The growth in the forecast period can be attributed to rise in diabetes and obesity rates, expanding aging population, e-commerce growth, educational campaigns on sugar awareness, sustainability considerations, rising interest in plant-based diets. Major trends in the forecast period include innovative flavor profiles, clean label and natural ingredients, packaging innovation, e-commerce and direct-to-consumer sales, personalization and customization.

The growing demand for electric power is anticipated to drive the growth of the substation automation market in the future. Electric power measures the amount of energy transferred per unit of time, and the increasing demand has necessitated more efficient management of the electrical grid system. Substation automation automates various tasks, including monitoring and controlling power supply at substations, ensuring a stable electricity supply, detecting and addressing faults in real time, and preventing power outages. For example, in January 2024, the International Energy Agency (IEA), a France-based intergovernmental organization, reported that global electricity demand rose by 2.2% in 2023. Additionally, in 2022, electricity demand in the United States increased by 2.6%. Therefore, the rising demand for electric power is a key factor propelling the growth of substation automation.

The growing emphasis on integrating renewable energy is anticipated to boost the substation automation market in the foreseeable future. Renewable energy, derived from naturally replenishing sources, is being integrated into substation automation to create a more flexible, resilient, and efficient electrical grid. This integration enables operators to address challenges related to the variability and unpredictability of renewable energy sources. For example, as of January 2023, the Energy Information Administration forecasts that 16% of total energy generation in 2023 will come from renewable sources such as wind and solar, up from 14% in 2022. Thus, the heightened focus on integrating renewable energy drives the growth of the substation automation market.

The increasing digitization of substation automation systems is a prominent trend gaining traction in the substation automation market. Leading market players are directing their efforts toward developing digitized substation automation systems for real-time monitoring and analysis of the electrical power grid system. For instance, in May 2022, Doble Engineering Company, a US-based provider of diagnostic testing solutions for the electric power industry, introduced the Doble F6880 Digital Network Analyzer. This device is designed to identify and resolve communication and network performance issues in IEC 61850 digital substation systems. The F6880 connects to station networks using copper or optical fiber Ethernet cables, digitizes the data, and checks for deviations from baseline engineering designs using IEC 61850 sampled values and Generic Object Oriented Substation Events (GOOSE). This enables efficient troubleshooting of malfunctioning digital signals.

Major companies in the substation automation market are introducing innovative solutions, such as smart substation control, to maintain their market position. Smart substation control involves implementing advanced technologies, intelligent devices, and automated systems to enhance the monitoring, control, and management of electrical substations. For example, in January 2023, ABB Ltd., a Switzerland-based digital technology provider, unveiled the first virtualized protection and control solution with Smart Substation Control and Protection SSC600 SW. This allows customers to use their preferred hardware while still accessing reliable control and protection features. The SSC600 SW represents a significant innovation poised to transform the design, operation, and maintenance of substations. With increased flexibility, reduced costs, and improved efficiency, this virtualized solution is set to play a pivotal role in the future of power grids.

In November 2023, Hubbell Inc., a US-based manufacturer and seller of electrical and electronic products, completed the acquisition of Systems Control for $1.1 billion. This strategic acquisition creates significant value for both companies and their stakeholders, strengthening the utility solutions portfolio and expanding market reach. Systems Control is a US-based manufacturer specializing in substation control and relay panels.

Major companies operating in the substation automation market include Schneider Electric SE, Siemens AG, General Electric Co., Black & Veatch Holdings Company, Valiant Communications, ABB Limited, Omicron Electronics GmbH, Hitachi Energy Limited, Milsoft Utility Solutions, Honeywell International Inc., Rockwell Automation Inc., Power Systems Engineering, Eaton Corporation, NovaTech LLC, Crompton Greaves Ltd., Mitsubishi Electric Corporation, GE Grid Solutions, Emerson Electric Co., Efacec Power Solutions, Arteche, Schweitzer Engineering Laboratories, Yokogawa Electric Corporation, Applied System Engineering Inc., Enel S.p.A.

North America was the largest region in the substation automation market in 2024. Asia-pacific is expected to be the fastest-growing region in the global substation automation market during the forecast period. The regions covered in the substation automation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the substation automation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Substation automation encompasses a combination of hardware and software components designed to monitor and manage an electrical system's operations, both at the local and remote levels. The primary objective of substation automation is to improve the functionality and maintenance of crucial power grid substations responsible for transforming, distributing, and regulating electrical energy.

The key elements of substation automation include hardware and software. Hardware refers to both external and internal devices and equipment that facilitate essential operations such as input, output, storage, communication, and processing. In the context of substation automation, hardware is utilized to oversee and control the electrical equipment within substations. Substation automation is applicable across various voltage levels, including low voltage, medium voltage, and high voltage, utilizing communication channels such as optical fiber, power line, copper wire, Ethernet, and others. The modules it incorporates include SCADA (supervisory control and data acquisition), IED (intelligent electronic devices), communication networks, and other modules catering to the needs of industries such as utilities, steel, oil and gas, mining, and transportation.

The substation automation market research report is one of a series of new reports that provides substation automation market statistics, including substation automation industry global market size, regional shares, competitors with a substation automation market share, detailed substation automation market segments, market trends and opportunities, and any further data you may need to thrive in the substation automation industry. This substation automation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The substation automation market consists of revenues earned by entities by providing substation automation services such as planning, designing, and engineering of substation automation systems, and testing and maintenance of systems. The market value includes the value of related goods sold by the service provider or included within the service offering. The substation automation market also includes sales of Remote Terminal Units (RTUs), Programmable Logic Controllers (PLCs), Human Machine Interfaces (HMIs) and Power Quality Monitoring devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Substation Automation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on substation automation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for substation automation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The substation automation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Hardware; Software2) By Rated Voltage: Low Voltage; Medium Voltage; High Voltage

3) By Communication: Optical Fiber Communication Channel; Power Line Communication Channel; Copper Wire Communication Channel; Ethernet; Other Communication

4) By Module: Supervisory Control and Data Acquisition (SCADA); Intelligent Electronic Devices (IED); Communication Network; Other Module

5) By End-User Industry: Utilities; Steel; Oil and Gas; Mining; Transportation

Subsegments:

1) By Hardware: Intelligent Electronic Devices (IEDs); Communication Network Devices; Remote Terminal Units (RTUs); Programmable Logic Controllers (PLCs); Human-Machine Interface (HMI) Devices2) By Software: Supervisory Control and Data Acquisition (SCADA); Energy Management Systems (EMS); Substation Automation System

Key Companies Mentioned: Schneider Electric SE; Siemens AG; General Electric Co.; Black & Veatch Holdings Company; Valiant Communications

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Schneider Electric SE

- Siemens AG

- General Electric Co.

- Black & Veatch Holdings Company

- Valiant Communications

- ABB Limited

- Omicron Electronics GmbH

- Hitachi Energy Limited

- Milsoft Utility Solutions

- Honeywell International Inc.

- Rockwell Automation Inc.

- Power Systems Engineering

- Eaton Corporation

- NovaTech LLC

- Crompton Greaves Ltd.

- Mitsubishi Electric Corporation

- GE Grid Solutions

- Emerson Electric Co.

- Efacec Power Solutions

- Arteche

- Schweitzer Engineering Laboratories

- Yokogawa Electric Corporation

- Applied System Engineering Inc.

- Enel S.p.A

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 38.12 Billion |

| Forecasted Market Value ( USD | $ 54.66 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |